Ivanka Trump wants to help the wealthy pay their au pairs

Her child care plan is absurdly tilted towards the rich

One of the biggest lingering questions about the Donald Trump presidency is the degree to which his campaign shtick of being a working-class populist was an open fraud. So far, all signs point towards "completely."

The most recent example comes from Ivanka Trump, who is reportedly the force behind a new plan to provide a tax deduction for child care. As usual for Republican policymaking, it is absurdly tilted towards the rich. Ultra-rich families — like those of the many Wall Street goons stocking Trump's Cabinet, or of the various Trump children themselves — will make out handsomely. But poor and working-class schlubs will get a pittance, if they get anything.

The full details of the plan have not been released yet, but the basic shape was described in a Bloomberg report. It would allow parents to deduct their child care expenses from their taxable income; single parents earning less than $250,000 would qualify, and so would couples earning less than $500,000. (This doesn't mean that a family making more than that would be totally ineligible, the deduction would just be phased out as income increased, up to an overall limit in deductions.) Additionally, there would be a $1,200 child care supplement in the Earned Income Tax Credit to cut poorer families in a bit.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Tax deductions reduce your taxable income, so the actual benefit will depend on your tax rate (as opposed to tax credits, which reduce your taxes owed directly). Kevin Drum does a quick sketch of what that would look like with a $5,000 deduction here. Essentially, the more you make, the more you benefit, up to the income cap. But that cap is extremely high — $500,000 is nearly nine times the median household income, so the number of super-rich families who wouldn't get at least a piece of it would be very small.

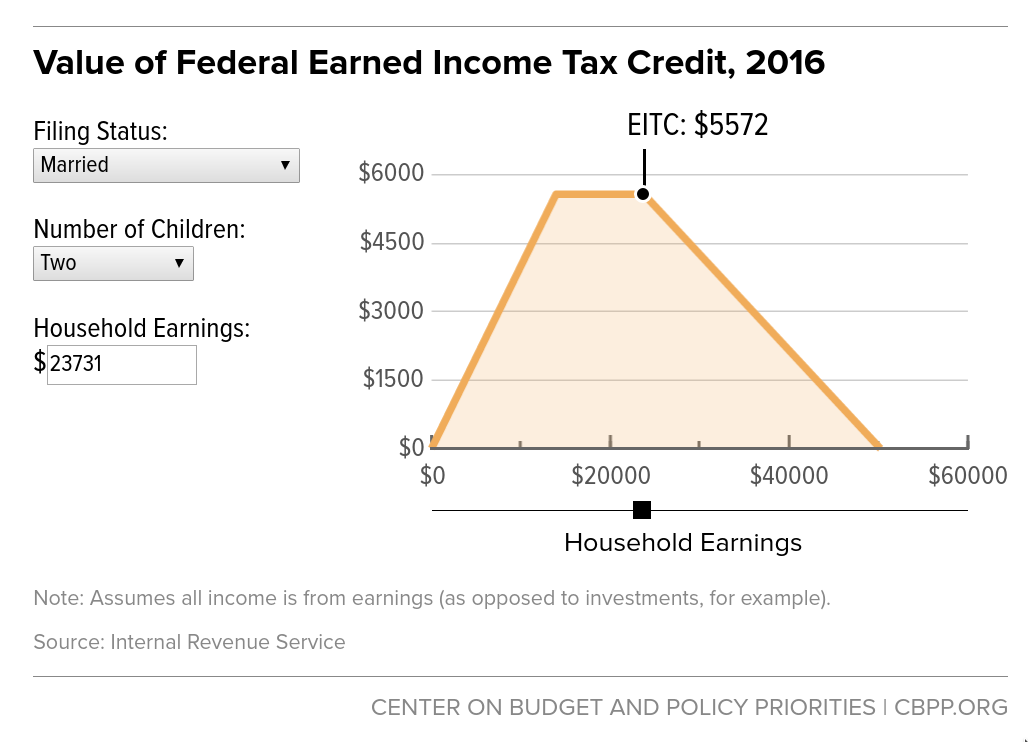

The right-leaning Tax Foundation conducted an analysis of Trump's child care plan, and found that it would cost $500 billion over 10 years. They did not break out how much of that is due to the EITC expansion and how much to the increased deduction, but at a rough guess the bulk of the cost is due to the deduction. The current EITC grants a maximum of $3,373 for one-child families, $5,572 for two-child families, and $6,269 for those with more than two children. For families right in the income sweet spot, that would be quite a sizable benefit — but there won't be very many of them, as the EITC also phases in and out fairly quickly:

