The Republican tax bill is already on the ropes

And the first round hasn't even started yet

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

The GOP's tax reform effort is already on the ropes — and the first round hasn't even started yet.

House Republicans will finally unveil the actual bill behind their tax reform plans on Thursday. They say they want to pass it through the House by Thanksgiving, then through the Senate and onto President Trump's desk before year's end.

There are myriad reasons why this seems unlikely. But let's begin with the most recent and prominent one. It's also something that's bedeviled the entire Republican legislative agenda since Trump took office: Keeping the party's small-but-crucial moderate wing happy.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

On Monday, Sen. Susan Collins (R-Maine) made two demands: 1. The tax package shouldn't lower the individual tax rate of 39.6 percent for people making over $1 million; and 2. The estate tax shouldn't be eliminated, as the outline released by the White House and GOP leadership called for.

Republicans hold a commanding majority in the House, but only a two-vote edge in the Senate. So if they lose Collins, they can only afford one other defection.

That said, Republicans were fiddling with the idea of leaving the 39.6 percent rate in place for millionaires already. And because the estate tax levies a 40 percent rate only on the portion of inheritances that exceeds $5.49 million ($10.98 million for couples), there's a lot that Republicans could do — raise the threshold, lower the rate — without killing it off entirely.

So how hard will it be for the GOP to accept Collins' demands? It depends on just how many Republican ideological stalwarts will insist on total elimination of the estate tax and nothing less.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

The next issue for the Republicans is less dramatic. But it's been simmering for a while, and could be more consequential.

The basic logic behind the tax reform plan is to cut rates — which would lose revenue — while clearing out loopholes — which would increase revenue. The budget blueprint the Republicans recently passed allows for $1.5 trillion in additional deficits over the next 10 years, so the goal isn't revenue neutrality. But since the the party is aiming for something like $5 trillion in total tax cuts, they'll still need to clear out $3.5 trillion in deductions, breaks, and other carve-outs in the code. (Or they'll have to cut spending.)

The problem is that every loophole in the tax code is there because someone lobbied to put it there. Which means every loophole the GOP kills is going to piss someone off, which could lose them votes.

The way Congress dealt with this challenge in the past was by making tax reform a bipartisan affair. Think of the 1986 tax overhaul, which used the same cut-the-rates, clear-out-the-loopholes logic. Getting both parties involved maximizes the potential combinations of votes you can use to get to a majority.

But this time, the Republicans have decided they don't want the Democrats involved at all. That's why they plan to pass the tax bill via reconciliation — a procedural tool that avoids the 60-vote threshold of the filibuster in the Senate. So the Republicans have a lot less room to maneuver. And chunks of their coalition are already getting pissed off about parts of the plan.

For instance, one big item was going to be eliminating the federal tax deduction for state and local taxes, which would've brought in around $1.3 trillion over 10 years all by itself. But Republican representatives from high-tax states didn't like that. So now it looks like the bill will still allow deductions for state and local property taxes specifically — which knocks the revenue gain down to about $870 billion. Republicans were also thinking of changing the tax treatment for 401(k)s in order to bring in new revenue, until President Trump scuttled the idea. So it's not at all obvious how Republicans are going to make both the politics and the budget math work in tandem.

In fact, the original plan was for the House to release its version of the bill today. But late last night, they delayed the rollout until Thursday. As Axios reported, "The likely delay of the scheduled release ... reveals the difficulties the team has had in resolving how to raise enough money to pay for the massive corporate tax cuts."

Like I said, the Republican tax plan is on the ropes, not knocked out already. But there are still plenty of rounds to go.

Jeff Spross was the economics and business correspondent at TheWeek.com. He was previously a reporter at ThinkProgress.

