What will happen if VAT is added to school fees?

Rumours that a Labour government will carry out its threat to charge VAT on school fees continue to grow

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

The introduction of VAT on private school fees has been on the Labour Party's agenda since they published their 2019 manifesto. If they come to power at the general election later this year, it is very likely they will introduce the 20 per cent tax. With parents already feeling the pinch from rapidly rising costs of education, an average of 8 per cent last year, and schools coming under financial pressure with teacher pension schemes, increased energy prices and wage inflation, we try to unpick what could happen if VAT is introduced.

Will VAT be added to school fee bills?

''The school doesn't have to pass this on to parents in fees. And each of the schools is going to have to ask themselves whether that's what they want to do,'' says Labour leader Sir Keir Starmer. The big question on most parent's minds is: will 20 per cent be added to my fees or will schools absorb it? The short answer is most probably a combination of both. VAT is a consumer tax and therefore you should expect to see it on your school bill. However, due to the likelihood of this added cost being unavoidable for many – an Independent Schools Council (ISC) survey suggests as many as 20 per cent of parents would withdraw their children – schools may do their bit to help. This could be done by reducing school fees but this is at the discretion of each school and will depend on the strength of their business as to how much support they can offer.

Will VAT be charged on paying fees in advance?

Many schools have suggested that parents who are able to, should consider paying fees upfront. VAT is charged at the point the service is supplied, so it will be added to your school fee bill when it is issued. Where fees have been paid upfront prior to the introduction of VAT, however, in principle the tax would not be due. The Independent Schools' Bursars Association says the government could pass new taxation laws to change VAT rules retrospectively, but few think this is likely.

Is VAT charged on boarding fees?

There is discussion over whether VAT can only be charged to some elements of educational 'supplies' made by schools. Accommodation, or the boarding part of education, may be treated as VAT exempt, but this depends on what the law states. Under the 28 day rule applied to hotel accommodation, this could be 4 per cent. However, there could be a difference between a 'traveller' and living in 'residential accommodation', so it is likely VAT will be applied to boarding fees, including state boarding.

How will VAT impact discounted fees or bursaries?

With around a third of children receiving some kind of financial support with school fees, according to the ISC many families on discounted fees will be impacted. If you have a full bursary and the education is provided free of charge, then no VAT can be attached.

Is VAT still charged if fees are paid by a grandparent or trust?

Yes, this is still considered a 'supply' of education paid by one person for the child, so VAT is charged.

How soon can VAT be imposed?

Labour has said it will bring in the change within a year of getting in power; however, expect it to be sooner rather than later, to maximise tax revenues. A law can be passed whenever a Labour government chooses, either as part of a new budget or independently as a 'money bill'.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

What will this mean for smaller schools and special educational needs (SEN) schools?

Whilst large schools may be better financially resourced, many smaller private schools will face bigger challenges. Some prep schools, foreign language schools and faith schools may be forced to close. Another important question surrounds whether SEN schools, in which many children are funded by local authorities, will be exempt from VAT.

What are schools doing?

Most schools have been scenario planning and scrutinising their cost base and fee structures. Joanna Wright, Head of King Edward's Witley, says: "We should remain calm and have confidence in our schools' capacity to provide an outstanding education... We share a common purpose." Many schools have been busy assessing their business models, diversifying and increasingly consolidating. Nicholas Dodd, COO of Bryanston School which merged with Knighton House in 2021, says: "We are planning for what may be coming down the line and being very proactive in responding to cost shocks and the national economic situation. We always look forwards, looking at opportunities whilst focusing on our main proposition."

What can parents do?

Communicate with your school and ask what plans are in place and what the options are. Work with them to help with this highly charged political campaign, pointing out all the other things private schools do in helping communities through local partnerships and employment. "Parent advocacy is very important. We must promote all the great things schools do and help raise awareness of why the imposition of VAT on school fees will have the greatest impact on hard working parents who are already making sacrifices in order to pay school fees," says King Edward's Witley's Joanna Wright. All parents should plan for what may come, this year or in the future. "Making the commitment to paying school and university fees is a long-term commitment covering potentially two decades. Many parents are already financial planning and considering that they might have to make further sacrifices," adds Bryanston's Nicholas Dodd.

Although we cannot be sure the Labour Party will win the general election, the implication of VAT on school fees weighs heavily on the minds of many parents and schools up and down the country. The impact on people – existing and new parents, staff, local communities, suppliers and, potentially, many children – will be significant. Whilst schools pore over the finances and the impact of VAT on their businesses, some families may consider private education to be off the table.

This article first appeared in The Week's Independent Schools Guide Spring/Summer 2024.

