How the world saved the Fed from disaster

Has the Fed wised up to the folly of a rate hike? Or is it just buying time?

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

The Federal Reserve surprised exactly no one with its decision to hold fire on Wednesday. Observers, experts, and their dogs were all expecting Fed officials to keep interest rates where they are. So that's not surprising.

But it's worth reviewing the grand plans the Fed had, not so long ago, for a whole series of rate hikes in 2016 — and how quickly those plans unraveled. Because maybe the Fed thought better of it or maybe it was saved from its folly by happy accidents from abroad.

It was back in December 2015 that the Fed decided to hike interest rates for the fist time in seven years. By itself it wasn't a huge change — their target rate went up from 0-to-0.25 percent to 0.25-to-0.5 percent. But that hike was supposed to be only the first of five slated till the end of 2016. Ever since the Great Recession, the Fed had kept its interest rate target as low as it could possibly go, in an effort to boost the recovery. Its December decision was meant as an announcement that this era was over — it might end gradually over the course of 2016, but it was going to end.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Fast forward four months, and one could genuinely wonder if there's going to be any rate hike in 2016.

By its mid-march meeting, the Fed had ratcheted back its expected rate hikes from four in 2016 to most likely just two. Even more remarkably, by February, some of the financial markets that trade based on expectations of the Fed's interest rate moves were already anticipating no rate hikes for the year.

There were, of course, some obvious reasons for this switch.

