Maybe the stock market isn't crazy

Behind all of the bad news, there might be reasons for optimism

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

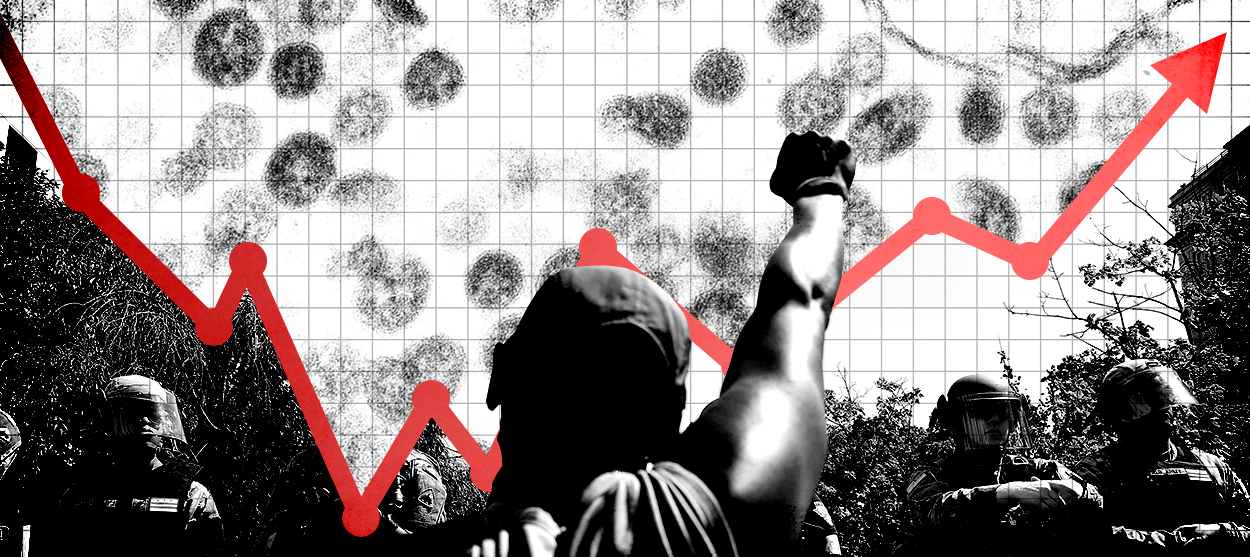

Mr. Market looks bizarrely detached from reality. Stocks have rallied sharply since late March, pushing the tech-heavy Nasdaq to an all-time high and the S&P 500 back to even for the year. And all this happening despite, well, everything: the economy plunging into the deepest recession in American history, the highest unemployment rate since the Great Depression, a deadly virus continuing to spread and take thousands of lives every week, and the most severe civil unrest since the 1960s. Wall Street's apparent disregard for the chaos and human suffering would seem a more powerful example of "late capitalism" than, say, Bloody Mary-flavored potato chips.

Of course, one might have said much the same thing to all those oddly bullish investors back in August 1982. The U.S. economy was in the middle of the worst economic downturn since the 1930s. The jobless rate was nearly 10 percent and heading higher. The interest rate on a 30-year mortgage was over 16 percent. And all this tumult was happening after more than a decade of extreme economic volatility including three previous recessions and double-digit inflation. There was no pandemic sweeping America, but there were lots of Soviet nuclear warheads pointed at America.

And yet that was the moment when stocks began a long or "secular" bull market that really didn't end until 2007 and the start of the Global Financial Crisis. It would be an overstatement to suggest investors were anticipating the Long Boom, much less the end of the Cold War and global spread of capitalism. Then again, markets are forward-looking. Investors may have seen enough good things happening around them to suggest a new era of peace and prosperity was awaiting them and their portfolios.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Or maybe they just got lucky. And maybe today's market bulls will get unlucky. Perhaps that much-predicted second wave of COVID-19 will turn out worse than expected, and we will all hunker down in our homes again. Or perhaps last week's surprisingly strong May jobs report will lull Congress into a false sense of economic security, and it'll delay passing more economic support for business or state governments. If that were to happen, according to Moody's Analytics, the current economic rebound would quickly end and the economy would slump back into recession in the second half of the year.

Then again, maybe investors — at least some of them — are looking beyond all that stuff. Wall Street is often criticized for being too short-sighted, of having an obsessive and unhealthy focus on quarterly earnings and share prices. But this could be a great example of Wall Street ignoring all those short-term uncertainties in favor of longer-term possibilities. To be sure, there are legitimate reasons to be optimistic right now — especially given the massive amount of fiscal and monetary stimulus being injected into the economy. The COVID-19 recession is almost certainly over, as the May job gains showed. And a new St. Louis Fed analysis using real-time data — jobs numbers from Homebase, a free scheduling tool used by local businesses and their workers — suggests "the recovery has continued at a healthy pace" into this month.

