How will Obama's new myRA retirement plan work?

In his State of the Union address, the president proposed a new way for Americans to create a nest egg. There are some catches.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

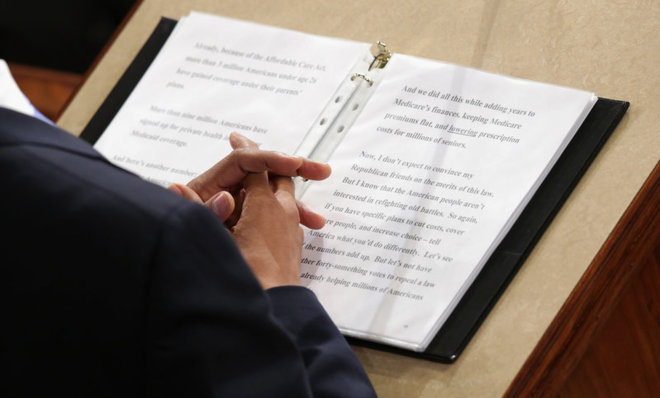

There weren't a lot of surprises in President Obama's State of the Union speech on Tuesday night. Some commentators were unprepared for Obama's fairly robust defense of the Affordable Care Act and the modesty of his "go it alone" executive orders. Most people found his tribute to Sgt. 1st Class Cory Remsburg, a badly wounded Army Ranger, unexpectedly moving. But I don't think anyone was expecting the myRA.

In the middle of the address, after a section about raising the minimum wage, Obama said he will "direct the Treasury to create a new way for working Americans to start their own retirement savings: MyRA," which he described as "a new savings bond that encourages folks to build a nest egg." He elaborated:

Today most workers don't have a pension. A Social Security check often isn't enough on its own. And while the stock market has doubled over the last five years, that doesn't help folks who don't have 401(k)s.... MyRA guarantees a decent return with no risk of losing what you put in. And if this Congress wants to help, work with me to fix an upside-down tax code that gives big tax breaks to help the wealthy save, but does little or nothing for middle-class Americans, offer every American access to an automatic IRA on the job, so they can save at work just like everybody in this chamber can. [SOTU, via Federal News Service]

Not a lot of information. The White House gave a bit more of a look at the new savings vehicle in a fact sheet, calling it "a new simple, safe, and affordable 'starter' retirement savings account" that would "be offered through a familiar Roth IRA Account and, like savings bonds, would be backed by the U.S. government."

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

The White House promises to provide more details today. But Damian Paletta and Anne Tergesen at The Wall Street Journal note that myRA appears "similar to an idea Treasury officials have studied for several years, which would create something called an R-bond, allowing employees to have a certain amount of money deducted from each paycheck and directed toward a specific investment."

The retirement plans will be voluntary for the employees of participating companies, and sort of structured like Roth IRAs: Workers pay taxes on the wages diverted into the myRA, but not when they draw the fund down at retirement age. The money can be rolled over into an ordinary Roth IRA without penalty, though — and will have to be after the account reaches a certain balance, reports Bloomberg News, citing government officials.

In other words, it really is just a "starter" retirement account. But that doesn't mean it can't be a big deal.

The idea that Americans aren't setting enough aside for retirement isn't controversial. Here are some quick numbers:

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

- 53 percent of working-age households are not on track to retire at their pre-retirement standard of living, according to Boston College's Center for Retirement Research.

- 59 percent of new middle-class retirees will outlive their savings, according to Ernst & Young projections.

- 68 percent of U.S. workers have access to retirement benefits, and 54 percent participate, according to a March 2013 Bureau of Labor Statistics analysis.

The myRA aims to improve that last statistic by encouraging businesses to offer their workers at least this one avenue for retirement savings, and opening the door to lower-income workers. Because the the accounts will be administered by the Treasury Department, modest investments won't be devoured by fund-maintenance fees. The White House hasn't said what kind of return it expects on the new accounts, but any guarantee of growing balances will also attract more risk-averse workers spooked by the recent stock market crashes.

The downside of a myRA, compared with many 401(k) plans, is that there will be no employer match and really only one investment option.

