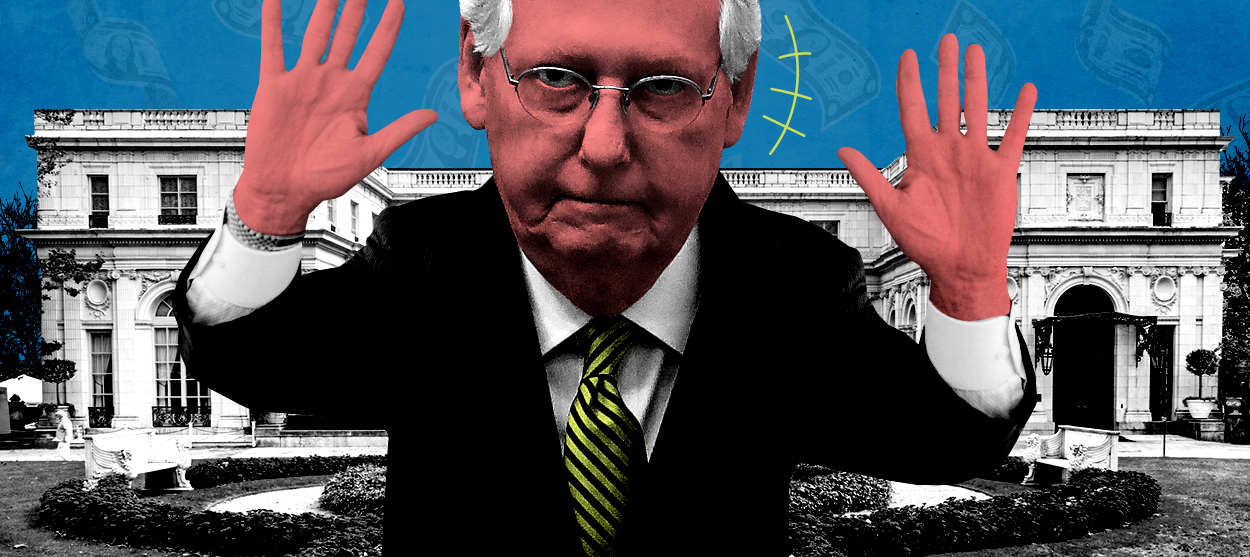

Republicans reveal their red line

Biden's plan to tax the rich has the party showing its true colors

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Republicans have been trying to claim the mantle of the working class of late. "We are a working class party now," wrote Sen. Josh Hawley last November. "The days of conservatives being taken for granted by the business community are over," wrote Sen. Marco Rubio endorsing an Amazon union drive (to punish the company for being too liberal). Rep. Jim Banks (R-Ind.) recently wrote a memo entitled "Cementing the GOP as the Working-Class Party."

There's just one problem. For the last 40 years at least the Republican Party has been the party of business — favoring deregulation, union busting, low wages, welfare cuts, and above all tax cuts for the rich. The only substantive piece of legislation passed during the Trump administration was a huge cut in tax rates that mainly benefited the wealthy and big corporations.

This week, President Biden officially proposed modest tax hikes on the rich and corporations, along with boosted IRS tax enforcement on top earners, to pay for infrastructure and welfare programs for the rest of the country. How are Republicans reacting? They're melting down, of course.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Biden's tax hikes are "the biggest economic blunder of our lifetime," Rep. Kevin Brady (R-Tex.), ranking member of the House Ways and Means Committee, told The Washington Post. "As you're trying to rebuild the economy from the biggest hit we've had in 90 years, why would you impose a massive tax hike on the very American businesses … you want to rehire workers?" Increasing corporate tax rates is "non-negotiable red line," said Sen. Shelley Capito (R-W.V.) at a news conference that also included Sens. John Cornyn (R-Tex.), John Barrasso (R-Wy.), Roger Wicker (R-Miss.), and Deb Fischer (R-Neb.). Senate Minority Leader Mitch McConnell also said he would not support Biden's infrastructure plan because of the "massive tax increases on all the productive parts of our economy."

Incidentally, the supposed justification for the Trump tax corporate cuts was that they would increase business investment and therefore employment, which is the same reasoning these Republicans are using to predict that hiking corporate taxes will harm the economy. The fact that the Trump tax cuts did no such thing, and the strong argument that a higher corporate tax rate will actually increase employment since it will incentivize businesses to hire so as to cut their tax liability, has had no effect whatsoever on Republican conventional wisdom.

The tax increases Biden is proposing are focused entirely on the rich, and especially the ultra-rich. He would nudge the top marginal tax rate from 37 to 39.5 percent, and boost the corporate tax rate from 21 to 28 percent. Stiffer hikes are focused on the top: increasing the rate on capital gains from 20 to 39.6 percent for those making over $1 million, and closing the completely unjustifiable "stepped-up basis" loophole, which allows wealthy people to transfer assets to their heirs without paying capital gains on any increase in value that happened over their lifetime. He also intends to close other loopholes that allow corporations to stash profits overseas, and is currently trying to coordinate a global minimum corporate tax with other countries. By and large, these are modest hikes, and they are aimed mostly at passive asset rents and legal chicanery to avoid taxes, not actual productive business.

