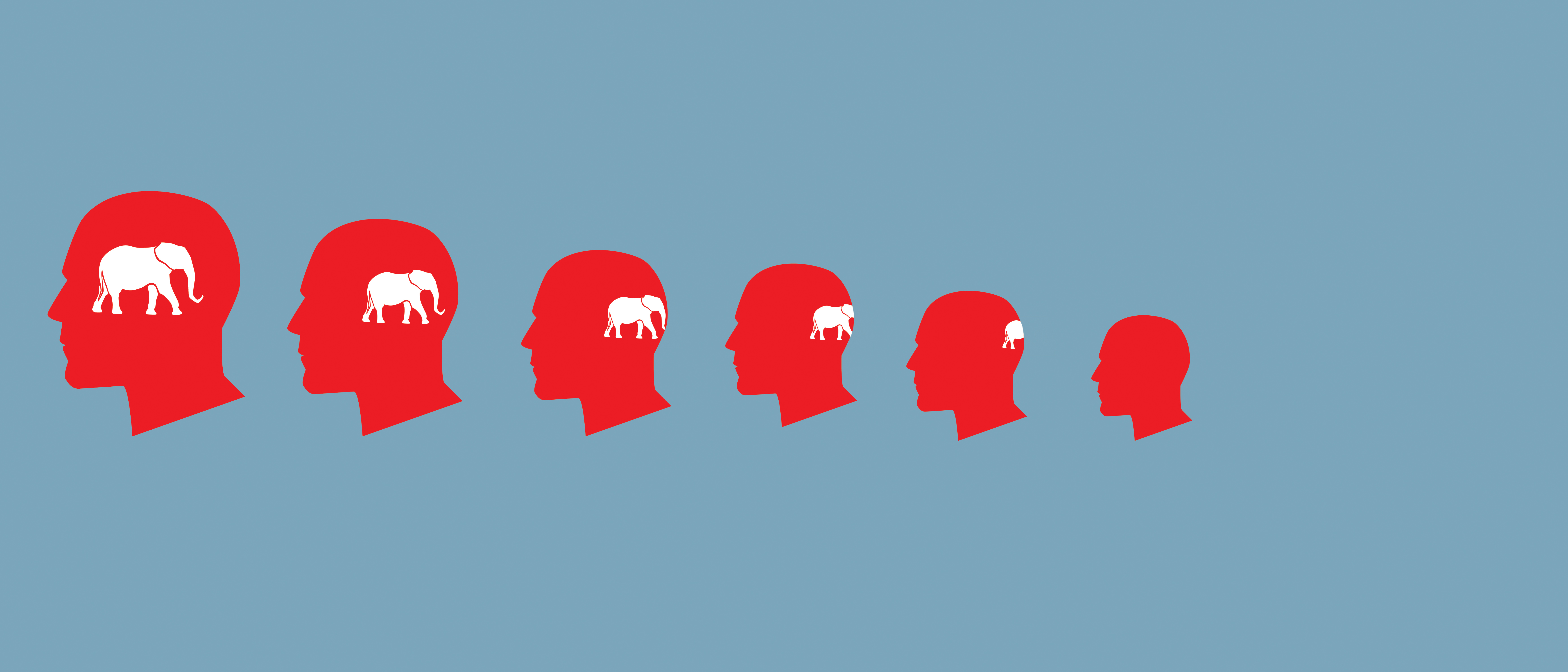

The withering of GOP economic thought

Mike Lee's plan is the best economic policy in the GOP. And it's still not nearly enough.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Republicans are out of ideas on the economy. Or at least, they're out of ideas that will do them any good politically.

There are, of course, still a few bright spots. For instance, simplifying and lowering the corporate tax rate remains a legible GOP policy goal, and possibly one that could be sold to the public. But on the taxes paid by individuals and families, on the benefits paid out by the government, and on the basic structure of America's political economy, for some time now, the traditional Republican playbook on economic issues has been almost exhausted.

Wednesday night's debate — which was specifically cast by CNBC as being about the economy — only added to the evidence that GOP offerings on this topic are wholly insufficient. There's the banal, like raising the age for eligibility for Medicare and Social Security, which Rand Paul mentioned. Sometimes it is crankish, like Ted Cruz's demand for 'sound money.' Or just gimmicky, like Carly Fiorina's three-page tax code. Republicans are just trying to fiddle with the few dials they have left, and no one is satisfied. This is a party that simply does not know how to address the economic issues that the vast majority of non-rich Americans care about.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

The 2016 race is hardly an aberration. Four years ago, Republican presidential nominee Mitt Romney was most comfortable talking to and about entrepreneurs, and his notorious comments about the 47 percent of voters who are "takers" certainly did not help him win the downwardly mobile whites who can and sometimes do swing Republican in states like Ohio, Virginia, and Pennsylvania.

How did we get here? On tax cuts, Republicans are partly the victims of their own success. Republican presidencies, and the Republican revolution in Congress, have cut a whole lot of taxes, consistently taking more and more families and households "off the rolls" of taxpayer. In fact, Republicans have done as much as Democrats to create a country in which millions of people receive more in benefits than they pay in. That means almost every future GOP-proposed tax cut that is aimed at individuals or households will, by logical necessity, "cut taxes for the richest Americans" and "do nothing for the poor." That doesn't play well in Toledo.

As Ramesh Ponnuru pointed out, Jeb Bush's proposed tax plan has cuts and trims that the Tax Foundation believes would raise middle-class incomes by nearly three percent. But the effect on high incomes would be nearly quadruple that. And, given the demographic realities of the party, these tax cuts end up helping rich white liberal voters more than downscale conservative families. That's why Bush has to promise that his plan will magically create four percent growth in the economy, something he only accomplished in Florida during a major housing bubble.

