The decline and fall of neoliberalism in the Democratic Party

How a generation of centrist policymaking became a giant failure

If the Democrats have one thing in common, it's their shared hatred of President Trump. His shocking win over Hillary Clinton and the subsequent madness of his rule have galvanized the party in a way unseen in at least a decade. Yet their unity in opposition masks lingering and deep fissures in the party.

From the late 1980s to 2016, neoliberal ideas held hegemonic sway among the Democratic elite. But the economy created by this ideology — and the ensuing crises — is a major reason why Clinton lost to Trump and the party is completely out of power today. This obvious failure has provided an ideological opening that the American left has been eager to fill.

Yet even the left-wing is divided about the best way forward. Should it follow Elizabeth Warren's lead and promise a return to the trust-busting ways of the early 20th century? Or should it emulate the more sweeping, Nordic-style politics of Bernie Sanders? Or perhaps the Democratic Socialists of America are right and something even more extreme is needed.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

In this series, I'm going address each of these factions in the Democratic Party, reckoning with their failures and analyzing their potential to transform the country.

Let's start with the weakest of the bunch: neoliberalism.

To understand neoliberalism, you need to understand where it came from.

Neoliberalism is an understanding of the economy that has its roots in the old classical liberal tradition of John Locke, Adam Smith, and David Ricardo. Orthodox capitalism in those days — the "long 19th century" from 1789-1914, in the words of Eric Hobsbawm — meant property rights, free labor, low taxes, the gold standard, little corporate regulation, no unions, and austerity budgets. Such policy did not cause the explosive growth of the Industrial Revolution — in particular, early textile manufacturing depended utterly on cheap slave-produced cotton — but the ideology they embedded was a key part of 19th-century political economy.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

The signature feature of this ideology was the "self-regulating market," to use Karl Polanyi's phrase. The idea was that if a government set up an orthodox framework, then the economy would run itself without any interference from the meddling hand of government, whose taxes or regulations might interfere with private profits, or reduce the political influence of business.

However, orthodox policy tended to produce an economy with highly unequal incomes, business concentration, unstable booms, and long, painful busts. As the 19th century progressed, America had steadily more ultra-wealthy people, more monopolies and oligopolies, and worse economic crises.

These fed off each other. When income inequality reached its all-time peak in the late 1920s, the worst economic collapse in capitalist history quickly followed — and orthodox measures only made it worse. The gold standard was a particular problem, as it strangled nations' ability to reflate their economy by devaluing their currency and increasing the supply of money. Grinding mass unemployment — with barely any welfare state to soften the blow — created tremendous political instability that destroyed the governments of many countries.

Nations took various roads out of the Great Depression. Every one involved ditching liberal orthodoxy — deficit spending and the abandonment of the gold standard being the key two policies in most instances, which had to overcome resistance from business. In Germany, fascism removed "capitalist objections to full employment," wrote economist Michal Kalecki, by routing all deficit spending into rearmament and by keeping labor quiescent with political repression and permanent dictatorship.

In the United States, the replacement ideology was the New Deal. After some initial failed experimentation with planning, New Dealers settled on a framework of stimulus, regulation, unionization, progressive taxation, and anti-trust, heavily influenced by Louis Brandeis (to be covered in the next article in this series). To get people back to work and prime the economic pump, vast new public works were built, and millions were directly employed by the state. Business — especially finance — was regulated, above all to prevent concentration. Unions were protected under a new legal regime created by the National Labor Relations Act. Taxes on the rich were sharply increased, both to raise revenue and to deliberately prevent the accumulation of vast fortunes. Finally, world trade was managed under the Bretton-Woods system.

New Dealism did not completely overcome the old orthodoxies — in 1937, FDR went back to austerity, instantly throwing millions out of work, and forcing him to return to spending. In fact, it took the mega-spending of war mobilization after 1941 to complete the New Deal, by finally abolishing mass unemployment, and creating the political space for Roosevelt to raise the top marginal tax rate to 94 percent.

The New Deal framework held for about three decades after the end of the war — during which time the country also had the greatest economic boom in American history. Critically, this time the fruits of growth were also broadly shared. For all the many faults in the New Deal (its compromises with racism being the major one), in this period America was reformed from a country which functioned mostly on behalf of a tiny elite into one which functioned on behalf of a large majority.

Which brings us back to neoliberalism.

