The case for erasing every last penny of student debt

Simple! Bold! Kids love it!

Student loan debt is a crushing problem in America. Over 44 million people have such loans, with an average balance of about $30,000 — making for a total debt pile of $1.4 trillion. Unsurprisingly, people often struggle to repay these debts with their entry-level wages after graduating. Student debt is now the most common form of troubled debt, with about 11 percent of them 90 days or more delinquent. Worse still, thanks to Republicans and neoliberal Democrats alike, they are almost impossible to discharge in bankruptcy.

We should try the most obvious solution: Congress should cancel all the debt and have the government pay back the lenders.

Perhaps that sounds radical and unworkable. But a new Levy Institute research paper by Scott Fullwiler, Stephanie Kelton, Catherine Ruetschlin, and Marshall Steinbaum demonstrates that it would be easily affordable and have powerfully positive side effects.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

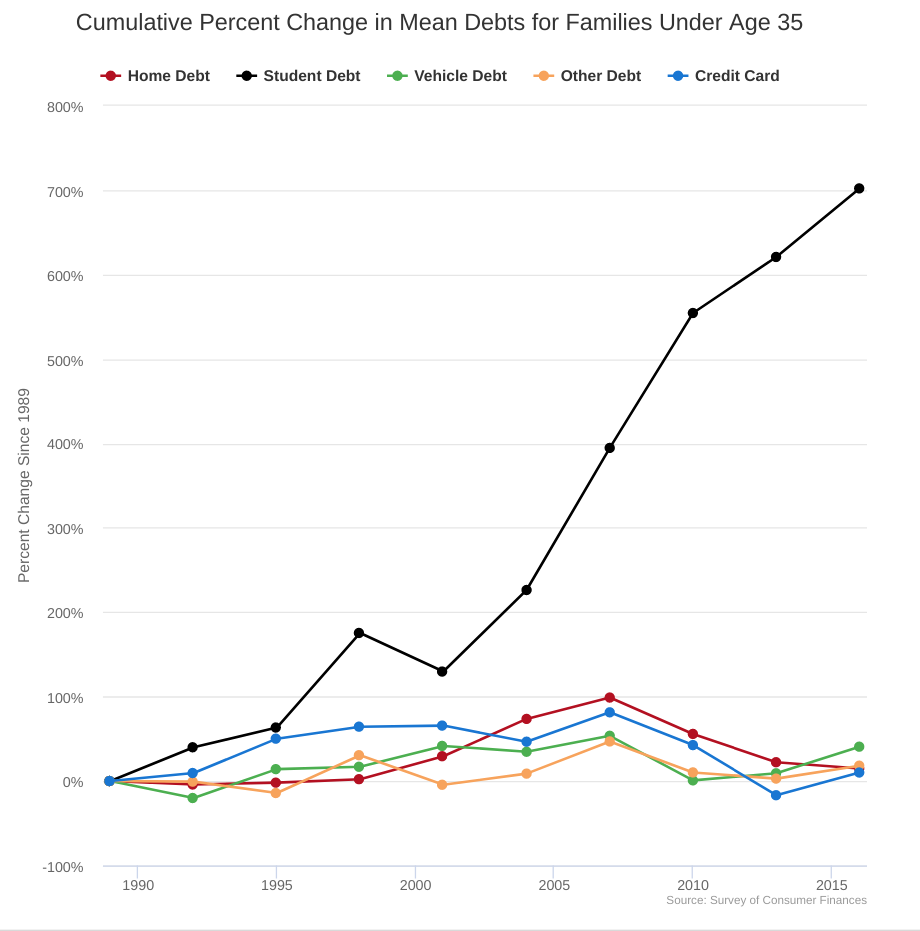

America's student debt is a steadily growing share of all household debt, now a full 10 percent of the total. What's more, that debt is heavily concentrated among young people, for obvious reasons. Since 1989, the average student loan debt held by families under 35 has increased by over 700 percent, from $1,810 to $14,516.

(Courtesy People's Policy Project)

Canceling America's $1.4 trillion in student loan debt would cost $140 billion per year for a decade. That's about the cost of the recent Republican tax giveaway to the rich. But meanwhile, eradicating all student loan debt would cause GDP to go up between $86 billion and $108 billion per year, the researchers find. America would also see a burst of job creation — something like 1.2 million to 1.5 million jobs per year— and a reduction in the unemployment rate of 0.22 to 0.36 percentage points.

