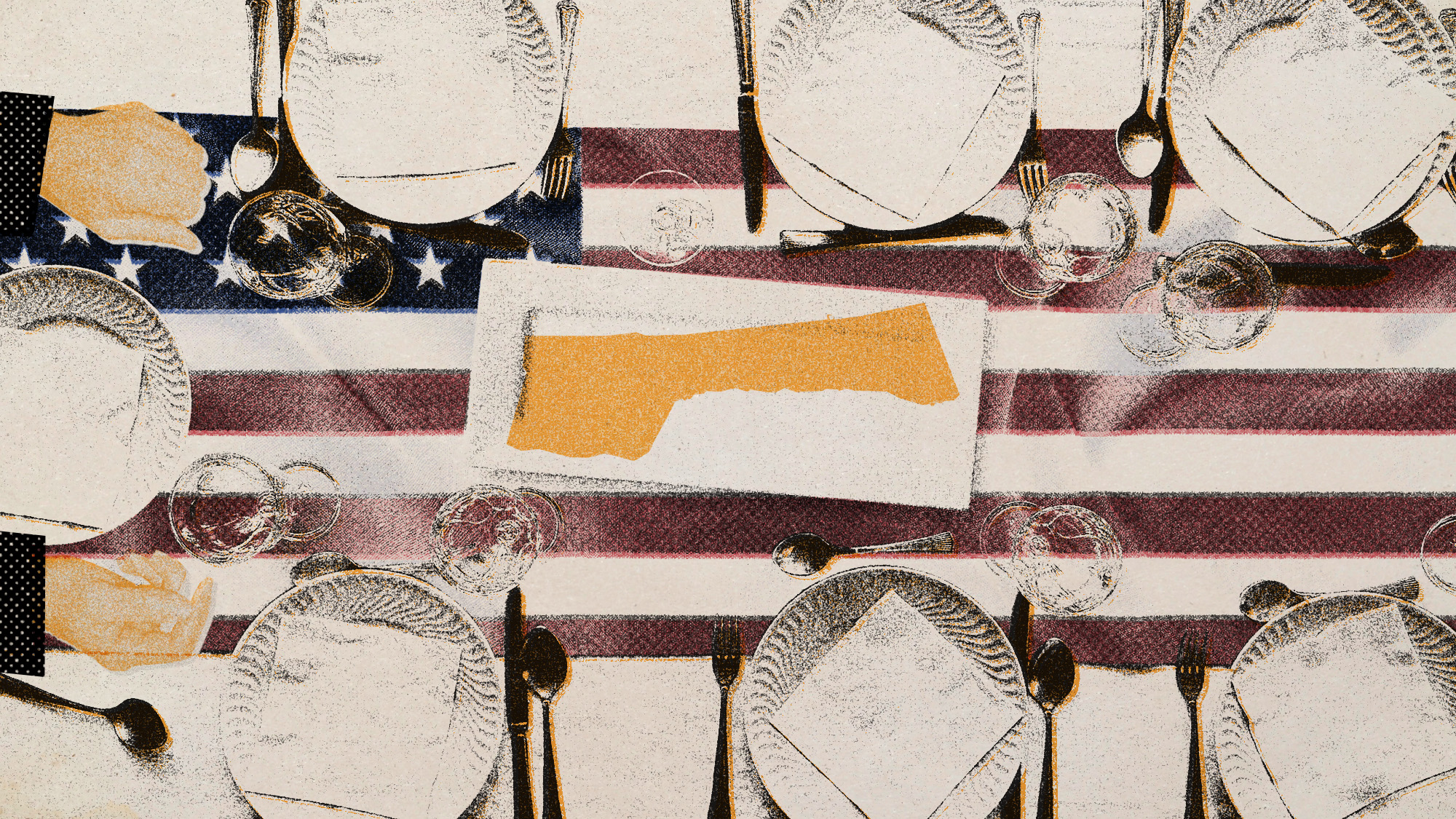

Can the UK avoid the Trump tariff bombshell?

President says UK is 'way out of line' but it may still escape worst of US trade levies

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Donald Trump has said the UK is "way out of line" in its trading relationship with the US but could still avoid the crippling tariffs expected to be imposed on the EU.

