Bitcoin price: why has the cryptocurrency’s value nosedived?

Some analysts are predicting a bull run later this year

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Bitcoin prices nosedived once again over the weekend following a month of gains, stalling the cryptocurrency’s recovery.

Values had risen from a low of $3,400 (£2,600) per coin on 8 February to Friday morning’s peak price of $4,190 (£2,005), according to ranking site CoinMarketCap.

But the virtual currency’s values plummeted suddenly on Friday afternoon, with about $400 wiped off the price of each bitcoin in the space of an hour, the website reports. As of 9am UK time today, the price sat at about $3,830 (£2,930).

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Bitcoin rivals including Etherum and Ripple also saw declines of around 5% over the weekend, Forbes reports.

Although the cause of the market’s sudden downturn was “not immediately apparent”, the drop may be the result of “traders and investors profit-taking and flooding the market with surplus digital tokens”, the business news site says.

The Daily Express notes that there is still a “widespread apathy in terms of open interest” around bitcoin, despite a boost to the market earlier this month when banking giant J.P. Morgan announced it was launching its own internal cryptocurrency.

“There’s still a huge amount of uncertainty around cryptocurrencies, and that is being reflected in market movement,” the newspaper says.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Despite the latest setbacks, some analysts are hopeful that the virtual coin will bounce back this year.

As cryptocurrency news site CoinDesk points out, the current market trend is very similar to bitcoin’s fluctuating values in early 2015. Back then, bitcoin entered a bull run in October, and experts believe the virtual currency may follow the same path in late 2019.

-

The ‘ravenous’ demand for Cornish minerals

The ‘ravenous’ demand for Cornish mineralsUnder the Radar Growing need for critical minerals to power tech has intensified ‘appetite’ for lithium, which could be a ‘huge boon’ for local economy

-

Why are election experts taking Trump’s midterm threats seriously?

Why are election experts taking Trump’s midterm threats seriously?IN THE SPOTLIGHT As the president muses about polling place deployments and a centralized electoral system aimed at one-party control, lawmakers are taking this administration at its word

-

‘Restaurateurs have become millionaires’

‘Restaurateurs have become millionaires’Instant Opinion Opinion, comment and editorials of the day

