Japan is no longer the world's third-biggest economy despite its stock market peaking

The country was overtaken by Germany after unexpectedly entering a recession

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Japan has long been one of the dominant economic forces in the world, particularly with its technological advances in the 21st century. So it sent shockwaves through the global market on Thursday when it was revealed that Japan had unexpectedly slipped into a recession, allowing Germany to overtake it as the world's third-largest economy.

Japan's gross domestic product shrank by 0.4% in the last quarter of 2023, the Japanese Cabinet Office said — far below the 1.4% growth estimate. This followed a third quarter of 2023 in which GDP growth shrank by 3.3%. Most economists officially define a recession as "two consecutive quarters of economic contraction," CNN said, so Japan's economy is clearly on a troubling trend.

What makes this all the more surprising is the recession comes as Japan's stock market, the Nikkei, is anything but down — just two days ago, it crossed 38,000 points for the first time since 1990. Most experts also agree that the Nikkei will continue to trend upward. The fact that Japan's economy is doing so poorly when its stock market is skyrocketing seems to be antithetical.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Inflation and domestic demand is hurting Japan

While global inflation has been slowing for a while, Japan's "so-called 'core-core inflation,'" inflation minus food and energy prices, has exceeded the Bank of Japan's 2% target for "15 straight months now," Clement Tan said for CNBC. As a result, the negative quarterly results from Thursday's report "throw into question the BOJ's preference for inflation in Japan to be driven by domestic demand, which is more sustainable and stable."

However, this raises a problem of its own because the recession "suggests high inflation is hurting domestic consumption in spite of the prospect of higher wages — and perhaps strengthening the case for looser monetary policy for much longer," Tan said. Much of this domestic drop was due to "consumption of clothing and eating out [that] caused a decline in private consumption," Tetsushi Kajimoto said for Reuters.

Japan's economy has become polarized because of higher prices, and "when corporate profits jump, the prices of goods also go up, but wages have not kept up and consumers are reluctant to spend," Shinichiro Kobayashi, the principal economist at Mitsubishi UFJ Research and Consulting, said to The New York Times.

Another overarching factor is the cooling-off of the Japanese yen, which "eats into profits on exports when earnings are repatriated," Justin McCurry said for The Guardian. Japan, like Germany, is resource-poor, has an aging population and is heavily dependent on exports," McCurry said. While "Japanese carmakers and other exporters have benefited from a weak yen ... the country's labor crunch is worse than Germany's." All of these factors combined have contributed to Japan's ongoing economic woes.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Not as bad as it seems

Despite the economic downswing, some experts are saying that Japan's situation may not be that bad — and not all agree that the country is in a recession at all. It is "debatable whether Japan is in a recession due to the poor quality of the nation's GDP data, which is often subject to large revisions," Marcel Thieliant, the head of the Asia-Pacific region at Capital Economics, said to The Japan Times. The judgments around what is technically a recession are "made based on the movements of the Business Conditions Index, which is staying steady," Norihiro Yamaguchi, a senior Japan economist at Oxford Economics, said to the Times.

"GDP stats represent history rather than the outlook," Yamaguchi said. "Given that consumer's confidence is improving with the real income recovering gradually, I expect the [Bank of Japan] will maintain their outlook of 'Japan's economy is likely to continue recovering moderately.'"

Given the current state of Japan's stock market, there may be reason to believe the country's economy is stronger overall than it may seem. "We think there is more upside on the Japanese stock market," Vasu Menon, the managing director of investment strategy at Singapore's OCBC Bank, said to Bloomberg. The way that the market responded to the economic report "seems to be a case of bad news being good news," Menon said.

The weaker-than-anticipated economy also means that the Bank of Japan may not increase its interest rates. When combining this with the series of recent corporate reforms in Japan, it "still makes a case for more upside for Japanese equities," Menon said.

Justin Klawans has worked as a staff writer at The Week since 2022. He began his career covering local news before joining Newsweek as a breaking news reporter, where he wrote about politics, national and global affairs, business, crime, sports, film, television and other news. Justin has also freelanced for outlets including Collider and United Press International.

-

How the FCC’s ‘equal time’ rule works

How the FCC’s ‘equal time’ rule worksIn the Spotlight The law is at the heart of the Colbert-CBS conflict

-

What is the endgame in the DHS shutdown?

What is the endgame in the DHS shutdown?Today’s Big Question Democrats want to rein in ICE’s immigration crackdown

-

‘Poor time management isn’t just an inconvenience’

‘Poor time management isn’t just an inconvenience’Instant Opinion Opinion, comment and editorials of the day

-

Companies are increasingly AI washing

Companies are increasingly AI washingThe explainer Imaginary technology is taking jobs

-

Is the US in a hiring recession?

Is the US in a hiring recession?Today's Big Question The economy is growing. Job openings are not.

