BP and Shell: the significance of Big Oil walking out of Russia

In time, a greener, cleaner BP may thank Ukraine for forcing its hand

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

BP’s decision to ditch its 20% stake in the Russian state oil giant Rosneft was almost a foregone conclusion following accusations that it was “fuelling the invasion of Ukraine”. And it was swiftly joined by Shell, which is divesting its stake in the Sakhalin-2 liquefied natural gas project, said Bloomberg.

The two companies “will write down billions of dollars”, but the moves have a greater significance. In just two days, Britain’s twin energy giants have dumped Russian investments nurtured over decades and shut themselves out of the world’s largest energy exporter, probably forever.” The US titan Exxon announced that it would follow; France’s Total is reviewing its Russian business.

Given that the total cost of jettisoning Rosneft could hit $25bn (including $11bn in forex losses), the immediate hit to BP’s shares was “a modest 4%”, noted Nils Pratley in The Guardian. The fall might have been steeper had the board “risked serious reputational damage” by ignoring “the UK government’s entreaties”. The hit to Shell, at around $3bn, is much less.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Neither company has outlined the “mechanics” of their exits. BP can either seek a buyer – at a fire-sale price – “or accept whatever token sum of devalued roubles” Rosneft cares to offer. “The latter looks more likely.”

BP boss Bernard Looney, and his predecessor Robert Dudley, are now off Rosneft’s board. Welcome news, said Alistair Osborne in The Times. But BP should have ended its tumultuous relationship with Russia years ago. “How much evidence did it need that Putin is no business partner?”

In time, a greener, cleaner BP may thank Ukraine for forcing its hand, said George Hay on Reuters Breakingviews. It is now “rid of an asset that presented an increasing headache on environmental, social and governance grounds”.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

Bonfire of the Murdochs: an ‘utterly gripping’ book

Bonfire of the Murdochs: an ‘utterly gripping’ bookThe Week Recommends Gabriel Sherman examines Rupert Murdoch’s ‘war of succession’ over his media empire

-

Gwen John: Strange Beauties – a ‘superb’ retrospective

Gwen John: Strange Beauties – a ‘superb’ retrospectiveThe Week Recommends ‘Daunting’ show at the National Museum Cardiff plunges viewers into the Welsh artist’s ‘spiritual, austere existence’

-

Should the EU and UK join Trump’s board of peace?

Should the EU and UK join Trump’s board of peace?Today's Big Question After rushing to praise the initiative European leaders are now alarmed

