What Janet Yellen could learn from Alan Greenspan

The so-called Oracle never saw the financial crisis coming. But his insights into the 90s economic boom were visionary.

In the aftermath of the 2008 financial crisis, no reputation was more tarnished than that of Alan Greenspan, the long-time Fed chair who presided over what turned out to be the mother of all asset bubbles. But as Janet Yellen, the current chair, mulls the central bank's direction amidst an improving economy, she would do well to remember the insights of the man who was once called the Oracle.

Whatever his other flaws, the greatest thing Greenspan ever did was to refuse to raise interest rates as the economic boom of the late 1990s gathered strength. Back then, as the unemployment rate started to fall below 6 percent, the usual suspects started howling piteously about the mounting danger of inflation. But as Jared Bernstein and Dean Baker explain in their excellent book Getting Back to Full Employment, Greenspan decided to let it ride. The economy roared, and inflation remained utterly quiescent.

Janet Yellen is now in a similar situation. The unemployment rate is headed towards 6 percent and trending down. The unemployment picture, while not objectively good, is the best it has been in a while, following three solid job reports that suggest a trend toward accelerating job growth. Inflation hawks are again baying for a tighter money policy (and therefore a slower recovery), and their yelping will only get louder as the unemployment rate gets lower.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Whether Yellen will also let it ride could determine the course of the American economy, as well as the destinies of millions of suffering Americans.

To be sure, there are major differences between economic conditions in the late 90s and mid-2014. The late 90s were a golden time when wage share of the economy, the participation rate, and the unemployment rate all spiked in the right directions. The year 2000, in particular, featured an unemployment rate of 4 percent for the entire year with inflation right on the 2 percent target.

The Fed was also less extended back then. Its benchmark interest rate target at the end of 1998 was 4.75 percent, whereas the current target has been stuck at near zero for years. Furthermore, the Fed is in the midst of buying tens of billions of dollars worth of assets a month as part of its quantitative easing program.

And just why the economy behaved as it did in the 90s is a matter of some dispute. Greenspan's great insight was that the internet revolution was juicing U.S. productivity, which mean the economy could absorb higher growth without causing higher inflation. In other words, Greenspan had a solid neoclassical argument to back up his position that inflation was a minor risk, since letting it ride would translate straightforwardly into a larger economy.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Today, the opposite seems to be happening, with job growth proceeding despite extremely weak GDP growth. That implies slowing productivity, which is already caused worries at previous Fed meetings. (The same dynamic has been happening in Britain for years now.)

I think economic inequality is partly to blame for this, with both mass-market producers and employers struggling to get traction because ordinary people — either buried under debt or without wealth — don't have enough money to spend. For whatever reason, our economy has a chronic problem generating sufficient aggregate demand. Low-capacity utilization seems to be the norm, not the exception.

Regardless of the theory, I have argued that an ethical weighing of the competing downside risks strongly militates towards stimulating the economy like mad. The economy ought to be able to absorb the creation of something like 10 million jobs before the end of Obama’s presidency, without a peep from inflation — and even if it can't, we must try.

The case for letting it ride relies mainly on bringing the long-term unemployed and those who are unwillingly working part-time back into the labor market. The fact that the Fed's target interest rate is at the zero lower bound is more reason to come up slowly, since if the central bank tightens too fast, it could crash the recovery and push the rate down to zero again. Yellen has mentioned these factors before, but they might not be as convincing as productivity, which is more important in neoclassical terms and was increasing sharply in Greenspan's day.

But there is history here as well. Back in the 90s, Yellen was a hawk arguing against Greenspan's jobs-first policy. Here's hoping she learned the right lessons from that era.

Ryan Cooper is a national correspondent at TheWeek.com. His work has appeared in the Washington Monthly, The New Republic, and the Washington Post.