-

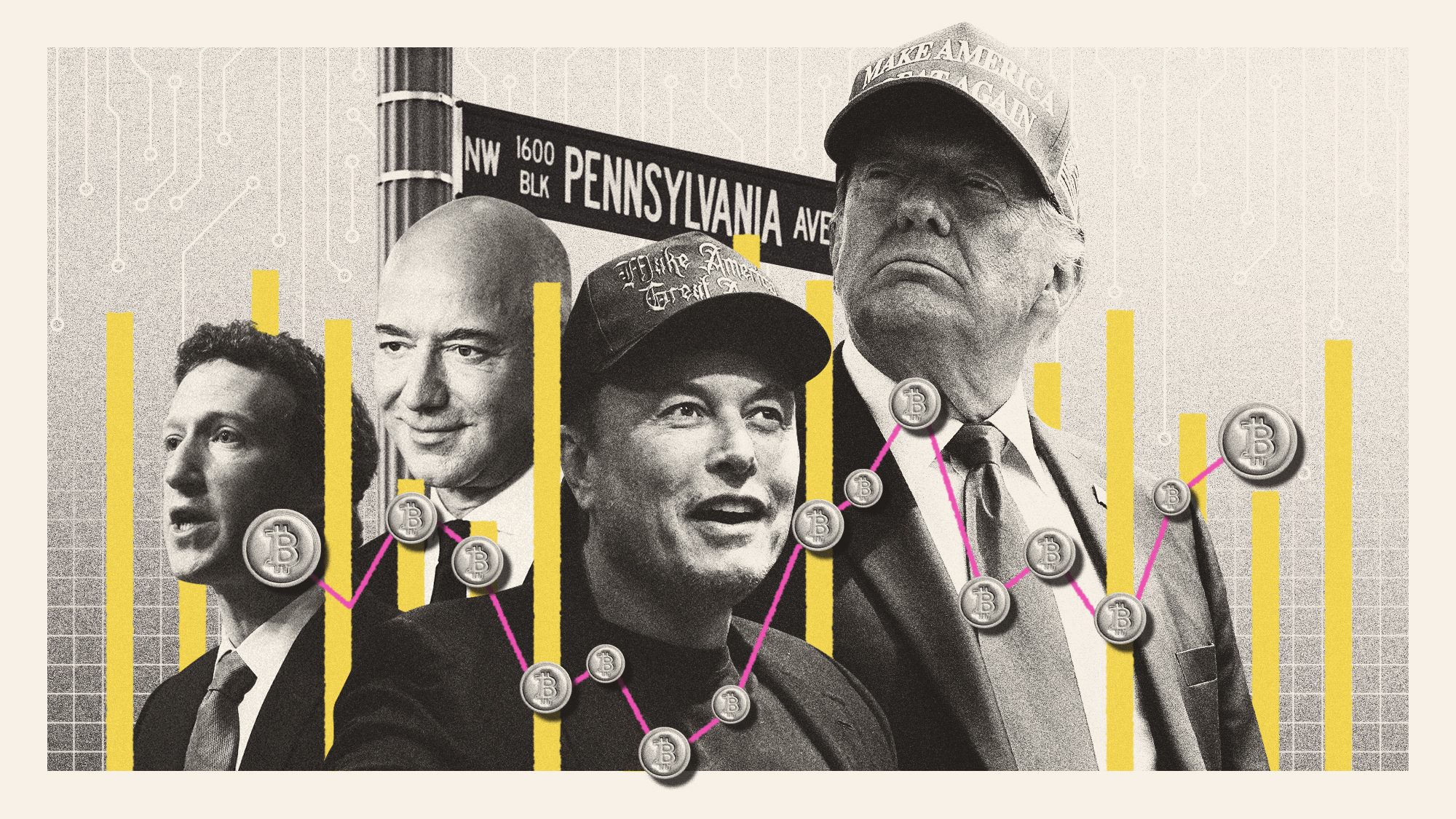

Why Trump pardoned crypto criminal Changpeng Zhao

Why Trump pardoned crypto criminal Changpeng ZhaoIn the Spotlight Binance founder’s tactical pardon shows recklessness is rewarded by the Trump White House

-

Bitcoin braces for a quantum computing onslaught

Bitcoin braces for a quantum computing onslaughtIN THE SPOTLIGHT The cryptocurrency community is starting to worry over a new generation of super-powered computers that could turn the digital monetary world on its head.

-

The noise of Bitcoin mining is driving Americans crazy

The noise of Bitcoin mining is driving Americans crazyUnder the Radar Constant hum of fans that cool data-centre computers is turning residents against Trump's pro-cryptocurrency agenda

-

What Trump's win could mean for Big Tech

What Trump's win could mean for Big TechTalking Points The tech industry is bracing itself for Trump's second administration

-

Network states: the tech broligarchy who want to create new countries

Network states: the tech broligarchy who want to create new countriesUnder The Radar Communities would form online around a shared set of 'values' and acquire physical territory, becoming nations with their own laws

-

Paraguay's dangerous dalliance with cryptocurrency

Paraguay's dangerous dalliance with cryptocurrencyUnder The Radar Overheating Paraguayans are pushing back over power outages caused by illegal miners

-

2023: the year of crypto instability

2023: the year of crypto instabilityThe Explainer Crypto reached peaks — and valleys — throughout 2023

-

Sam Bankman-Fried found guilty: where does crypto go from here?

Sam Bankman-Fried found guilty: where does crypto go from here?Today's Big Question Conviction of the 'tousle-haired mogul' confirms sector's 'Wild West' and 'rogue' image, say experts