Who will save the global economy now?

China's market drop has revealed a depressing truth: There's no cavalry coming

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

For the Chinese stock markets, it was not a happy New Year.

On Monday — the first day of trading in 2016 — the Shanghai Composite index dropped 7 percent, and the smaller Shenzhen Composite fell 8.2 percent. It was an unwelcome reminder of two precipitous crashes that befell China's stock market midway through 2015. Stocks in America, Europe and Japan dropped a bit in response, but by Tuesday things appeared to have leveled off.

Now, as always, the first thing needed here is a bit of perspective: China's stock market remains above the lowest point of its mid-2015 plunge, and even that trough was well above where the market was at the same point in 2014. On top of that, the performance of any country's stock market has only a tangential relationship to the performance of its real economy, and it would take a truly catastrophic turn for China's real economy to drag down America's real economy.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

That said, the situation for China's real economy isn't exactly good.

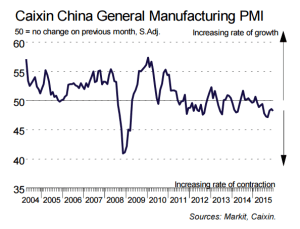

Stock markets are skittish creatures, and what set off the latest panic was a bad showing from the Caixin index, which measures China's manufacturing sector. Any reading on the index below 50 means the industry is shrinking rather than growing. Economists had been hoping for a 48.9 in December, but got 48.2 instead. A similar disappointment from the Caixin is what set off the last stock market rout in August.

In fact, China's manufacturing sector has been contracting for 10 months, and has been slowing down for years:

(Graph courtesy of the Financial Times.)

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

That long, slow decay — rather than the threat of some sudden and catastrophic crash — is the real story here. Nor is it purely a Chinese story: America and other western nations buy manufactured goods and other services from China, which in turn buys a lot of raw materials from other developing countries. In the modern globalized world, all the economies feed off of and into one another, and thus tend to converge on the same trend lines. America's recovery from the Great Recession has been tepid at best, and Europe's has been considerably worse. In fact, when you add up all the international economies we can keep track of, it looks like global output shrank 4.9 percent in 2015. The whole planet has been in recession.