-

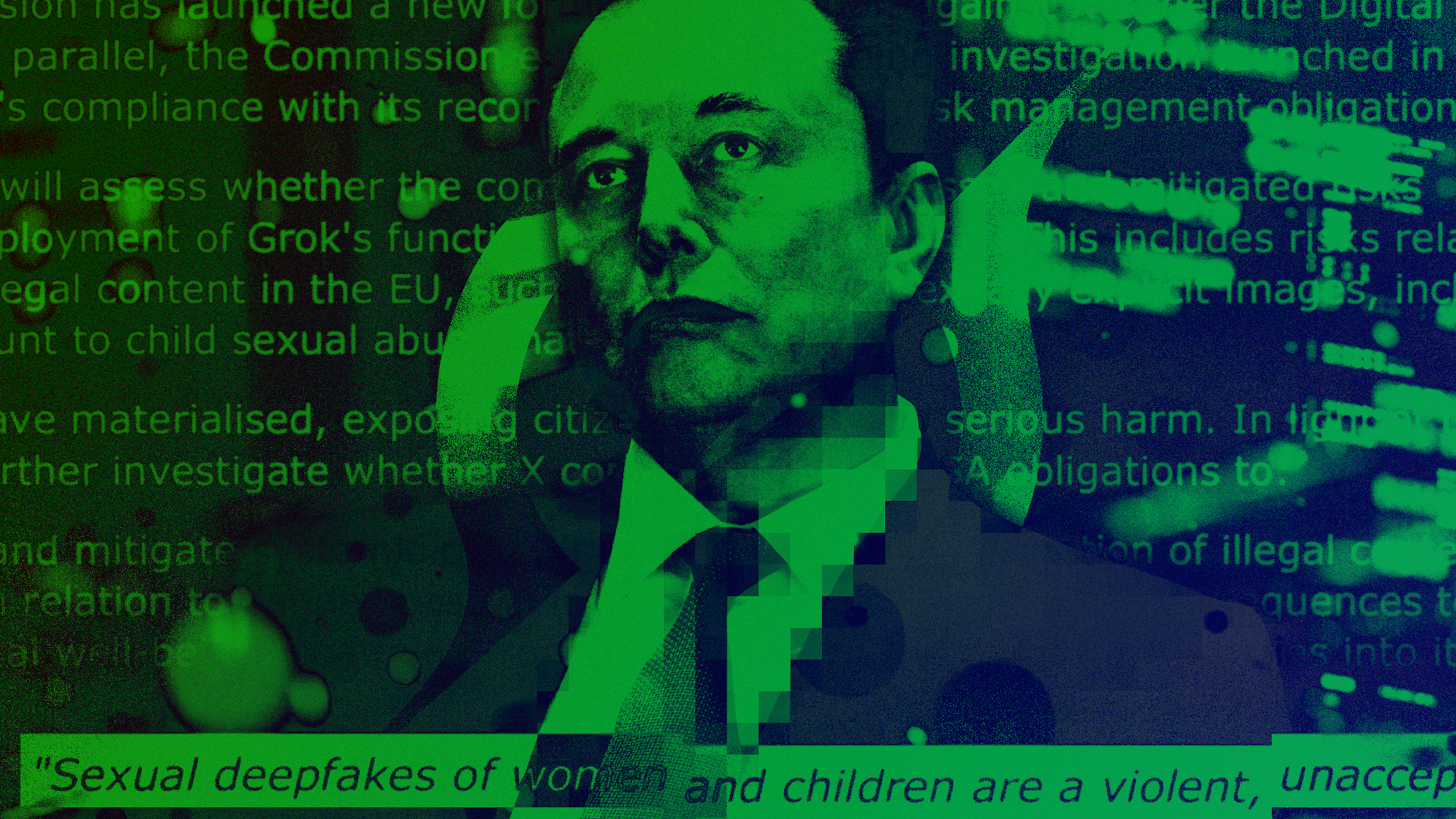

Grok in the crosshairs as EU launches deepfake porn probe

Grok in the crosshairs as EU launches deepfake porn probeIN THE SPOTLIGHT The European Union has officially begun investigating Elon Musk’s proprietary AI, as regulators zero in on Grok’s porn problem and its impact continent-wide

-

‘But being a “hot” country does not make you a good country’

‘But being a “hot” country does not make you a good country’Instant Opinion Opinion, comment and editorials of the day

-

Why have homicide rates reportedly plummeted in the last year?

Why have homicide rates reportedly plummeted in the last year?Today’s Big Question There could be more to the issue than politics

-

The billionaires’ wealth tax: a catastrophe for California?

The billionaires’ wealth tax: a catastrophe for California?Talking Point Peter Thiel and Larry Page preparing to change state residency

-

Bari Weiss’ ‘60 Minutes’ scandal is about more than one report

Bari Weiss’ ‘60 Minutes’ scandal is about more than one reportIN THE SPOTLIGHT By blocking an approved segment on a controversial prison holding US deportees in El Salvador, the editor-in-chief of CBS News has become the main story

-

Has Zohran Mamdani shown the Democrats how to win again?

Has Zohran Mamdani shown the Democrats how to win again?Today’s Big Question New York City mayoral election touted as victory for left-wing populists but moderate centrist wins elsewhere present more complex path for Democratic Party

-

Millions turn out for anti-Trump ‘No Kings’ rallies

Millions turn out for anti-Trump ‘No Kings’ ralliesSpeed Read An estimated 7 million people participated, 2 million more than at the first ‘No Kings’ protest in June

-

Ghislaine Maxwell: angling for a Trump pardon

Ghislaine Maxwell: angling for a Trump pardonTalking Point Convicted sex trafficker's testimony could shed new light on president's links to Jeffrey Epstein

-

The last words and final moments of 40 presidents

The last words and final moments of 40 presidentsThe Explainer Some are eloquent quotes worthy of the holders of the highest office in the nation, and others... aren't

-

The JFK files: the truth at last?

The JFK files: the truth at last?In The Spotlight More than 64,000 previously classified documents relating the 1963 assassination of John F. Kennedy have been released by the Trump administration

-

'Seriously, not literally': how should the world take Donald Trump?

'Seriously, not literally': how should the world take Donald Trump?Today's big question White House rhetoric and reality look likely to become increasingly blurred