Hillary Clinton has a smart idea to fix the economy. Republicans should steal it.

This is a Clinton economic proposal the GOP should love

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Bad news for Republican presidential candidates searching for a fresh message beyond moldy Reagan nostalgia and tired anti-Obamaism: Hillary Clinton just stole a potentially powerful theme right from under them.

In her economic policy speech Monday at the New School in Manhattan, Clinton said Corporate America deserves some of the blame for the weak and uneven economic recovery. Big business, she said, suffers from "short-termism" and too often practices "quarterly capitalism" where "everything is focused on the next earnings report or the short-term share price, and the result is too little attention on the sources of long-term growth: research and development, physical capital and talent."

Now, it's surely tempting for Republicans to view Clinton's critique as just another Democratic attack on "job creators," or as campaign strategery from a centrist Democratic candidate looking to ward off a more liberal rival. But there's more to it than that, and the GOP should pay attention.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

First, short-termism might be an actual problem hurting economic growth and preventing worker incomes from rising faster. Take one aspect of it: companies using cash for stock buybacks rather than new investment in people and machines. Buybacks have risen sharply since the Great Recession. S&P 500 companies bought back some $500 billion of their own shares last year, according to Goldman Sachs, or about a third of their cash and half of their earnings. Meanwhile, business investment remains below pre-recession levels or barely above, depending on the measure. That might partially explain why U.S. productivity growth has stalled out the past five years. Without faster productivity growth, the economy will remain stuck in low gear.

Second, it's not just Democratic presidential candidates or economic populists raising the issue. Laurence Fink, CEO of investment firm BlackRock, recently complained in an essay that C-suite suits "are rewarding shareholders, which causes the stock to spike. But to the extent that those cash expenditures starve corporate investment, the economy suffers." Clayton Christensen, Harvard business professor and innovation guru, bemoans today's "capitalist's dilemma" where "doing the right thing for long-term prosperity is the wrong thing for most investors." Worries about short-term results mean bosses would rather invest in incremental innovation to improve existing products rather than riskier experimentation that might fail or disrupt existing business lines. And in his 2014 book Mass Flourishing: How Grassroots Innovation Created Jobs, Challenge, and Change, Nobel laureate economist Edmund Phelps writes, "Short-termism is rife in business and finance. In the private sector, CEOs have no long-term interest in their companies, and mutual funds have only a short-term interest in holding the shares."

Third, arguing against short-termism should be a natural fit for Republicans. When government fails to properly fund pensions and healthcare entitlements, or creates regulations that hamper new business formation, or favors teachers unions over students, that's a kind of short-termism. The Democrats behind these policies are not thinking about the long-term health of the economy or the country — they're concerned only with pleasing their constituent interest groups right now. Republicans have long rightfully skewered them for it.

Republicans just need to apply that same concept to the private sector, as well. Of course, some of the possible solutions might be uncomfortable, such as reforming executive pay. But not all of them. Tax and regulatory policies that encourage more startups may also combat short-termism by the big guys. If incumbents don't innovate against new competitors, they won't be around for the long-term.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

What's more, both Fink and Christensen think tax policy plays a big role in encouraging short-term strategies by businesses as they respond to activist investors. All an investor has to do to pay low investment tax rates is hold a stock for a year. But what if investors had to stick around for two or three years to gain a preferential tax rate? And what if the longer they held the stock, the lower the rate would fall? Heck, we could even make stock flippers pay a rate higher than the ordinary income tax of 40 percent. Such changes might nudge investors and companies to better tolerate short-term pain for long-term gain.

Clinton hinted at just such an approach during her speech, proposing "a new plan to reform capital gains taxes to reward longer-term investments that create jobs, more than just quick trades." In other words, Clinton might have figured out a way to deeply cut investment taxes — that's right, tax cuts for the rich, Republicans — in a way that looks pro-worker. Hubby Bill was great at stealing GOP issues in the 1990s, such as welfare reform and balanced budgets, and making them his own. And now it looks like Hillary is picking Republican pockets all over again.

James Pethokoukis is the DeWitt Wallace Fellow at the American Enterprise Institute where he runs the AEIdeas blog. He has also written for The New York Times, National Review, Commentary, The Weekly Standard, and other places.

