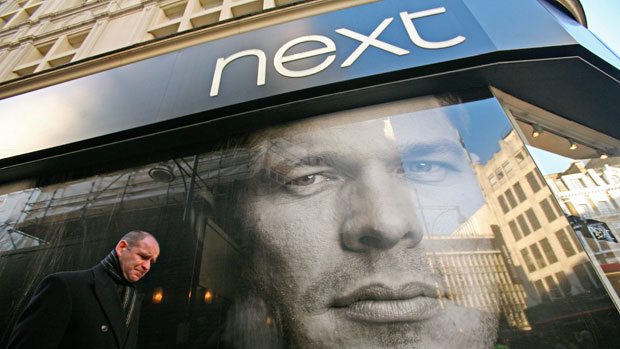

Next warns of 'challenging' 2017 after Christmas downturn

Share price plummets 12 per cent in early morning trading following 0.4 per cent drop in sales over festive season

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

High street fashion chain Next has warned that 2017 will be "challenging" after reporting a downturn in sales over the festive period.

Full-price sales year-on-year were down 0.4 per cent in November and the first 24 days of December, said the retailer, while annual profits for 2016 are now expected to be £792m, the lower end of previous forecasts of between £785m and £825m.

The news caused Next's share price to fall 12 per cent as trading opened in London today.

Article continues belowThe Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

The company said: "The year ahead looks set to be another challenging year; therefore we are preparing the company for tougher times."

It added: "The fact that sales continued to decline in quarter four, beyond the anniversary of the start of the slowdown in November 2015, means that we expect the cyclical slow-down in spending on clothing and footwear to continue into next year."

It also warned prices could rise by up to five per cent because of the fall in the value of the pound following the Brexit vote, something which would "depress sales revenues by around 0.5 per cent".

Sales for the next 12 months are expected to lie between a fall of 4.5 per cent and a rise of 1.5 per cent, while profits are predicted to fall to between £680m and £780m.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

There is "one bright spot" for the retailer, says Retail Week: sales from its Next Directory catalogue increased by 5.1 per cent.

Retail Week adds that the company has "historically outperformed the High Street", but says its performance has "faltered in recent quarters".

Next, however, said it was "well-placed to weather a downturn in consumer demand".

It added: "Our balance sheet remains robust and our net debt is forecast to close the current year at around £850m, this is more than covered by the value of our Directory debtor book, which will be approximately £1bn at the end of January 2017."