Britain sells first ever bonds with minus rates - but what does that mean?

Historic sale comes as Bank of England mulls interest rates cut into negative territory

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

The UK government has broken new economic ground by borrowing £3.8bn for three years at a price that means investors will get back less than they paid out.

Or as The Times puts it, “for the first time in history, investors have lent the UK government money for a lengthy period with the promise that they will not be paid back in full”.

The issuing of government bonds, or gilts, with an effective negative interest rate of minus 0.003% on Wednesday came as Bank of England governor Andrew Bailey told MPs that plans to slash the base rate - currently at 0.1% - into negative territory were “under active review”.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

So what does it all mean?

A “negative yield” effectively means that investors “have to pay to lend money to fund the government’s response to the Covid-19 pandemic”, says The Guardian.

Gilts are seen as a “safe haven in times of financial stress”, with expectations that “inflation will be close to zero or could turn negative” currently adding to their appeal.

Investopedia explains that during periods of extremely low interest rates, “large institutional investors” are often “willing to pay a little over face value for high-quality bonds”.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

These investors accept “a negative return on their investment for the safety and liquidity that high-quality government and corporate bonds offer”, says the financial information site.

The practice has already been deployed in Japan and Germany, with Britain now joining the “topsy-turvy world of negative rates on new government borrowing”, adds The Times.

–––––––––––––––––––––––––––––––For a round-up of the most important stories from around the world - and a concise, refreshing and balanced take on the week’s news agenda - try The Week magazine. Start your trial subscription today –––––––––––––––––––––––––––––––

What happens next?

Aaron Rock, investment director at Aberdeen Standard Investments, predicts that regardless of whether the BoE’s Monetary Policy Committee chooses to adopt negative policy rates due to low inflation, “there will be continued demand for gilts at low and negative yields”.

BoE boss Bailey last month ruled out cutting policy rates to below zero. But the ongoing crisis has “persuaded the Bank that it needs to consider all tools available to make credit cheaper for embattled businesses and households”, according to The Guardian.

“The move would be unprecedented in the Bank’s 325-year history and would leave only the US Federal Reserve among major central banks to rule out negative rates,” the newspaper adds.

-

Switzerland could vote to cap its population

Switzerland could vote to cap its populationUnder the Radar Swiss People’s Party proposes referendum on radical anti-immigration measure to limit residents to 10 million

-

Political cartoons for February 15

Political cartoons for February 15Cartoons Sunday's political cartoons include political ventriloquism, Europe in the middle, and more

-

The broken water companies failing England and Wales

The broken water companies failing England and WalesExplainer With rising bills, deteriorating river health and a lack of investment, regulators face an uphill battle to stabilise the industry

-

The end for central bank independence?

The end for central bank independence?The Explainer Trump’s war on the US Federal Reserve comes at a moment of global weakening in central bank authority

-

Should Labour break manifesto pledge and raise taxes?

Should Labour break manifesto pledge and raise taxes?Today's Big Question There are ‘powerful’ fiscal arguments for an income tax rise but it could mean ‘game over’ for the government

-

What are stablecoins, and why is the government so interested in them?

What are stablecoins, and why is the government so interested in them?The Explainer With the government backing calls for the regulation of certain cryptocurrencies, are stablecoins the future?

-

Why the catastrophe bond market is growing

Why the catastrophe bond market is growingThe Explainer The bonds pay for climate change disaster damages

-

How the US bond market works – and why it matters

How the US bond market works – and why it mattersThe Explainer Donald Trump was forced to U-turn on tariffs after being 'spooked' by rise in Treasury yields

-

US Treasuries were a safe haven for investors. What changed?

