The daily business briefing: October 10, 2023

Union workers walk out at Mack Trucks after rejecting contract, Walgreens pharmacists strike demanding better pay and staffing, and more

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

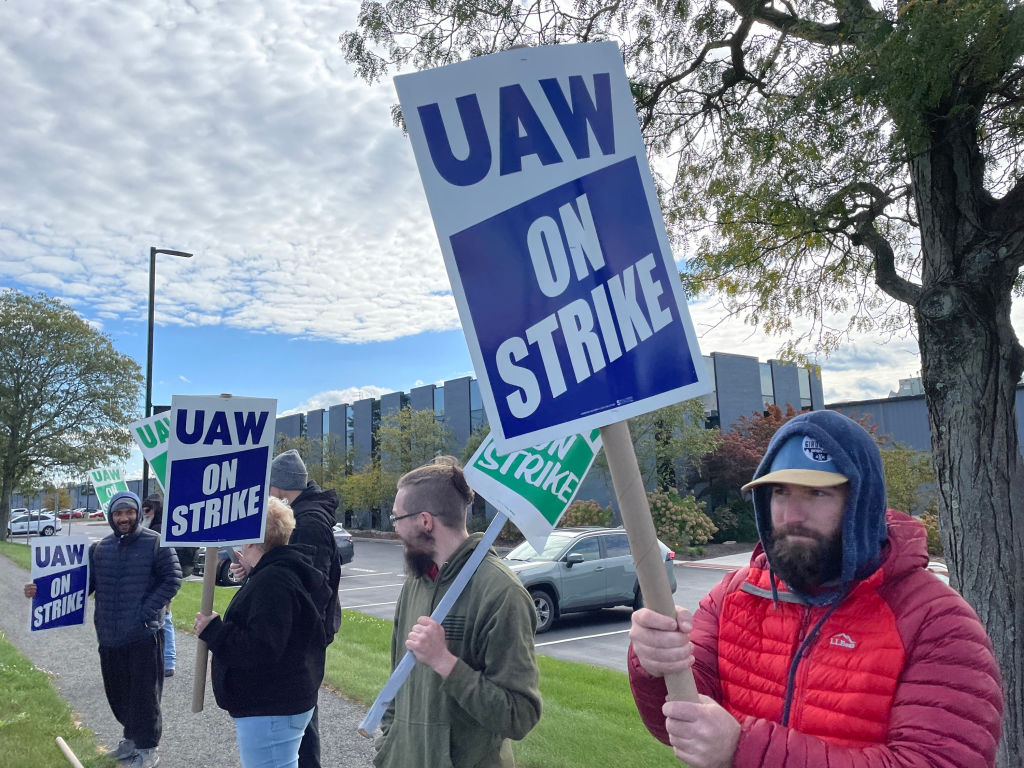

1. Mack Trucks workers go on strike

Union workers at Mack Trucks walked off the job Monday after rejecting a five-year contract the United Auto Workers negotiated with the company. The strike, which involved 4,000 unionized workers, comes as the UAW continues an unprecedented simultaneous strike against all three big Detroit automakers: Ford, General Motors and Chrysler's Stellantis. Union President Shawn Fain told Mack parent company Volvo Trucks that 73% of the workers voted against the deal. The proposal included a 19% pay raise over the contract's five years, including 10% upon ratification and a $3,500 ratification bonus. Also, workers' weekly health care contributions would have remained unchanged. "I'm inspired to see UAW members at Mack Trucks holding out for a better deal," Fain said. The Associated Press

2. Walgreens pharmacists walk out demanding better pay, staffing

Several hundred Walgreens pharmacists and pharmacy technicians staged a walkout Monday. Like CVS pharmacists who held a similar strike in late September, the Walgreens employees are demanding better working conditions and staffing, along with more resources to ensure they can do their jobs safely. In addition to filling prescriptions, Walgreens pharmacy employees perform rapid flu and Covid-19 testing, administer vaccines and work with insurance companies on approvals and co-pays. The walkout was scheduled to last through Wednesday. The company downplayed the impact. Walgreens spokesperson Marty Maloney said "a small number of our pharmacies are experiencing disruptions, and we apologize for any inconvenience." USA Today

