Bitcoin price: why the cryptocurrency’s future is uncertain in the UK

Finance watchdog says ‘market immaturity’ raises concerns over digital coin trading

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

The Financial Conduct Authority (FCA) has warned cryptocurrency investors that the technology has “no intrinsic value” and provides “few protections” to customers.

The UK watchdog has released a set of regulatory guidelines for areas of the virtual currency market that fall under its jurisdiction.

The move has been hailed by Reuters as “a milestone” in Britain’s regulation of this small yet highly popular part of the financial sector.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

The FCA said that “a combination of market immaturity, volatility, and a lack of credible information or oversight raises concerns about market integrity, manipulation and insider dealing within cryptoasset markets”, the news site reports.

It’s not the first time the watchdog has sent a warning to would-be cryptocurrency investors. Last year, an FCA study revealed that the majority of subjects interviewed about the virtual coins believed that it was “highly likely or inevitable” they would make money, The Daily Telegraph says.

The watchdog likened the “distorted thinking” of investors to “people believing they can out-smart a slot machine”, the newspaper adds.

Is bitcoin in trouble?

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

While the FCA’s review doesn’t explicitly say that bitcoin and its rivals, such as ethereum and Ripple, are under threat from tighter regulation, some analysts believe that the report is a sign of a possible cryptocurrency ban in Britain.

“Although not a ban, [the FCA warning is] a move in that direction,” Herbert Sim, business development chief at Broctagon Fintech Group, told Forbes.

“This lack of enthusiasm is shared by several countries; the US with its scrutiny of libra [Facebook’s own digital coin], and India, who are looking to implement a similar ban on cryptocurrencies which are not state regulated”, he said. “These movements could end up coming back to bite.”

However, Christopher Woolard, strategy and competition director at the FCA, said the watchdog’s warning was simply aimed at clarifying “which cryptoasset activities fall inside our regulatory perimeter”.

“This is a small, complex and evolving market covering a broad range of activities,” he said.

The FCA followed Woolard’s comments by advising customers to “be cautious when investing in such cryptoassets and should ensure they understand and can bear the risks involved with assets that have no intrinsic value”.

It’s worth noting that most aspects of cryptocurrency investment are unregulated and do not fall under the FCA’s Financial Services Compensation Scheme, a “lifeboat fund” that provides compensation when “some types of investment collapse”, the Telegraph says.

Has the news affected prices?

Not at the moment. Bitcoin’s volatility means prices can fluctuate wildly on the back of regulatory news, though values have remained stable in the hours following the FCA’s announcement.

At 10.30am UK time today, bitcoin values were around $10,000 (£8,260) per coin, according to ranking site CoinMarketCap. The digital coin has traded around the $10,000 mark over the past week, after tumbling from its 2019 high of $13,000 (£10,730) earlier this month.

-

Local elections 2026: where are they and who is expected to win?

Local elections 2026: where are they and who is expected to win?The Explainer Labour is braced for heavy losses and U-turn on postponing some council elections hasn’t helped the party’s prospects

-

6 of the world’s most accessible destinations

6 of the world’s most accessible destinationsThe Week Recommends Experience all of Berlin, Singapore and Sydney

-

How the FCC’s ‘equal time’ rule works

How the FCC’s ‘equal time’ rule worksIn the Spotlight The law is at the heart of the Colbert-CBS conflict

-

Why Trump pardoned crypto criminal Changpeng Zhao

Why Trump pardoned crypto criminal Changpeng ZhaoIn the Spotlight Binance founder’s tactical pardon shows recklessness is rewarded by the Trump White House

-

Bitcoin braces for a quantum computing onslaught

Bitcoin braces for a quantum computing onslaughtIN THE SPOTLIGHT The cryptocurrency community is starting to worry over a new generation of super-powered computers that could turn the digital monetary world on its head.