-

Trump wants a weaker dollar, but economists aren’t so sure

Trump wants a weaker dollar, but economists aren’t so sureTalking Points A weaker dollar can make imports more expensive but also boost gold

-

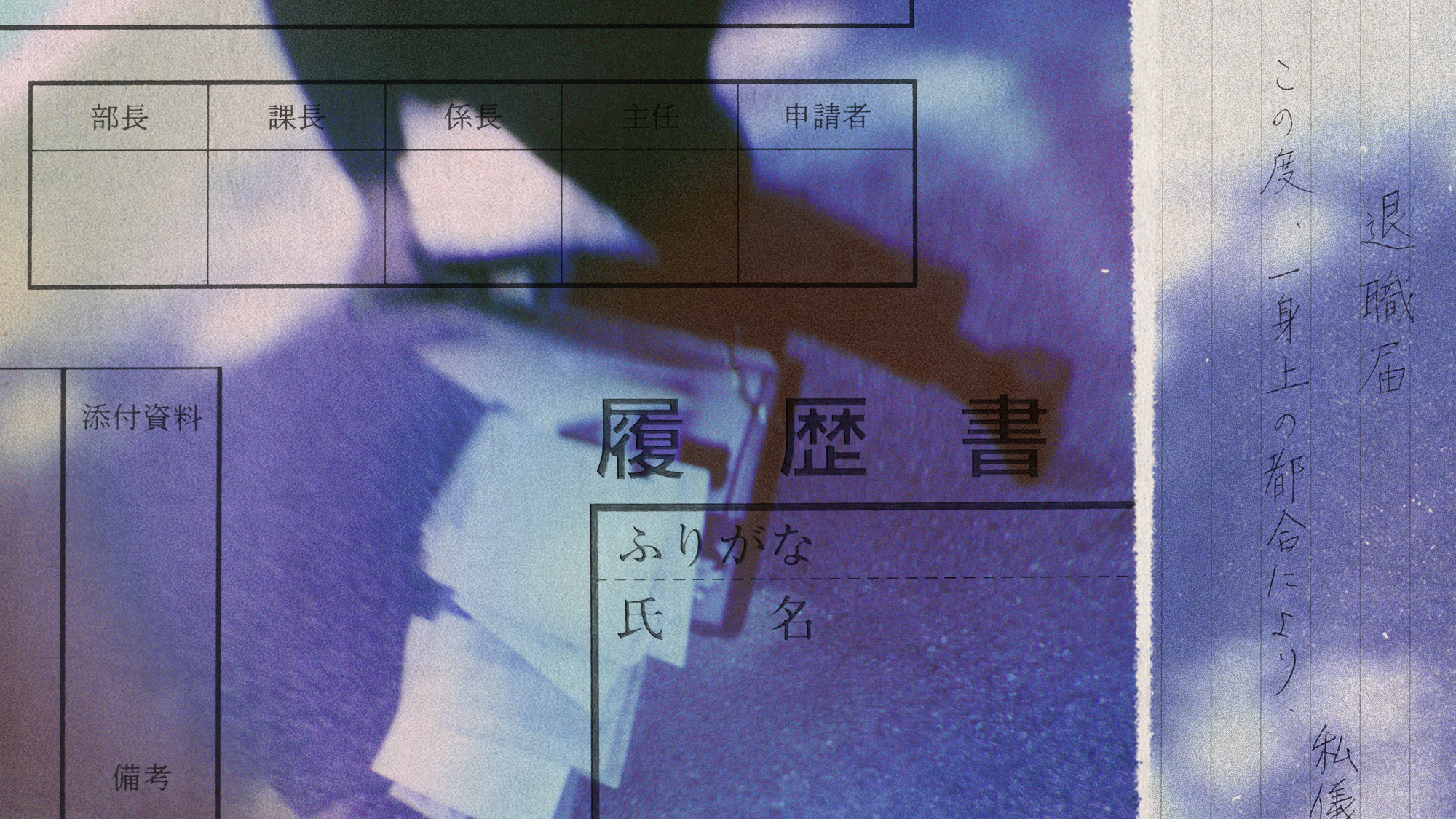

Why quitting your job is so difficult in Japan

Why quitting your job is so difficult in JapanUnder the Radar Reluctance to change job and rise of ‘proxy quitters’ is a reaction to Japan’s ‘rigid’ labour market – but there are signs of change

-

Did markets’ ‘Sell America’ trade force Trump to TACO on Greenland?

Did markets’ ‘Sell America’ trade force Trump to TACO on Greenland?Today’s Big Question Investors navigate a suddenly uncertain global economy

-

Why Saudi Arabia is muscling in on the world of anime

Why Saudi Arabia is muscling in on the world of animeUnder the Radar The anime industry is the latest focus of the kingdom’s ‘soft power’ portfolio

-

Can Trump make single-family homes affordable by banning big investors?

Can Trump make single-family homes affordable by banning big investors?Talking Points Wall Street takes the blame

-

Why is pizza in decline?

Why is pizza in decline?In the Spotlight The humble pie is getting humbler