Looking forward, there's a chance that American businesses, big and small, will use this economic shock as an opportunity to make their companies stronger and profitable for the long run. As University of Chicago economist Chad Syverson told me in a podcast chat. "You could tell a story where a shock like this is such a big thing that it basically forces a reckoning on the part of companies that makes them realize, 'Oh, we were doing this thing for this-and-that reason, but that was decided 25 years ago because of something that doesn't matter anymore. Why are we really doing it this way? Can't we do it this other way instead?' And you get productivity gains that way."

If bosses feel the need to get smarter and more productive, maybe they will take a new look at technologies such as artificial intelligence. American growth overall would be a lot stronger if more firms outside the tech sector were using the latest digital tools. There will also be a lot of workers who will be a bit more tech savvy as a result of having to work from home.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

There are also some early signs that Washington might be getting more serious about solving long-term problems. As Goldman Sachs noted in a recent report: "In FY 2019, federal R&D spending equaled 0.6 percent of US GDP and 2.8 percent of total federal outlays, the lowest in over 60 years." It's an evergreen issue that keeps getting ignored. But now there's a new piece of bipartisan congressional legislation intended to start dealing with that investment deficit. The Endless Frontiers Act — the name is derived from FDR science adviser Vannevar Bush's 1945 report arguing for permanent government support for science — would boost U.S. research spending by $100 billion over five years. One thing the pandemic has highlighted is the importance of a nation's science and technology prowess in a crisis.

Wall Street still might be crazy to be this optimistic. And maybe the stock market's spring fling will turn into a summer swoon. But it might also be the case that Wall Street is ignoring so many bad things today because America might look a lot better tomorrow.

Want more essential commentary and analysis like this delivered straight to your inbox? Sign up for The Week's "Today's best articles" newsletter here.

James Pethokoukis is the DeWitt Wallace Fellow at the American Enterprise Institute where he runs the AEIdeas blog. He has also written for The New York Times, National Review, Commentary, The Weekly Standard, and other places.

-

How the FCC’s ‘equal time’ rule works

How the FCC’s ‘equal time’ rule worksIn the Spotlight The law is at the heart of the Colbert-CBS conflict

-

What is the endgame in the DHS shutdown?

What is the endgame in the DHS shutdown?Today’s Big Question Democrats want to rein in ICE’s immigration crackdown

-

‘Poor time management isn’t just an inconvenience’

‘Poor time management isn’t just an inconvenience’Instant Opinion Opinion, comment and editorials of the day

-

The billionaires’ wealth tax: a catastrophe for California?

The billionaires’ wealth tax: a catastrophe for California?Talking Point Peter Thiel and Larry Page preparing to change state residency

-

Bari Weiss’ ‘60 Minutes’ scandal is about more than one report

Bari Weiss’ ‘60 Minutes’ scandal is about more than one reportIN THE SPOTLIGHT By blocking an approved segment on a controversial prison holding US deportees in El Salvador, the editor-in-chief of CBS News has become the main story

-

Has Zohran Mamdani shown the Democrats how to win again?

Has Zohran Mamdani shown the Democrats how to win again?Today’s Big Question New York City mayoral election touted as victory for left-wing populists but moderate centrist wins elsewhere present more complex path for Democratic Party

-

Millions turn out for anti-Trump ‘No Kings’ rallies

Millions turn out for anti-Trump ‘No Kings’ ralliesSpeed Read An estimated 7 million people participated, 2 million more than at the first ‘No Kings’ protest in June

-

‘We must empower young athletes with the knowledge to stay safe’

‘We must empower young athletes with the knowledge to stay safe’Instant Opinion Opinion, comment and editorials of the day

-

Ghislaine Maxwell: angling for a Trump pardon

Ghislaine Maxwell: angling for a Trump pardonTalking Point Convicted sex trafficker's testimony could shed new light on president's links to Jeffrey Epstein

-

The last words and final moments of 40 presidents

The last words and final moments of 40 presidentsThe Explainer Some are eloquent quotes worthy of the holders of the highest office in the nation, and others... aren't

-

IMF sees slump from tariffs, Trump tries to calm markets

IMF sees slump from tariffs, Trump tries to calm marketsSpeed Read The International Monetary Fund predicts the U.S. and global economies will slow significantly due to the president's trade war