Does the fiscal cliff deal vindicate George W. Bush?

Bush 43 has only slowly recovered from abysmal popularity numbers. Will this arguably symbolic win for his tax cuts speed the political rehabilitation?

Short-term history hasn't been very kind to our 43rd president. Four years after he left office, more than two-thirds of Americans still blame George W. Bush for our lousy economy — including nearly half of Republicans — and he has the lowest approval rating of any living U.S. president, according to a mid-2012 CNN poll. When the German news weekly Der Speigel mistakenly published its obituary for Bush's father, George H.W. Bush, last week, it called the elder former president "the better Bush," dubbing him a "colorless politician" whose legacy only looks good next to that of his bumbling son. But the ongoing effort to rehabilitate Bush 43's image got an unexpected assist this week: President Obama and an overwhelming majority of Democratic lawmakers voted to permanently enshrine most of his signature tax cuts, sending only about the top 1 percent of earners back to Clinton-era marginal tax rates.

"The retention of 98 percent of the Bush tax cuts by the most liberal president to hold office reminds us that a mere four years after leaving office, George W. Bush has a legacy that is becoming more impressive with time," says Jennifer Rubin at The Washington Post. It's not just taxes: From pushing immigration reform to advances in drone warfare to fighting AIDS in Africa, "Bush seems to be a more accomplished Republican figure in the Obama era." But this tax victory is especially sweet for the GOP and Bush family. Rubin quotes Kevin Hasset at the American Enterprise Institute:

After everything settles, people of both parties will have to agree that this was a big win for Bush. Almost all of Bush's favored tax policies have become a permanent part of the tax code. The top rate is higher, but marginal tax rates on 'rich' people with incomes below $400,000 are even lower than they would have been if Bush's tax cuts had never passed.... It is especially important that dividends will probably never again be taxed as ordinary income.

Of course, no tax policy is etched in stone — Congress can and will change the newly "permanent" rates, maybe as soon as a few months from now. But it's not just Bush supporters who have noticed the tax legacy issue:

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

The funny thing, says Dick Polman at NewsWorks, is that most Republicans were as opposed to the "fiscal deal that permanently locks in 82 percent of Bush's sweeping tax cuts" as Democrats were supportive of it. Sure, the Democrats got a host of tax concessions that will help the poor and middle class, above and beyond keeping the Bush-era rates, but there's a glaring "irony that Obama, against House Republican resistance, wound up delivering a win to Bush."

Of the 236 voting GOPers, 151 voted No, seeking to send America over the fiscal cliff in part because the deal didn't make permanent the Bush tax cuts for the rich as well. How predictably pitiful that, with respect to the Bush cuts, most House Republicans could not accept four-fifths of a loaf — all because they continue to deem it blasphemy that any American, under any circumstance, suffer even a teensy tax rise.... 85 House Republicans did vote Yes — an historic occasion, because this was the first time in two decades that virtually any GOPer in the chamber had agreed to hike taxes on anyone. But they didn't vote Yes in order to lock in most of the Bush cuts and deliver a symbolic victory to their former president. They voted Yes only because they knew it would be political suicide to keep defending rich people.

But that's exactly why "the idea that this is a 98 percent victory for the Bush tax cuts only works if you buy what's really a bogus sales pitch," says Josh Marshall at Talking Points Memo. It's not like Democrats were ever really opposed to lowering marginal tax rates for the poor and middle class — in any case, Obama certainly isn't. But for Republicans, "the purpose of the Bush tax cuts was really for the high income earners — if not the 1 percent, maybe the top 2 percent of the country. The rest was part of the marketing push." If that sounds unfair, consider how Republicans would have reacted if they believed "Democrats were offering to concede 98 percent of the debate and substance of the Bush tax cuts." There would have been no histrionics, no fight. "No matter how you slice it, whether it's common sense or Occam's Razor or really anything else, it all comes out the same: It's all about the top rates" — and those top rates are now at Clinton-era levels.

I don't know, says Jonathan Cohn at The New Republic. "I could make a solid case" that the fiscal cliff deal is "a massive defeat for liberals." If Democrats had done nothing, all of the Bush tax cuts would be gone, consigned to the dustbin of history. Instead, Obama settled for $600 billion in tax revenue, nowhere near what we need to fund vital government programs in the long run. It really is, in some ways, "as if President George W. Bush finally won — the tax cuts he'd always wanted would be staying on the books indefinitely, 'starving the [government] beast' of the resources it needs to survive."

But that analysis is also too simplistic... Transferring money from the wealthy to the poor and middle-class — a fair interpretation of what this deal would do — is surely not the kind of policies that Bush had in mind when he took office. The shift would be temporary, yes: The expansions of the tax credits, for example, would last only a few years. But money now is more valuable than money in the future, since lawmakers can always take it away.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Peter has worked as a news and culture writer and editor at The Week since the site's launch in 2008. He covers politics, world affairs, religion and cultural currents. His journalism career began as a copy editor at a financial newswire and has included editorial positions at The New York Times Magazine, Facts on File, and Oregon State University.

