John Lewis rapped over 'unfair' Apple Watch promotion

Stock was withdrawn 'sooner than it could have been' during Black Friday sales period, says retailer

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

John Lewis cuts staff bonus as pound slump bites

13 January

John Lewis and Waitrose both enjoyed stellar Christmas sales in what proved to be a strong festive season for the high street, but this will not prevent staff feeling the pinch this year.

Bosses at John Lewis Partnership, which owns both brands, warned yesterday its lucrative annual bonus for employees, considered "partners" in the company, will fall "significantly" when it is confirmed in March.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

"This will be the fourth consecutive year that the group, which is collectively owned by its staff, has reduced the payout," says The Guardian.

But the paper adds it is "highly unusual" for the company to cut payments in years when profits have risen, which is precisely what is expected this year.

Last year, staff received around 10 per cent of their salaries, or an average of £1,500.

Sales at John Lewis, including online, rose by 2.7 per cent in the six weeks to 31 December, with internet transactions surging 12 per cent. Waitrose, meanwhile, saw like-for-like sales rise 2.8 per cent.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Chairman Charlie Mayfield said: "Although we expect to report profits up on last year, trading profit is under pressure. This reflects the greater changes taking place across the retail sector."

A sharp fall in the pound since the Brexit vote, increasing import costs, has made the retail sector highly competitive.

Mayfield said the worst effects are still to come from sterling's near-20 per cent slump, which will force retailers to decide whether to swallow higher costs or pass them on to consumers.

Until now, most companies have been sheltered because they typically hedge currency six to 12 months in advance.

Mayfield added: "Sterling, I think, is the dog that hasn't really barked. My view is quite a lot of [the cost] will be absorbed by retailers as we are in an increasingly competitive market place with excess of retail space.

"Even if it is passed on to customers it is not necessarily a good thing as it will dampen demand."

The Guardian says online sales also bring their own pressures to retailers "because of the cost of home deliveries and returns".

John Lewis boss steps down to be Tories' mayoral pick

30 September

John Lewis boss Andy Street is stepping down from the department store after being selected as a candidate to be West Midlands's first mayor.

The "proud Brummie", a 31-year veteran of the chain, was formally selected by local members of the Conservative Party to be its official candidate for the election, to be held in May next year, says the BBC. Bosses said they will announce his successor in due course.

Under Street's nine-year rule as managing director, John Lewis has seen sales increase by nearly 70 per cent, reaching £3.7bn last year.

The businessman will use a speech at the Conservative Party conference this Sunday to "set out his plans to make the West Midlands an even more prosperous and successful part of the country".

He is up against Labour candidate Sion Simon MEP and Liberal Democrat Beverley Nielsen, who also has a business background as a regional head for the Confederation of British Industry.

Elections for so-called "metro mayors" of combined authority districts are also taking place next year in Greater Manchester, Liverpool and Tees Valley.

The "Conservatives see the West Midlands contest as the one they have the best chance of winning", says the Birmingham Mail.

While many voters in the cities of Birmingham, Wolverhampton and Coventry typically vote Labour at the general election, more traditional Tory areas such as Solihull also come under the combined authority.

Introduced as part of a devolution deal struck by former chancellor George Osborne, mayoral contests can throw up surprises as party loyalties matter less and popular personalities can win the day, as Tory Boris Johnson proved by winning Labour-dominated London for two consecutive terms.

Street said: "This election needs to go beyond traditional political loyalties and I look forward to seeking voters' support for the job ahead."

John Lewis profits slump as staff costs bite

16 September

John Lewis has reported a sharp dip in profits for the first six months of the year. The fall is blamed in part on higher staff costs, which have helped to wipe out a steady rise in sales and market share.

The partnership's chairman, Sir Charlie Mayfield, said the retailer was being affected by "far-reaching changes in society, in retail and in the workplace".

Group pre-tax profits fell by almost 15 per cent to a little less than £82m. The Financial Times adds that when certain one-off expenses are factored in – such as a £25m property writedown relating to seven new Waitrose supermarkets it no longer plans to open – profits are down by almost 75 per cent.

Overall sales rose 3.1 per cent to £5.3bn, driven by a rise of more than three per cent in like-for-like turnover at the company's John Lewis department stores.

Sales experienced a modest dip – by one per cent on a like-for-like basis – at the store's Waitrose supermarket chain. The company has now substantially scaled back its plans for expansion.

Operating profits at John Lewis and Waitrose were down 31 and 10.5 per cent respectively.

The fall in profits is closely linked to increased staff costs as a result of the introduction of the national living wage, which set the minimum wage for over 25s at £7.20 from April.

This rate will increase steadily in the coming years and is set to reach £9 an hour or more by 2020. John Lewis pays its staff above the minimum and expects to spend as much as £30m maintaining its premium wages, which are augmented by a generous annual bonus.

In return for these perks, the store expects staff productivity to increase. As structural changes are set in motion over the next few years, the retailer also expects its workforce to shrink.

"Our ownership structure makes it especially important that we manage the partnership carefully and thoughtfully for the long term and our plans anticipate the impact of these bigger changes," Mayfield told the BBC.