-

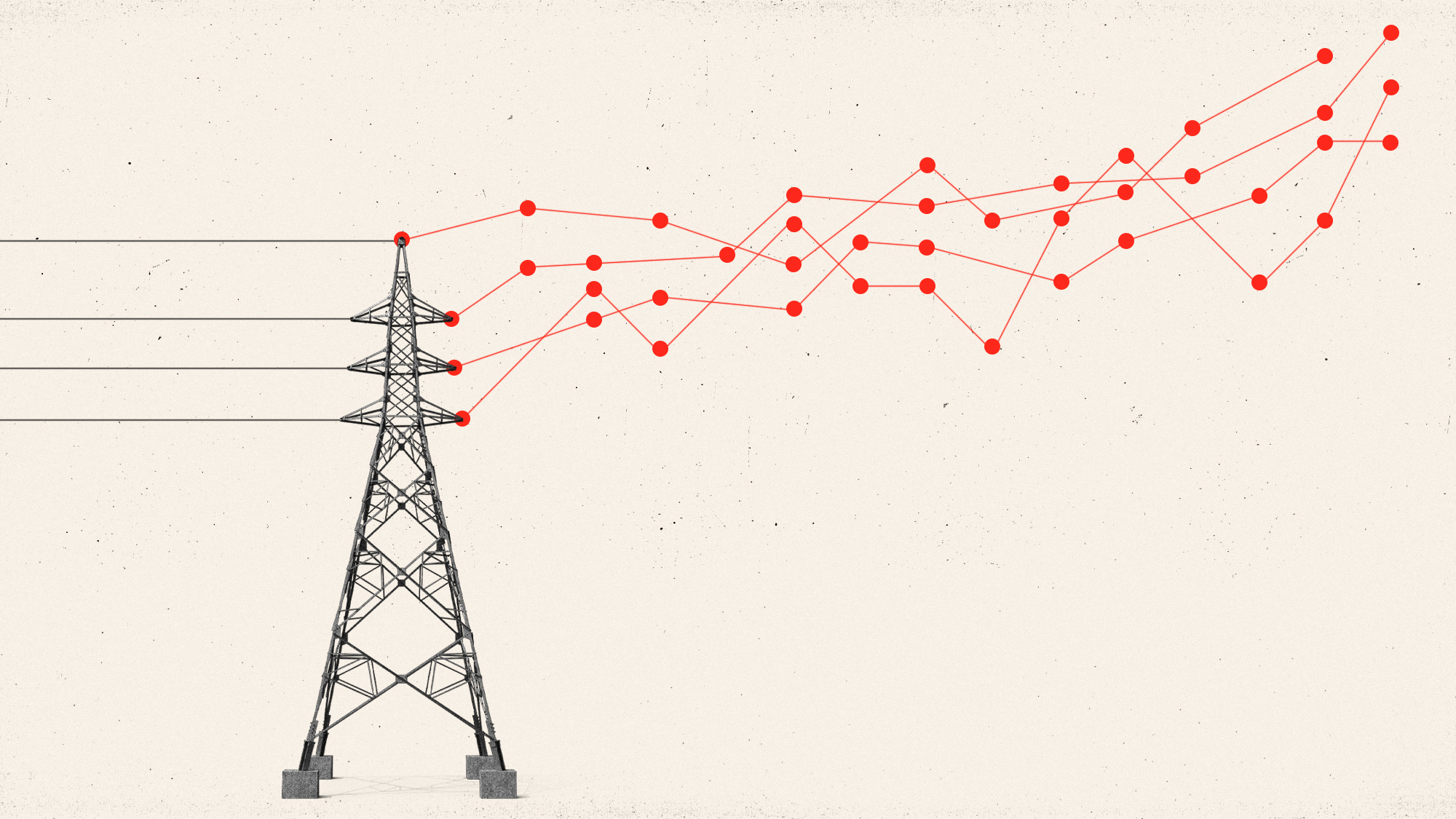

Why are electric bills rising so fast?

Why are electric bills rising so fast?Today's Big Question Data centers for artificial intelligence and the cost of natural gas both contribute

-

London Stock Exchange's mass exodus

London Stock Exchange's mass exodusThe Explainer The UK's stock market is shrinking at its fastest rate since 2010 with companies flocking to US and Europe

-

Enron mystery: 'sick joke' or serious revival?

Enron mystery: 'sick joke' or serious revival?Speed Read 23 years after its bankruptcy filing, the Texas energy firm has announced its resurrection

-

Big Oil doesn't need to 'drill, baby, drill'

Big Oil doesn't need to 'drill, baby, drill'In the Spotlight Trump wants to expand production. Oil companies already have record output.

-

Why is Saudi Arabia going it alone on costly oil cuts?

Why is Saudi Arabia going it alone on costly oil cuts?Today's Big Question The unilateral production cuts could hurt its finances while raising gas prices for drivers and OPEC

-

Great British Nuclear: one step forward to take two steps back?

Great British Nuclear: one step forward to take two steps back?Talking Point New flagship agency to deliver UK’s next generation of reactors delayed as nuclear output is set to decline further

-

Clashes: Modi's favored billionaire fights fraud claims

Clashes: Modi's favored billionaire fights fraud claimsfeature What does this mean for India's clean energy plan?

-

Russia's weaponization of oil and gas exports to neuter Europe on Ukraine is backfiring badly

Russia's weaponization of oil and gas exports to neuter Europe on Ukraine is backfiring badlySpeed Read