Neoliberalism was, at bottom, an updated version of the old liberal ideology. It's different than the classical school in important ways (no gold standard, for example), but its fundamental economic bedrock is quite similar: deregulation, tax and spending cuts, union busting, and free trade. Its adherents resurrected the idea of the self-regulating market, creating an elaborate mathematic model in which depressions were always the result of structural problems, the economy is always at full employment, and nothing could be changed without making someone else worse off. Once again, the political message was that regulations and taxation should be kept as low as possible.

A generation of economists centered around the Chicago School, including Friedrich von Hayek, Milton Friedman, and Robert Lucas, provided the intellectual backbone, gaining strength in the 1950s and '60s. They argued that New Deal structures were a drag on economic growth, and that taxes, regulation, and social insurance needed to be cut. America simply couldn't afford the strangling red tape and high taxes of the New Deal. And this time, they assured everyone, things would be different — no 1929-style crash would be in the cards.

Neoliberals' opportunity came in the 1970s, when the world economy ran into difficulties. War spending, the baby boom coming of age, and the oil shocks created serious inflation and pushed the U.S. into a trade deficit, which broke the Bretton-Woods system. Profits declined and big business mobilized against labor. The first wave of de-industrialization hit manufacturing.

Meanwhile, New Dealers ran into political difficulties. In 1972, George McGovern ran on a strongly left-wing platform, and got flattened by Nixon, seemingly demonstrating that the New Deal was no longer a vote winner. Neoliberal economists were reaching the height of academic respectability, they had a convincing story to explain the problems, and they gained the ears of top Democratic politicians like Ted Kennedy and Jimmy Carter. On the advice of Alfred Kahn, Kennedy shepherded through airline deregulation, while Carter appointed neoliberal Paul Volcker to chair of the Federal Reserve, where Volcker proceeded to create a terrible recession to crush inflation. "The standard of living of the average American has to decline," he said.

This produced growing inequality, which turned out to be a keystone element of neoliberal political economy. Deregulation, union-busting, abandoning anti-trust, and so forth shunted money to the top of the income ladder — thus providing more resources for lobbying, political pressure groups, think tanks, and economics departments to produce yet more neoliberal policy.

All this enabled neoliberal political operatives, who were organizing within the Democratic Party to push out the old New Dealers. The Democratic "Watergate Babies" elected after Nixon's downfall were largely neoliberals, and proved quickly to be amenable to deregulation and abandoning anti-trust.

Additionally, hard-line conservatives had been hazed out of power since 1932, but had been carefully organizing and building their strength ever since. The Volcker Recession allowed them to seize the moment, finally electing one of their own to the presidency: Ronald Reagan. The three succeeding Republican terms finally cemented the idea among the Democratic elite that the party would simply have to submit to neoliberalism to be able to compete.

Effectively, both parties conspired to break the New Deal.

For a time, it seemed that the neoliberals were right. America enjoyed reasonably good growth under Reagan, and did even better in the late '90s under Bill Clinton, when a boom in high-tech companies led to the first sustained period of full employment since the '70s — without so much as a whisper of inflation. The Democratic elite's adoption of neoliberalism seemed to be paying off — partly, no doubt, why Clinton followed Reagan's lead on anti-trust and passed two large packages of financial deregulation.

However, there were problems below the surface. In the New Deal days, wages had grown along with productivity. But in the mid-'70s, the link was broken, and median wages began to stagnate. As a result, income inequality began to increase, as economic growth flowed into corporate profits, executive pay, and capital gains instead of to the working class.

The spectacular late-'90s boom was, in retrospect, the first and last time the U.S. saw full employment under neoliberalism. It was followed immediately by a financial crisis and a prolonged "jobless recovery," where growth returned reasonably quickly but employment and wages lagged far behind. (Only in 2017 did the median household income finally surpass the 1999 peak — despite the economy being 18 percent larger.)

Financial deregulation also dramatically increased financial sector size and instability. Contrary to prophets of the self-regulating market, an unchained Wall Street quickly created an escalating series of financial crises, requiring expensive government bailouts. Not even a single decade after Clinton's last package of deregulation, the worst financial panic since 1929 struck, leading to the worst recession since the 1930s.

The Democrats swept to power in a wave election in 2008, as the economy entered free fall. They had every opportunity to abandon neoliberalism and return to the kind of New Deal policy that the Great Recession called for — and they blew it.

Early on, there was a brief window where the Democrats' old thinking snuck through, leading to the passage of the Recovery Act stimulus under President Obama. But this was only about half the necessary size, and instead of continuing to work on unemployment, the party became obsessed with deficits, turning to austerity by February 2010. With unemployment still at 10 percent during that year's midterms, the Democrats were flattened at the polls, leading to Republican control of the House and dozens of state legislatures.

