The upper middle class got totally suckered by the Republican Party

One percenters couldn't get tax cuts through ObamaCare repeal, so now the upper middle class is going to pay

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Republicans are planning a tax "reform," and as usual this is code for a gigantic handout to the rich, in the form of a huge corporate tax cut and elimination of the inheritance tax. Somewhat unusually, they are at the moment attempting to partially pay for it by soaking the upper-middle class — limiting some tax benefits which the upper-middle class relies on, including the mortgage interest deduction and the deduction for state and local taxes.

It's just one more example of how the upper middle class is being played for fools by Republicans — and by the entire idea of tax subsidies. If they had any sense, they'd sign up with Bernie Sanders-style universal programs and get back at their real enemy: the top 1 percent.

America has long had an idiosyncratic aversion to classic social-democratic policy, where you raise taxes to provide a universal benefit. (If public elementary schools were proposed for the first time today, many would regard it as communist or an unconscionable subsidy of rich families.) Much of that comes from the upper middle class, which tends to regard government spending as the subsidization of irresponsible poor people at their expense.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

But that does not change the fact that a modern society needs a tremendous amount of government spending to stay on its feet, for the simple reason that purely capitalist institutions only dole out income to workers and owners of capital. The latter category is tiny, and the former category excludes about half the population, because the sorts of people who cannot or struggle to work — children, students, disabled, and unemployed people, the elderly, and so on — make up about half the population.

To square this circle, the American state has relied on the magic of tax subsidies. With a few notable exceptions (like Social Security), American welfare policy typically uses tax deductions and credits to direct money to the non-working categories of people. Children (by far the biggest category of non-workers) are one of the biggest recipients of tax subsides, funneled through several deductions and credits for their parents. These are economically identical to taxing and spending, but have the handy property of seeming somehow different. Hey presto, you can do Big Government Welfare while pretending not to!

Other objectives, like mass homeownership, would be impossible without government-created and -insured 30-year mortgages, and the subsidy of the mortgage interest deduction (though of course that objective could be achieved by other means).

The problem with tax subsidies is that they are horrendously inefficient. Most require at least some income to claim, and since rich people pay more taxes, tax breaks are more valuable to them — in other words, they leave out many who do need them, and when they do pay, it's inversely to need. When you include tax subsidies, America actually ranks as having the fifth-largest welfare state in the world — it's just that a huge piece of the money is going to people who don't need it.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

That very unfairness has made tax subsidies quite attractive to the upper middle class (let's call these people the top income quintile, minus the very top 1 percent). And they do quite well out of the bargain — as of 2013, they collect 73 percent of the mortgage interest deduction spending and 80 percent of the state and local tax deduction. But the class of people really making out like bandits is the top 1 percent, raking in 30 percent of the mortgage deduction and 68 percent of the even larger low rate on capital gains and dividends.

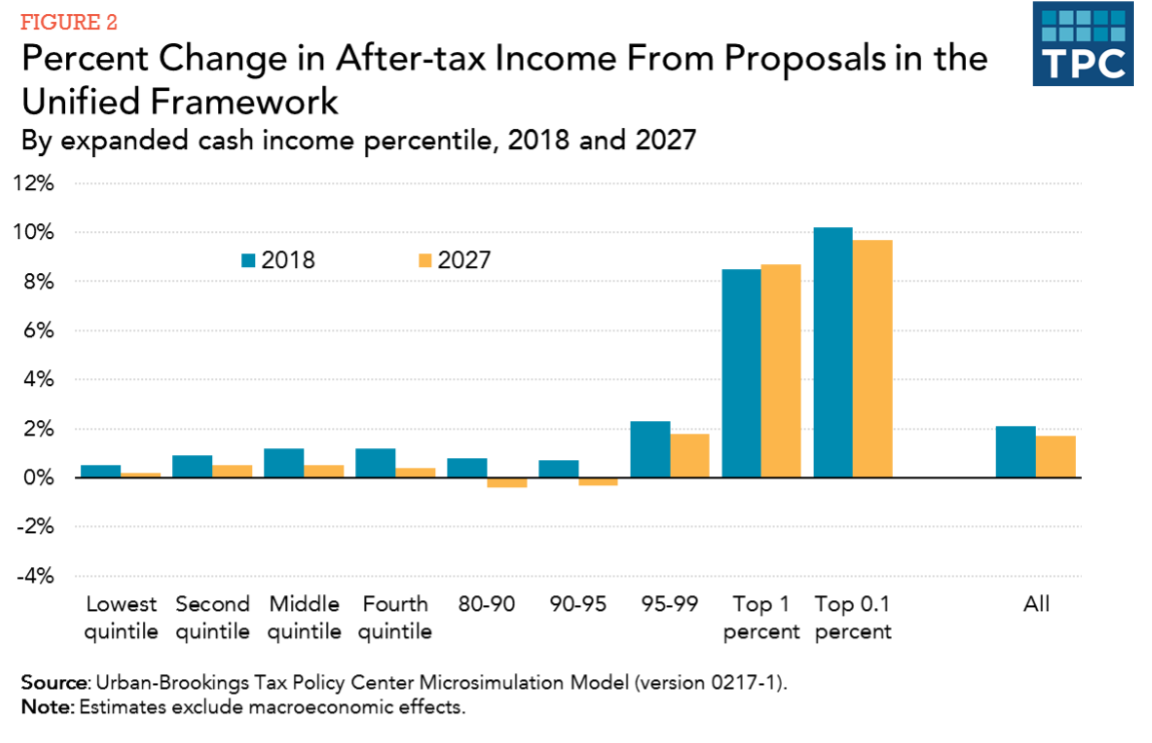

Republicans just recently tried to pass a big tax cut for the ultra-wealthy disguised as an ObamaCare repeal — in other words, paid for by snatching health care from the middle class and the poor — and they failed. Now they're trying another similar tax cut, and perhaps burned by the backlash to throwing people off their insurance, they're trying to pay for it by snatching tax benefits from the upper middle class, especially in blue states. The overall state of affairs is summarized by this Tax Policy Center chart — the 1 percent and 0.1 percent get a huge handout, the bottom three-quarters get a few bucks, and after the tax hikes planned to bite in a few years take effect, the 80-95th percentiles of earners will pay more:

(Courtesy Tax Policy Center)

It's a political risk, to be sure. Already the upper middle class is mobilizing to defend their interests. But this should demonstrate where the actual loyalties of the 1 percent lie: with themselves alone.

Bernie Sanders and company, of course, would also raise those people's taxes. But they wouldn't give the money to the ultra-rich. Instead, they'd set up universal welfare programs — Medicare for all, a child allowance, paid leave, and so forth — that would more than compensate for the increased tax bill for almost everyone. The only people that would be absolute losers under American social democracy would be the top 5 percent or so — and even then, the real big-time losers would be the top 0.1-0.01 percent who are grabbing down vast quantities of lightly-taxed capital income.

The wealthy tycoons that have a death grip on the Republican agenda are perfectly happy to use the upper middle class as a heat shield when it comes to defending their priorities. But when the tables are turned, they will cast those same people under the tank treads of plutocracy to pay for their own goodies. If the upper middle class had a lick of sense, they'd recognize this fact, and start punishing the plutocrats for it.

Ryan Cooper is a national correspondent at TheWeek.com. His work has appeared in the Washington Monthly, The New Republic, and the Washington Post.