Eurozone economies grow at fastest rate since 2007 crisis

New figures are in stark contrast to UK growth forecasts

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Eurozone economies grew at their fastest rate for a decade last year, contrasting sharply with UK economic growth since the Brexit vote.

Official figures for 2017 from Eurostat show the GDP of the single currency area expanded by 2.5% last year, its highest rate since 2007 and the start of the financial crisis.

After years of economic stagnation and rolling crises, “the eurozone is in the midst of a broad cyclical expansion, fuelled by recovering confidence and monetary stimulus from the European Central Bank” and buoyed by a resurgent global economy, says The Independent.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Despite uncertainty surrounding the impact of the ongoing Brexit negotiations with the UK, said Balraj Sroya of Foenix Partners, the strong GDP and other economic indicators show the eurozone has put the recession and Greek debt crisis behind it “and is looking stronger and more stable than ever”.

The figures contrast starkly with the recent performance of the UK economy and growth forecasts for the next few years post-Brexit.

The UK economy is estimated to have grown by 1.8% in 2017, down from 2016’s 1.9% rate and its weakest expansion since 2012. Last week the International Monetary Fund downgraded its outlook for UK growth for 2019 to 1.5%, compared to 2.2% for the eurozone.

The latest growth figures came as the fallout continued from the leaked assessment reports detailing the impact of Brexit on the UK economy.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

First published by Buzzfeed, the secret report which concludes all three likely Brexit options would leave Britain poorer makes grim reading for Brexiters and has led Labour to accuse the Government of a “cover-up” in an attempt to hide the economic severity of leaving the EU.

Defending the decision not to release the findings to MPs or the public, ministers said the report must remain secret to avoid harming the “national interest”.

-

Lawmakers say Epstein files implicate 6 more men

Lawmakers say Epstein files implicate 6 more menSpeed Read The Trump department apparently blacked out the names of several people who should have been identified

-

Maxwell pleads 5th, offers Epstein answers for pardon

Maxwell pleads 5th, offers Epstein answers for pardonSpeed Read She offered to talk only if she first received a pardon from President Donald Trump

-

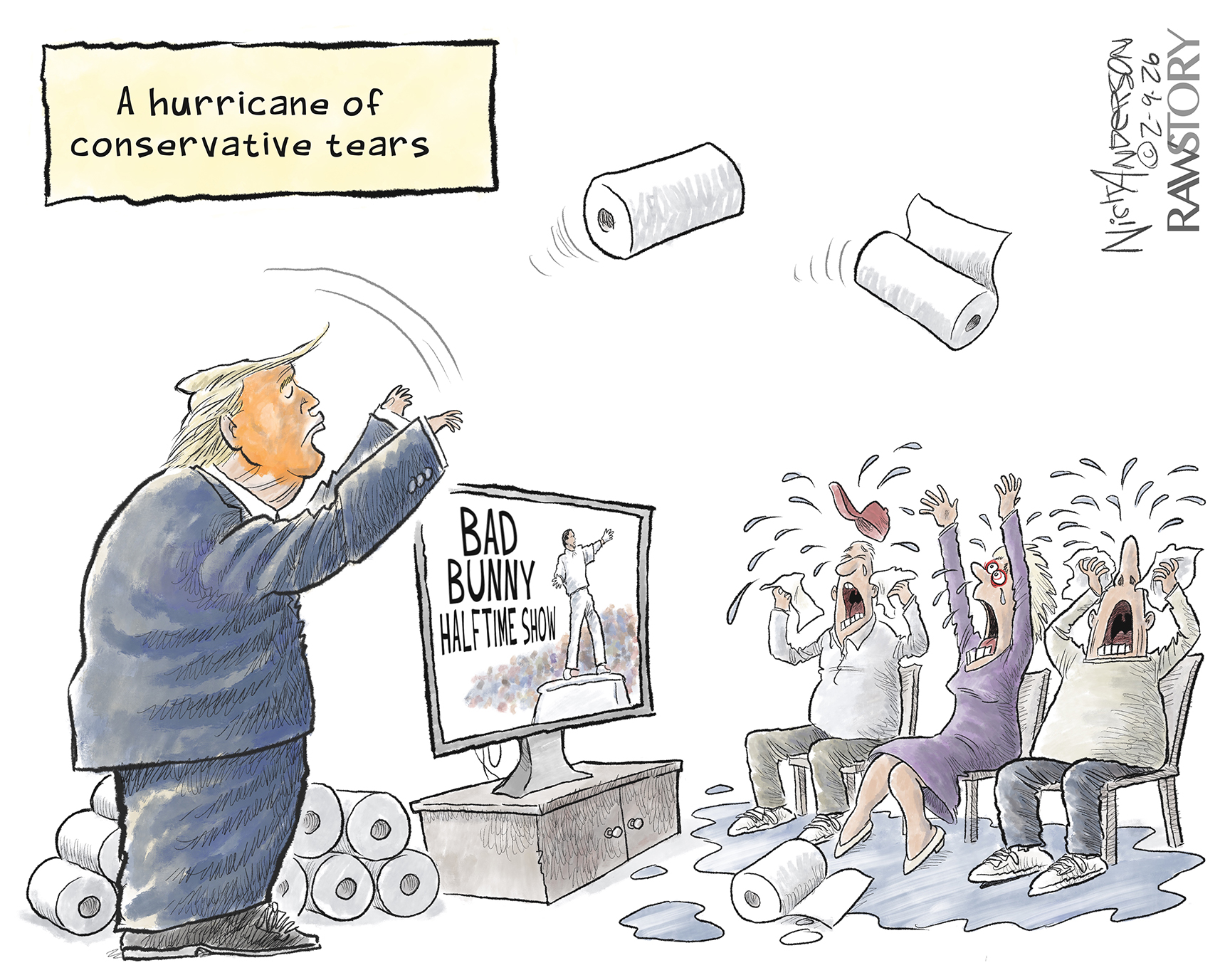

Political cartoons for February 10

Political cartoons for February 10Cartoons Tuesday's political cartoons include halftime hate, the America First Games, and Cupid's woe

-

Can the UK avoid the Trump tariff bombshell?

Can the UK avoid the Trump tariff bombshell?Today's Big Question President says UK is 'way out of line' but it may still escape worst of US trade levies

-

Five years on, can Labour's reset fix Brexit?

Five years on, can Labour's reset fix Brexit?Today's Big Question Keir Starmer's revised deal could end up a 'messy' compromise that 'fails to satisfy anyone'

-

Why au pairs might become a thing of the past

Why au pairs might become a thing of the pastUnder The Radar Brexit and wage ruling are threatening the 'mutually beneficial arrangement'

-

Brexit: where we are four years on

Brexit: where we are four years onThe Explainer Questions around immigration, trade and Northern Ireland remain as 'divisive as ever'

-

Is it time for Britons to accept they are poorer?

Is it time for Britons to accept they are poorer?Today's Big Question Remark from Bank of England’s Huw Pill condemned as ‘tin-eared’

-

Is Brexit to blame for the current financial crisis?

Is Brexit to blame for the current financial crisis?Talking Point Some economists say leaving the EU is behind Britain’s worsening finances but others question the data

-

Labour shortages: the ‘most urgent problem’ facing the UK economy right now

Labour shortages: the ‘most urgent problem’ facing the UK economy right nowSpeed Read Britain is currently in the grip of an ‘employment crisis’

-

Will the energy war hurt Europe more than Russia?

Will the energy war hurt Europe more than Russia?Speed Read European Commission proposes a total ban on Russian oil