Insider trading on Capitol Hill?

Members of Congress are much better at picking stocks than the average investor, according to new research. Are they playing fair?

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

A new study found that from 1985 to 2001, members of the House of Representatives made 6.8 percent more on their stock purchases and sales than the average investor. An earlier investigation by the same researchers found that senators also beat the market. The latest report, which was published in the journal Business and Politics, concludes that members of Congress were almost certainly relying on insider information to fatten their stock portfolios. Are lawmakers engaged in shady trading, or are they just unusually savvy investors?

This is corruption, pure and simple: There is no denying it now, says Vox Populi. "Congress is shamelessly crooked." And the most disgusting part of this is that it's perfectly legal, because members of Congress have exempted themselves from laws that send corporate executives to prison for doing the same thing — trading on insider knowledge for personal gain.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Wait, there is no direct proof of anything shady: The researchers have no specific evidence to back up their conclusions, says Seth Fiegerman at Minyanville. They're just assuming politicians are picking stocks based on inside information about the industries and companies they oversee. But maybe they really are just good investors. "If nothing else, next time you write a letter to your congressman, you may want to ask him for stock advice."

"Your congressman: A better investor than you?"

Still, congressmen should be regulated like bankers: Beating the market by 6.8 percent over so many years is "better than hedge-fund superstars" can do, says Randall W. Forsyth at Barron's. It defies credulity to suggest that everyone on Capitol Hill is that good. But don't worry, there is an "estimably logical" solution. Let "the same reporting requirements imposed on corporate insiders be placed on members of Congress. After all, being on Capitol Hill makes one an ultimate insider."

"Fire your hedge fund manager, hire your congressman"

