What do negative oil prices mean?

Perfect storm of oversupply and storage shortages sees producers paying to get rid of US crude

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

US oil prices fell into negative territory for the first time in history on Monday, as the coronavirus pandemic wipes out global demand.

With fewer people driving and flying worldwide, a flood of unwanted oil in the market caused the West Texas Intermediate (WTI) - the benchmark price for US oil - to drop to around -$40 a barrel. Or to put it another way, “producers were paying buyers to take oil off their hands”, says The Guardian.

How can oil prices drop below zero?

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Oil-producing countries agreed a historic deal earlier this month to cut production by 10% in order to protect the market. However, that decrease is far less than the drop in demand amid the coronavirus crisis, leaving a large surplus of oil and no buyers.

As a result, storage capacity has filled up quickly.

All the same, only WTI has fallen into negative territory as yet. Brent crude, the grade used in the UK and elsewhere, was trading at around $26 a barrel on Monday, and WTI has since rebounded above zero, with experts describing the drop below zero as a quirk.

Explaining how the so-called quirk came about, the BBC notes that current oil prices are actually the “market price for future months”, taking into account the cost of physically delivering the stuff at a later date.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Owing to the dramatic drop in global oil consumption and lack of space to store the surplus, traders holding WTI contracts for May - which expire at the end of trading today - were unable to find buyers. Faced with the prospect of having to pick up the oil “at a massive hub in Cushing, Oklahoma, known as the Pipeline Crossroads of the world”, and store it themselves, traders became “desperate to get rid of the contract”, says The Telegraph.

On the other side of the equation, shutting down production is expensive for producers, so they were willing to pay a premium for buyers to take the oil.

A combination of these factors caused US crude oil prices to crash from around $18 a barrel to as low as –$40.32 in a matter of hours on Monday evening.

What does this mean for the future?

The future of WTI is highly uncertain.

June WTI (oil contracts expiring a month from now) is trading at $22 a barrel - a significant increase from Monday’s low - suggesting traders believe the oversupply crisis will be resolved in a month’s time.

But the main US storage hub in Cushing is expected to be full within a matter of weeks - and the World Economic Forum has warned that June WTI is falling overall, signalling a potentially turbulent few months ahead.

“Today it's pretty clear that a major issue in the market is a glut in the US and lack of storage capacity,” said Michael McCarthy, chief strategist at CMC Markets in Sydney.

In the longer term, WTI futures for delivery in May 2021 are currently at $35.50, which “suggests anyone who can hold onto oil for a while can make a tidy profit – as long as they have somewhere to keep it”, says The Telegraph.

What does this mean for global oil prices and petrol?

Although the WTI crash has left oil traders reeling, the downturn will probably have less impact on other regions of the oil market.

In the UK, oil prices are still above zero, “in part because they face lower transport costs and easier access to ports”, The Guardian says.

And with fuel duty and VAT - factors not dictated by oil prices - accounting for more than two-thirds of the price of petrol in the UK, consumers are unlikely to see significantly lower prices at the pumps any time soon, although a gradual slump is expected over 2020.

-

6 of the world’s most accessible destinations

6 of the world’s most accessible destinationsThe Week Recommends Experience all of Berlin, Singapore and Sydney

-

How the FCC’s ‘equal time’ rule works

How the FCC’s ‘equal time’ rule worksIn the Spotlight The law is at the heart of the Colbert-CBS conflict

-

What is the endgame in the DHS shutdown?

What is the endgame in the DHS shutdown?Today’s Big Question Democrats want to rein in ICE’s immigration crackdown