(Courtesy Center on Budget and Policy Priorities)

Worse yet, the EITC requires that you have wage income before you can claim it, so people without jobs are left out. Under the Trump plan, the very poorest parents will get no child care help at all. As Alan Cole, a Tax Foundation analyst, told Bloomberg, "the largest benefits will go to relatively affluent dual-income families using paid child care."

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Bryce Covert makes two more key points: First, there is already a program to help lower-income families with child care costs, for up to $4,800 per year — but it hasn't been fully funded of late due to Republican austerity. Second, yearly tax benefits are a bad way to help cash-strapped poor families with constant expenses like child care — far better to have a monthly payment so people don't have to juggle budgets or savings accounts.

So we see the overall shape of Ivanka Trump's signature policy idea. Wealthy families who can easily front the cash for a daycare or an au pair will get a nice fat tax reduction when their accountant files their taxes for them — and the richer they are, they more they will get, up to quite a high bar. The top half of poor families will get a few scraps, assuming they can navigate their way through the hellish paperwork to claim the EITC properly, while the poorest of the poor will get little or nothing.

Welcome to President Trump's America!

Ryan Cooper is a national correspondent at TheWeek.com. His work has appeared in the Washington Monthly, The New Republic, and the Washington Post.

-

High Court action over Cape Verde tourist deaths

High Court action over Cape Verde tourist deathsThe Explainer Holidaymakers sue TUI after gastric illness outbreaks linked to six British deaths