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

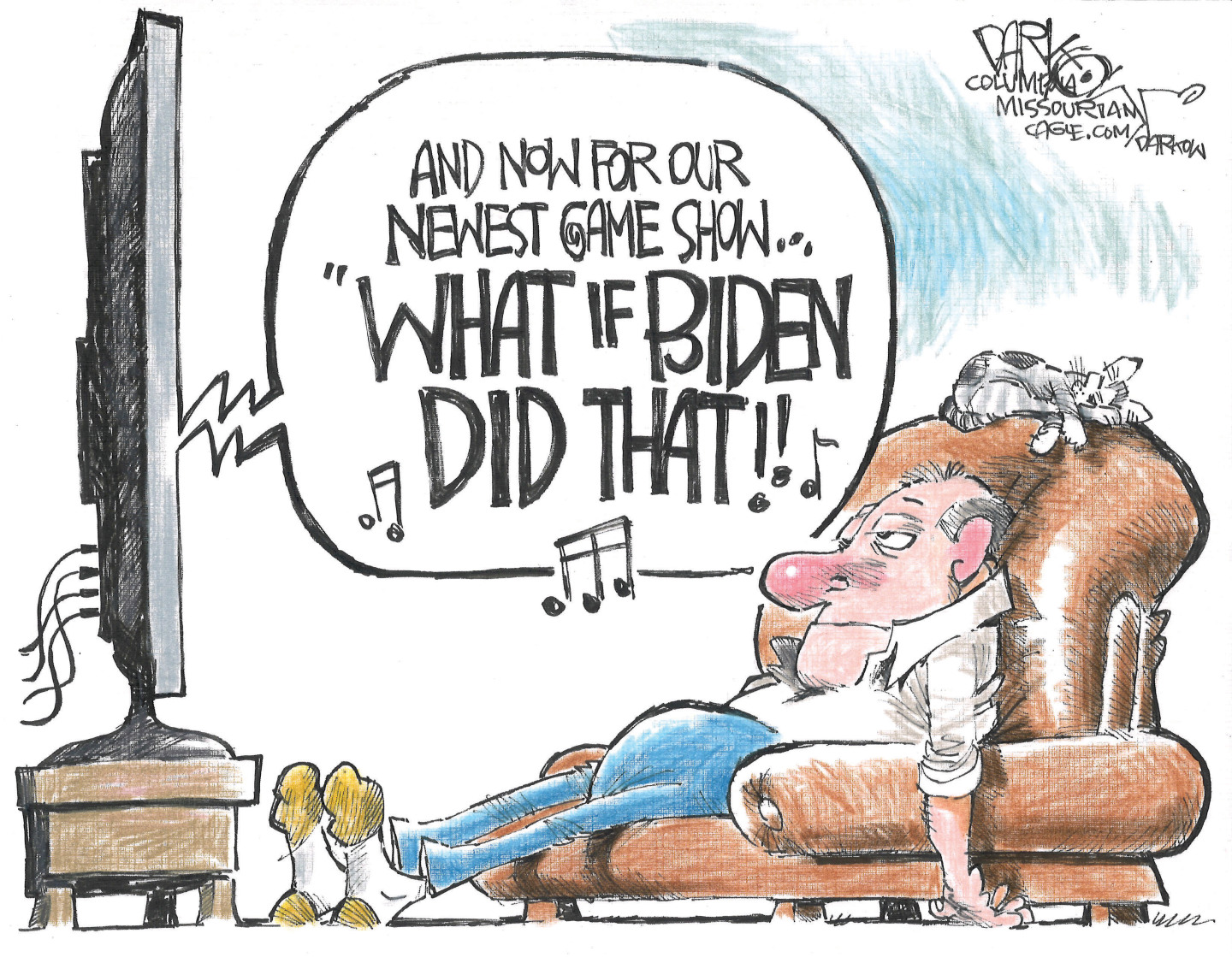

Political cartoons for February 13

Political cartoons for February 13Cartoons Friday's political cartoons include rank hypocrisy, name-dropping Trump, and EPA repeals

-

Palantir's growing influence in the British state

Palantir's growing influence in the British stateThe Explainer Despite winning a £240m MoD contract, the tech company’s links to Peter Mandelson and the UK’s over-reliance on US tech have caused widespread concern

-

Quiz of The Week: 7 – 13 February

Quiz of The Week: 7 – 13 FebruaryQuiz Have you been paying attention to The Week’s news?

-

The billionaires’ wealth tax: a catastrophe for California?

The billionaires’ wealth tax: a catastrophe for California?Talking Point Peter Thiel and Larry Page preparing to change state residency

-

Bari Weiss’ ‘60 Minutes’ scandal is about more than one report

Bari Weiss’ ‘60 Minutes’ scandal is about more than one reportIN THE SPOTLIGHT By blocking an approved segment on a controversial prison holding US deportees in El Salvador, the editor-in-chief of CBS News has become the main story

-

Has Zohran Mamdani shown the Democrats how to win again?

Has Zohran Mamdani shown the Democrats how to win again?Today’s Big Question New York City mayoral election touted as victory for left-wing populists but moderate centrist wins elsewhere present more complex path for Democratic Party

-

Millions turn out for anti-Trump ‘No Kings’ rallies

Millions turn out for anti-Trump ‘No Kings’ ralliesSpeed Read An estimated 7 million people participated, 2 million more than at the first ‘No Kings’ protest in June

-

Ghislaine Maxwell: angling for a Trump pardon

Ghislaine Maxwell: angling for a Trump pardonTalking Point Convicted sex trafficker's testimony could shed new light on president's links to Jeffrey Epstein

-

The last words and final moments of 40 presidents

The last words and final moments of 40 presidentsThe Explainer Some are eloquent quotes worthy of the holders of the highest office in the nation, and others... aren't

-

The JFK files: the truth at last?

The JFK files: the truth at last?In The Spotlight More than 64,000 previously classified documents relating the 1963 assassination of John F. Kennedy have been released by the Trump administration

-

'Seriously, not literally': how should the world take Donald Trump?

'Seriously, not literally': how should the world take Donald Trump?Today's big question White House rhetoric and reality look likely to become increasingly blurred