-

Political cartoons for February 15

Political cartoons for February 15Cartoons Sunday's political cartoons include political ventriloquism, Europe in the middle, and more

-

The broken water companies failing England and Wales

The broken water companies failing England and WalesExplainer With rising bills, deteriorating river health and a lack of investment, regulators face an uphill battle to stabilise the industry

-

A thrilling foodie city in northern Japan

A thrilling foodie city in northern JapanThe Week Recommends The food scene here is ‘unspoilt’ and ‘fun’

-

American universities are losing ground to their foreign counterparts

American universities are losing ground to their foreign counterpartsThe Explainer While Harvard is still near the top, other colleges have slipped

-

Education: More Americans say college isn’t worth it

Education: More Americans say college isn’t worth itfeature College is costly and job prospects are vanishing

-

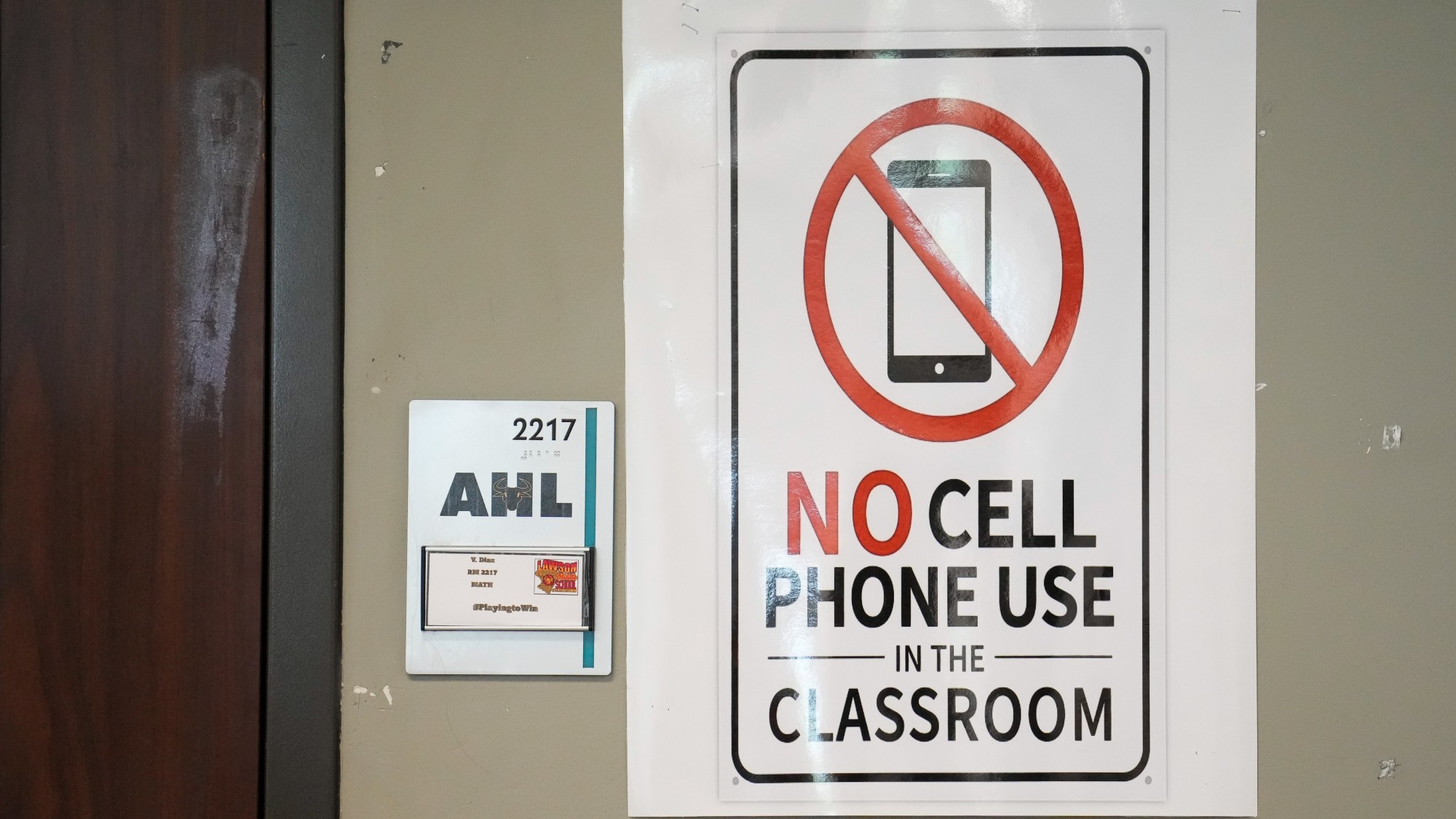

The pros and cons of banning cellphones in classrooms

The pros and cons of banning cellphones in classroomsPros and cons The devices could be major distractions

-

School phone bans: Why they're spreading

School phone bans: Why they're spreadingFeature 17 states are imposing all-day phone bans in schools

-

Schools: The return of a dreaded fitness test

Schools: The return of a dreaded fitness testFeature Donald Trump is bringing the Presidential Fitness Test back to classrooms nationwide

-

Columbia: A justified surrender to Trump?

Columbia: A justified surrender to Trump?Feature Columbia agrees to a $221M settlement and new restrictions to restore federal funding

-

Send reforms: government's battle over special educational needs

Send reforms: government's battle over special educational needsThe Explainer Current system in 'crisis' but parents fear overhaul will leave many young people behind

-

Education: America First vs. foreign students

Education: America First vs. foreign studentsFeature Trump's war on Harvard escalates as he blocks foreign students from enrolling at the university