Bitcoin price: cryptocurrency to set record for ‘longest downward trend’

Experts say investors are switching from virtual currency back to gold

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Bitcoin is on the brink of setting a new record for the “longest downward trend” in value as it continues to lose steam.

The cryptocurrency will take the record, referred to as a “bear market” in the industry, if prices continue to slide in February, says virtual currency news site Bitcoin Exchange Guide.

The longest bear market so far began in December 2013 and ended in January 2015, when prices slipped from roughly $1,230 per coin to $320 (£930 to £240), according to ranking site CoinMarketCap.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Despite recovering to nearly $20,000 (£15,200) in December 2017, prices have been in free-fall since and currently sit at $3,580 (£2,720) as of 9am today UK time.

There’s little to suggest a turnaround is imminent, which experts believe is pushing investors to put their money into other assets.

Speaking to US broadcaster CNBC, Jan Van Eck, chief executive of investment management firm Van Eck Associates, said “we just polled 4,000 bitcoin investors and their number one investment for 2019 is actually gold. So gold lost to bitcoin and now it’s going the other way.”

He added that “bitcoin pulled a little bit of demand away from gold” in 2017, but the pendulum has now swung the other way.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

While Van Eck’s comments will bring little solace to devoted bitcoin investors, Anthony Pompliano, founder of capital management firm Morgan Creek Digital Assets, told crypto site Ethereum World News that bitcoin will not fall much further below the $3,000 (£2,280) mark.

However, he claims that the virtual coin is unlikely to skyrocket in value over the next 12 months and will sit between $2,500 and $4,500 (£1,900 and £3,420) for most of the year.

-

Local elections 2026: where are they and who is expected to win?

Local elections 2026: where are they and who is expected to win?The Explainer Labour is braced for heavy losses and U-turn on postponing some council elections hasn’t helped the party’s prospects

-

6 of the world’s most accessible destinations

6 of the world’s most accessible destinationsThe Week Recommends Experience all of Berlin, Singapore and Sydney

-

How the FCC’s ‘equal time’ rule works

How the FCC’s ‘equal time’ rule worksIn the Spotlight The law is at the heart of the Colbert-CBS conflict

-

Why Trump pardoned crypto criminal Changpeng Zhao

Why Trump pardoned crypto criminal Changpeng ZhaoIn the Spotlight Binance founder’s tactical pardon shows recklessness is rewarded by the Trump White House

-

Bitcoin braces for a quantum computing onslaught

Bitcoin braces for a quantum computing onslaughtIN THE SPOTLIGHT The cryptocurrency community is starting to worry over a new generation of super-powered computers that could turn the digital monetary world on its head.

-

The noise of Bitcoin mining is driving Americans crazy

The noise of Bitcoin mining is driving Americans crazyUnder the Radar Constant hum of fans that cool data-centre computers is turning residents against Trump's pro-cryptocurrency agenda

