Democrats are blowing a big chance to do child benefits right

Why not make government programs clean and efficient?

President Biden and congressional Democrats, led by Rep. Richard Neal (D-Mass.) are working up the biggest overhaul and expansion of American child benefits in decades. As part of Biden's COVID-19 relief package, they would substantially increase the Child Tax Credit for the next year (from $2,000 for children under 17 to $3,000 for children under 18, and $3,600 for those under 6), pay out the benefit monthly instead of annually, and change it so poor people with no tax liability still receive the full benefit — though it would still phase out for richer people.

On one level, this is encouraging. The truth that America has the highest rate of child poverty among rich nations because it has a meager welfare state is starting to become conventional wisdom, and this expansion of tax subsidies would cut child poverty considerably. Neal's proposal is far to the left of Hillary Clinton's similar idea in 2016.

But Democrats are failing to seize the golden opportunity presented by the pandemic — and by a well-timed proposal from Republican Sen. Mitt Romney — to clean out some of the policy muck cluttering up the American welfare state, and to build a clean, efficient program that is legible to its recipients. Instead they are trying to jerry-rig a yearly tax credit into a monthly form that is guaranteed to create a lot of problems and headaches.

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Why would the expanded credit only apply for one year? Democrats must use the Senate reconciliation process to get around the filibuster, because they do not (yet) have the votes to get rid of it. The goofy reconciliation rules mean each piece of the relief bill can't increase the budget deficit for more than one year — so either it must be a one-year program, or they have to find offsetting pay-fors in the form of cuts or tax hikes. Reportedly, the stumbling block is that a permanent child benefit program would add perhaps another trillion dollars to the 10-year cost of the bill, which is already $1.9 trillion, and there are not votes for that.

Democrats say they will press to make the program permanent in a later bill, perhaps hoping that the new benefit will be hugely popular and create its own constituency. It's risky and far from ideal, but if there simply aren't the votes, there's not much to be done about that.

More importantly, Democrats are sticking with the basic structure of the CTC despite it being totally unsuited to delivering a monthly benefit. Currently the benefits are calculated based on a family's income, size, and marital status over the whole year, and so they are received when you file your taxes after the end of the year. It is obviously impossible to know any of those things for sure before the year is over, and so, as Matt Bruenig explains at the People's Policy Project, Neal is proposing to tell the IRS to use the tax returns and family status from the prior year as a baseline for the next year's monthly payments. But because incomes bounce around, and children may be born during the year, this would guarantee a considerable level of inaccuracy. People may not get benefits they need until year-end anyway if their income decreases or they have a kid, or they may get dinged with a big surprise tax bill if they suddenly make enough money to land in the phase-out zone.

Neal would partly address the overpayment problem with a small "safe harbor" that would allow for $2,000 of overpayment per child, and would have the IRS create a website where people could update their family and income information. That's better than nothing, but it's still overly complicated and burdensome, and realistically many people will fail to file their updates.

One can imagine how Democrats probably backed themselves into this design. Moderate liberals and their allied think tanks have invested a lot of time and energy defending tax credits as effective anti-poverty measures. But they also feel the need to address critics who rightly attack tax credits for leaving out the very poor and delivering their benefits late, so they made it a fully refundable monthly program. That then created more potential problems, and so they're scurrying around bolting on even more kludges to make it halfway functional.

If we step back, the truth is this is a maddeningly backwards and inefficient way to achieve the goal of getting money into the hands of parents. Instead, as Senator Mitt Romney (R-Utah) suggests in his proposal for a child allowance, you could have the Social Security Administration cut all parents the exact same check from the moment their children are born (information SSA already has), and then set up a special new tax that would effectively phase out the benefit for the rich, taking it back during tax time. This could easily be built into automatic withholding for most people so there would be no surprise tax bills.

This would be a far superior approach even if Democrats discarded every other element of the Romney plan. Neal could construct the exact same child benefit schedule that would benefit the exact same people in the exact same way, but make it much easier and simpler for everyone involved.

And that is perhaps the most underrated aspect of a child allowance. All modern societies must have a welfare state to function at all, America very much included. But as Suzanne Mettler writes in The Submerged State, because of the triumph of neoliberalism under Ronald Reagan and Bill Clinton, it became popular to hide welfare provisions in the tax code, so that people collecting government benefits could pretend they were rugged individualists. Instead of getting a check from the state, qualifying people paid less in tax — achieving a similar outcome, but at the cost of complexity, inaccuracy, and enabling toxic anti-government ideology.

A classic child allowance puts government right up in your face. Oh, you've got a new son you say? Here's a check from good old Uncle Sam, from birth until he turns 18 years old. The action and the justification are clear as day. It makes it impossible for parents to pretend the government isn't doing anything for them, and raises the logical question of what else it should be doing — perhaps more money for disabled folks, or universal health insurance?

A monthly advance tax credit would achieve some of this effect, but it would be worse than a child allowance in every way. There may not be another opportunity to reform America's child benefits this decade. Why not do it right?

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Ryan Cooper is a national correspondent at TheWeek.com. His work has appeared in the Washington Monthly, The New Republic, and the Washington Post.

-

Jared and Ivanka's Albanian island

Jared and Ivanka's Albanian islandUnder The Radar The deal to develop Sazan has been met with widespread opposition

-

Storm warning

Storm warningFeature The U.S. is headed for an intense hurricane season. Will a shrunken FEMA and NOAA be able to respond?

-

U.S. v. Skrmetti: Did the trans rights movement overreach?