-

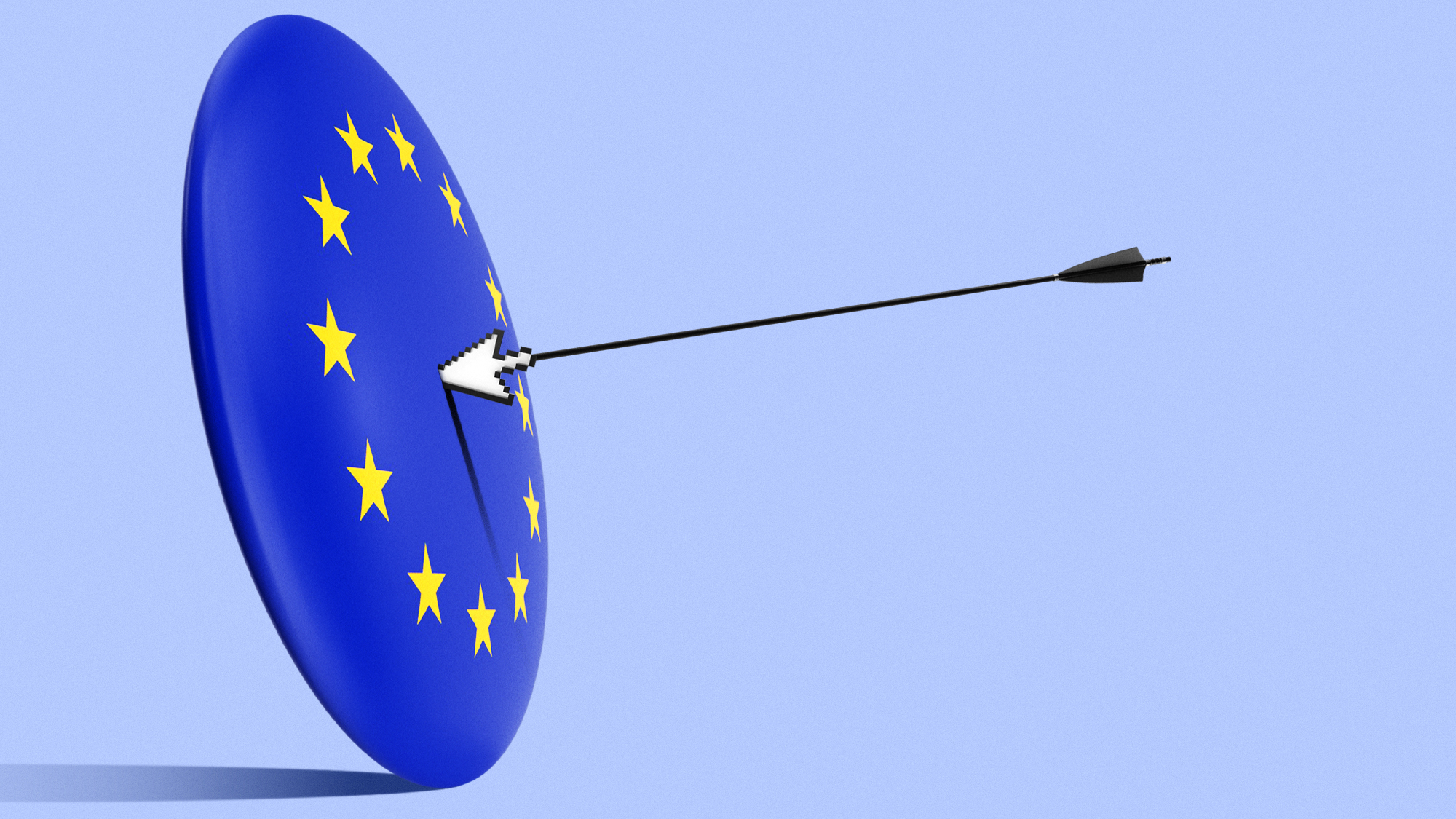

Can Europe regain its digital sovereignty?

Can Europe regain its digital sovereignty?Today’s Big Question EU is trying to reduce reliance on US Big Tech and cloud computing in face of hostile Donald Trump, but lack of comparable alternatives remains a worry

-

The Mandelson files: Labour Svengali’s parting gift to Starmer

The Mandelson files: Labour Svengali’s parting gift to StarmerThe Explainer Texts and emails about Mandelson’s appointment as US ambassador could fuel biggest political scandal ‘for a generation’

-

Magazine printables - February 13, 2026

Magazine printables - February 13, 2026Puzzle and Quizzes Magazine printables - February 13, 2026

-

The billionaires’ wealth tax: a catastrophe for California?

The billionaires’ wealth tax: a catastrophe for California?Talking Point Peter Thiel and Larry Page preparing to change state residency

-

Bari Weiss’ ‘60 Minutes’ scandal is about more than one report

Bari Weiss’ ‘60 Minutes’ scandal is about more than one reportIN THE SPOTLIGHT By blocking an approved segment on a controversial prison holding US deportees in El Salvador, the editor-in-chief of CBS News has become the main story

-

Has Zohran Mamdani shown the Democrats how to win again?

Has Zohran Mamdani shown the Democrats how to win again?Today’s Big Question New York City mayoral election touted as victory for left-wing populists but moderate centrist wins elsewhere present more complex path for Democratic Party

-

Millions turn out for anti-Trump ‘No Kings’ rallies

Millions turn out for anti-Trump ‘No Kings’ ralliesSpeed Read An estimated 7 million people participated, 2 million more than at the first ‘No Kings’ protest in June

-

Ghislaine Maxwell: angling for a Trump pardon

Ghislaine Maxwell: angling for a Trump pardonTalking Point Convicted sex trafficker's testimony could shed new light on president's links to Jeffrey Epstein

-

The last words and final moments of 40 presidents

The last words and final moments of 40 presidentsThe Explainer Some are eloquent quotes worthy of the holders of the highest office in the nation, and others... aren't

-

The JFK files: the truth at last?

The JFK files: the truth at last?In The Spotlight More than 64,000 previously classified documents relating the 1963 assassination of John F. Kennedy have been released by the Trump administration

-

'Seriously, not literally': how should the world take Donald Trump?

'Seriously, not literally': how should the world take Donald Trump?Today's big question White House rhetoric and reality look likely to become increasingly blurred