The coronavirus might cause inflation — and that's a good thing

Super-unemployment might pole-vault America out of the economic doldrums

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Last week saw yet more grueling unemployment news. Since the coronavirus outbreak began ravaging the U.S., there have been 38.6 million unemployment filings, and 27.3 million people are now collecting benefits. Congress drastically expanded unemployment benefits and eligibility with the CARES Act, and it is clear that super-unemployment is the most important system keeping the bulk of downscale Americans from starving. Many are certainly still falling through the cracks, but many millions are able to feed their families only thanks to this program.

This is leading to worries about inflation. Nouriel "Dr. Doom" Roubini, an economist who predicted the 2008 financial crisis, says that we're in for an "inflationary conflagration by mid-decade." At the Financial Times, Martin Wolf suggests that it's not certain, but possible: "I will not forget the almost universally unexpected surge in inflation in the 1970s. This could happen again."

It's just possible they are right — but if so, it will be a good thing. If super-unemployment continues, the masses might have enough money to pole-vault the United States out of the economic sandpit it has been trapped in since 2008.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

The coronavirus pandemic is having two contradictory effects on the world economy. First, spending is collapsing as people are buying dramatically less in most categories of consumption. Sales of cars, appliances, flights, hotel rooms, clothes, restaurant meals, and so forth have fallen sharply or all but collapsed. Thus people who are still getting income are saving a lot — indeed, in March the savings rate shot up to the highest level since the early 1980s. Second, the pandemic is playing hell with global supply chains. Manufacturing is fouled up, agriculture is a mess, and international shipping has become difficult. More broadly, globalization is starting to be rolled back thanks to the pandemic and Trump's trade war with China — something that may only accelerate as American elites blearily realize how vulnerable America is without some domestic manufacturing capacity.

So the argument for inflation is that once the virus passes, most Americans will have saved up a substantial amount of money, and will try to catch up on all the missed purchases — only to run headlong into supply bottlenecks. There will not be enough goods and services to go around, and prices will rise as people bid against each other.

Now, as my former colleague Jeff Spross argues, it's important to be clear on the distinction between broad-based inflation and price spikes in certain sectors. The former is caused by spending in general outstripping productive capacity, while the latter is caused by either a particular supply disruption, or a sudden surge of demand for some particular item. These are blurred together in inflation indexes, which measure the price of a representative "basket" of goods and services, but the conceptual difference is clear. If we see the prices of a few particular items shooting up, it's isolated supply issues, but if basically everything is becoming more expensive at once, it's true inflation.

So why would broad inflation be a good thing? From 2008 up to when the pandemic hit, the U.S. economy was stuck in a mild depression. When interest rates are high, the Federal Reserve (or Fed) can stimulate the economy by lowering them — but rates hit zero in 2008, and the economy remained depressed. Congress and President Obama passed the Recovery Act spending package in 2009 to compensate, which indeed stopped the immediate crisis. However, this was only about half as big as it needed to be, and there were no further rounds of stimulus — on the contrary, the various levels of American government passed a bunch of austerity instead, slowing the recovery.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

As a result, growth never recovered to its pre-crisis level, inflation remained low, and unemployment remained high for years. Only in 2016 did the unemployment rate fall to 5 percent — about what analysts had been supposing was full employment. But one can only be sure that full employment has been reached when prices start to rise, implying that the spending from new jobs is bumping up against the economy's productive capacity. Instead, inflation remained consistently at or below the Fed's 2 percent target as unemployment continued to drop all the way to 3.5 percent in February this year.

In other words, we were clearly well short of full employment and full production even in February — and now the coronavirus has thrown a wrench in everything. So far the fall in spending is far outstripping any supply problems, as some inflation indexes have dipped below zero. But that doesn't rule out inflation in the future — if I had to guess, it seems highly improbable, but then again nothing like this pandemic has happened in modern times. Who knows what will happen?

