The daily business briefing: April 6, 2022

Biden is set to extend student-loan payment pause, Musk joins Twitter's board, and more

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

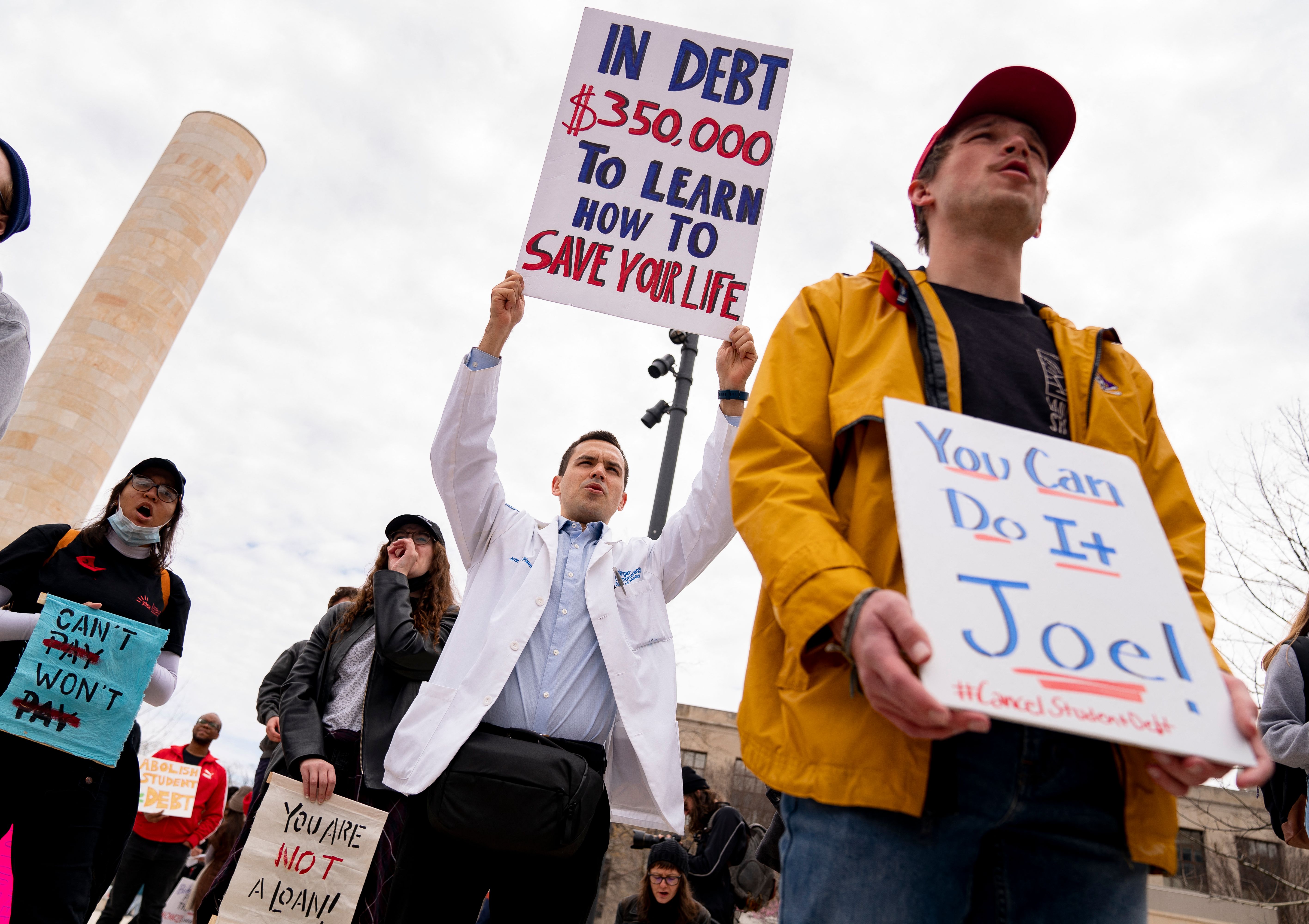

1. Biden to extend pause on student loan payments

President Biden plans to extend a pause on federal student loan payments until Aug. 31, The New York Times reported Tuesday, citing an administration official briefed on the matter. This will be the sixth delay on making people resume payments since the policy was enacted more than two years ago to help people manage the financial fallout from the coronavirus pandemic. Without another extension, payments are scheduled to resume in less than a month for tens of millions of borrowers. Seven million people have avoided collection steps, including paycheck garnishments, during the pause. The administration official said the latest delay will be announced this week. Some progressive politicians and activists want the debts canceled altogether.