U.S. v. Skrmetti: Did the trans rights movement overreach?Feature The Supreme Court upholds a Tennessee law that bans transgender care for minors, dealing a blow to trans rights

-

The last words and final moments of 40 presidents

The last words and final moments of 40 presidentsThe Explainer Some are eloquent quotes worthy of the holders of the highest office in the nation, and others... aren't

-

The JFK files: the truth at last?

The JFK files: the truth at last?In The Spotlight More than 64,000 previously classified documents relating the 1963 assassination of John F. Kennedy have been released by the Trump administration

-

'Seriously, not literally': how should the world take Donald Trump?

'Seriously, not literally': how should the world take Donald Trump?Today's big question White House rhetoric and reality look likely to become increasingly blurred

-

Will Trump's 'madman' strategy pay off?

Will Trump's 'madman' strategy pay off?Today's Big Question Incoming US president likes to seem unpredictable but, this time round, world leaders could be wise to his playbook

-

Democrats vs. Republicans: who are the billionaires backing?

Democrats vs. Republicans: who are the billionaires backing?The Explainer Younger tech titans join 'boys' club throwing money and support' behind President Trump, while older plutocrats quietly rebuke new administration

-

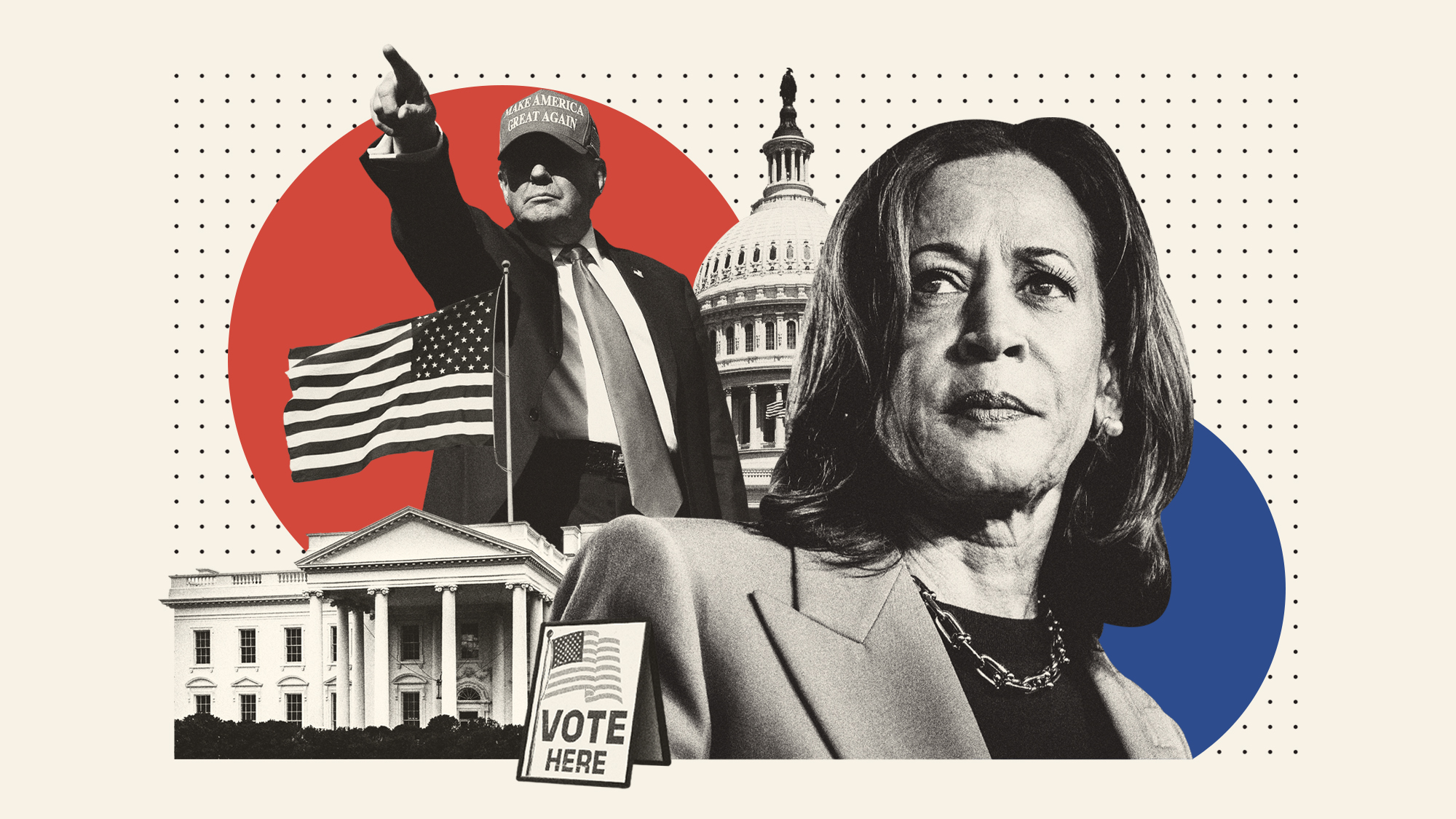

US election: where things stand with one week to go

US election: where things stand with one week to goThe Explainer Harris' lead in the polls has been narrowing in Trump's favour, but her campaign remains 'cautiously optimistic'

-

Is Trump okay?

Is Trump okay?Today's Big Question Former president's mental fitness and alleged cognitive decline firmly back in the spotlight after 'bizarre' town hall event

-

The life and times of Kamala Harris

The life and times of Kamala HarrisThe Explainer The vice-president is narrowly leading the race to become the next US president. How did she get to where she is now?