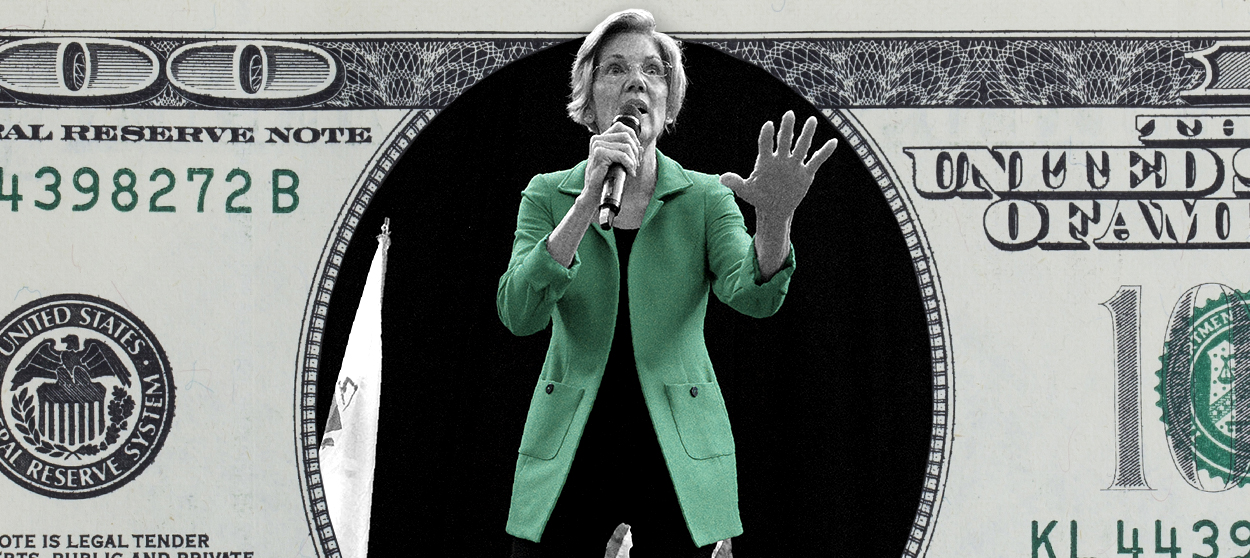

How Elizabeth Warren's wealth tax could save America

There's a strong economic case for Elizabeth Warren's wealth tax. There's an even stronger moral one.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Likely presidential contender Sen. Elizabeth Warren (D-Mass.) has a big new idea: She wants to directly tax the assets of the richest Americans. Her associates are calling it the "ultra-millionaire tax."

This is not crazy. Taxes on wages and income are common, including taxes on the money people get when they sell assets. Straight-up wealth taxes like Warren is proposing — which go after the value of things that individuals own — are less common, but not unheard of.

"My proposal will help address runaway wealth concentration and at the same time accelerate badly needed investments in rebuilding our middle class," Warren said in a statement. Conservatives, not surprisingly, rail against the proposal as an economy destroyer. But Warren has the right idea.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

The tax would work like this: If an individual owns more than $50 million in assets, all the wealth over that threshold would gets taxed at 2 percent. All assets over $1 billion would get taxed at 3 percent. Calculations suggest the tax would raise $2.75 trillion over a decade, all from roughly 75,000 households.

That's a big pot of money, but tax revenue alone shouldn't really be seen as the impetus here. There's a growing awareness in liberal and Democratic circles of the federal government's unique monetary and fiscal powers, and how it doesn't necessarily need to "pay for" all its spending. As Warren herself said, the real point of the tax is to squash inequality and to push the economy out of its lethargic state.

That the tax could raise so much money from roughly 0.06 percent of U.S. families should tell you how insanely skewed wealth ownership is in America. The richest 1 percent of households account for 40 percent of wealth all by themselves, and the wealthiest 5 percent boast 65 percent of all wealth. In other words, the top 1 percent own roughly as much wealth as the bottom 95 percent.

This matters because wealth is power. Wealth gives you a say in how businesses are run and how neighborhoods are developed. It gives you a say in who gets loans and who doesn't, or who gets hired to do what and for how much. At bottom, wealth is the power to command your fellow citizens.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Taxing the portfolios of the super-wealthy at 2 or 3 percent a year may seem small. But the effects would compound over time. "We think it could have a significant affect on wealth concentration in the long run,” Emmanuel Saez, a left-leaning economist who consulted on the proposal, told The Washington Post.

That's the moral argument. What about the economic one?

The right claims that if you tax away the accumulated wealth holdings of the rich, you undermine the economy's ability to grow, leading to fewer jobs and lower wages for everybody. Wealth is the fuel that drives all economic activity, and ultra-millionaires are the "job creators," as Republicans like to say.

It's a description of the economy that's badly wrong, if not downright backwards. The money that businesses use to power jobs, wages, and new investment comes largely out of their revenue — which of course is supplied by consumers, not investors. The rest of the money comes mostly from bank loans and the like. Investors only play a relatively minor role.

To the extent investment by the wealthy does matter, the ultra-millionaire tax could create a "use it or lose it" dynamic that would actually spur job creation and wage growth. Right now, wealthy Americans can just sit on their wealth holdings, take no risks, and get interest and returns on it. But under Warren's tax, they'd see their wealth holdings slowly taxed away every year. To stay ahead, the wealthy would need to make the assets work harder: invest in more long-shot startups or small businesses they might have otherwise gone ignored. Opponents of Warren's idea object to how the tax would "distort" investment decisions. But the "distortion" is a feature, not a bug.

America has seen investment in its economy erode over recent decades to remarkable lows. There are many reasons for that: chronically slack labor markets, growing monopoly power, the death of unions, and more. But what all those things have in common is they took the pressure off the rich, who no longer need to fear that their wealth will be sapped away by competitive forces and worker demands. They can relax while their assets extract wealth from the rest of the economy on their behalf. Warren's tax would bring some of that pressure back into play.

Now, there are some secondary complications.

For one thing, it's not entirely clear the wording of the Constitution allows for a wealth tax. (Though Warren consulted with experts and at least some of them said she was in the clear.)

The ultra-millionaire tax would also face administrative hurdles: Figuring out the value of income streams is relatively easy. Figuring out the value of various assets — from stocks to houses to yachts to patents and more — is tougher. But governments already do this for things like property and inheritance taxes, and data technology is making the process easier. Warren's proposal would also include a big infusion of new resources for the Internal Revenue Service.

All things considered, Warren's wealth tax would probably be a net plus for the American economy. It would definitely be a net plus for American democracy.

Jeff Spross was the economics and business correspondent at TheWeek.com. He was previously a reporter at ThinkProgress.