Incredibly, the Democrats responded by doubling down on neoliberalism. Over and over again during the Obama years, the party elite proved itself overly sympathetic to the concerns of the market.

Instead of attacking the concentrated wealth and power of big finance, Democrats took the neoliberal route and passed a blizzard of complicated rules in the Dodd-Frank financial reform package that attempted to reduce specific financial sector risk. Many of those provisions were quite worthy, to be sure, but after the crisis the biggest banks are even larger than they were before the crisis and financial sector profits quickly bounced back to their previous levels.

The Obama administration also proved itself largely incapable of enforcing laws against white-collar crime. Department of Justice careerists like Eric Holder and Lanny Breuer were terrified that anything more than gentle wrist-slap fines would undermine the stability of the financial sector. As a result, despite massive fraud carried out during the housing bubble and the ensuing crash, no major bank and none of their top executives were convicted of anything.

Most damning of all, neoliberalism under Obama turned in the worst economic performance since the 1930s. Despite the fact that the 2008 crash left obvious excess capacity, there was no catch-up growth — on the contrary, growth was about two-thirds the 1945-2007 average, with no sign of speeding up on the horizon. Even 10 years after the start of the recession, there is every sign that the economy is still depressed.

So despite the confident predictions of the Chicago School, the political economy created by neoliberalism turned out to be identical to 1920s laissez-faire economics in every important respect. The United States is once again a country which functions mostly on behalf of a tiny capitalist elite. It has the same extreme inequality, the same bloated, crisis-prone financial sector, the same corruption, and the same political backlash to the status quo and rising extremist factions.

Now, it must be admitted that Obama is a magnificent political talent, the finest national politician in terms of raw ability since FDR. As long as he was at the top of the party, his sheer charisma and moderately good policy record allowed him to get re-elected — especially against a tone-deaf aristocrat like Mitt Romney, who had advocated that Detroit be allowed to go bankrupt.

But Hillary Clinton, by her own admission, is not very good at retail politics. She has neither the cool, effortless charisma of Obama, nor the warm human touch of her husband. Worse, she is accurately perceived as being firmly ensconced in the political and economic elite — made worse still by a (partly unfairly) awful relationship with the press, and a lingering miasma of scandal and corruption. But fundamentally, Clinton — virtually handpicked by the party elite, and promising to continue and build on the accomplishments of Obama — was the candidate of Democratic Party neoliberalism, for better and worse. And she lost to Donald Trump.

All this has profoundly discredited neoliberalism within the Democratic Party. The last generation of centrist policymaking has been a giant failure. There was some partial recognition of the problems under President Obama, and much worthy policy, but nowhere near the fundamental economic restructuring that is clearly needed to stop the economic elite from hoarding the fruits of growth.

So what is to be done?

Next up, the return of the trust busters.

This is the first article in a four-part series on the future of the American left. Stay tuned for the next installment.

Ryan Cooper is a national correspondent at TheWeek.com. His work has appeared in the Washington Monthly, The New Republic, and the Washington Post.