-

The noise of Bitcoin mining is driving Americans crazy

The noise of Bitcoin mining is driving Americans crazyUnder the Radar Constant hum of fans that cool data-centre computers is turning residents against Trump's pro-cryptocurrency agenda

-

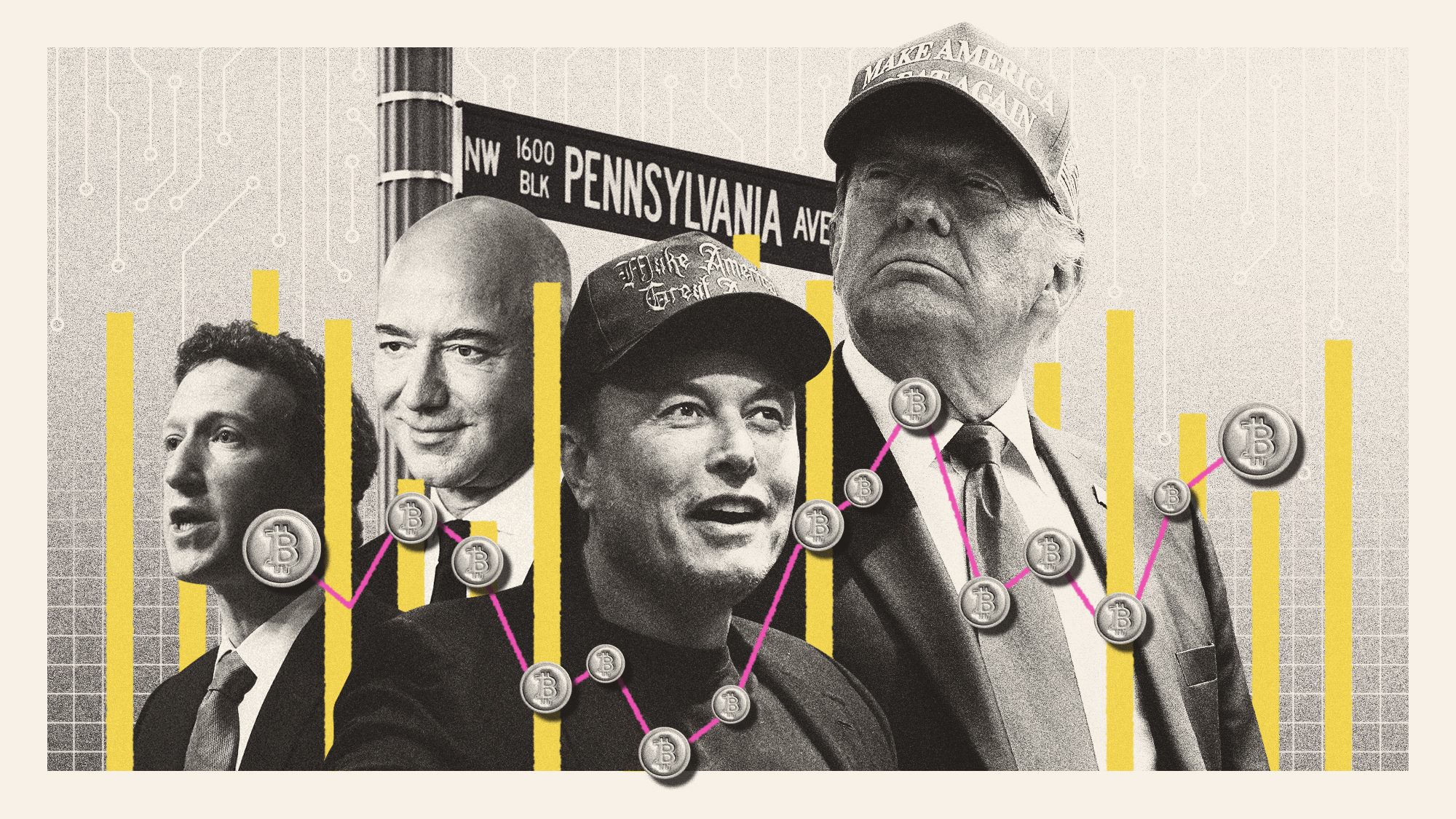

What Trump's win could mean for Big Tech

What Trump's win could mean for Big TechTalking Points The tech industry is bracing itself for Trump's second administration

-

Network states: the tech broligarchy who want to create new countries

Network states: the tech broligarchy who want to create new countriesUnder The Radar Communities would form online around a shared set of 'values' and acquire physical territory, becoming nations with their own laws

-

Paraguay's dangerous dalliance with cryptocurrency

Paraguay's dangerous dalliance with cryptocurrencyUnder The Radar Overheating Paraguayans are pushing back over power outages caused by illegal miners

-

2023: the year of crypto instability

2023: the year of crypto instabilityThe Explainer Crypto reached peaks — and valleys — throughout 2023

-

Sam Bankman-Fried found guilty: where does crypto go from here?

Sam Bankman-Fried found guilty: where does crypto go from here?Today's Big Question Conviction of the 'tousle-haired mogul' confirms sector's 'Wild West' and 'rogue' image, say experts