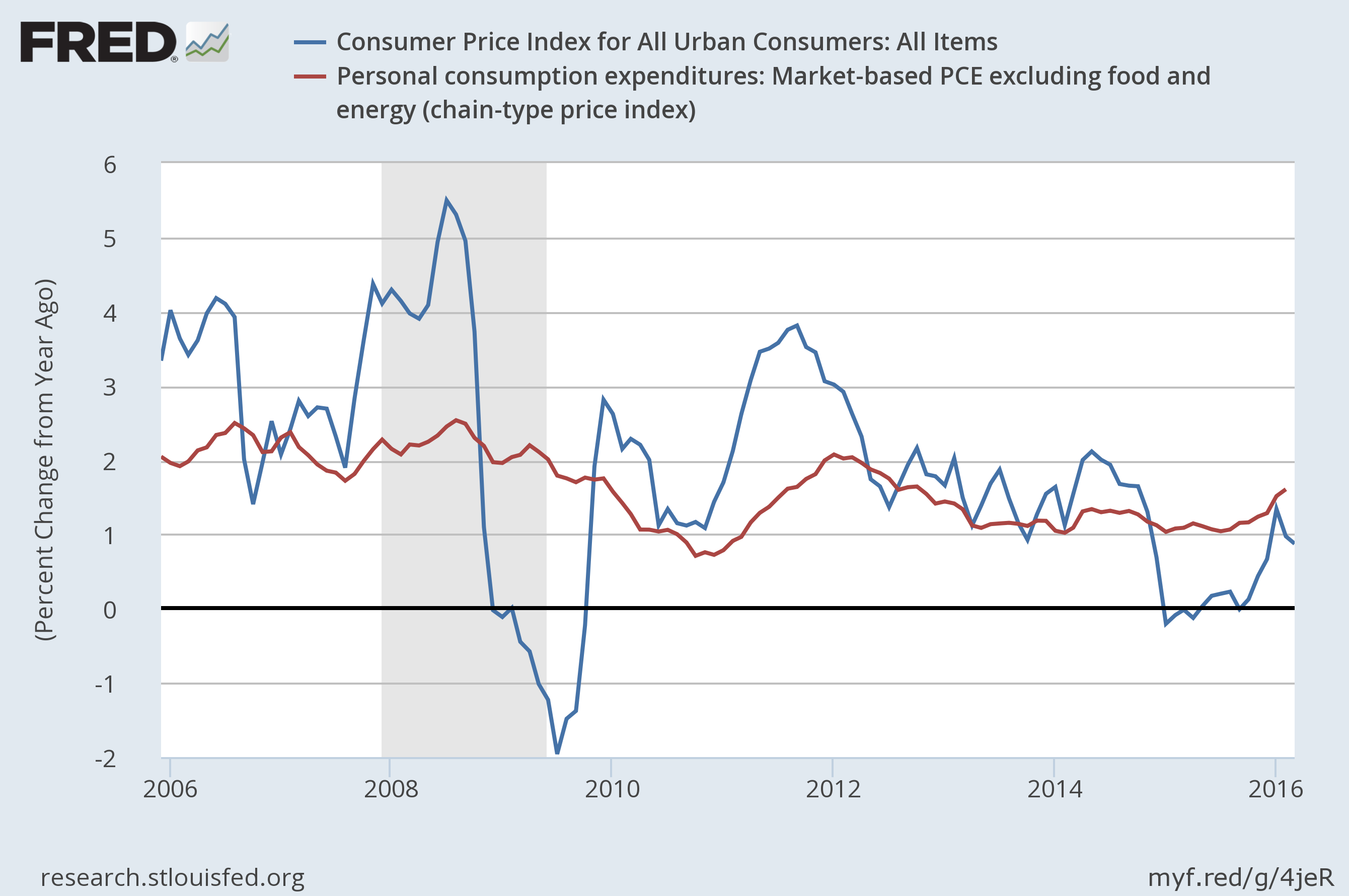

Through October, November, and December of last year, the economy saw some relatively high job gains. Furthermore, the consumer price index (CPI) — the most popular metric for inflation — had jumped from a growth rate of zero in September 2015 to 1.2 percent by December. And if you squinted, even the personal consumption expenditures (PCE) metric — the Fed's preferred inflation measure — appeared to be ticking up. Since the whole point of hiking interest rates is to slow inflation, you could spin a superficial story about how it was time for a hike. Then job creation fall back again for the first three months of 2016, the CPI reversed and headed downward, and the PCE's ascent slowed to a near-plateau:

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Even ignoring these developments, the case for a hike in December was never strong. For one thing, the average job creation rate for all of 2015 was actually lower than the average rate for 2014. More importantly, even when inflation is rising, it's important to ask from what baseline? A rise from 5 percent to 6 percent is arguably something to worry about. But a rise from 0 to 1 percent, or from 1 percent to 2 percent? Interest rate hikes may slow down the economy, but they also slow down job creation and wage growth. And overshooting the inflation target by a few points is far less risky than dragging the economy back into recession.

The simple fact is the December rate hike — and the rate hikes planned after it — was always a bad idea. Nothing that spectacular changed in the U.S. economy from December to April. The very design of the Fed, and the general financial elite socioeconomic circles in which its officials swim, biases it towards prioritize holding down inflation over encouraging more employment. After seven years of rockbottom interest rates, a groupthink had likely set in at the institution that interest rates just had to go up.

So what changed their minds? More than anything unique to the U.S. economy, it was probably global risks. The worldwide collapse in oil prices, while already well underway by December of 2015, is now pretty clearly going to stick around for another year or two. That will hold down inflation. The slowdown of China and the rest of the global economy will also make it harder for the U.S. to generate jobs than would otherwise be the case. That militates against interest rate hikes as well. Finally, the fast approaching referendum in Britain — on whether that country will cut ties with the European Union — has panicked financial markets and given Fed officials yet another reason to think twice about hiking rates.

The problem with groupthink is that it takes on a life of its own. Once people have chosen a particular course, it can be hard to turn from it, even if it was always a bad idea. Doing so requires swallowing your pride and admitting you were wrong. So these kinds of fluke international events can give people an opportunity to change their minds while saving face.

The question now is whether Fed officials are really rethinking the whole rate hike question under cover of the Brexit, oil prices, and the rest. Wednesday's press release contains few clues, though if you read between the lines you can maybe see the Fed talking itself into a hike for its next meeting in June. Only time will tell.

Jeff Spross was the economics and business correspondent at TheWeek.com. He was previously a reporter at ThinkProgress.

-

Why is the Trump administration talking about ‘Western civilization’?

Why is the Trump administration talking about ‘Western civilization’?Talking Points Rubio says Europe, US bonded by religion and ancestry

-

Quentin Deranque: a student’s death energizes the French far right

Quentin Deranque: a student’s death energizes the French far rightIN THE SPOTLIGHT Reactions to the violent killing of an ultraconservative activist offer a glimpse at the culture wars roiling France ahead of next year’s elections

-

Secured vs. unsecured loans: how do they differ and which is better?

Secured vs. unsecured loans: how do they differ and which is better?the explainer They are distinguished by the level of risk and the inclusion of collateral

-

The pros and cons of noncompete agreements

The pros and cons of noncompete agreementsThe Explainer The FTC wants to ban companies from binding their employees with noncompete agreements. Who would this benefit, and who would it hurt?

-

What experts are saying about the economy's surprise contraction

What experts are saying about the economy's surprise contractionThe Explainer The sharpest opinions on the debate from around the web

-

The death of cities was greatly exaggerated

The death of cities was greatly exaggeratedThe Explainer Why the pandemic predictions about urban flight were wrong

-

The housing crisis is here

The housing crisis is hereThe Explainer As the pandemic takes its toll, renters face eviction even as buyers are bidding higher

-

How to be an ally to marginalized coworkers

How to be an ally to marginalized coworkersThe Explainer Show up for your colleagues by showing that you see them and their struggles

-

What the stock market knows

What the stock market knowsThe Explainer Publicly traded companies are going to wallop small businesses

-

Can the government save small businesses?

Can the government save small businesses?The Explainer Many are fighting for a fair share of the coronavirus rescue package

-

How the oil crash could turn into a much bigger economic shock

How the oil crash could turn into a much bigger economic shockThe Explainer This could be a huge problem for the entire economy