Bitcoin: is it a ‘get rich quick’ scheme?

Financial watchdog finds most crypto investors bought digital coins without understanding the market

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Investors are buying cryptocurrencies such as bitcoin and Ethereum in an attempt to make a quick profit without fully understanding the market, according to a new study.

Research by the Financial Conduct Authority (FCA) into consumer attitudes towards cryptocurrency found that most people did not have “a good understanding of what they are purchasing”, The Daily Telegraph reports.

Some investors who were quizzed by the watchdog talked about buying “whole” coins, without realising that they could buy a fraction of a digital currency, the newspaper says.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Around 3% of all those interviewed had purchased a virtual coin. Men between 20 and 44 were the most aware of cryptocurrencies, bitcoin was the favoured token, and around half of the investors had spent less than £200.

When asked why they had invested, many said they had heard about the opportunity through “friends, acquaintances and social media personalities”, the Daily Mirror reports.

Bitcoin’s surging values in late 2017, when the cryptocurrency peaked at nearly $20,000 (£15,280), has also played a major role in luring amateur investors to the market.

Following its meteoric rise, the cryptocurrency market had endured repeated sell-offs over the past 14 months. As of 10am UK time, bitcoin’s value sat at $3,917 (£2,993) per coin, according to CoinMarketCap.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Although the lack of understanding among investors has caused concern, the FCA concludes that the “overall scale of harm” may “not have been as high as previously feared”, as the sums being invested are generally quite small, the BBC reports.

Nevertheless, Laura Suter, a personal finance analyst at investment firm AJ Bell, is urging potential bitcoin investors to ensure they “know the risk of what you’re buying and that you’re not just relying on hype and excitement from friends or social media”.

“Investing is not a get rich quick scheme, it’s a way to build wealth slowly and with patience,” she warned.

-

Why is the Trump administration talking about ‘Western civilization’?

Why is the Trump administration talking about ‘Western civilization’?Talking Points Rubio says Europe, US bonded by religion and ancestry

-

Quentin Deranque: a student’s death energizes the French far right

Quentin Deranque: a student’s death energizes the French far rightIN THE SPOTLIGHT Reactions to the violent killing of an ultraconservative activist offer a glimpse at the culture wars roiling France ahead of next year’s elections

-

Secured vs. unsecured loans: how do they differ and which is better?

Secured vs. unsecured loans: how do they differ and which is better?the explainer They are distinguished by the level of risk and the inclusion of collateral

-

Why Trump pardoned crypto criminal Changpeng Zhao

Why Trump pardoned crypto criminal Changpeng ZhaoIn the Spotlight Binance founder’s tactical pardon shows recklessness is rewarded by the Trump White House

-

Bitcoin braces for a quantum computing onslaught

Bitcoin braces for a quantum computing onslaughtIN THE SPOTLIGHT The cryptocurrency community is starting to worry over a new generation of super-powered computers that could turn the digital monetary world on its head.

-

The noise of Bitcoin mining is driving Americans crazy

The noise of Bitcoin mining is driving Americans crazyUnder the Radar Constant hum of fans that cool data-centre computers is turning residents against Trump's pro-cryptocurrency agenda