2. Twitter adds Elon Musk to its board

Twitter is appointing Tesla CEO Elon Musk to its board, the social media company announced Tuesday. Musk, the world's richest person, has acquired a 9.2 percent stake in Twitter, a regulatory filing revealed Monday. That makes him Twitter's largest individual shareholder. Musk has agreed not to acquire more than 14.9 percent of Twitter shares or attempt a takeover, the Securities and Exchange Commission filing said. Musk said he was excited to work with the board to make "significant improvements" to Twitter. Like Twitter founder Jack Dorsey and CEO Parag Agrawal, he has suggested reshaping social networks by shifting power from companies to users, giving people more control over what they see in their feeds.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

3. Obama returns to White House to push health-care reform

Former President Barack Obama returned to the White House for the first time in five years on Tuesday to join President Biden as he signed an executive order telling federal agencies to find ways to improve Medicare and the Affordable Care Act. Biden also called for lowering the costs of the federal health insurance programs. Biden called the Affordable Care Act, Obama's signature domestic policy achievement, the "most consequential piece of legislation" since the establishment of Medicare and Medicaid in 1965. The Biden administration announced it would close the "family glitch," which blocks Obamacare premium assistance to people getting health care through a relative's work. Republicans accused Biden of trampling Congress' authority.

4. JetBlue offers to buy Spirit Airlines in $3.6 billion deal

JetBlue Airways has offered to buy budget carrier Spirit Airlines in an unsolicited $3.6 billion deal, Spirit said Tuesday. JetBlue said merging the two companies would position it "as the most compelling national low-fare challenger to the four large dominant U.S. carriers by accelerating JetBlue's growth," which would encourage Delta Air Lines, American Airlines, United Airlines, and Southwest Airlines to drop fares. JetBlue said the offer, which amounts to a 50 percent premium over Spirit's recent closing price, was "superior" to the ongoing merger effort involving Spirit and low-cost carrier Frontier Airlines. Frontier said JetBlue's offer "would lead to more expensive travel for consumers."

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

5. Stock futures fall ahead of Fed minutes

U.S. stock futures fell early Wednesday ahead of the release of minutes from the Federal Reserve's most recent policy meeting. Futures tied to the Dow Jones Industrial Average and the S&P 500 were down by 0.5 percent and 0.7 percent at 7 a.m. ET. Nasdaq futures were down by 1.1 percent. Investors will be looking to the minutes for fresh details on the Fed's plan to raise interest rates and reduce the central bank's balance sheet to help fight high inflation. The Dow fell 0.8 percent on Tuesday. The S&P 500 and the tech-heavy Nasdaq plunged by 1.3 percent and 2.3 percent, respectively, after Fed Governor Lael Brainard said the Fed needs to act quickly to bring down inflation.

Harold Maass is a contributing editor at The Week. He has been writing for The Week since the 2001 debut of the U.S. print edition and served as editor of TheWeek.com when it launched in 2008. Harold started his career as a newspaper reporter in South Florida and Haiti. He has previously worked for a variety of news outlets, including The Miami Herald, ABC News and Fox News, and for several years wrote a daily roundup of financial news for The Week and Yahoo Finance.

-

The ‘ravenous’ demand for Cornish minerals

The ‘ravenous’ demand for Cornish mineralsUnder the Radar Growing need for critical minerals to power tech has intensified ‘appetite’ for lithium, which could be a ‘huge boon’ for local economy

-

Why are election experts taking Trump’s midterm threats seriously?

Why are election experts taking Trump’s midterm threats seriously?IN THE SPOTLIGHT As the president muses about polling place deployments and a centralized electoral system aimed at one-party control, lawmakers are taking this administration at its word

-

‘Restaurateurs have become millionaires’

‘Restaurateurs have become millionaires’Instant Opinion Opinion, comment and editorials of the day

-

Buffett: The end of a golden era for Berkshire Hathaway

Buffett: The end of a golden era for Berkshire HathawayFeature After 60 years, the Oracle of Omaha retires

-

Tariffs have American whiskey distillers on the rocks

Tariffs have American whiskey distillers on the rocksIn the Spotlight Jim Beam is the latest brand to feel the pain

-

TikTok secures deal to remain in US

TikTok secures deal to remain in USSpeed Read ByteDance will form a US version of the popular video-sharing platform

-

SiriusXM hopes a new Howard Stern deal can turn its fortunes around

SiriusXM hopes a new Howard Stern deal can turn its fortunes aroundThe Explainer The company has been steadily losing subscribers

-

How will the Warner Bros. bidding war affect the entertainment industry?

How will the Warner Bros. bidding war affect the entertainment industry?Today’s Big Question Both Netflix and Paramount are trying to purchase the company

-

Texas is trying to become America’s next financial hub

Texas is trying to become America’s next financial hubIn the Spotlight The Lone Star State could soon have three major stock exchanges

-

US mints final penny after 232-year run

US mints final penny after 232-year runSpeed Read Production of the one-cent coin has ended

-

How could worsening consumer sentiment affect the economy?

How could worsening consumer sentiment affect the economy?Today’s Big Question Sentiment dropped this month to a near-record low