The daily business briefing: January 2, 2018

U.S. stock futures fall after more disappointing data from China, Netflix pulls a comedy show episode after Saudi Arabia complains, and more

- 1. U.S. stock futures fall ahead of first day of trading in 2019

- 2. Netflix pulls comedy show episode in Saudi Arabia after complaint

- 3. Trump invites lawmakers to White House meeting as shutdown continues

- 4. Oil prices fall on growing oversupply, economic worries

- 5. Drugmakers ring in the new year with higher drug prices

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

1. U.S. stock futures fall ahead of first day of trading in 2019

Dow Jones Industrial Average futures dropped sharply early Wednesday after a private sector survey, China's Caixan/Markit Manufacturing Purchasing Managers' Index, showed that manufacturing activity in the world's second largest economy fell to 49.7 in December from 50.2 the month before, the first such contraction in 19 months. "That showed external demand remained subdued due to the trade frictions between China and the U.S., while domestic demand weakened more notably," wrote Zhengsheng Zhong, director of macroeconomic analysis at CEBM Group, a subsidiary of Caixin. The news sent Dow futures falling by more than 1 percent. Futures for the S&P 500 and the Nasdaq also fell by more than 1 percent.

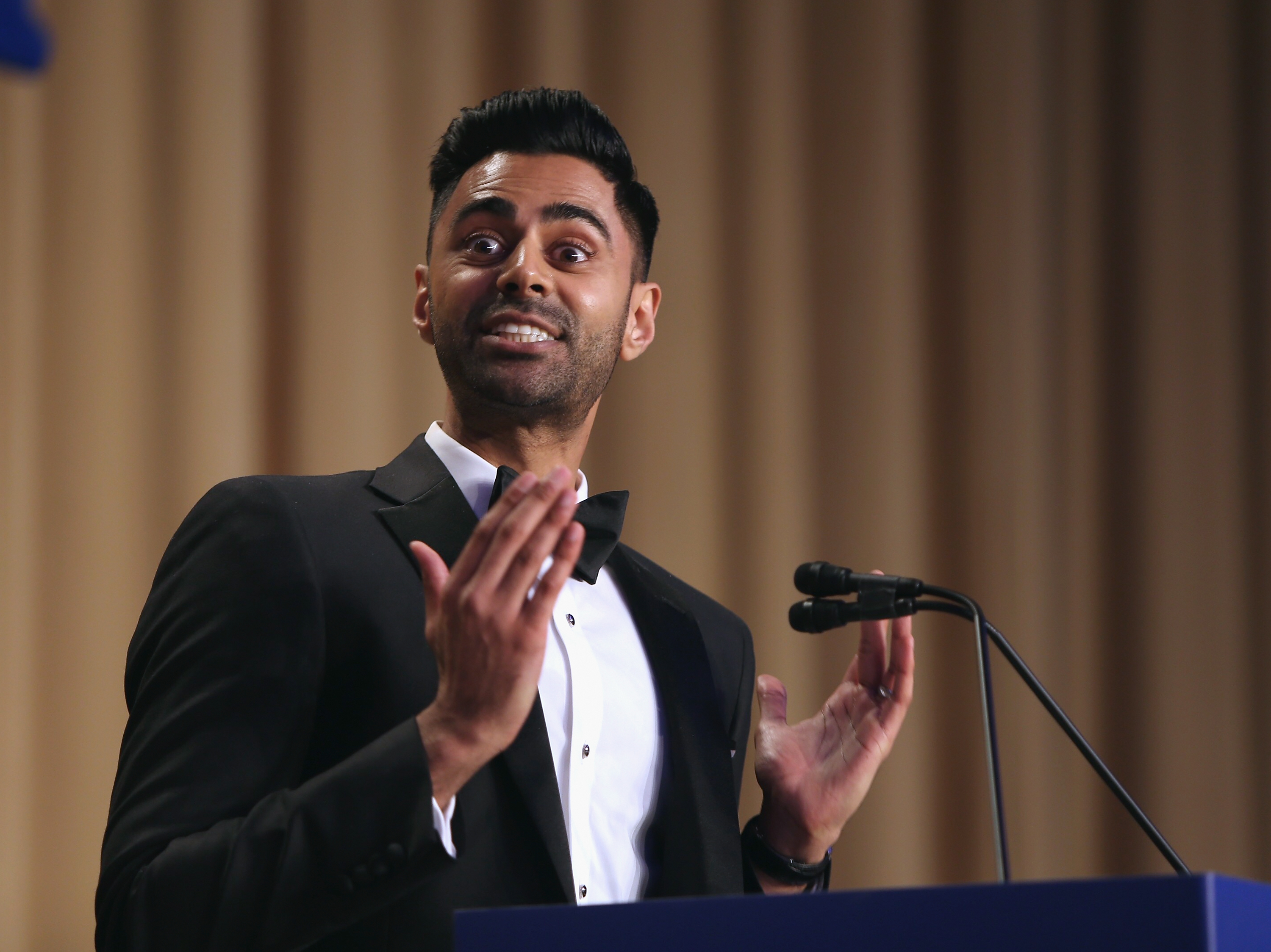

2. Netflix pulls comedy show episode in Saudi Arabia after complaint

Netflix confirmed Wednesday that it has pulled the second episode of Daily Show alumnus Hasan Minhaj's new topical comedy show, Patriot Act, from its streaming service in Saudi Arabia following complaints from the kingdom's Communications and Information Technology Commission. "We strongly support artistic freedom worldwide and only removed this episode in Saudi Arabia after we had received a valid legal request — and to comply with local law," Netflix said in a statement, referring to Saudi Arabia's cyber-crime statute. In the episode, Minhaj criticizes Saudi Arabia and its crown prince, Mohammed bin Salman, for the murder of journalist Jamal Khashoggi inside the Saudi consulate in Istanbul, among other things. The episode is still available on YouTube in Saudi Arabia.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

