Why canceling student debt could be good for everyone

The economic impact of Elizabeth Warren's big proposal

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

When it comes to the student debt crisis, Democratic presidential contender Sen. Elizabeth Warren (D-Mass.) wants to go big. On Monday, Warren announced a plan that would simply cancel out a vast chunk of the $1.5 trillion in student loans currently hanging over Americans' heads.

As a straightforward alleviation of human suffering, the plan is worth doing. But it also has merits as a raw boost to the economy.

The first thing to understand is that paying down debt is always, by and large, a drag on growth. Whenever the federal government or a private bank makes a loan, they are literally injecting new money into the economy. When the person who owes the loan pays it back, the money is removed from the economy. Canceling $1.5 trillion in debt would free up hundreds of billions of dollars to be spent on goods and services and fresh economic activity, rather than simply being drained away.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

That's the big picture, anyway. The nitty gritty of Warren's proposal is worth examining though.

Warren's plan would actually cancel around $640 billion of debt. Specifically, she would eliminate $50,000 worth of debt for any household that makes less than $100,000 a year. For Americans making more than that, the amount of debt relief would slowly decline until hitting $0 for people making $250,000 or more in annual income. It's not a complete eradication of the student debt burden. But Warren's team estimates that the proposal would completely wipe out all student debt for 75 percent of the Americans who owe it, and offer at least some debt relief to 95 percent.

A lot of student debt is owned by the federal government directly. Eliminating that is a simple matter of legal cancelation, no additional government spending necessary. But a smaller portion is owned by private lenders, so in that case the government would pay off the debt itself. Long story short, the vast majority of the money that people lose servicing their debt burdens would instead get freed up for other purposes.

It's difficult to project precisely what the overall economic impact of this would be. Student debt is distributed all up and down the income ladder, and people at different income levels will spend or save the freed up money in varying proportions — it's the spending that will juice job growth and economic activity. But a Levy Institute paper from early 2018 — written by economists Scott Fullwiler, Stephanie Kelton, Catherine Ruetschlin, and Marshall Steinbaum — took a crack at figuring it out.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

The scenario they modeled is a bit different from Warren's proposal. First off, they projected what would happen if all the student debt was eliminated, not just the vast majority. The results of Warren's proposal would probably be modestly lower than the figures cited below. Second, they projected what would happen if the debt cancelation occurred in 2017, against the baseline of 2017's economic growth, unemployment, and government debt and deficits. Third, they assumed the cancelation is paid for with additional deficit spending. Warren, meanwhile, proposed a new wealth tax that's estimated to raise $2.75 trillion over ten years, providing a pot of money she says she would use to pay for the $1.25 trillion total cost of her student debt and college tuition plans as well as other proposals.

It's worth noting that taxes also remove money from the economy, so a student debt cancelation offset by a tax hike ought to have a smaller impact on job growth than a cancelation financed with more deficit spending. But the richer the people paying the tax, the less likely it is to affect their spending. Warren's wealth tax would fall solely on the 75,000 wealthiest American households, so in terms of a negligible effect on aggregate demand, her plan is probably just about as close as you could get to a deficit-financed debt cancelation.

At any rate, here's what the Levy paper found.