US Treasuries were a safe haven for investors. What changed?Today's Big Question Doubts about America's fiscal competence after 'Liberation Day'

-

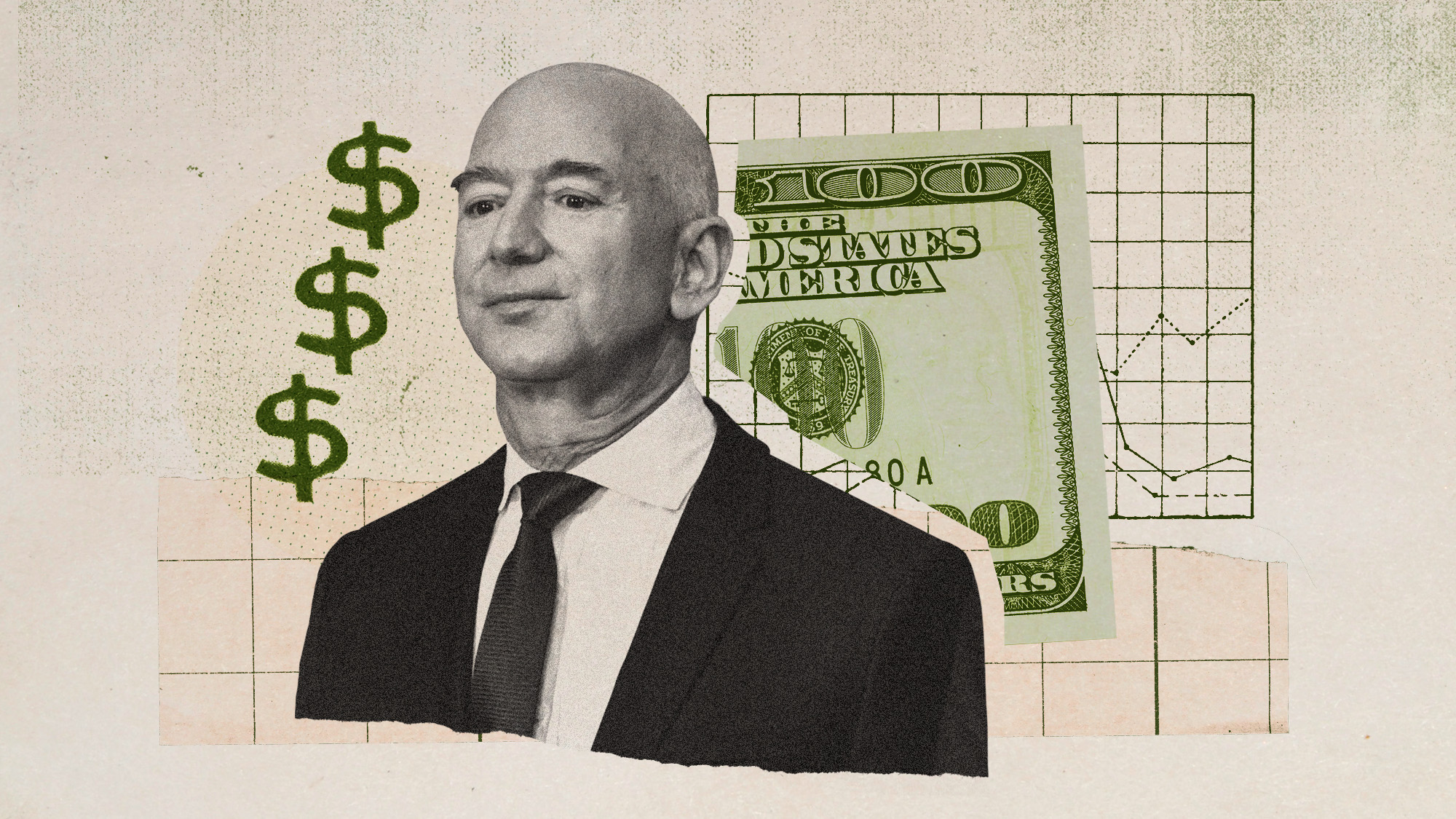

What's Jeff Bezos' net worth?

What's Jeff Bezos' net worth?In Depth The Amazon tycoon and third richest person in the world made his fortune pioneering online retail

-

Will Rachel Reeves have to raise taxes again?

Will Rachel Reeves have to raise taxes again?Today's Big Question Rising gilt yields and higher debt interest sound warning that Chancellor may miss her Budget borrowing targets