In the FTX crypto collapse, echoes of recent history

The 21st century has been one financial scandal after another

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

The bigger they are, the harder they fall, at least in the world of finance.

And boy, is Sam Bankman-Fried experiencing a hard fall. Bankman-Fried — known as "SBF" to his fans — is the 30-year-old wunderkind philanthropist billionaire who founded FTX, one of the world's biggest cryptocurrency exchanges. FTX declared bankruptcy in November, and now Bankman-Fried and his company are "in the crosshairs of U.S. prosecutors," The Wall Street Journal reports. FTX's name has already been yanked from the arena where the Miami Heat play. And Bankman-Fried is really, really sorry.

For the uninitiated (and even for the intiated) cryptocurrency can be a new and often confusing financial product. But FTX appears to have made some very old-fashioned missteps: It reportedly lent out billions of dollars in customer funds to a sister company, Alameda Research. "In general, mixing customer funds with counterparties and trading them without explicit consent, according to U.S. securities law, is illegal," CNBC reports. "It also violates FTX's terms of service." Along the way, at least $1 billion in client funds reportedly went missing.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

This isn't the first time that a high-profile company has turned out to be a bit of fool's gold. Here are some of FTX's 21st century predecessors:

MF Global

"One of the last major financial companies to file for bankruptcy with little warning to investors was MF Global Inc.," Steven Church and Jeremy Hill report at Bloomberg. MF Global was headed by former New Jersey Gov. Jon Corzine — he'd gone into politics after making his fortune at Goldman Sachs, then back to finance after leaving office — and the firm's implosion bears some striking similarities to the FTX collapse: When MF Global declared bankruptcy in 2011, regulators discovered that roughly $1.6 billion in customer money had gone missing, used to cover bets on European debt.

That affected more than 26,000 customers, "a hodgepodge of farmers, small-time investors, and hedge funds," according to The New York Times. They eventually got their money back, paid out of MF Global's assets as the company was unwound in bankruptcy. In 2017, Corzine paid a $5 million penalty and was barred from commodity trading.

Enron

Enron also shares some commonalities with FTX. Like the crypto company, Enron slapped its name on sports stadiums: Minute Maid Park in Houston, where the Astros play, used to be Enron Field. Like FTX, it basked in media adulation: It was named "America's Most Innovative Company" by Fortune six years in a row ending in 2001. And like FTX, Enron — an energy company — turned out to be a house of cards.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

The company declared bankruptcy in December 2001, and quickly became what The New York Times called "the biggest corporate and accounting scandals of a generation." Much of the firm's reported profits turned out to be the result of funny accounting. For example: Enron reported a profit as soon as contract to provide power to another company — even though a dime had not yet been paid, and even though the actual profit depended on the hope of falling energy prices coming to fruition. That looked good to Wall Street, but the gap between on-paper profits and actual revenues proved too much.

The consequences were vast, CNBC notes: 21 people were convicted in the scandal, accounting giant Arthur Andersen was forced out of business, and the Sarbanes-Oxley act tightening corporate accounting rules was passed. One more interesting tidbit: John Jay Ray III, the lawyer who steered Enron through bankruptcy, has now been asked to do the same for FTX.

WorldCom

The early 21st century seemed chock-a-block with one giant accounting scandal after another: Aside from Enron, companies like Adelphia, Tyco, and Global Crossing all fell by the wayside. But the largest disaster of the time was when WorldCom — then the nation's second-largest long-distance telephone company — declared bankruptcy in 2002, "following revelations of an $11 billion accounting fraud that included pressure by top executives on subordinates to inflate numbers to make the company seem more profitable," The Associated Press later reported. The company's CEO, Bernard Ebbers, denied he knew about the fraud, but he was the source of a related problem: The company "personally lent Ebbers some $400 million to cover loans he'd made against his own shares of stock," NPR reported.

WorldCom's bankruptcy "wiped out the portfolios of many employees and shareholders and drained billions of dollars from retirement accounts," The Washington Post reported; the California Public Employees' Retirement System alone lost more than $500 million in WorldCom bonds and stock. Ebbers served 13 years of a 25-year prison sentence, then was granted compassionate release before he died in 2020 at age 78.

Bernie Madoff

This is probably the simplest financial scandal on the list to explain: Bernie Madoff ran a straight-up Ponzi scheme, one that grew to $65 billion in investor assets. His victims included "members of the Wilpon family, the previous owners of the New York Mets; the late Elie Wiesel, the Holocaust survivor and Nobel laureate; banks, hedge funds, and charities; and thousands of elderly retirees," The Wall Street Journal reported in 2021. They were lured by Madoff's "air of exclusivity" — if investors seemed reluctant to invest, or to invest large sums, he would threaten to walk away from the deal.

And he got away with it for years despite many red flags: One whistleblower went to the Securities and Exchange Commission to warn of Madoff's "suspiciously consistent returns," Bloomberg's Matthew Brooker writes. "The Madoff fraud was always hiding in plain sight." The whole thing collapsed in 2008. Madoff died in prison at age 82 in 2021 while serving a 150-year prison sentence.

Joel Mathis is a writer with 30 years of newspaper and online journalism experience. His work also regularly appears in National Geographic and The Kansas City Star. His awards include best online commentary at the Online News Association and (twice) at the City and Regional Magazine Association.

-

How the FCC’s ‘equal time’ rule works

How the FCC’s ‘equal time’ rule worksIn the Spotlight The law is at the heart of the Colbert-CBS conflict

-

What is the endgame in the DHS shutdown?