The certain opposition to increased IRS enforcement is particularly telling. Republican officials have not said much about this, probably because trying to protect rich tax cheats is extremely unpopular, but anti-tax fanatics like Grover Norquist are starting to lay the groundwork by arguing Biden will use the IRS as political weapon. "You'll see tremendous politicization of the IRS during a Biden administration," he told Fox News. "There will be an effort to bulk up and harass, first, small businesses, then they will go after political groups." (Republicans threw a similar fit over the IRS supposedly harassing conservative nonprofit groups during the Obama administration, but it turned out liberal groups were also targeted.)

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Trump's head of the National Economic Council Larry Kudlow (and leading candidate for the worst economic forecaster in history) predicted on Fox Business that sending "IRS agents out there to run around the country to harass taxpayers" would not work as predicted: "It has been tried many times and utterly failed." At National Review, Kevin Williamson argues that the real problem is legal tax loopholes, and suggests without evidence that working-class people cheat as much as the rich.

In reality, a recent study estimated that while the bottom half of Americans understate their taxable income by 7 percent on average, the top one percent understate theirs by more than 20 percent. (This is because the rich can use complex tools like pass-through companies and offshore accounts that ordinary people cannot.)

Naively, one might think that IRS enforcement has nothing to do with tax rates per se — whatever the tax rate is, surely it's only fair for rich people to pay what they owe. But this is not how Republicans think. When they took control of the House in 2010, they steadily hacked away at the IRS budget, which decreased by a fifth over a decade. The obvious intention was to make it easier for rich people to cheat — it's not a coincidence that audit rates of the top 1 percent fell by four-fifths between 2011 and 2018.

Making oligarchs comply with the tax code is therefore a threat to the Republican political model. For decades, they have whipped themselves and their voters into a froth over culture war nonsense to win elections, while funding their campaigns, think tanks, media institutions, and political committees with oligarch cash. Then in office, they deliver policy changes to further enrich those same oligarchs. Indeed, none other than Donald Trump has been embroiled in a years-long legal battle with the IRS over a potentially fraudulent $73 million tax refund.

Now, occasionally a handful of Republicans have made populist statements that weren't completely fake. Hawley has proposed some antitrust reforms that would have a real effect, while Senator Mitt Romney (R-Utah) has sketched out a child allowance plan that is flatly better than the one Biden passed in the American Rescue Plan. But those are marginal policies — the vast bulk of the party has not supported either idea.

The same story is true when it comes to tax hikes on the rich. Though a handful of Senate Republicans expressed token willingness to consider increased corporate rates, that will certainly not translate into actual votes for Biden's ambitious proposals. On the contrary, their much smaller infrastructure counter-proposal has no tax hikes at all, relying instead on unspecified user fees that would be guaranteed to land on the middle and working class. "My own view is that the pay-for ought to come from people who are using it," Romney told reporters.

One could imagine a future in which Republicans get mad enough over "woke corporations" interfering with their schemes to overturn democracy that they actually try to attack oligarch power. But until they're willing to hit the rich where it hurts — in their Cayman Islands bank accounts — the GOP pose of being a workers' party will remain a fraud.

Ryan Cooper is a national correspondent at TheWeek.com. His work has appeared in the Washington Monthly, The New Republic, and the Washington Post.

-

Switzerland could vote to cap its population

Switzerland could vote to cap its populationUnder the Radar Swiss People’s Party proposes referendum on radical anti-immigration measure to limit residents to 10 million

-

Political cartoons for February 15

Political cartoons for February 15Cartoons Sunday's political cartoons include political ventriloquism, Europe in the middle, and more

-

The broken water companies failing England and Wales

The broken water companies failing England and WalesExplainer With rising bills, deteriorating river health and a lack of investment, regulators face an uphill battle to stabilise the industry

-

The billionaires’ wealth tax: a catastrophe for California?

The billionaires’ wealth tax: a catastrophe for California?Talking Point Peter Thiel and Larry Page preparing to change state residency

-

Bari Weiss’ ‘60 Minutes’ scandal is about more than one report

Bari Weiss’ ‘60 Minutes’ scandal is about more than one reportIN THE SPOTLIGHT By blocking an approved segment on a controversial prison holding US deportees in El Salvador, the editor-in-chief of CBS News has become the main story

-

Has Zohran Mamdani shown the Democrats how to win again?

Has Zohran Mamdani shown the Democrats how to win again?Today’s Big Question New York City mayoral election touted as victory for left-wing populists but moderate centrist wins elsewhere present more complex path for Democratic Party

-

Millions turn out for anti-Trump ‘No Kings’ rallies

Millions turn out for anti-Trump ‘No Kings’ ralliesSpeed Read An estimated 7 million people participated, 2 million more than at the first ‘No Kings’ protest in June

-

Ghislaine Maxwell: angling for a Trump pardon

Ghislaine Maxwell: angling for a Trump pardonTalking Point Convicted sex trafficker's testimony could shed new light on president's links to Jeffrey Epstein

-

The last words and final moments of 40 presidents

The last words and final moments of 40 presidentsThe Explainer Some are eloquent quotes worthy of the holders of the highest office in the nation, and others... aren't

-

The JFK files: the truth at last?

The JFK files: the truth at last?In The Spotlight More than 64,000 previously classified documents relating the 1963 assassination of John F. Kennedy have been released by the Trump administration

-

'Seriously, not literally': how should the world take Donald Trump?

'Seriously, not literally': how should the world take Donald Trump?Today's big question White House rhetoric and reality look likely to become increasingly blurred