The positive news on the horizon is that John Lewis typically endures a more volatile and lower-profit first half of the year, with greater sales in the second half that covers the critical Christmas period and accounts for around two-thirds of the store's annual total.

Pointing to big gains in online shopping and market share, John Lewis's managing director Andy Street says the group is "extremely well prepared" for a "brilliant" performance going into the second half.

John Lewis staff bonus cut as profits fall – but nobody seems to care

11 March

John Lewis Partnership has dropped its staff bonus for the third consecutive year and to a 13-year low, as it reported profits fell by close to 11 per cent last year.

Staff at the mutual, who, as co-owners of the business, are entitled to a share of the profits, were allocated a combined payout of a little more than £145m, or around ten per cent of their salaries. This, the BBC notes, is down from 11 per cent last year, 15 per cent in 2014 and 17 per cent in 2013.

The fall reflects the "tough trading conditions" faced by the company's brands and especially at its supermarket group, Waitrose, amid a period of deflation. Close to three per cent was wiped off prices across the sector in 2015.

Overall profit before tax and exceptional items was £434.8m, up 24 per cent on 2015. This was boosted by £129m proceeds from a big property sale, however, and underlying pre-tax profit was down 10.9 per cent at £305.5m. Revenues edged up 0.5 per cent to £9.75bn.

At Waitrose, sales were £232.6m, down two per cent. When adjusted for the fact that the last financial year comprised of 53 trading weeks rather than 52, the like-for-like figure showed an increase of 3.9 per cent. Actual like-for-like sales in stores open more than one year fell 1.3 per cent but given the deflation, this still amounted to an increase in market share.

Meanwhile, at the John Lewis department store, business profits were mostly flat at £250.2m, down 0.1 per cent but up 0.2 per cent on a 52-week comparison.

Dragging down the overall performance was a big increase of £54.2m in the operating cost for the firm's pension scheme, which was up 28.4 per cent. Most of this additional expense, the Daily Telegraph points out, was due to the "low interest rate environment".

All in all, chairman Sir Charlie Mayfield said John Lewis had put in a "healthy trading performance" in what had been a "difficult market". He noted that deflation had persisted in the grocery sector and that there was "fairly subdued trade in non-food generally" – he is "not expecting [market conditions] to become any easier".

This may not bode well for a bigger bonus next year, although staff don't seem too concerned. In fact, the Telegraph says their reaction to this year's lower payout, which is the equivalent of around five weeks' pay, was jubilant.

"We were expecting between eight and ten per cent, so ten per cent is amazing," said Charlie McCarter, a University of Southampton graduate who aims to become a line manager. "It's been a hard year, especially in retail, from what I can gather."

John Lewis defies gloom over Christmas retail figures

06 January

John Lewis has published positive sales figures for the important Christmas trading period, defying gloomy forecasts across the retail sector.

Overall sales in the six weeks to 2 January rose by more than 4 per cent from the same season last year to £1.81bn, The Guardian notes. The John Lewis department-store brand was the driving force, with overall sales rising 6.9 per cent to £951.3m and like-for-like sales at stores open more than one year up 5.1 per cent.

In contrast, the Waitrose supermarket brand fell on a like-for-like basis by 1.4 per cent. But even here there were bright spots: overall sales rose 1.2 per cent to £859.8m, while a late peak in consumer buying saw stores record all-time high sales volumes on both the 23and 24December. Footfall was up 7 per cent, with takings hit by ongoing deflation across the industry.

Underneath the headline figures, the wider dynamic shaking up the high street was apparent, with fewer consumers buying in stores and more migrating online. But unlike Next, which published "disappointing" festive season figures yesterday, John Lewis benefitted from a huge 21 per cent surge in web-based revenues that more than offset a 1.2 per cent dip in stores.

John Lewis Partnership chairman Sir Charlie Mayfield told the BBC that the employee-owned firm was "pleased" with the results. He noted that grocery was "challenging" because of the deflationary environment – "If broccoli is half price, you and I have to eat twice as much for us to make the same money," he said – and that in-store sales were strongly up for the department stores' post-Christmas clearance sales event.

Also, significantly, John Lewis said alongside home and technology that its fashion department had seen strong sales growth, bucking the pattern of decline among clothing brands prompted by the unseasonably warm winter weather.

-

The problem with diagnosing profound autism

The problem with diagnosing profound autismThe Explainer Experts are reconsidering the idea of autism as a spectrum, which could impact diagnoses and policy making for the condition

-

What to know before filing your own taxes for the first time

What to know before filing your own taxes for the first timethe explainer Tackle this financial milestone with confidence

