Donald Trump's new tariff policy is deceptively smart

Slapping a tariff on all imports really would do wonders for job growth

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Donald Trump's incoming presidential administration is talking about slapping a 5 percent tariff on all imports. Or maybe it's 10 percent? In typical Trump fashion, the idea seems to be the result of spitballing and competition over who says the number with the most digits.

Sober and serious-minded critics are of course aghast: This could upend global trade arrangements! It will raise consumer prices! It is based on a silly misreading of basic economics!

They shouldn't be so quick.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

The basic idea here is simple: Make imports more expensive, and companies wouldn't sell as many goods made abroad to Americans, likely turning to domestic producers for those goods. So instead of American consumers' money going to create jobs in other countries, it helps create jobs here. This is why, all other things being equal, a trade deficit is a drag on growth.

Of course, all other things aren't equal, as Trump's critics point out. What we do to shrink the trade deficit could backfire, leading to a smaller economy overall. For instance, America's manufacturing base for shoes and clothes is just gone. Rather than switching to cheaper production, sellers might react to the tariff by just raising prices on American consumers. But foreign investors still want to park money in U.S. assets. So the dollar could actually strengthen, hurting American exports. In the end, maybe you shrink the trade deficit, but shrink GDP along with it.

It's a clever and technocratic response. But the assumption that foreign investors would want to keep pumping money into America's economy depends too much on the prejudice that wealthy capitalists drive all economic activity. It's not necessarily the case.

Sure, if you're a Chinese manufacturer, and Americans are paying you U.S. dollars for your goods, you need to park that money in American assets. But people don't invest just for the thrill of it — they invest to make more money, so they can ultimately buy more goods and services. And making money from American assets only helps you buy goods and services denominated in American dollars. So foreign investors' demand for U.S. assets isn't completely divorced from America's demand for imports. Reducing the second will probably reduce the first. That will lower the value of the U.S. dollar and help American exports, which helps American jobs. (Over the long-term, tariffs might also force suppliers to rebuild lost domestic manufacturing bases like clothes and shoes.)

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

But don't we want more investment in America?

Well yes, and scaring off foreign investment would be a bad idea if capital for investment was in short supply. But the U.S. has the opposite problem. America's economy and the global economy suffer from a savings glut — a massive surplus of money with not enough places to park it.

Finally, there's a more subtle point to be made.

As I mentioned, tariffs on exports would bring more American demand back to American businesses. That would create more jobs. Fewer people would be looking for work, meaning labor is scarcer. So employers would have to compete more for labor, giving workers leverage to demand better pay and benefits. Which itself could offset the hit of higher prices to households' pocketbooks.

But economists and elites tend to get hung up on consumption as a measure of well-being. Buying more stuff at cheaper prices is certainly nice. But consumption is also a passive act. Your income — what you earn — is the real measure of your social stature. That's what defines your relationship to your employer and your community. Shrinking the trade deficit is about giving workers more say over the terms of their own employment.

Now, the other tariff idea Trump has discussed — simply slapping one tariff on one offending foreign competitor at a time — would be a game of whack-a-mole: Sellers here would just move to the next cheapest foreign producer.

But it sounds like Trump's team is now talking about a blanket tax on all imports. That's a better idea: It allows the economy to adjust, finding the most cost-effective arrangements in a new set of circumstances that's fundamentally more biased towards keeping domestic demand flowing to domestic jobs. But he could still set off a trade war. So another possible approach is assigning the Federal Reserve to buy up the assets of foreign countries who have manipulated their currency to make their exports to us cheaper. That would strengthen their currencies' values, and bring them back into balance with ours. It's a proportional response to other countries' shenanigans that cuts to the root of what causes trade imbalances.

But if nothing else, Trump's tariff proposal would make for a fascinating real-world experiment: We'd finally see just how well one of the cherished beliefs of the pro-globalization consensus holds up.

Jeff Spross was the economics and business correspondent at TheWeek.com. He was previously a reporter at ThinkProgress.

-

At least 8 dead in California’s deadliest avalanche

At least 8 dead in California’s deadliest avalancheSpeed Read The avalanche near Lake Tahoe was the deadliest in modern California history and the worst in the US since 1981

