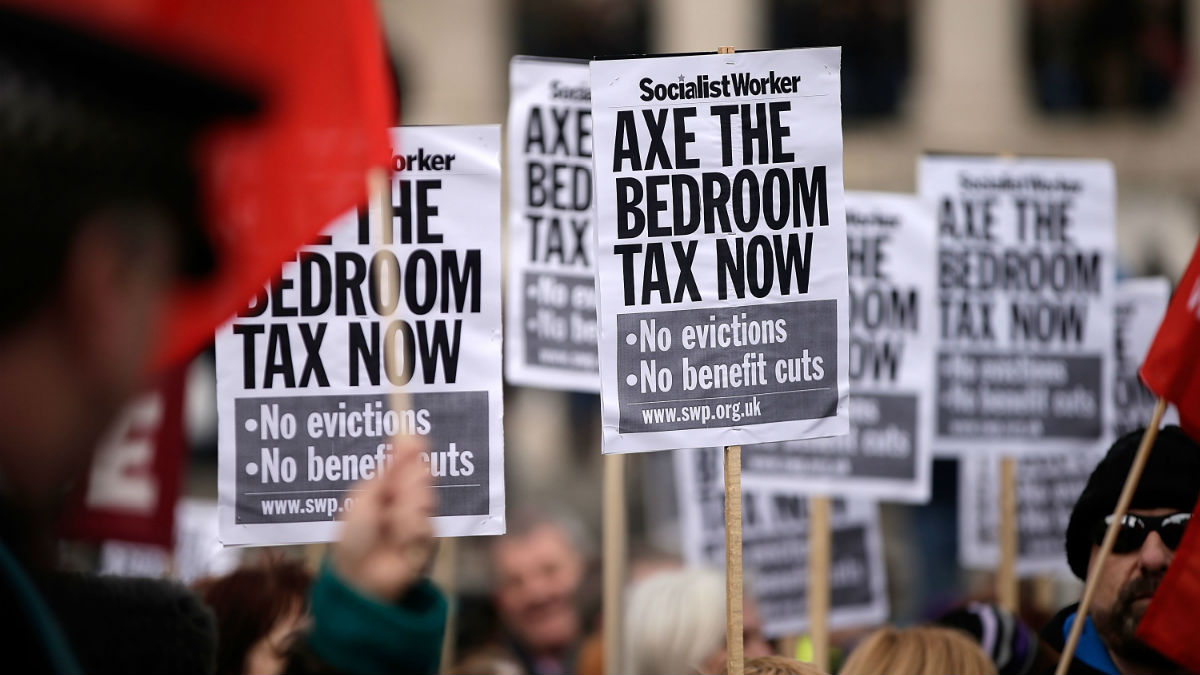

'Bedroom tax' declared unlawful by Court of Appeal

Domestic violence victim and family of disabled teenager win legal challenges against policy

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

The Court of Appeal has declared the government's "bedroom tax" discriminatory and unlawful following a legal challenge by a victim of domestic violence and the family of a disabled teenager.

Since April 2013, social-housing tenants who have unoccupied bedrooms have had their benefits cut in a bid to encourage them to downsize to a smaller property.

But the spare room subsidy has faced criticism for disproportionately affecting the vulnerable and causing financial problems for those unable to find suitable alternative accommodation.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Today, three judges at the Court of Appeal ruled in the favour of two parties who argued the policy was at fault for unlawful discrimination.

In one case, an unnamed single mother lived in a three-bedroomed council house fitted with a secure panic room to protect her from a violent ex-partner.

In the second case, Paul and Sue Rutherford, the grandparents of a severely disabled teenager, had a spare third bedroom for his equipment and to allow carers to stay overnight.

Lord Chief Justice Lord Thomas, Lord Justice Tomlinson and Lord Justice Vos allowed both appeals on the grounds the "admitted discrimination" in each case "has not been justified by the Secretary of State".

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

The government, which rejects the term "bedroom tax", has told the BBC it will appeal.

Ministers claim the removal of the spare room subsidy was a "fair and necessary reform" that aims to save around £480m a year from the housing benefit bill and enable families in overcrowded accommodation to find an appropriately sized property.