-

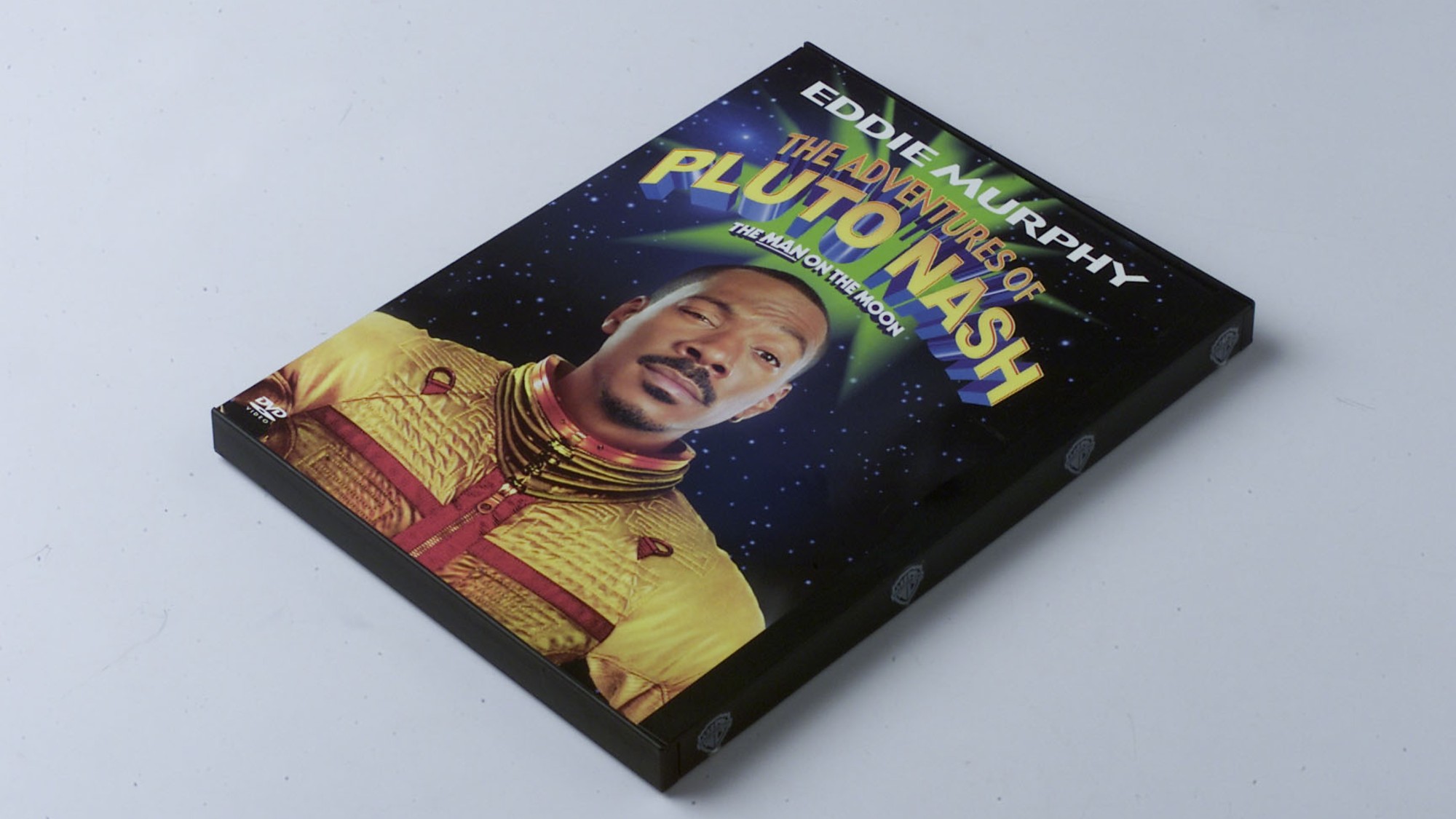

The biggest box office flops of the 21st century

The biggest box office flops of the 21st centuryin depth Unnecessary remakes and turgid, expensive CGI-fests highlight this list of these most notorious box-office losers

-

Five key takeaways from Jeremy Hunt's Autumn Statement

Five key takeaways from Jeremy Hunt's Autumn StatementThe Explainer Benefits rise with higher inflation figure, pension triple lock maintained and National Insurance cut

-

Withdrawing benefits: 'war on work shy' or 'matter of fairness'?

Withdrawing benefits: 'war on work shy' or 'matter of fairness'?Talking Point Jeremy Hunt to boost minimum wage while cracking down on claimants who refuse to look for work

-

Is it all change at John Lewis?

Is it all change at John Lewis?feature Proposed changes to company’s business model have been causing concern in Middle England

-

Tory leadership election: why tax cuts are an economic gamble

Tory leadership election: why tax cuts are an economic gamblefeature The candidates regard tax cuts as the road to redemption, only differing on the details of how much and how soon

-

Will John Lewis close some stores permanently?

Will John Lewis close some stores permanently?In Depth Sources suggest not all of the chain’s department stores will reopen after coronavirus lockdown is lifted

-

How Betfred makes millions treating gambling addicts

How Betfred makes millions treating gambling addictsSpeed Read Company owners also run firm that provides treatment for those hooked on betting

-

Retail sector suffers worst year in quarter of a century

Retail sector suffers worst year in quarter of a centurySpeed Read British Retail Consortium says last year marked first annual sales decline since 1995

-

John Lewis to buy back used clothing

John Lewis to buy back used clothingSpeed Read Retailer will pay customers for unwanted items, including socks and underwear