Let's suppose most Americans end the crisis with a sizable bucket of cash, and there is a broad supply crunch, leading to inflation in the 4-10 percent range. This will mean several things. First, the Fed will be able to raise interest rates off the zero lower bound. Second, there will no longer be a shortage of demand — prices can only rise if there is bidding happening. Third, job creation will explode as businesses start or expand to increase production. In other words, all the major problems of the Great Recession will be solved at a stroke.

This will be uncomfortable in the short-term for some, but not nearly as bad as a years-long mild depression — and more importantly, it will be a much more favorable position for policymakers. A bit of moderate price pressure would put some badly needed steam into the boiler of the American economy, and if inflation gets too high, the Fed can solve it relatively easily with higher interest rates (or Congress could with higher taxes, or credit and price controls). Insofar as the government decides to untangle global supply chains to increase American manufacturing employment and make the production system more resilient, that will be much easier with high spending, because it means guaranteed profits for anybody who figures out how to re-shore production.

But this optimistic future depends on Congress keeping the money taps open for as long as the crisis lasts. Super-unemployment is set to expire at the end of July, and there is zero chance the pandemic will be solved by then. The unemployment boost, other rescue payments to individuals, and support for businesses to protect payroll, should continue until there is a vaccine and life can return to something like normal. (A future Biden administration could further improve the situation by seizing the post-coronavirus opportunity to boost labor organizing and attack climate change, but that's a subject for another article.)

There is some risk in the inflation strategy, but that is true for every policy choice. Americans leaving the crisis with too little money in their pockets risks tipping us straight back into the same depressed sandpit we were stuck in after 2008. Too much money, and we might see inflation come back to maybe where it was in the late 1980s. It's clear which option is better.

Want more essential commentary and analysis like this delivered straight to your inbox? Sign up for The Week's "Today's best articles" newsletter here.

Ryan Cooper is a national correspondent at TheWeek.com. His work has appeared in the Washington Monthly, The New Republic, and the Washington Post.

-

The ‘ravenous’ demand for Cornish minerals

The ‘ravenous’ demand for Cornish mineralsUnder the Radar Growing need for critical minerals to power tech has intensified ‘appetite’ for lithium, which could be a ‘huge boon’ for local economy

-

Why are election experts taking Trump’s midterm threats seriously?

Why are election experts taking Trump’s midterm threats seriously?IN THE SPOTLIGHT As the president muses about polling place deployments and a centralized electoral system aimed at one-party control, lawmakers are taking this administration at its word

-

‘Restaurateurs have become millionaires’

‘Restaurateurs have become millionaires’Instant Opinion Opinion, comment and editorials of the day

-

What's Jeff Bezos' net worth?

What's Jeff Bezos' net worth?In Depth The Amazon tycoon and third richest person in the world made his fortune pioneering online retail