-

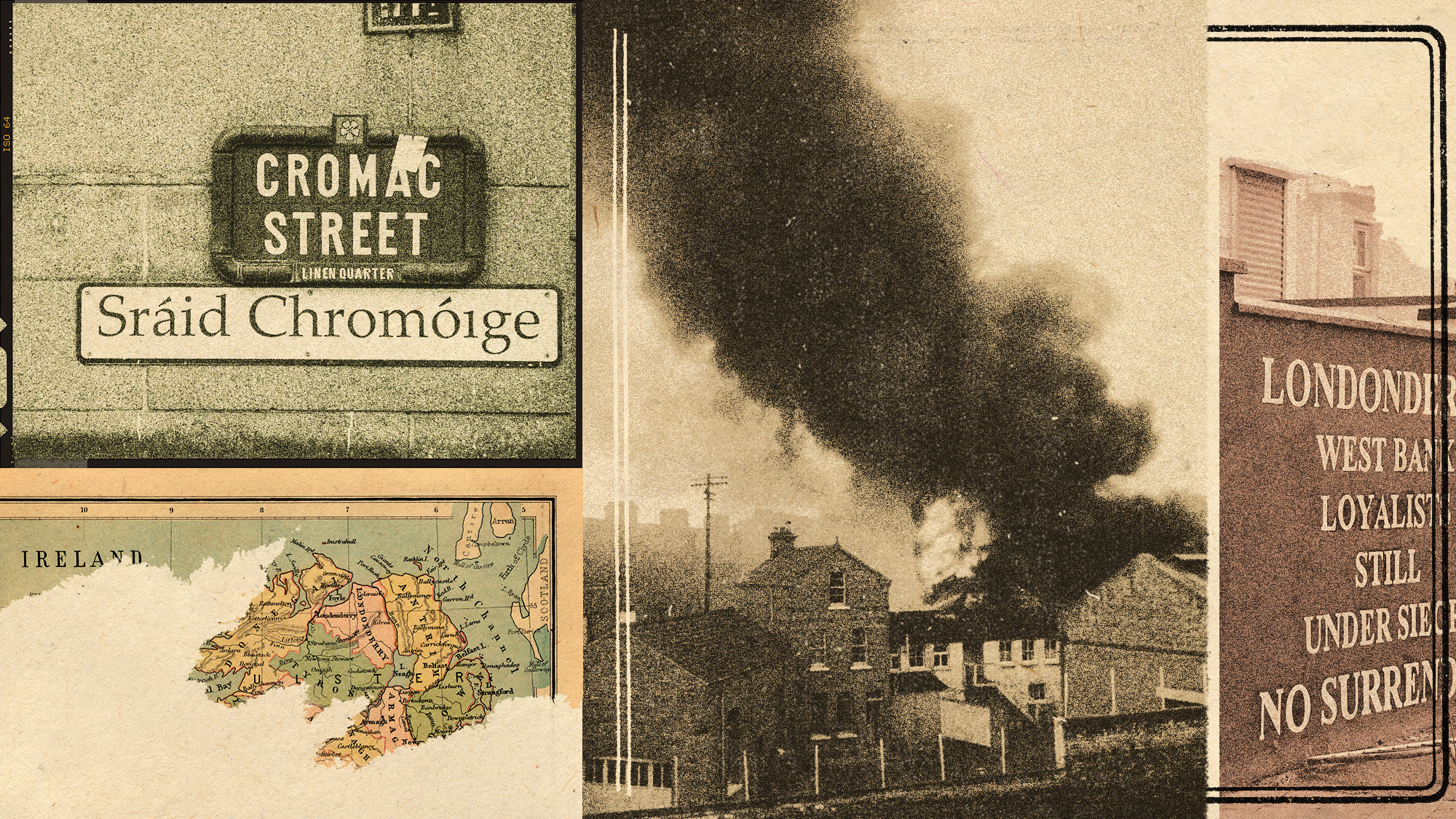

The battle over the Irish language in Northern Ireland

The battle over the Irish language in Northern IrelandUnder the Radar Popularity is soaring across Northern Ireland, but dual-language sign policies agitate division as unionists accuse nationalists of cultural erosion

-

Villa Treville Positano: a glamorous sanctuary on the Amalfi Coast

Villa Treville Positano: a glamorous sanctuary on the Amalfi CoastThe Week Recommends Franco Zeffirelli’s former private estate is now one of Italy’s most exclusive hotels

-

The billionaires’ wealth tax: a catastrophe for California?

The billionaires’ wealth tax: a catastrophe for California?Talking Point Peter Thiel and Larry Page preparing to change state residency

-

Bari Weiss’ ‘60 Minutes’ scandal is about more than one report

Bari Weiss’ ‘60 Minutes’ scandal is about more than one reportIN THE SPOTLIGHT By blocking an approved segment on a controversial prison holding US deportees in El Salvador, the editor-in-chief of CBS News has become the main story

-

Has Zohran Mamdani shown the Democrats how to win again?

Has Zohran Mamdani shown the Democrats how to win again?Today’s Big Question New York City mayoral election touted as victory for left-wing populists but moderate centrist wins elsewhere present more complex path for Democratic Party

-

Millions turn out for anti-Trump ‘No Kings’ rallies

Millions turn out for anti-Trump ‘No Kings’ ralliesSpeed Read An estimated 7 million people participated, 2 million more than at the first ‘No Kings’ protest in June

-

Ghislaine Maxwell: angling for a Trump pardon

Ghislaine Maxwell: angling for a Trump pardonTalking Point Convicted sex trafficker's testimony could shed new light on president's links to Jeffrey Epstein

-

The last words and final moments of 40 presidents

The last words and final moments of 40 presidentsThe Explainer Some are eloquent quotes worthy of the holders of the highest office in the nation, and others... aren't

-

The JFK files: the truth at last?

The JFK files: the truth at last?In The Spotlight More than 64,000 previously classified documents relating the 1963 assassination of John F. Kennedy have been released by the Trump administration

-

'Seriously, not literally': how should the world take Donald Trump?

'Seriously, not literally': how should the world take Donald Trump?Today's big question White House rhetoric and reality look likely to become increasingly blurred