-

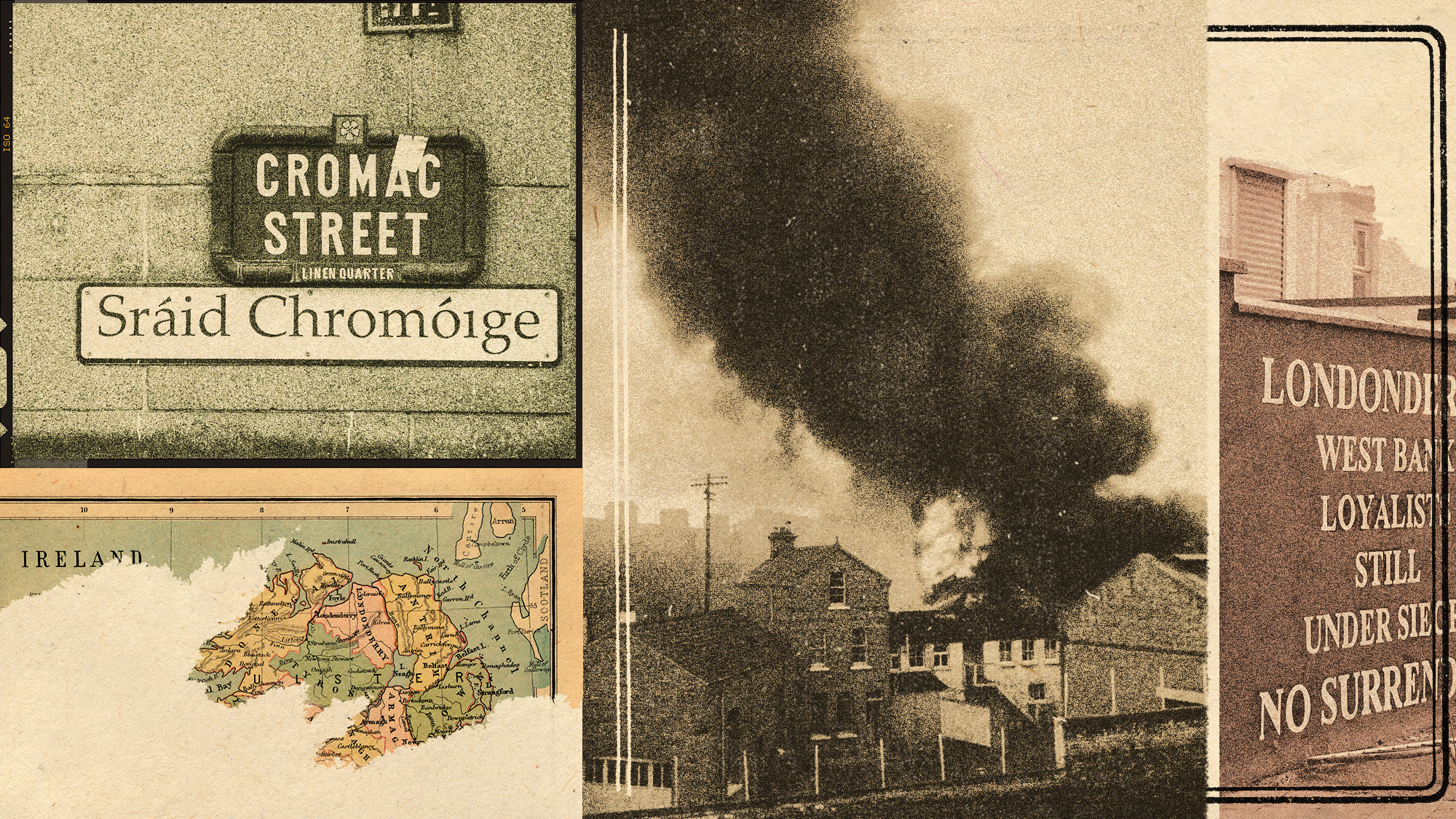

The battle over the Irish language in Northern Ireland

The battle over the Irish language in Northern IrelandUnder the Radar Popularity is soaring across Northern Ireland, but dual-language sign policies agitate division as unionists accuse nationalists of cultural erosion

-

Villa Treville Positano: a glamorous sanctuary on the Amalfi Coast

Villa Treville Positano: a glamorous sanctuary on the Amalfi CoastThe Week Recommends Franco Zeffirelli’s former private estate is now one of Italy’s most exclusive hotels