-

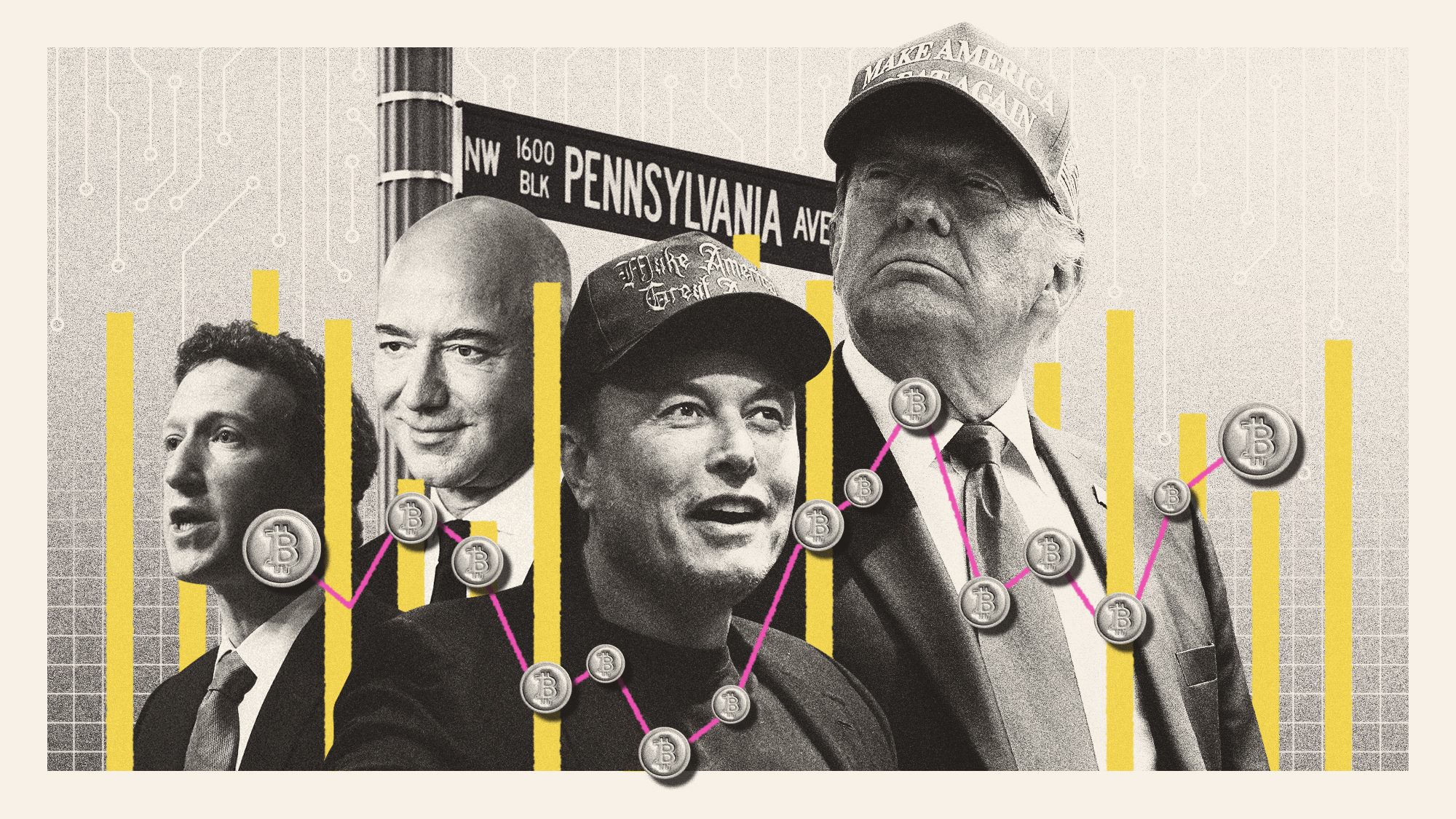

What Trump's win could mean for Big Tech

What Trump's win could mean for Big TechTalking Points The tech industry is bracing itself for Trump's second administration

-

Network states: the tech broligarchy who want to create new countries

Network states: the tech broligarchy who want to create new countriesUnder The Radar Communities would form online around a shared set of 'values' and acquire physical territory, becoming nations with their own laws

-

Paraguay's dangerous dalliance with cryptocurrency

Paraguay's dangerous dalliance with cryptocurrencyUnder The Radar Overheating Paraguayans are pushing back over power outages caused by illegal miners

-

2023: the year of crypto instability

2023: the year of crypto instabilityThe Explainer Crypto reached peaks — and valleys — throughout 2023

-

Sam Bankman-Fried found guilty: where does crypto go from here?

Sam Bankman-Fried found guilty: where does crypto go from here?Today's Big Question Conviction of the 'tousle-haired mogul' confirms sector's 'Wild West' and 'rogue' image, say experts