The daily business briefing: July 29, 2016

Google-parent Alphabet reports strong ad sales, the Bank of Japan unveils stimulus expansion, and more

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

1. Google profits rise on strong ad sales

Google parent company Alphabet reported a 24 percent jump in quarterly profit thanks to strong ad sales. Revenue reached $21.5 billion, beating analysts' expectations by $750 million. Alphabet posted its results after trading closed on Thursday, a day after another internet giant, Facebook, also reported strong ad sales. Both companies benefited from a surge in internet use by smartphone users, which helped them sell more ads to companies targeting their users. Alphabet shares rose by two percent in after-hours trading.

The New York Times The Wall Street Journal

2. Bank of Japan stimulus falls short of expectations

The Bank of Japan announced Friday that it was expanding its economic stimulus by doubling its exchange-traded fund (ETF) purchases. The central bank has faced pressure from the Japanese government and investors to take bolder steps to boost the economy. The new measures fell short of expectations, and Japan's benchmark Nikkei stock index fell by nearly two percent. The Bank of Japan left a key interest rate unchanged at 0.1 percent. BOJ Governor Haruhiko Kuroda said further action was possible depending on conclusions from a comprehensive review it is conducting of the impact of current stimulus measures.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

3. Amazon shares rise as profit gains continue

Amazon reported its fifth straight quarter of profit gains on Thursday, signaling progress from investments in its network to fulfill customer orders. The Seattle-based online retailer's profit increased to $857 million, or $1.78 per share, from $92 million, or 19 cents per share, a year earlier. The company's stock gained two percent in after-hours trading on the news. Amazon's earnings for the quarter did not include the take from Prime Day, a massive July 12 sale for the tens of millions of subscribers to Amazon's Prime service.

4. CBS says sales of shows offset declining TV ad sales

CBS Corp. on Thursday reported quarterly earnings of $3.29 billion, narrowly beating analysts' expectations. CBS, owner of the most-watched U.S. TV network, said its earnings rose to 93 cents a share, exceeding analysts' estimates of 86 cents per share. CBS benefited from rising licensing deals for Star Trek and sales of other shows to other broadcasters, which offset declining TV ad sales. A 44 percent increase in fees paid by affiliated TV stations also helped. CBS stock, which is up by 15 percent this year, edged higher.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

5. Oracle to acquire cloud-computing company NetSuite for $9.3 billion

Oracle announced Thursday that it would buy cloud-computing company NetSuite for $9.3 billion in cash. The deal amounts to a 19 percent premium over NetSuite's Wednesday closing price. Oracle is trying to catch up to rivals such as Microsoft and Amazon by making a rapid shift to cloud services. NetSuite was co-founded by Oracle executive chairman Larry Ellison, who is the biggest shareholder in both companies. Cowen & Co. analyst J. Derrick Wood said in a research note that Ellison could face a "high degree of litigation" if the price appears higher than those paid in similar acquisitions.

Harold Maass is a contributing editor at The Week. He has been writing for The Week since the 2001 debut of the U.S. print edition and served as editor of TheWeek.com when it launched in 2008. Harold started his career as a newspaper reporter in South Florida and Haiti. He has previously worked for a variety of news outlets, including The Miami Herald, ABC News and Fox News, and for several years wrote a daily roundup of financial news for The Week and Yahoo Finance.

-

The broken water companies failing England and Wales

The broken water companies failing England and WalesExplainer With rising bills, deteriorating river health and a lack of investment, regulators face an uphill battle to stabilise the industry

-

A thrilling foodie city in northern Japan

A thrilling foodie city in northern JapanThe Week Recommends The food scene here is ‘unspoilt’ and ‘fun’