-

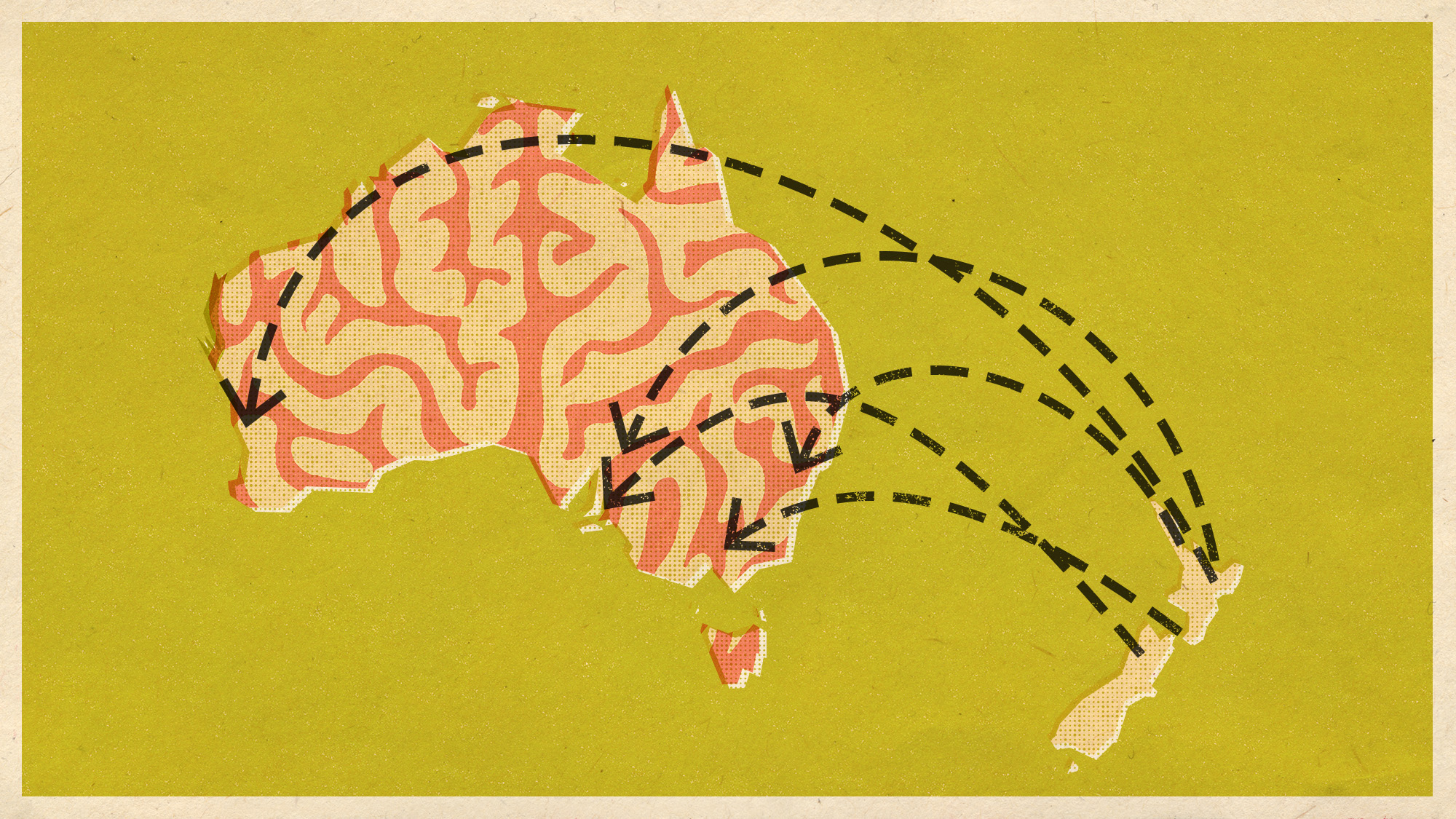

'Brain drain' fear as record numbers leave New Zealand

'Brain drain' fear as record numbers leave New ZealandUnder The Radar Neighbouring Australia is luring young workers with prospect of better jobs

-

Ghost kitchens are pulling a disappearing act

Ghost kitchens are pulling a disappearing actunder the radar The delivery-only trend is failing to live up to the hype built up during the pandemic

-

The birth of the weekend: how workers won two days off

The birth of the weekend: how workers won two days offThe Explainer Since the 1960s, there has been talk of a four-day-week, and post-pandemic work patterns have strengthened those calls

-

Why household wealth took off during the pandemic

Why household wealth took off during the pandemicUnder The Radar The Covid-19 pandemic caused a lot of pain and hardship, but new research shows it also left most Americans wealthier

-

Empty office buildings are blank slates to improve cities

Empty office buildings are blank slates to improve citiesSpeed Read The pandemic kept people home and now city buildings are vacant

-

Inflation vs. deflation: which is worse for national economies?

Inflation vs. deflation: which is worse for national economies?Today's Big Question Lower prices may be good news for households but prolonged deflation is ‘terrible for the economy’

-

America's 'cataclysmic' drop in college enrollment

America's 'cataclysmic' drop in college enrollmentToday's Big Question "The slide in the college-going rate since 2018 is the steepest on record"