Perhaps the worst idea, floated at various times by Rand Paul, Ben Carson, and Ted Cruz, is to begin adding more citizens back onto the nation's split check through a flat tax. Some, like Paul, would get rid of the payroll tax as a partial sop to this constituency. And the less said about Mike Huckabee's consumption tax plan, the Fair Tax, the better. Needless to say, whatever the claims these candidates make about revenue, the reality of their plans is that they will amount to a massive tax increase on the poorest Americans.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Somewhere, Hillary Clinton is salivating over the prospect of pointing this out at a debate next fall.

Another problem for Republicans who claim to want to simplify the tax code: Middle-class Americans really like their tax loopholes, or at least have organized their life plans around them. They see the mortgage interest rate deduction as the only way of affording a mortgage payment. They see the loophole that their employer uses to compensate them in a health insurance plan as the only way to provide good health care to their families. They see the state income tax deduction as the only thing that makes living in high-tax states remotely affordable. And so on.

Further, Republicans will find no obvious solutions in monetary policy, both because they cannot control it, and there is little to be done. Interest rates are so low and have been for so long that the common definition of "saving for the future" in America has been changed to "investing" or "buying appreciable assets." Americans now put away money for the future by buying securities or real estate. There's no stimulus left in that tank of liberating savings to more productive use, until the National Guard comes a knockin' to open our change jars.

Republican economic thinking has also withered when it has come to balancing budgets. That means that despite Tea Party protestations, most Republican lawmakers not named Paul Ryan care about budget deficits much, much less than they once did. And that's if they care at all. Democrats don't care as much either. But it hurts Republicans more.

Reality will force us to care, someday. The moment interest rates do start to rise, the interest payments on America's national debt will take significantly larger bites out of the annual budget. Presumably this would force Congress to make significant cuts to spending somewhere. But why presume anything.

Of all the GOP economic plans out there, the only one that seems to begin untying the Republican knot — how to pay for government, not strangle growth, and change the code to help Republican constituencies — is the one promoted by Sens. Marco Rubio and Mike Lee. Their proposal lowers rates modestly at the top, reduces the number of tax brackets, and dramatically expands the child credit, making it applicable to payroll taxes as well as income taxes. Overall, their plan reduces the tax increases that come with moving from one tax bracket to a higher one, especially for married couples with children.

But it only solves a few urgent needs for the GOP. Yes, it offers a package of reform that has tangible benefits to constituencies that might vote Republican. And yes, it moves some tax burden away from younger workers at the early stages of forming families. But it doesn't close the persistent gap between what the government collects and what it is already committed to spending. And consequently, it does nothing to hedge against the rate hikes that would immediately turn our national debt into a pressing budget disaster.

In other words, even the best ideas on economic policy reform in the GOP are, at best, only a very modest beginning.

Michael Brendan Dougherty is senior correspondent at TheWeek.com. He is the founder and editor of The Slurve, a newsletter about baseball. His work has appeared in The New York Times Magazine, ESPN Magazine, Slate and The American Conservative.

-

Touring the vineyards of southern Bolivia

Touring the vineyards of southern BoliviaThe Week Recommends Strongly reminiscent of Andalusia, these vineyards cut deep into the country’s southwest

-

American empire: a history of US imperial expansion

American empire: a history of US imperial expansionDonald Trump’s 21st century take on the Monroe Doctrine harks back to an earlier era of US interference in Latin America

-

Elon Musk’s starry mega-merger

Elon Musk’s starry mega-mergerTalking Point SpaceX founder is promising investors a rocket trip to the future – and a sprawling conglomerate to boot

-

The billionaires’ wealth tax: a catastrophe for California?

The billionaires’ wealth tax: a catastrophe for California?Talking Point Peter Thiel and Larry Page preparing to change state residency

-

Bari Weiss’ ‘60 Minutes’ scandal is about more than one report

Bari Weiss’ ‘60 Minutes’ scandal is about more than one reportIN THE SPOTLIGHT By blocking an approved segment on a controversial prison holding US deportees in El Salvador, the editor-in-chief of CBS News has become the main story

-

Has Zohran Mamdani shown the Democrats how to win again?

Has Zohran Mamdani shown the Democrats how to win again?Today’s Big Question New York City mayoral election touted as victory for left-wing populists but moderate centrist wins elsewhere present more complex path for Democratic Party

-

Millions turn out for anti-Trump ‘No Kings’ rallies

Millions turn out for anti-Trump ‘No Kings’ ralliesSpeed Read An estimated 7 million people participated, 2 million more than at the first ‘No Kings’ protest in June

-

Ghislaine Maxwell: angling for a Trump pardon

Ghislaine Maxwell: angling for a Trump pardonTalking Point Convicted sex trafficker's testimony could shed new light on president's links to Jeffrey Epstein

-

The last words and final moments of 40 presidents

The last words and final moments of 40 presidentsThe Explainer Some are eloquent quotes worthy of the holders of the highest office in the nation, and others... aren't

-

The JFK files: the truth at last?

The JFK files: the truth at last?In The Spotlight More than 64,000 previously classified documents relating the 1963 assassination of John F. Kennedy have been released by the Trump administration

-

'Seriously, not literally': how should the world take Donald Trump?

'Seriously, not literally': how should the world take Donald Trump?Today's big question White House rhetoric and reality look likely to become increasingly blurred