America's perpetual doldrums

What disappointing GDP numbers signal about the economy

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

The economy grew at a disappointing 1.9 percent in real terms for the third quarter, government numbers reported Wednesday.

It's darkly amusing to hold this result up against President Trump's regular bombastic promises to deliver soaring growth numbers. But there's nothing funny about the possibility that the latest recovery cycle is slowing to a close. Particularly since it would only confirm the even darker suspicion that the country's decades-long economic slowdown is continuing apace.

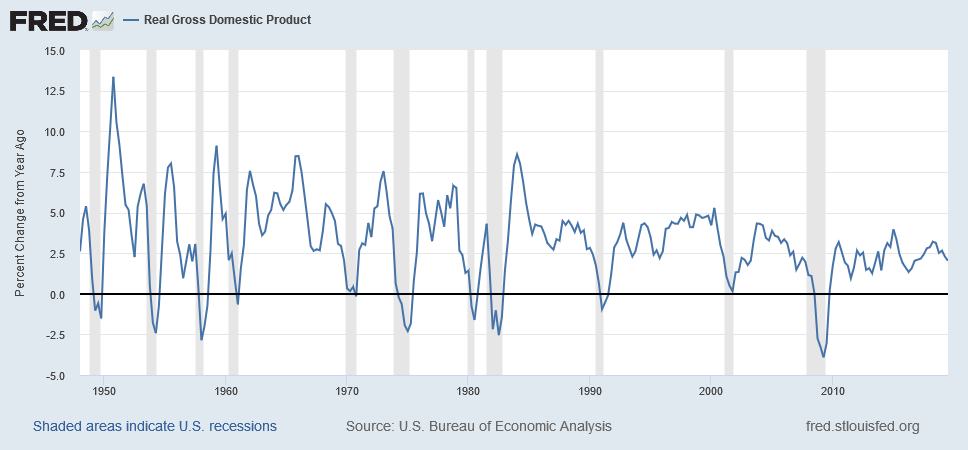

Granted, there's still no immediate sign of recession. And the slow growth over the last three months was at least partially influenced by one-off events like the General Motors strike. But there is evidence the recovery has plateaued. It's entirely possible the economy could trundle along for a few more years before actually contracting, but if you parse the quarterly growth numbers and the year-over-year changes, there's a pretty distinct slowdown over the last year or so.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Even if we avoid recession for a few more years, what if we've already hit the peak for the post-2008 recovery? What if this is as good as it gets?

That would be a disaster. As good as the headline unemployment rate is, it hides deeper problems. Overall labor force participation collapsed after the Great Recession, and still has not recovered. More telling is the overall portion of the working age population that's employed. (This latter statistic isn't affected if, say, retirees become a bigger share of the country.) That measure only just recently reached its peak before the 2008 collapse, and remains well below its peak before the 2001 recession.

Nationally, wage growth still hasn't quite punched into the 3.5-to-4 percent range that's characterized the strongest parts of the last few recoveries. The good news is that wages for the lowest-earning Americans have actually grown faster in the last few years than wages for richer Americans. But wages have been more or less flat for the last three decades for most people, and inequality has soared. There is an enormous amount of ground we still need to make up.

In other words, it's not that the economy isn't making progress. It is. It's just that we need the progress to last for years and years more. Another bad recession, even if it doesn't hit right away, could wipe out what gains we've made.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

The thing is, we should probably assume that's what's going to happen, because that's what's been happening for a while now.

Since 1980, we've gone through repeated cycles where the economy makes modest progress, then gets set way back by a recession, and Americans never quite recover to their previous level before the next downturn hits. It's been a slow ratchet that's left Americans gradually worse off. In fact, if we just want to return to real growth in gross domestic product (GDP) for a moment, the slowdown is clear as day.

Of course, GDP is something of an abstract aggregate; the slowdown has really made itself felt in other ways.

As I mentioned, wage growth has stagnated over the last 30 or 40 years, and the overall amount of working-age people with jobs keeps getting knocked down. Recoveries have become less robust, and it's taking them a lot longer to add back the jobs that were lost. American households are loaded up with debt. Then there are the broader sociological consequences, from the opioid epidemic, to suicide, to collapsing rates of marriage and all the rest of it.

Moreover, during the long slow decline of American growth, our policymakers have largely been doing all the right things, according to mainstream economics.

We've spent most of the last few decades rampantly cutting taxes, for one thing. The latest example was the massive tax cut for corporate incomes and business owners that Republicans pushed through in 2017. It was supposed to boost business investment, leading to more jobs and higher wages. But business investment was the worst performing part of Wednesday's growth numbers.

Granted, we haven't managed to reduce the national debt and deficit the way the mainstream would like. But the channel by which bigger government debt loads are supposed to harm growth is higher interest rates. And those just keep falling as well.

In fact, they're so low that we've basically run out of room to do another thing the mainstream advises: Rely on the Federal Reserve to manage the macroeconomy. The central bank tries to boost growth by cutting interest rates — which, to its credit, it's doing — but those rates started out so low the Fed can't really do much.

We've been trying all the standard plays and none of it has worked. But we better figure out something. Because it sure looks like America's permanent economic doldrums are set to continue.

Want more essential commentary and analysis like this delivered straight to your inbox? Sign up for The Week's "Today's best articles" newsletter here.

Jeff Spross was the economics and business correspondent at TheWeek.com. He was previously a reporter at ThinkProgress.

-

How the FCC’s ‘equal time’ rule works

How the FCC’s ‘equal time’ rule worksIn the Spotlight The law is at the heart of the Colbert-CBS conflict

-

What is the endgame in the DHS shutdown?

What is the endgame in the DHS shutdown?Today’s Big Question Democrats want to rein in ICE’s immigration crackdown

-

‘Poor time management isn’t just an inconvenience’

‘Poor time management isn’t just an inconvenience’Instant Opinion Opinion, comment and editorials of the day

-

The billionaires’ wealth tax: a catastrophe for California?

The billionaires’ wealth tax: a catastrophe for California?Talking Point Peter Thiel and Larry Page preparing to change state residency

-

Bari Weiss’ ‘60 Minutes’ scandal is about more than one report

Bari Weiss’ ‘60 Minutes’ scandal is about more than one reportIN THE SPOTLIGHT By blocking an approved segment on a controversial prison holding US deportees in El Salvador, the editor-in-chief of CBS News has become the main story

-

Has Zohran Mamdani shown the Democrats how to win again?

Has Zohran Mamdani shown the Democrats how to win again?Today’s Big Question New York City mayoral election touted as victory for left-wing populists but moderate centrist wins elsewhere present more complex path for Democratic Party

-

Millions turn out for anti-Trump ‘No Kings’ rallies

Millions turn out for anti-Trump ‘No Kings’ ralliesSpeed Read An estimated 7 million people participated, 2 million more than at the first ‘No Kings’ protest in June

-

Ghislaine Maxwell: angling for a Trump pardon

Ghislaine Maxwell: angling for a Trump pardonTalking Point Convicted sex trafficker's testimony could shed new light on president's links to Jeffrey Epstein

-

The last words and final moments of 40 presidents

The last words and final moments of 40 presidentsThe Explainer Some are eloquent quotes worthy of the holders of the highest office in the nation, and others... aren't

-

The JFK files: the truth at last?

The JFK files: the truth at last?In The Spotlight More than 64,000 previously classified documents relating the 1963 assassination of John F. Kennedy have been released by the Trump administration

-

'Seriously, not literally': how should the world take Donald Trump?

'Seriously, not literally': how should the world take Donald Trump?Today's big question White House rhetoric and reality look likely to become increasingly blurred