-

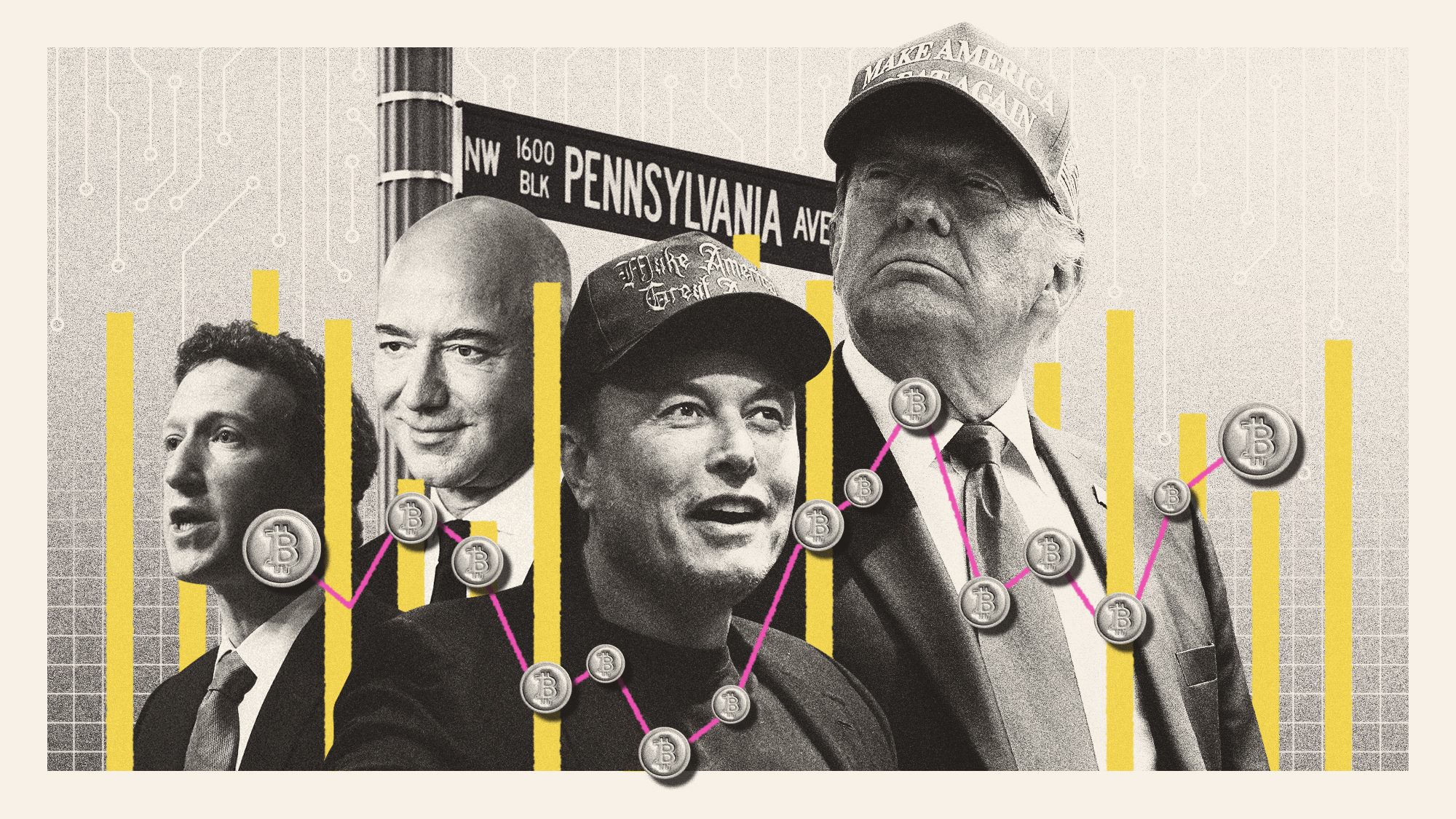

What Trump's win could mean for Big Tech

What Trump's win could mean for Big TechTalking Points The tech industry is bracing itself for Trump's second administration

-

Network states: the tech broligarchy who want to create new countries

Network states: the tech broligarchy who want to create new countriesUnder The Radar Communities would form online around a shared set of 'values' and acquire physical territory, becoming nations with their own laws

-

Paraguay's dangerous dalliance with cryptocurrency

Paraguay's dangerous dalliance with cryptocurrencyUnder The Radar Overheating Paraguayans are pushing back over power outages caused by illegal miners

-

2023: the year of crypto instability

2023: the year of crypto instabilityThe Explainer Crypto reached peaks — and valleys — throughout 2023

-

Sam Bankman-Fried found guilty: where does crypto go from here?

Sam Bankman-Fried found guilty: where does crypto go from here?Today's Big Question Conviction of the 'tousle-haired mogul' confirms sector's 'Wild West' and 'rogue' image, say experts