-

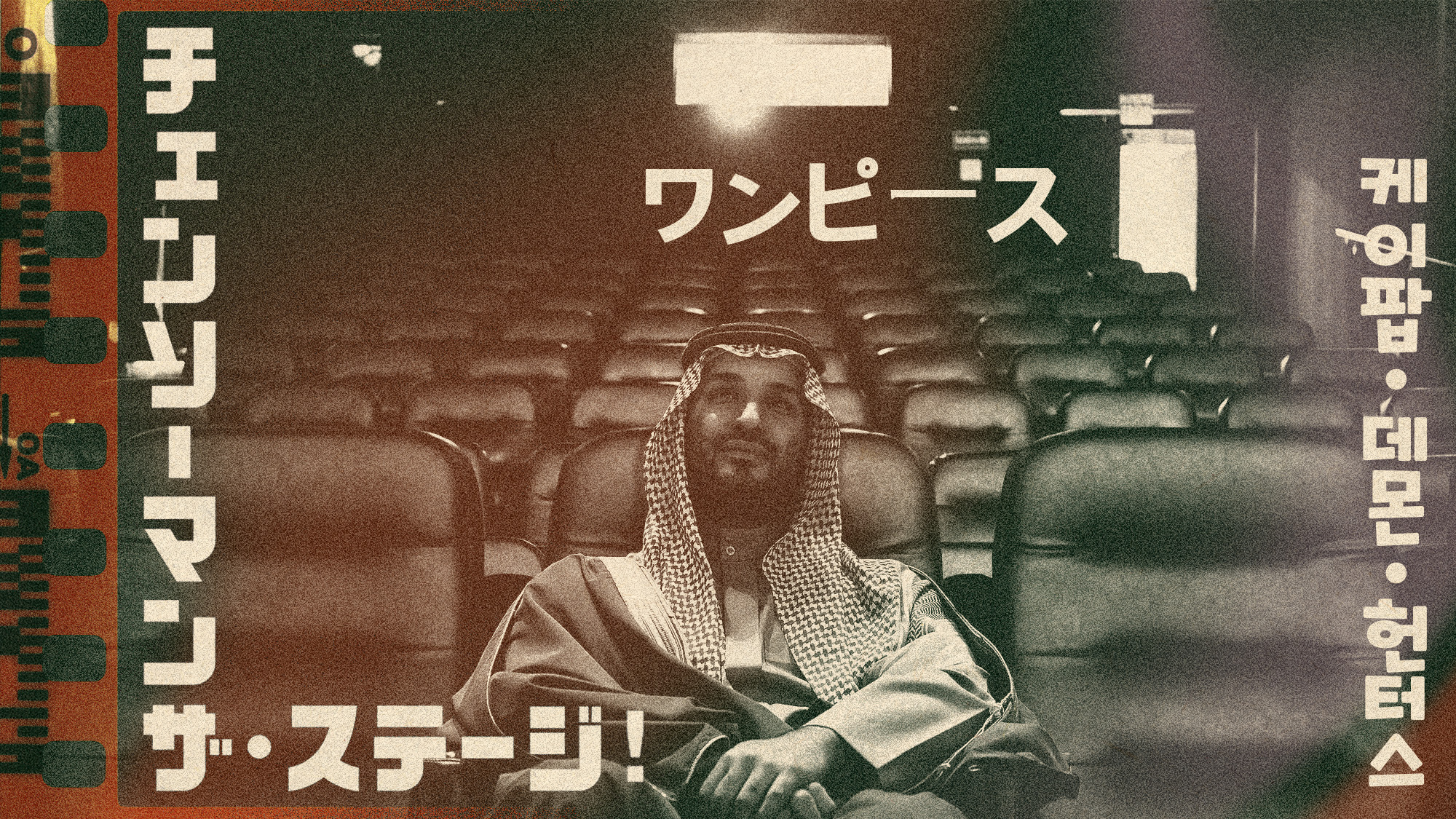

Why Saudi Arabia is muscling in on the world of anime

Why Saudi Arabia is muscling in on the world of animeUnder the Radar The anime industry is the latest focus of the kingdom’s ‘soft power’ portfolio

-

Electronic Arts to go private in record $55B deal

Electronic Arts to go private in record $55B dealspeed read The video game giant is behind ‘The Sims’ and ‘Madden NFL’

-

What Saudi Arabia wants with EA video games

What Saudi Arabia wants with EA video gamesIn the Spotlight The kingdom’s latest investment in gaming is another win for its ‘soft power’ portfolio

-

How might the Israel-Hamas war affect the global economy?

How might the Israel-Hamas war affect the global economy?Today's Big Question Regional escalation could send oil prices and inflation sky-high, sparking a worldwide recession

-

Recent mega-mergers could signal a turning point for the US oil industry

Recent mega-mergers could signal a turning point for the US oil industryTalking Point Both Chevron and Exxon have recently spent billions to acquire smaller oil companies

-

The PGA gets a Saudi makeover

The PGA gets a Saudi makeoverfeature Fans and players are reeling after the league announced a surprise merger with its Saudi-backed rival

-

Has Saudi Arabia lost control of oil prices?

Has Saudi Arabia lost control of oil prices?Today's Big Question Kingdom goes it alone to cut production, risking tension with US and reigniting cooling inflation in Europe

-

Why is Saudi Arabia going it alone on costly oil cuts?

Why is Saudi Arabia going it alone on costly oil cuts?Today's Big Question The unilateral production cuts could hurt its finances while raising gas prices for drivers and OPEC