Having announced 25% levies on goods coming from Canada and Mexico, as well as 10% on those from China, the US president has now turned his attention to Europe.

"Whitehall is watching anxiously," said The Telegraph, even though UK ministers are hoping that "a good dose of charm and sweet talk can keep British companies out of the firing line".

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

What did the commentators say?

Trump has described the US's $213 billion (£173 billion) trade deficit with the EU last year as "an atrocity", but "when it comes to the UK, things are slightly different", said the BBC. "The US doesn't run as high a trade deficit with Britain – in fact at one point last year it ran a surplus – and government ministers hope that this will persuade the president to spare the UK from tariffs."

It may be true that "the UK does not appear to be directly in Trump's sights", said The Guardian's economics editor, Heather Stewart, "but even if the UK can avoid being slapped with tariffs directly", our "open economy" means we are vulnerable to the knock-on effects of any "significant slowdown in international trade flows".

A 2022 risk analysis by the Office for Budget Responsibility estimated an all-out global trade war would depress UK GDP by 5% over a decade. Under 10% tariffs on all US imports, the National Institute of Economic and Social Research predicted the pound could lose 10-15% of its value against a resurgent dollar, leading to higher import costs and higher inflation. The subsequent rise in UK government bonds would push up borrowing costs for the Treasury – leaving less money to spend on public services.

The "risks for the UK's growth-starved and debt-bloated economy are significant – and they may be unavoidable, even if it is not a direct target", said The Telegraph.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

What next?

With US tariffs on the EU looking increasingly likely, "Britain may face tough diplomatic choices", said Business Matters.

Keir Starmer, who today becomes the first UK prime minister since Brexit to attend an EU summit in Brussels, has vowed to "reset" relations with the bloc, including closer economic cooperation.

At the same time, senior figures in his cabinet have also been trying to mend bridges with the new US administration. Chancellor Rachel Reeves recently praised Trump's "optimism", "but locking in a stronger UK-EU agreement while placating Washington could become more difficult".

If the UK is forced to choose, the EU "remains our biggest trade partner and offers more trade policy certainty", said Adam Butlin on the London School of Economics blog. "But such polarisation of picking sides with one or another trade partner is not an ideal situation."

-

Should the EU and UK join Trump’s board of peace?

Should the EU and UK join Trump’s board of peace?Today's Big Question After rushing to praise the initiative European leaders are now alarmed

-

Antonia Romeo and Whitehall’s women problem

Antonia Romeo and Whitehall’s women problemThe Explainer Before her appointment as cabinet secretary, commentators said hostile briefings and vetting concerns were evidence of ‘sexist, misogynistic culture’ in No. 10

-

Local elections 2026: where are they and who is expected to win?

Local elections 2026: where are they and who is expected to win?The Explainer Labour is braced for heavy losses and U-turn on postponing some council elections hasn’t helped the party’s prospects

-

Currencies: Why Trump wants a weak dollar

Currencies: Why Trump wants a weak dollarFeature The dollar has fallen 12% since Trump took office

-

TikTok: New owners, same risks

TikTok: New owners, same risksFeature What are Larry Ellison’s plans for TikTok US?

-

Trump wants a weaker dollar, but economists aren’t so sure

Trump wants a weaker dollar, but economists aren’t so sureTalking Points A weaker dollar can make imports more expensive but also boost gold

-

Leadership: A conspicuous silence from CEOs

Leadership: A conspicuous silence from CEOsFeature CEOs were more vocal during Trump’s first term

-

The end for central bank independence?

The end for central bank independence?The Explainer Trump’s war on the US Federal Reserve comes at a moment of global weakening in central bank authority

-

Can Trump make single-family homes affordable by banning big investors?

Can Trump make single-family homes affordable by banning big investors?Talking Points Wall Street takes the blame

-

What will the US economy look like in 2026?

What will the US economy look like in 2026?Today’s Big Question Wall Street is bullish, but uncertain

-

Tariffs have American whiskey distillers on the rocks

Tariffs have American whiskey distillers on the rocksIn the Spotlight Jim Beam is the latest brand to feel the pain