-

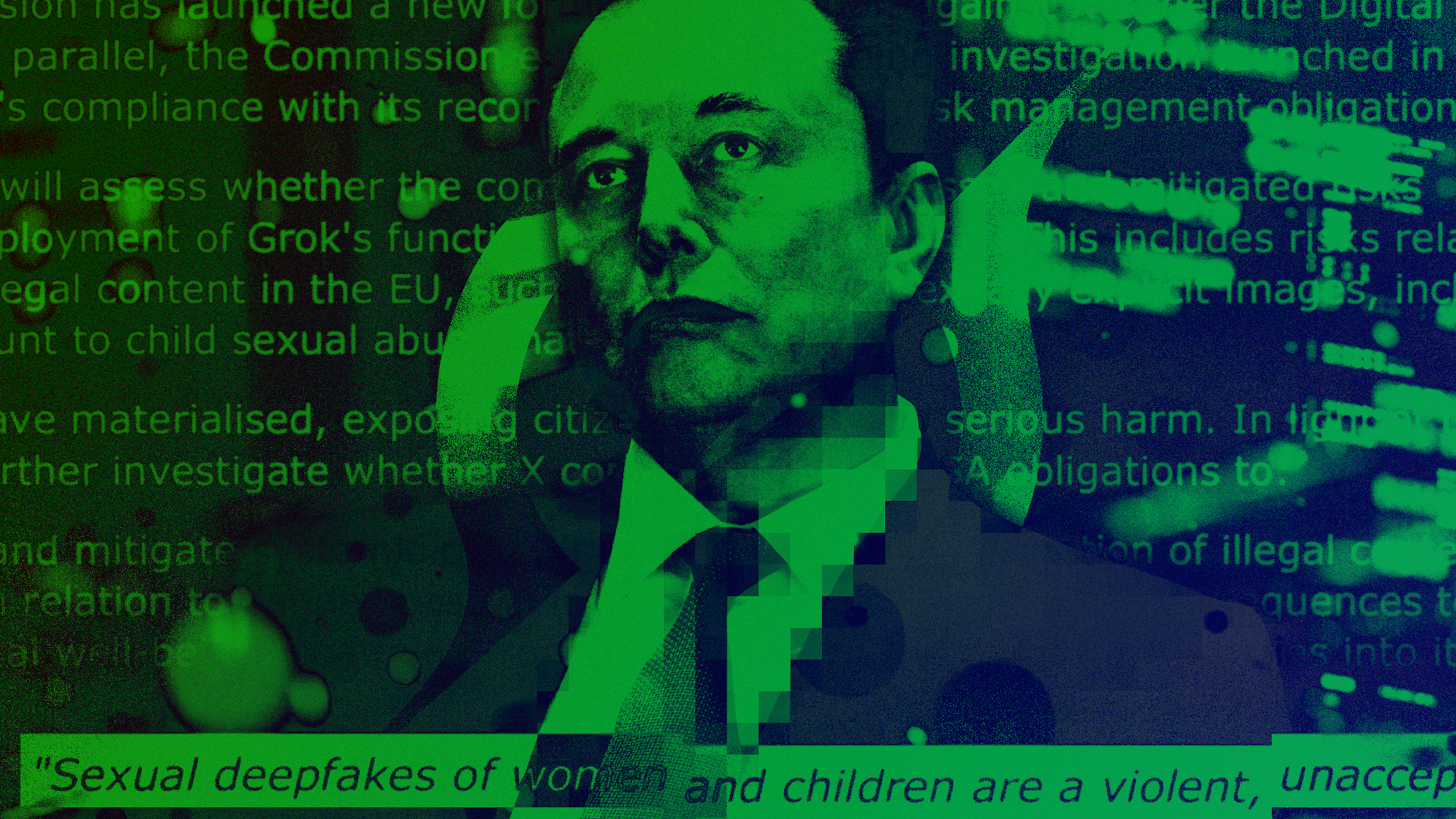

Grok in the crosshairs as EU launches deepfake porn probe

Grok in the crosshairs as EU launches deepfake porn probeIN THE SPOTLIGHT The European Union has officially begun investigating Elon Musk’s proprietary AI, as regulators zero in on Grok’s porn problem and its impact continent-wide

-

‘But being a “hot” country does not make you a good country’

‘But being a “hot” country does not make you a good country’Instant Opinion Opinion, comment and editorials of the day

-

Why have homicide rates reportedly plummeted in the last year?

Why have homicide rates reportedly plummeted in the last year?Today’s Big Question There could be more to the issue than politics

-

The billionaires’ wealth tax: a catastrophe for California?

The billionaires’ wealth tax: a catastrophe for California?Talking Point Peter Thiel and Larry Page preparing to change state residency

-

Bari Weiss’ ‘60 Minutes’ scandal is about more than one report

Bari Weiss’ ‘60 Minutes’ scandal is about more than one reportIN THE SPOTLIGHT By blocking an approved segment on a controversial prison holding US deportees in El Salvador, the editor-in-chief of CBS News has become the main story

-

Has Zohran Mamdani shown the Democrats how to win again?

Has Zohran Mamdani shown the Democrats how to win again?Today’s Big Question New York City mayoral election touted as victory for left-wing populists but moderate centrist wins elsewhere present more complex path for Democratic Party

-

Millions turn out for anti-Trump ‘No Kings’ rallies

Millions turn out for anti-Trump ‘No Kings’ ralliesSpeed Read An estimated 7 million people participated, 2 million more than at the first ‘No Kings’ protest in June

-

Ghislaine Maxwell: angling for a Trump pardon

Ghislaine Maxwell: angling for a Trump pardonTalking Point Convicted sex trafficker's testimony could shed new light on president's links to Jeffrey Epstein

-

The last words and final moments of 40 presidents

The last words and final moments of 40 presidentsThe Explainer Some are eloquent quotes worthy of the holders of the highest office in the nation, and others... aren't

-

The JFK files: the truth at last?

The JFK files: the truth at last?In The Spotlight More than 64,000 previously classified documents relating the 1963 assassination of John F. Kennedy have been released by the Trump administration

-

'Seriously, not literally': how should the world take Donald Trump?

'Seriously, not literally': how should the world take Donald Trump?Today's big question White House rhetoric and reality look likely to become increasingly blurred