3. Trump invites lawmakers to White House meeting as shutdown continues

President Trump on Tuesday denounced a proposal by House Democrats to end the partial government shutdown without allocating the $5 billion he is demanding for a wall on the Mexican border. "The problem is, without a Wall there can be no real Border Security," Trump tweeted, "and our Country must finally have a Strong and Secure Southern Border!" Trump invited a bipartisan group of congressional leaders to the White House to discuss border security, tweeting, "Let's make a deal!" House Democratic leader Nancy Pelosi (D-Calif.) said the impasse gave Democrats, who take control of the House in the new Congress, "a great opportunity to show how we will govern responsibly & quickly pass our plan to end the irresponsible #TrumpShutdown."

4. Oil prices fall on growing oversupply, economic worries

Oil prices fell on Wednesday as major OPEC and non-OPEC producers raised output and weak manufacturing data from China stoked fears of a global economic slowdown that could weaken demand. Brent crude fell by 33 cents to $53.47 a barrel. "The omens are far from encouraging," said Stephen Brennock of oil broker PVM. "The current bearish bias will therefore continue in the near term and it stands to reason that oil will struggle to break out from its current trough." Other analysts were less gloomy, saying prices could rebound when an OPEC-led supply cut starts this month. Oil prices dropped in 2018 for the first year since 2015 on mounting concerns over excess supply and slowing global economic growth.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

5. Drugmakers ring in the new year with higher drug prices

Pharmaceutical companies started the new year by raising prices on hundreds of drugs in the U.S., The Wall Street Journal reported Tuesday, citing an analysis from Rx Savings Solutions. Allergan led the way with a nearly 10 percent increase on 27 medicines. More than three dozen drugmakers hiked prices on hundreds of products. The average increase in drug list prices was 6.3 percent, and both brand-name drugmakers like Allergan and generics makers like Hikma Pharmaceuticals raised prices well above inflation. Allergan raised prices on about half its drugs, including the Alzheimer's medication Namenda, and Hikma increased prices for morphine, the anesthetic ketamine, and enalaprilat, a blood-pressure drug, the Journal notes.

Harold Maass is a contributing editor at The Week. He has been writing for The Week since the 2001 debut of the U.S. print edition and served as editor of TheWeek.com when it launched in 2008. Harold started his career as a newspaper reporter in South Florida and Haiti. He has previously worked for a variety of news outlets, including The Miami Herald, ABC News and Fox News, and for several years wrote a daily roundup of financial news for The Week and Yahoo Finance.

-

Kia EV4: a ‘terrifically comfy’ electric car

Kia EV4: a ‘terrifically comfy’ electric carThe Week Recommends The family-friendly vehicle has ‘plush seats’ and generous space

-

Bonfire of the Murdochs: an ‘utterly gripping’ book

Bonfire of the Murdochs: an ‘utterly gripping’ bookThe Week Recommends Gabriel Sherman examines Rupert Murdoch’s ‘war of succession’ over his media empire

-

Gwen John: Strange Beauties – a ‘superb’ retrospective

Gwen John: Strange Beauties – a ‘superb’ retrospectiveThe Week Recommends ‘Daunting’ show at the National Museum Cardiff plunges viewers into the Welsh artist’s ‘spiritual, austere existence’

-

Epstein files topple law CEO, roil UK government

Epstein files topple law CEO, roil UK governmentSpeed Read Peter Mandelson, Britain’s former ambassador to the US, is caught up in the scandal

-

Iran and US prepare to meet after skirmishes

Iran and US prepare to meet after skirmishesSpeed Read The incident comes amid heightened tensions in the Middle East

-

Israel retrieves final hostage’s body from Gaza

Israel retrieves final hostage’s body from GazaSpeed Read The 24-year-old police officer was killed during the initial Hamas attack

-

China’s Xi targets top general in growing purge

China’s Xi targets top general in growing purgeSpeed Read Zhang Youxia is being investigated over ‘grave violations’ of the law

-

Panama and Canada are negotiating over a crucial copper mine

Panama and Canada are negotiating over a crucial copper mineIn the Spotlight Panama is set to make a final decision on the mine this summer

-

Why Greenland’s natural resources are nearly impossible to mine

Why Greenland’s natural resources are nearly impossible to mineThe Explainer The country’s natural landscape makes the task extremely difficult

-

Iran cuts internet as protests escalate

Iran cuts internet as protests escalateSpeed Reada Government buildings across the country have been set on fire

-

US nabs ‘shadow’ tanker claimed by Russia

US nabs ‘shadow’ tanker claimed by RussiaSpeed Read The ship was one of two vessels seized by the US military