-

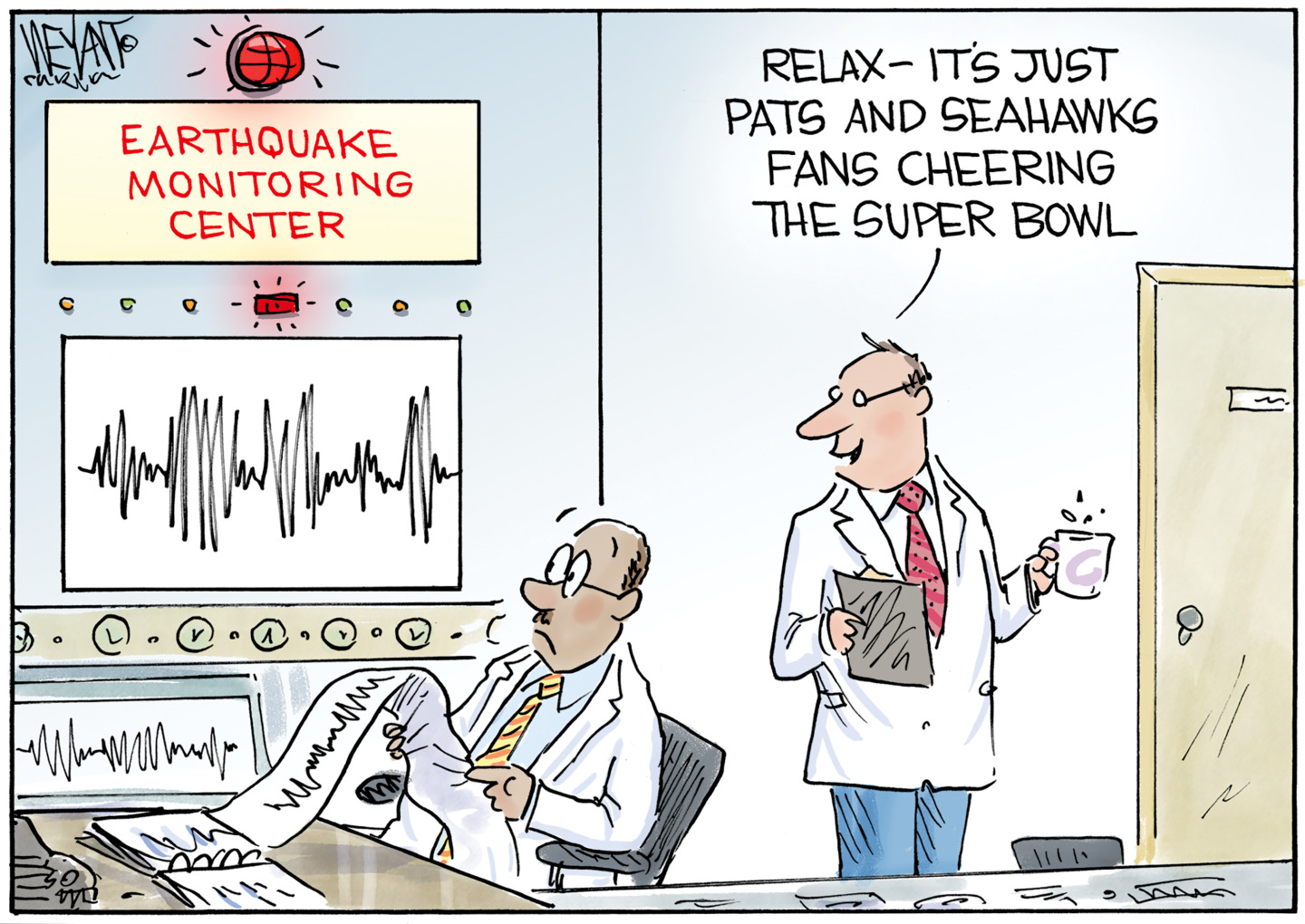

Political cartoons for February 7

Political cartoons for February 7Cartoons Saturday’s political cartoons include an earthquake warning, Washington Post Mortem, and more

-

5 cinematic cartoons about Bezos betting big on 'Melania'

5 cinematic cartoons about Bezos betting big on 'Melania'Cartoons Artists take on a girlboss, a fetching newspaper, and more

-

The fall of the generals: China’s military purge

The fall of the generals: China’s military purgeIn the Spotlight Xi Jinping’s extraordinary removal of senior general proves that no-one is safe from anti-corruption drive that has investigated millions

-

The billionaires’ wealth tax: a catastrophe for California?

The billionaires’ wealth tax: a catastrophe for California?Talking Point Peter Thiel and Larry Page preparing to change state residency

-

Bari Weiss’ ‘60 Minutes’ scandal is about more than one report

Bari Weiss’ ‘60 Minutes’ scandal is about more than one reportIN THE SPOTLIGHT By blocking an approved segment on a controversial prison holding US deportees in El Salvador, the editor-in-chief of CBS News has become the main story

-

Has Zohran Mamdani shown the Democrats how to win again?

Has Zohran Mamdani shown the Democrats how to win again?Today’s Big Question New York City mayoral election touted as victory for left-wing populists but moderate centrist wins elsewhere present more complex path for Democratic Party

-

Millions turn out for anti-Trump ‘No Kings’ rallies

Millions turn out for anti-Trump ‘No Kings’ ralliesSpeed Read An estimated 7 million people participated, 2 million more than at the first ‘No Kings’ protest in June

-

Ghislaine Maxwell: angling for a Trump pardon

Ghislaine Maxwell: angling for a Trump pardonTalking Point Convicted sex trafficker's testimony could shed new light on president's links to Jeffrey Epstein

-

The last words and final moments of 40 presidents

The last words and final moments of 40 presidentsThe Explainer Some are eloquent quotes worthy of the holders of the highest office in the nation, and others... aren't

-

The JFK files: the truth at last?

The JFK files: the truth at last?In The Spotlight More than 64,000 previously classified documents relating the 1963 assassination of John F. Kennedy have been released by the Trump administration

-

'Seriously, not literally': how should the world take Donald Trump?

'Seriously, not literally': how should the world take Donald Trump?Today's big question White House rhetoric and reality look likely to become increasingly blurred