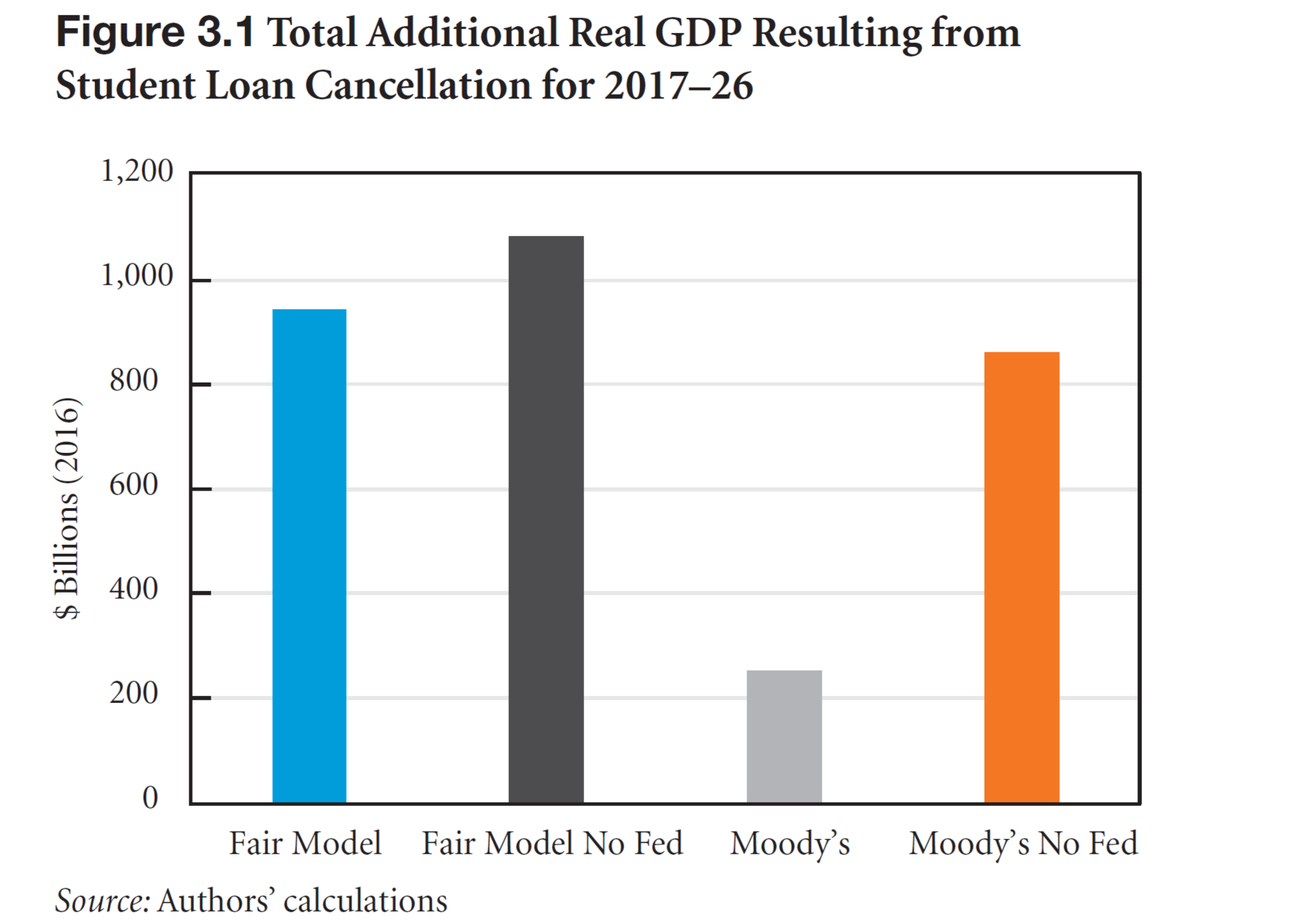

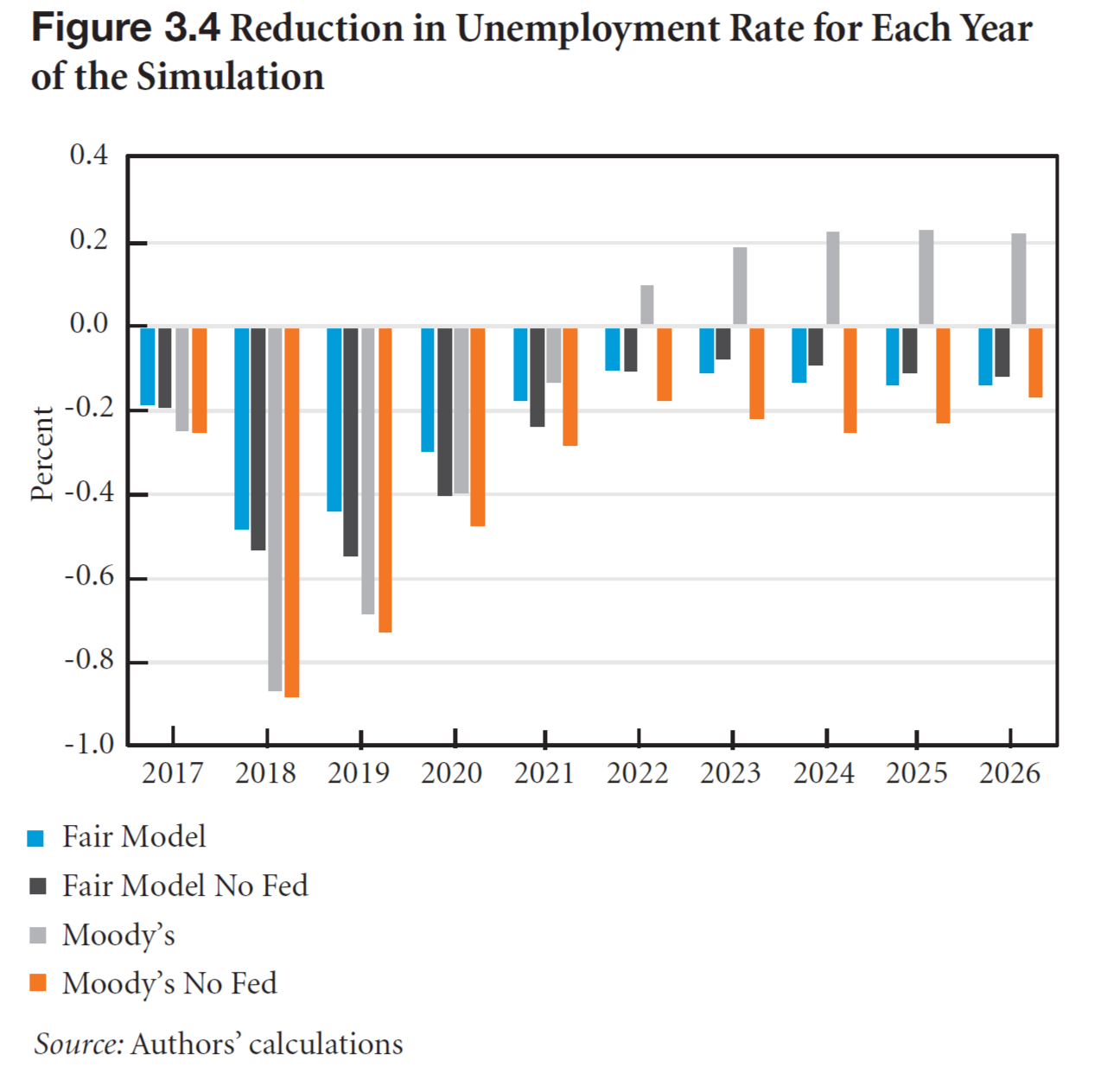

The four scenarios are two different macroeconomic models, with two variants of each model — one where the Federal Reserve reacts to the new economic activity by slightly raising interest rates, and one where it doesn't. In three of the four scenarios, the debt cancelation results in $861 billion to $1.08 trillion in additional economic output, measured in 2016 dollars. The much lower outlier is the Moody's model, assuming the Fed reacts. Basically, the assumptions that model makes about the Fed's behavior result in it hiking interest rates more severely in later years. You can see this in their breakdown of the additional growth by each year over the 10-year window.

The paper's authors included the assumption of no Fed reaction because the policy's effects on inflation are so minimal that the Fed might plausibly not react at all. The Fed might also be less inclined to hike rates in Warren's case because she raises offsetting tax revenue rather than just relying on borrowing.

All of which means the three scenarios with the higher ranges are probably the much more likely outcomes.

Finally, here's how much that additional job creation would reduce the unemployment rate each year over the 10-year window, according to the same study.

This doesn't get into the rest of Warren's higher education proposal, which would get rid of all tuition and fees for two- and four-year public colleges, juice up Pell grants, and establish a $50 billion fund to help out historically black colleges.

The obvious draw of clearing out all student loans is putting an end to a spiraling debt crisis that's been sucking in ever more Americans. But higher economic growth also means additional jobs, which means higher wages, and more security and prosperity for families and communities. And that's quite a bonus.

Editor's note: This piece previously misstated the total value of debt to be canceled by Warren's plan. We regret the error.

Jeff Spross was the economics and business correspondent at TheWeek.com. He was previously a reporter at ThinkProgress.