-

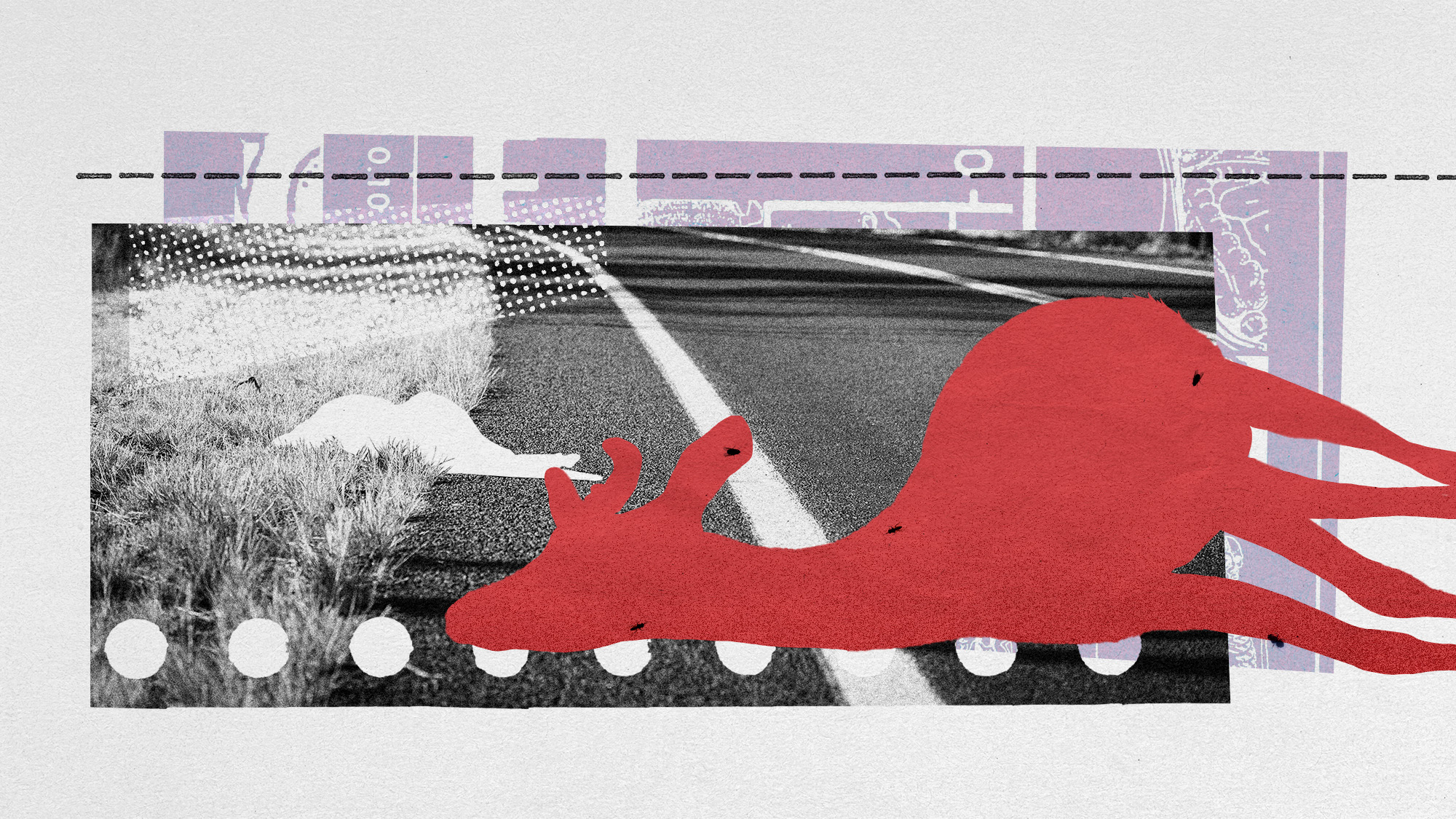

How roadkill is a surprising boon to scientific research

How roadkill is a surprising boon to scientific researchUnder the radar We can learn from animals without trapping and capturing them

-

The billionaires’ wealth tax: a catastrophe for California?

The billionaires’ wealth tax: a catastrophe for California?Talking Point Peter Thiel and Larry Page preparing to change state residency

-

Bari Weiss’ ‘60 Minutes’ scandal is about more than one report

Bari Weiss’ ‘60 Minutes’ scandal is about more than one reportIN THE SPOTLIGHT By blocking an approved segment on a controversial prison holding US deportees in El Salvador, the editor-in-chief of CBS News has become the main story

-

Has Zohran Mamdani shown the Democrats how to win again?

Has Zohran Mamdani shown the Democrats how to win again?Today’s Big Question New York City mayoral election touted as victory for left-wing populists but moderate centrist wins elsewhere present more complex path for Democratic Party

-

Millions turn out for anti-Trump ‘No Kings’ rallies

Millions turn out for anti-Trump ‘No Kings’ ralliesSpeed Read An estimated 7 million people participated, 2 million more than at the first ‘No Kings’ protest in June

-

Ghislaine Maxwell: angling for a Trump pardon

Ghislaine Maxwell: angling for a Trump pardonTalking Point Convicted sex trafficker's testimony could shed new light on president's links to Jeffrey Epstein

-

The last words and final moments of 40 presidents

The last words and final moments of 40 presidentsThe Explainer Some are eloquent quotes worthy of the holders of the highest office in the nation, and others... aren't

-

The JFK files: the truth at last?

The JFK files: the truth at last?In The Spotlight More than 64,000 previously classified documents relating the 1963 assassination of John F. Kennedy have been released by the Trump administration

-

'Seriously, not literally': how should the world take Donald Trump?

'Seriously, not literally': how should the world take Donald Trump?Today's big question White House rhetoric and reality look likely to become increasingly blurred