3. Vermont utility proposes home batteries to bolster grid

A Vermont utility, Green Mountain Power, proposed installing backup batteries at most of its customers' homes as part of an effort to make the grid more resilient in bad weather. The company also said it wants to bury more power lines and strengthen overhead cables, according to a Monday filing with state regulators. Green Mountain Power said its battery proposal would cost less than putting up new lines and building more power plants. "Call us the un-utility," Mari McClure, Green Mountain’s CEO, told The New York Times. "We're completely flipping the model, decentralizing it." The company's filing asked the Vermont Public Utility Commission to authorize it to spend an initial $280 million to strengthen its grid and buy batteries. The New York Times

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

4. Country Garden warn of missed debt payment as China property woes continue

Chinese property developer Country Garden warned Tuesday it couldn't meet a deadline to repay a $60 million loan, the latest indication of more pain looming in China's real estate crisis. Country Garden warned in a filing to the Hong Kong Stock Exchange that sales faced "remarkable pressure," and the company "expects that it will not be able to meet all of its offshore payment obligations when due or within the relevant grace periods." Chinese authorities once praised Country Garden as a model property developer, as it avoided defaults that plagued China Evergrande, the world's most debt-laden property firm. China Evergrande defaulted in 2021 after Beijing restricted borrowing by developers. The Associated Press

5. Oil prices, defense stocks jump

Oil prices and defense stocks rose Monday following Hamas' surprise attack in southern Israel. Concerns that the fighting would spread beyond Israel sent international benchmark Brent crude futures up 4.2%. U.S. benchmark West Texas Intermediate jumped 4.3% to $86.38 per barrel. Shares of defense contractors Lockheed Martin and Northrop Grumman shot up by 8.9% and 11%, respectively, in their best days since March 2020, according to The Wall Street Journal. The major U.S. stock indexes initially traded lower Monday but rebounded as Israeli forces regained control of several towns from Palestinian militants. The Dow Jones Industrial Average and the S&P 500 closed up 0.6%. The Nasdaq gained 0.4%. Futures for the three main U.S. indexes were up slightly early Tuesday. The Wall Street Journal, CNBC

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Harold Maass is a contributing editor at The Week. He has been writing for The Week since the 2001 debut of the U.S. print edition and served as editor of TheWeek.com when it launched in 2008. Harold started his career as a newspaper reporter in South Florida and Haiti. He has previously worked for a variety of news outlets, including The Miami Herald, ABC News and Fox News, and for several years wrote a daily roundup of financial news for The Week and Yahoo Finance.

-

The Olympic timekeepers keeping the Games on track

The Olympic timekeepers keeping the Games on trackUnder the Radar Swiss watchmaking giant Omega has been at the finish line of every Olympic Games for nearly 100 years

-

Will increasing tensions with Iran boil over into war?

Will increasing tensions with Iran boil over into war?Today’s Big Question President Donald Trump has recently been threatening the country

-

Corruption: The spy sheikh and the president

Corruption: The spy sheikh and the presidentFeature Trump is at the center of another scandal

-

Buffett: The end of a golden era for Berkshire Hathaway

Buffett: The end of a golden era for Berkshire HathawayFeature After 60 years, the Oracle of Omaha retires

-

Tariffs have American whiskey distillers on the rocks

Tariffs have American whiskey distillers on the rocksIn the Spotlight Jim Beam is the latest brand to feel the pain

-

TikTok secures deal to remain in US

TikTok secures deal to remain in USSpeed Read ByteDance will form a US version of the popular video-sharing platform

-

SiriusXM hopes a new Howard Stern deal can turn its fortunes around

SiriusXM hopes a new Howard Stern deal can turn its fortunes aroundThe Explainer The company has been steadily losing subscribers

-

How will the Warner Bros. bidding war affect the entertainment industry?

How will the Warner Bros. bidding war affect the entertainment industry?Today’s Big Question Both Netflix and Paramount are trying to purchase the company

-

Texas is trying to become America’s next financial hub

Texas is trying to become America’s next financial hubIn the Spotlight The Lone Star State could soon have three major stock exchanges

-

US mints final penny after 232-year run

US mints final penny after 232-year runSpeed Read Production of the one-cent coin has ended

-

How could worsening consumer sentiment affect the economy?

How could worsening consumer sentiment affect the economy?Today’s Big Question Sentiment dropped this month to a near-record low