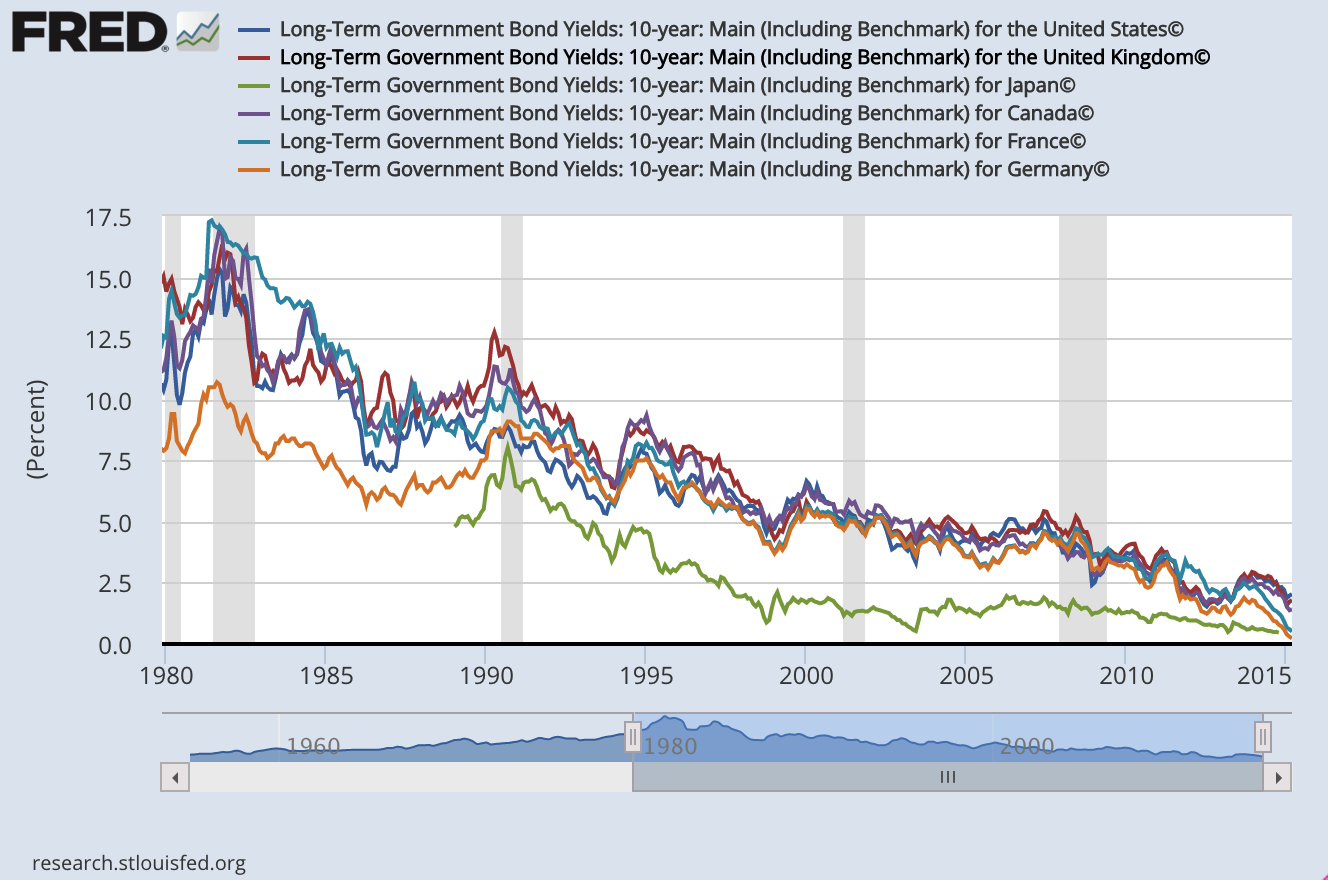

The flip-side of this point is what investors in financial markets around the world have been doing in response. "Investors also appeared to seek some safety in government bonds," in response to China's stock turmoil this week, The New York Times reported. "The yield on the 10-year Treasury note, which falls as its price rises, declined slightly to 2.25 percent, from 2.27 percent."

Bonds — i.e. debt — from the United States government and other western powers are considered the safest investments on Earth, because of those governments' unique powers: Not only can they command revenue through their legal power to tax, at the end of the day they can also just create new supplies of money to pay those bonds off. So investors flock to park their money in those bonds when everywhere else in the global economy looks like a shaky and unreliable opportunity for a return.

Now, Econ 101 says that the price of something goes up as demand for it outstrips supply, and as the Times says the yield on debt moves inversely to its price. So if we're in something at or close to a global recession, and as a result there's more investor demand for the safe harbor of government debt than supply, it shouldn't surprise anyone that yields on debt for the major western governments are heading for historic lows.

In fact, they've been trending downward for a good long while, which is all part of that "secular stagnation" debate you may have heard of.

Now consider the implication of this logic: Even as the governments in North American and Europe have all embraced calls for austerity and lower deficits to varying degrees, the financial markets have been calling for them to issue more debt, not less.

Why would this be? Well, the way you combat recessions is by boosting aggregate demand: Aggregate demand at the national level in the case of a national recession, and aggregate demand at the global level in a global recession. But private companies can't do that. They can generate new economic activity, certainly, but only out of the raw material of already-present demand that's as yet untapped. Because of their unique fiscal powers, only governments can actually increase demand. So there's a certain symmetry here: The global economy — driven primarily by America, Europe, China, Japan, Canada, Australia and crew — is in a downturn, so by asking those governments to issue more debt, investors are effectively asking them to revive their economies, and thus ultimately give those investors economic activity to invest in that's not government debt.

The financial markets meant to coordinate global economic activity are practically begging major governments to engage in looser monetary policy and much more deficit-financed stimulus spending, but none of them are doing it. Europe is driving itself into repeated recessions with austerity, and has only belatedly moved to highly selected monetary stimulus. America has shrunk its deficits and shows no desire to expand them again, and now the Fed is tightening its policy. And China has so mismanaged and over-borrowed in its own transition to a modern service economy that it's not clear how much its government could do, either.

In short, the world is in recession, and the institutions that could fight back either can't, or just won't.

Jeff Spross was the economics and business correspondent at TheWeek.com. He was previously a reporter at ThinkProgress.

-

How the FCC’s ‘equal time’ rule works

How the FCC’s ‘equal time’ rule worksIn the Spotlight The law is at the heart of the Colbert-CBS conflict

-

What is the endgame in the DHS shutdown?

What is the endgame in the DHS shutdown?Today’s Big Question Democrats want to rein in ICE’s immigration crackdown

-

‘Poor time management isn’t just an inconvenience’

‘Poor time management isn’t just an inconvenience’Instant Opinion Opinion, comment and editorials of the day

-

The pros and cons of noncompete agreements

The pros and cons of noncompete agreementsThe Explainer The FTC wants to ban companies from binding their employees with noncompete agreements. Who would this benefit, and who would it hurt?

-

What experts are saying about the economy's surprise contraction

What experts are saying about the economy's surprise contractionThe Explainer The sharpest opinions on the debate from around the web

-

The death of cities was greatly exaggerated

The death of cities was greatly exaggeratedThe Explainer Why the pandemic predictions about urban flight were wrong

-

The housing crisis is here

The housing crisis is hereThe Explainer As the pandemic takes its toll, renters face eviction even as buyers are bidding higher

-

How to be an ally to marginalized coworkers

How to be an ally to marginalized coworkersThe Explainer Show up for your colleagues by showing that you see them and their struggles

-

What the stock market knows

What the stock market knowsThe Explainer Publicly traded companies are going to wallop small businesses

-

Can the government save small businesses?

Can the government save small businesses?The Explainer Many are fighting for a fair share of the coronavirus rescue package

-

How the oil crash could turn into a much bigger economic shock

How the oil crash could turn into a much bigger economic shockThe Explainer This could be a huge problem for the entire economy