What is the endgame in the DHS shutdown?Today’s Big Question Democrats want to rein in ICE’s immigration crackdown

-

‘Poor time management isn’t just an inconvenience’

‘Poor time management isn’t just an inconvenience’Instant Opinion Opinion, comment and editorials of the day

-

Why Trump pardoned crypto criminal Changpeng Zhao

Why Trump pardoned crypto criminal Changpeng ZhaoIn the Spotlight Binance founder’s tactical pardon shows recklessness is rewarded by the Trump White House

-

Bitcoin braces for a quantum computing onslaught

Bitcoin braces for a quantum computing onslaughtIN THE SPOTLIGHT The cryptocurrency community is starting to worry over a new generation of super-powered computers that could turn the digital monetary world on its head.

-

The noise of Bitcoin mining is driving Americans crazy

The noise of Bitcoin mining is driving Americans crazyUnder the Radar Constant hum of fans that cool data-centre computers is turning residents against Trump's pro-cryptocurrency agenda

-

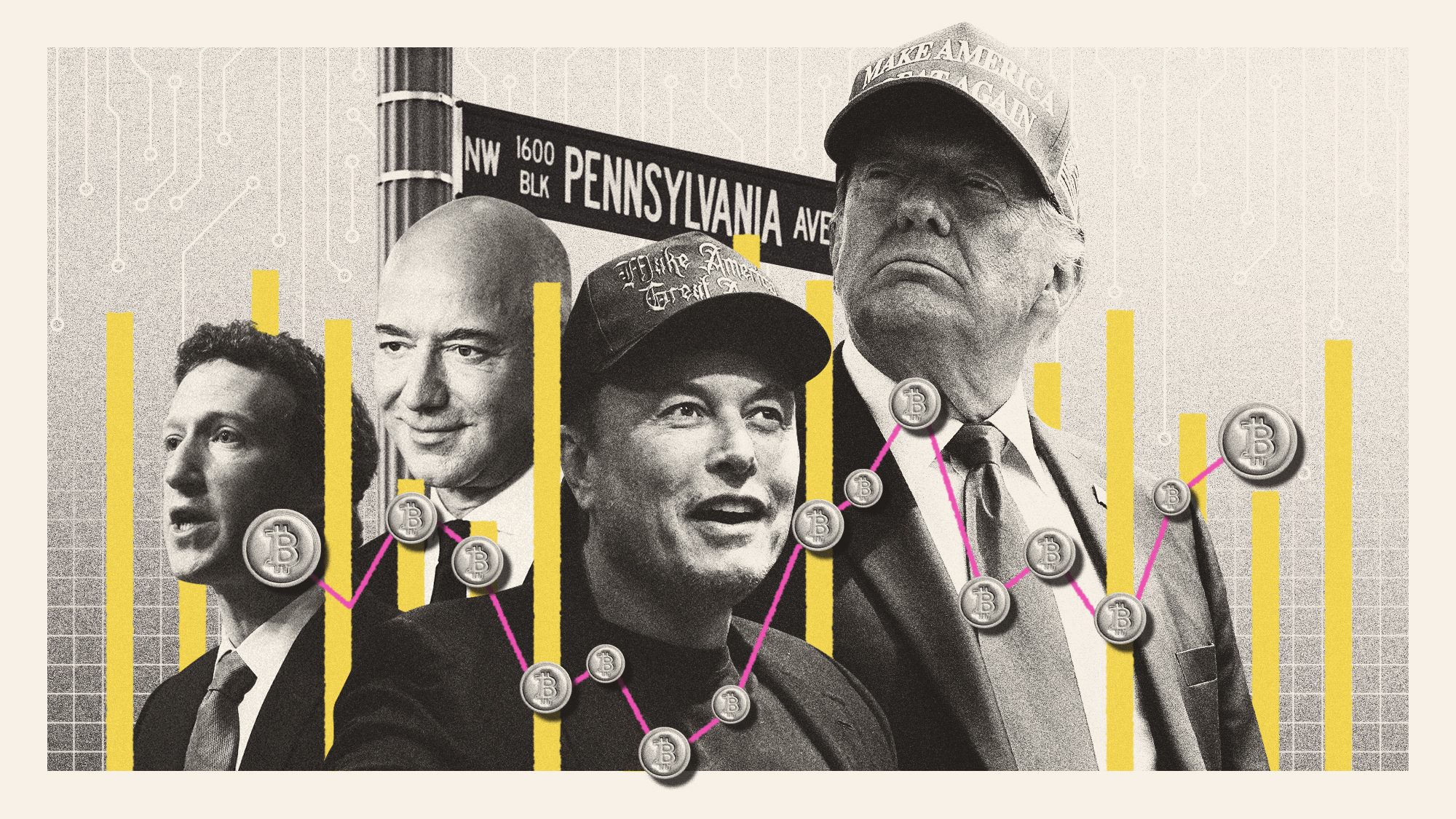

What Trump's win could mean for Big Tech

What Trump's win could mean for Big TechTalking Points The tech industry is bracing itself for Trump's second administration

-

Network states: the tech broligarchy who want to create new countries

Network states: the tech broligarchy who want to create new countriesUnder The Radar Communities would form online around a shared set of 'values' and acquire physical territory, becoming nations with their own laws

-

Paraguay's dangerous dalliance with cryptocurrency

Paraguay's dangerous dalliance with cryptocurrencyUnder The Radar Overheating Paraguayans are pushing back over power outages caused by illegal miners

-

2023: the year of crypto instability

2023: the year of crypto instabilityThe Explainer Crypto reached peaks — and valleys — throughout 2023

-

Sam Bankman-Fried found guilty: where does crypto go from here?

Sam Bankman-Fried found guilty: where does crypto go from here?Today's Big Question Conviction of the 'tousle-haired mogul' confirms sector's 'Wild West' and 'rogue' image, say experts