-

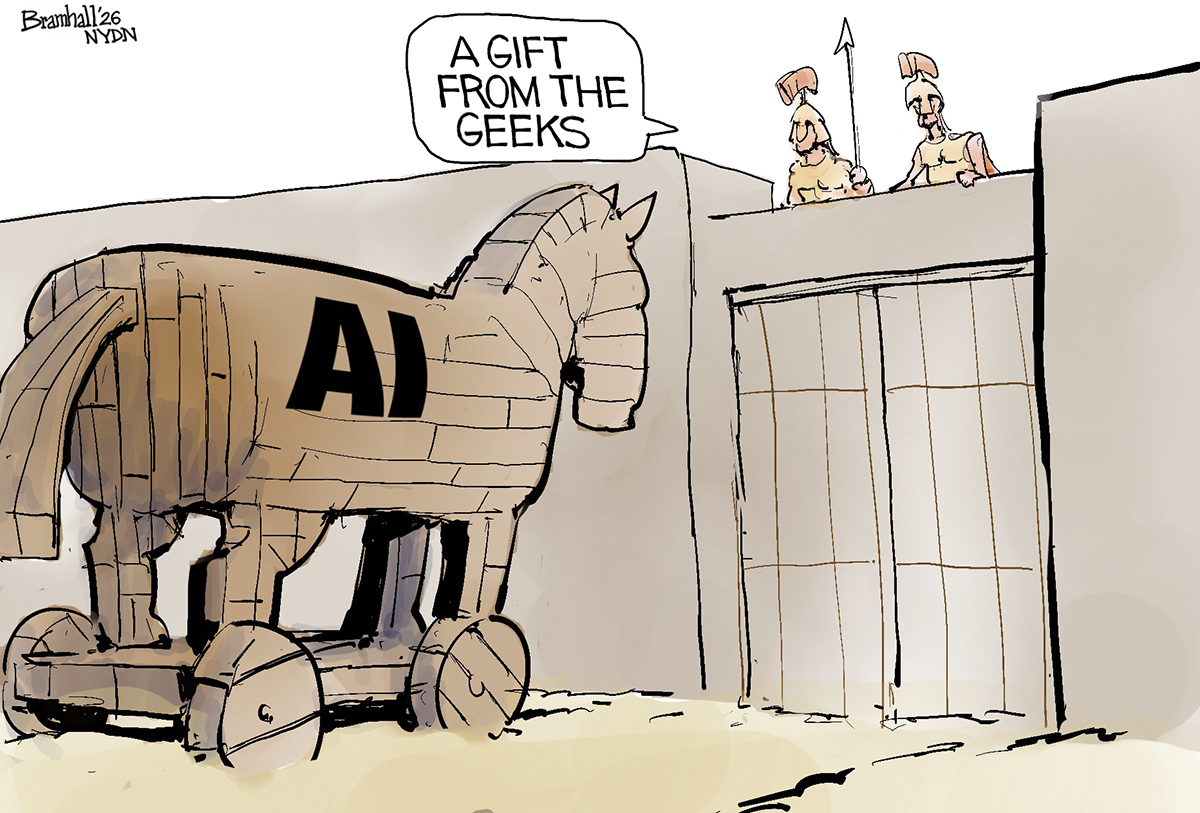

Political cartoons for February 19

Political cartoons for February 19Cartoons Thursday’s political cartoons include a suspicious package, a piece of the cake, and more

-

The Gallivant: style and charm steps from Camber Sands

The Gallivant: style and charm steps from Camber SandsThe Week Recommends Nestled behind the dunes, this luxury hotel is a great place to hunker down and get cosy

-

The billionaires’ wealth tax: a catastrophe for California?

The billionaires’ wealth tax: a catastrophe for California?Talking Point Peter Thiel and Larry Page preparing to change state residency

-

Bari Weiss’ ‘60 Minutes’ scandal is about more than one report

Bari Weiss’ ‘60 Minutes’ scandal is about more than one reportIN THE SPOTLIGHT By blocking an approved segment on a controversial prison holding US deportees in El Salvador, the editor-in-chief of CBS News has become the main story

-

Has Zohran Mamdani shown the Democrats how to win again?

Has Zohran Mamdani shown the Democrats how to win again?Today’s Big Question New York City mayoral election touted as victory for left-wing populists but moderate centrist wins elsewhere present more complex path for Democratic Party

-

Millions turn out for anti-Trump ‘No Kings’ rallies

Millions turn out for anti-Trump ‘No Kings’ ralliesSpeed Read An estimated 7 million people participated, 2 million more than at the first ‘No Kings’ protest in June

-

Ghislaine Maxwell: angling for a Trump pardon

Ghislaine Maxwell: angling for a Trump pardonTalking Point Convicted sex trafficker's testimony could shed new light on president's links to Jeffrey Epstein

-

The last words and final moments of 40 presidents

The last words and final moments of 40 presidentsThe Explainer Some are eloquent quotes worthy of the holders of the highest office in the nation, and others... aren't

-

The JFK files: the truth at last?

The JFK files: the truth at last?In The Spotlight More than 64,000 previously classified documents relating the 1963 assassination of John F. Kennedy have been released by the Trump administration

-

'Seriously, not literally': how should the world take Donald Trump?

'Seriously, not literally': how should the world take Donald Trump?Today's big question White House rhetoric and reality look likely to become increasingly blurred