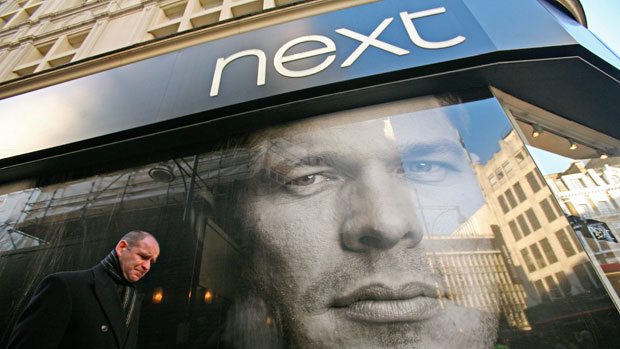

Next warns of 'challenging' 2017 after Christmas downturn

Share price plummets 12 per cent in early morning trading following 0.4 per cent drop in sales over festive season

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

High street fashion chain Next has warned that 2017 will be "challenging" after reporting a downturn in sales over the festive period.

Full-price sales year-on-year were down 0.4 per cent in November and the first 24 days of December, said the retailer, while annual profits for 2016 are now expected to be £792m, the lower end of previous forecasts of between £785m and £825m.

The news caused Next's share price to fall 12 per cent as trading opened in London today.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

The company said: "The year ahead looks set to be another challenging year; therefore we are preparing the company for tougher times."

It added: "The fact that sales continued to decline in quarter four, beyond the anniversary of the start of the slowdown in November 2015, means that we expect the cyclical slow-down in spending on clothing and footwear to continue into next year."

It also warned prices could rise by up to five per cent because of the fall in the value of the pound following the Brexit vote, something which would "depress sales revenues by around 0.5 per cent".

Sales for the next 12 months are expected to lie between a fall of 4.5 per cent and a rise of 1.5 per cent, while profits are predicted to fall to between £680m and £780m.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

There is "one bright spot" for the retailer, says Retail Week: sales from its Next Directory catalogue increased by 5.1 per cent.

Retail Week adds that the company has "historically outperformed the High Street", but says its performance has "faltered in recent quarters".

Next, however, said it was "well-placed to weather a downturn in consumer demand".

It added: "Our balance sheet remains robust and our net debt is forecast to close the current year at around £850m, this is more than covered by the value of our Directory debtor book, which will be approximately £1bn at the end of January 2017."

-

Political cartoons for February 16

Political cartoons for February 16Cartoons Monday’s political cartoons include President's Day, a valentine from the Epstein files, and more

-

Regent Hong Kong: a tranquil haven with a prime waterfront spot

Regent Hong Kong: a tranquil haven with a prime waterfront spotThe Week Recommends The trendy hotel recently underwent an extensive two-year revamp

-

The problem with diagnosing profound autism

The problem with diagnosing profound autismThe Explainer Experts are reconsidering the idea of autism as a spectrum, which could impact diagnoses and policy making for the condition

-

Can the UK avoid the Trump tariff bombshell?

Can the UK avoid the Trump tariff bombshell?Today's Big Question President says UK is 'way out of line' but it may still escape worst of US trade levies

-

Five years on, can Labour's reset fix Brexit?

Five years on, can Labour's reset fix Brexit?Today's Big Question Keir Starmer's revised deal could end up a 'messy' compromise that 'fails to satisfy anyone'

-

Why au pairs might become a thing of the past

Why au pairs might become a thing of the pastUnder The Radar Brexit and wage ruling are threatening the 'mutually beneficial arrangement'

-

Brexit: where we are four years on

Brexit: where we are four years onThe Explainer Questions around immigration, trade and Northern Ireland remain as 'divisive as ever'

-

Is it time for Britons to accept they are poorer?

Is it time for Britons to accept they are poorer?Today's Big Question Remark from Bank of England’s Huw Pill condemned as ‘tin-eared’

-

Is Brexit to blame for the current financial crisis?

Is Brexit to blame for the current financial crisis?Talking Point Some economists say leaving the EU is behind Britain’s worsening finances but others question the data

-

Labour shortages: the ‘most urgent problem’ facing the UK economy right now

Labour shortages: the ‘most urgent problem’ facing the UK economy right nowSpeed Read Britain is currently in the grip of an ‘employment crisis’

-

Will the energy war hurt Europe more than Russia?

Will the energy war hurt Europe more than Russia?Speed Read European Commission proposes a total ban on Russian oil