There are undoubtedly better solutions out there — Obama has been proposing automatic (opt-out) enrollment in IRAs for workers without employer retirement plans "in every budget since he took office," the White House notes, and Congress has been kicking around ideas for years. (Research shows employees are much more likely to save for retirement when the money is taken out of their paycheck.)

With his new plan, Obama mostly "admitted what U.S. employees have long known: Retirement security stinks in this country and 401(k)s are not the answer," says John Wasik at Forbes. "Retirement accounts should be universally available — you shouldn't have to depend upon an employer to offer them." He makes a good point:

The problem isn't that Americans don't have enough ways to save for retirement — they have too many. Look at the alphabet soup of plans from 401(k)s, 403(b)s, 457s to Roth IRAs. Why not consolidate them and make the tax breaks uniform through credits? Make a universal plan with low fees accessible to everyone — regardless of where they work. [Forbes]

But any significant changes to America's retirement infrastructure requires action by Congress. Obama is about as optimistic that will happen as you are. The myRA's main advantage is that the president already has the authority to implement it by executive action, through a program that allows workers to purchase U.S. savings bonds tax-free, Brian Graff at the American Society of Pension Professionals & Actuaries tells Bloomberg.

"This isn't earth-shattering stuff," Graff says. "But it is a step in the right direction to get more people saving for retirement, which I would think is a bipartisan issue."

It may well be. But the devil, as they say, is in the details. Stay tuned.

Peter has worked as a news and culture writer and editor at The Week since the site's launch in 2008. He covers politics, world affairs, religion and cultural currents. His journalism career began as a copy editor at a financial newswire and has included editorial positions at The New York Times Magazine, Facts on File, and Oregon State University.

-

Should the EU and UK join Trump’s board of peace?

Should the EU and UK join Trump’s board of peace?Today's Big Question After rushing to praise the initiative European leaders are now alarmed

-

Antonia Romeo and Whitehall’s women problem

Antonia Romeo and Whitehall’s women problemThe Explainer Before her appointment as cabinet secretary, commentators said hostile briefings and vetting concerns were evidence of ‘sexist, misogynistic culture’ in No. 10

-

Local elections 2026: where are they and who is expected to win?

Local elections 2026: where are they and who is expected to win?The Explainer Labour is braced for heavy losses and U-turn on postponing some council elections hasn’t helped the party’s prospects

-

The billionaires’ wealth tax: a catastrophe for California?

The billionaires’ wealth tax: a catastrophe for California?Talking Point Peter Thiel and Larry Page preparing to change state residency

-

Bari Weiss’ ‘60 Minutes’ scandal is about more than one report

Bari Weiss’ ‘60 Minutes’ scandal is about more than one reportIN THE SPOTLIGHT By blocking an approved segment on a controversial prison holding US deportees in El Salvador, the editor-in-chief of CBS News has become the main story

-

Has Zohran Mamdani shown the Democrats how to win again?

Has Zohran Mamdani shown the Democrats how to win again?Today’s Big Question New York City mayoral election touted as victory for left-wing populists but moderate centrist wins elsewhere present more complex path for Democratic Party

-

Millions turn out for anti-Trump ‘No Kings’ rallies

Millions turn out for anti-Trump ‘No Kings’ ralliesSpeed Read An estimated 7 million people participated, 2 million more than at the first ‘No Kings’ protest in June

-

Ghislaine Maxwell: angling for a Trump pardon

Ghislaine Maxwell: angling for a Trump pardonTalking Point Convicted sex trafficker's testimony could shed new light on president's links to Jeffrey Epstein

-

The last words and final moments of 40 presidents

The last words and final moments of 40 presidentsThe Explainer Some are eloquent quotes worthy of the holders of the highest office in the nation, and others... aren't

-

The JFK files: the truth at last?

The JFK files: the truth at last?In The Spotlight More than 64,000 previously classified documents relating the 1963 assassination of John F. Kennedy have been released by the Trump administration

-

'Seriously, not literally': how should the world take Donald Trump?

'Seriously, not literally': how should the world take Donald Trump?Today's big question White House rhetoric and reality look likely to become increasingly blurred