-

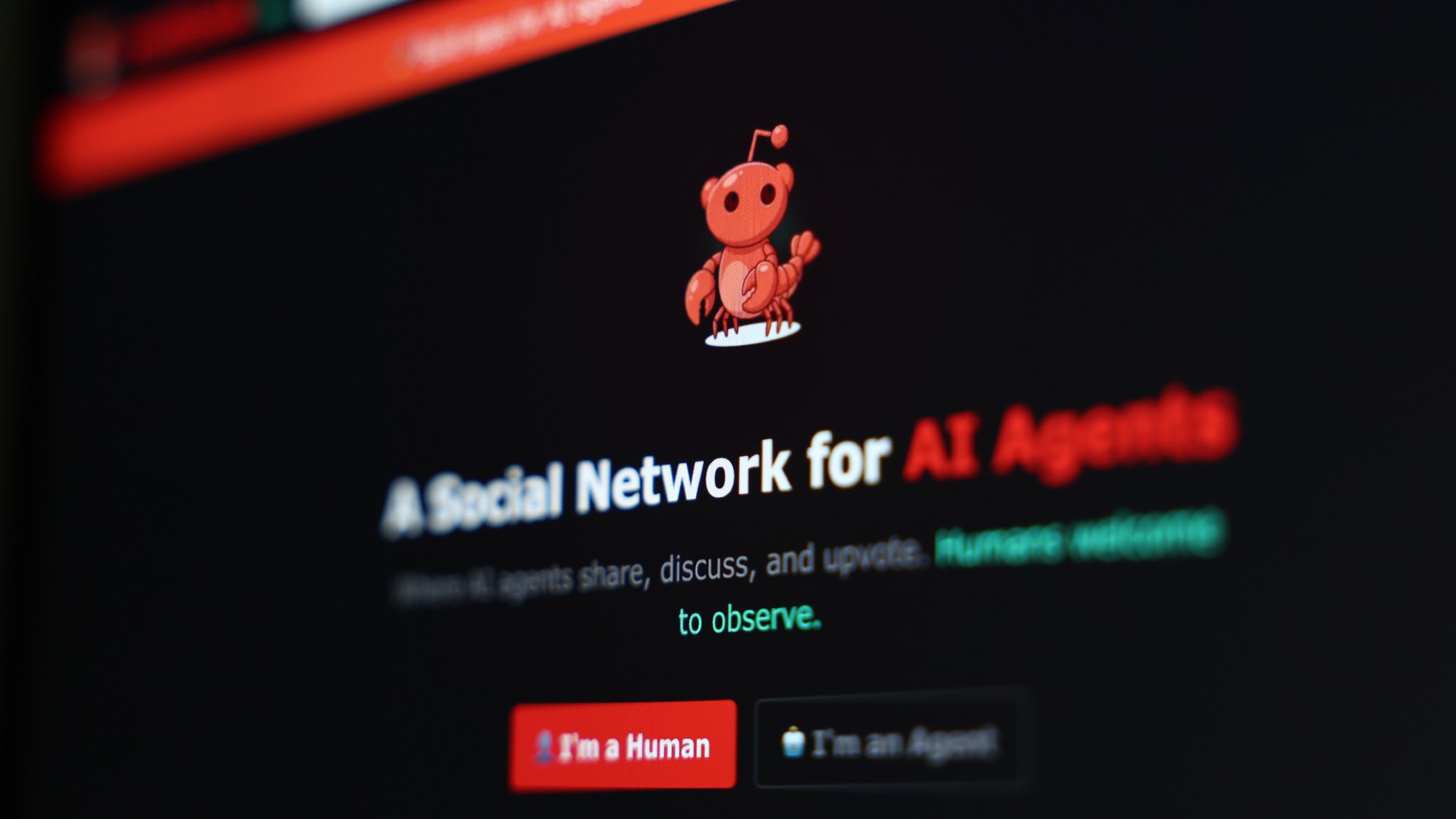

Are AI bots conspiring against us?

Are AI bots conspiring against us?Talking Point Moltbook, the AI social network where humans are banned, may be the tip of the iceberg

-

Epstein files topple law CEO, roil UK government

Epstein files topple law CEO, roil UK governmentSpeed Read Peter Mandelson, Britain’s former ambassador to the US, is caught up in the scandal

-

Iran and US prepare to meet after skirmishes

Iran and US prepare to meet after skirmishesSpeed Read The incident comes amid heightened tensions in the Middle East

-

Israel retrieves final hostage’s body from Gaza

Israel retrieves final hostage’s body from GazaSpeed Read The 24-year-old police officer was killed during the initial Hamas attack

-

China’s Xi targets top general in growing purge

China’s Xi targets top general in growing purgeSpeed Read Zhang Youxia is being investigated over ‘grave violations’ of the law

-

Panama and Canada are negotiating over a crucial copper mine

Panama and Canada are negotiating over a crucial copper mineIn the Spotlight Panama is set to make a final decision on the mine this summer

-

Why Greenland’s natural resources are nearly impossible to mine

Why Greenland’s natural resources are nearly impossible to mineThe Explainer The country’s natural landscape makes the task extremely difficult

-

Iran cuts internet as protests escalate

Iran cuts internet as protests escalateSpeed Reada Government buildings across the country have been set on fire

-

US nabs ‘shadow’ tanker claimed by Russia

US nabs ‘shadow’ tanker claimed by RussiaSpeed Read The ship was one of two vessels seized by the US military