Nothing says 'mainstream' like paying for pot with plastic

Visa is essentially looking the other way at legal pot sales

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

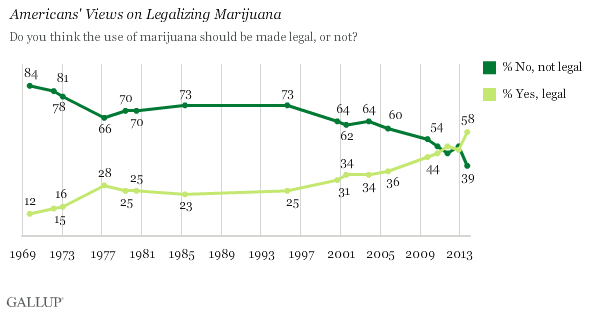

It's hard to overstate the quiet revolution in America's relationship with marijuana. At least three new national polls — from CNN, Pew, and Gallup — show that for the first time a clear majority of Americans favor legalizing pot.

And they are voting with their pocketbooks: Thanks in part to pot tourists from outside the state, Colorado's legal pot purveyors rung up "well over $5 million in sales in the first five days of operation," according to the National Cannabis Industry Association. Sales have been so brisk that many retailers are rationing the amount people can buy, and some have temporarily run out of weed. (Recreational weed was illegal to grow as well as sell before Jan. 1.)

The world of finance is even showing some interest in the pot business, with at least one private-equity firm — the High Times Growth Fund —ready to speculate in the marijuana industry and groups springing up to connect ganjapreneurs with investors.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

But there are two related things that are keeping marijuana on the fringes: Federal law prohibits the possession, use, and sale of pot; and financial institutions are leery of involving themselves in the marijuana market. So far, that means even legal pot has been almost exclusively a cash-only business. The Denver City Council, recognizing the risks to pot businesses of its employees carrying around suitcases of cash, voted on Monday to urge the federal government to allow pot retailers legal access to national banking institutions.

"It would be nice if the banks would work with us," Linda Andrews, owner of Denver pot retailer the Lodo Wellness Center, tells Denver's ABC 7 News. "We're figuring out some systems. We've got safes. We don't keep (cash) here."

The Justice Department is preparing some legal guidance for banks regarding businesses that sell marijuana in states that allow it, but the advisory isn't expected to lay out clear rules and it probably won't be ready for weeks or even months anyway. There's too much money at stake for this banking limbo to hold for very long.

In steps Visa.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

The official rules of Visa, MasterCard, and American Express forbid using their credit cards to buy marijuana, but Visa and, to a lesser extent, MasterCard "have quietly decided not to enforce their rules," says Robin Sidel in The Wall Street Journal. Following the lead of the Justice Department, Visa is essentially looking the other way at locally legal pot sales.

"Given the federal government's position and recognizing this is an evolving legal matter with different standards applicable in different states," Visa said in a statement, "our local merchant acquirers are best suited to make any determination about potential illegality."

Now, Visa can't just wave its magic wand and allow pot retailers to accept plastic — its credit-card network involves lots of players, and the major banks and processing firms aren't touching the marijuana business. But smaller, independent companies, sensing opportunity, are stepping in to fill that gap.

One strategy involves processing pot transactions as more anodyne purchases — though that is risky. "Tinkering with the so-called merchant category codes is considered a severe violation of card-industry rules," says The Wall Street Journal's Sidel. The more promising workaround is treating all credit-card transactions as if the customer were taking cash out of an ATM.

At Denver Relief, for example, about 30 percent of customers use plastic to buy their weed, entering their PINs and paying a $2 fee per transaction, under a credit card processing system purchased from GreenHouse Payment Solutions. "It's like when salmon can't swim in one direction, they'll figure out another way to go up the river," GreenHouse owner Chris Mills tells The Wall Street Journal.

This is the final big piece to the marijuana-legalization puzzle. Colorado has taken huge steps by legalizing and, yes, taxing cannabis sales. But until people can buy their legal ganja using their credit card, the marijuana business can only grow so big. Consumers spend more when they're not paying with cash, but there's also the psychological barrier: Nothing will say "mainstream" like being able to pay for pot with plastic.

Peter has worked as a news and culture writer and editor at The Week since the site's launch in 2008. He covers politics, world affairs, religion and cultural currents. His journalism career began as a copy editor at a financial newswire and has included editorial positions at The New York Times Magazine, Facts on File, and Oregon State University.

-

Bad Bunny’s Super Bowl: A win for unity

Bad Bunny’s Super Bowl: A win for unityFeature The global superstar's halftime show was a celebration for everyone to enjoy

-

Book reviews: ‘Bonfire of the Murdochs’ and ‘The Typewriter and the Guillotine’

Book reviews: ‘Bonfire of the Murdochs’ and ‘The Typewriter and the Guillotine’Feature New insights into the Murdoch family’s turmoil and a renowned journalist’s time in pre-World War II Paris

-

Witkoff and Kushner tackle Ukraine, Iran in Geneva

Witkoff and Kushner tackle Ukraine, Iran in GenevaSpeed Read Steve Witkoff and Jared Kushner held negotiations aimed at securing a nuclear deal with Iran and an end to Russia’s war in Ukraine