What's behind those projections? It's simple: Millions more people would be able to buy homes and cars, start families, and pump money into the economy that would otherwise have gone to debt collectors.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Undoubtedly, many unsympathetic reckless borrowers would benefit handsomely from such a policy. Conversely, people who have already paid off their loans might rightfully feel cheated. But remember, the burden of student loan debt falls the hardest on poorer and minority Americans. The top income quintile does have the largest absolute balances, but unlike in ages past, many middle- and working-class people now borrow heavily simply to attend a four-year or two-year public school. Such people may have smaller balances — but are much less able to repay. As a result, Latinos suffer from delinquent loans at higher rates than whites, and blacks much higher than Latinos. In this sense, debt cancellation would be a powerfully progressive move. Yes, plenty of rich people would benefit, and some people would feel shafted. But overall, this policy would help millions and millions of people. And there's no sense in setting up some complicated means test when universal cancellation would be so much simpler and facially fair.

Now, you may ask, what happens after we wipe out all student loan debt? Wouldn't it just start accumulating anew again the very next day?

No. Because any debt cancellation should logically be paired with a new free college policy. We need to create a total reset on the way America administers higher education.

Neoliberal market mechanisms are simply an abysmal way to conduct higher education policy. Trying to provide public goods by shoving costs onto individuals (as public funding for college has been slashed over the years) means many are unable to pay or are victimized by predatory private institutions.

Neoliberal market ideology also drives skyrocketing prices for public colleges too, as institutions ostensibly of higher learning have started acting like businesses, with students acting like customers. Schools have developed bloated administrative staffs and built preposterously luxurious and wasteful ancillary buildings — while simultaneously neglecting their core academic functions.

The government should counter this trend by building out a robust public school option for college-level education, just like there is for K-12. The federal government could help state government shoulder most or all of this burden, and set up a large network of free federal universities as well. The sum total of all public college tuition was only $58 billion in fiscal year 2014, so let's call it $80 billion yearly to spin up the program. (The fact that this is dramatically cheaper than the debt cancellation idea incidentally demonstrates the hellish inefficiency of those debt subsidies.)

The point would be not only to allow everyone, poor and rich alike, access to a high-quality college education, but also to extirpate the legions of "educational" institutions that make billions grifting poor people and minorities, and force private schools to compete on quality rather than advertising and luxury amenities.

But let's start by canceling all student debt. It would be simple and straightforward, and also help out the population of people who got ripped off by the old system. Let's do it.

Ryan Cooper is a national correspondent at TheWeek.com. His work has appeared in the Washington Monthly, The New Republic, and the Washington Post.

-

The billionaires’ wealth tax: a catastrophe for California?

The billionaires’ wealth tax: a catastrophe for California?Talking Point Peter Thiel and Larry Page preparing to change state residency

-

Bari Weiss’ ‘60 Minutes’ scandal is about more than one report

Bari Weiss’ ‘60 Minutes’ scandal is about more than one reportIN THE SPOTLIGHT By blocking an approved segment on a controversial prison holding US deportees in El Salvador, the editor-in-chief of CBS News has become the main story

-

Has Zohran Mamdani shown the Democrats how to win again?

Has Zohran Mamdani shown the Democrats how to win again?Today’s Big Question New York City mayoral election touted as victory for left-wing populists but moderate centrist wins elsewhere present more complex path for Democratic Party

-

Millions turn out for anti-Trump ‘No Kings’ rallies

Millions turn out for anti-Trump ‘No Kings’ ralliesSpeed Read An estimated 7 million people participated, 2 million more than at the first ‘No Kings’ protest in June

-

Ghislaine Maxwell: angling for a Trump pardon

Ghislaine Maxwell: angling for a Trump pardonTalking Point Convicted sex trafficker's testimony could shed new light on president's links to Jeffrey Epstein

-

The last words and final moments of 40 presidents

The last words and final moments of 40 presidentsThe Explainer Some are eloquent quotes worthy of the holders of the highest office in the nation, and others... aren't

-

The JFK files: the truth at last?

The JFK files: the truth at last?In The Spotlight More than 64,000 previously classified documents relating the 1963 assassination of John F. Kennedy have been released by the Trump administration

-

'Seriously, not literally': how should the world take Donald Trump?

'Seriously, not literally': how should the world take Donald Trump?Today's big question White House rhetoric and reality look likely to become increasingly blurred