Will Europe face an energy crisis again this winter?

Unpredictable gas markets threaten to cause further problems and price hikes

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Countries across Europe are bracing for another energy crisis amid warnings about volatile gas markets and higher prices as winter approaches.

The "sudden energy shock" following Russia's invasion of Ukraine last year triggered fears that Europe's energy infrastructure wouldn't cope when the cold set in, potentially "causing economies to crumble", said Michael Bradshaw, professor of global energy at Warwick Business School, in an article on The Conversation. But a mild winter coupled with EU moves to reduce energy consumption and pivot away from Russian fuel dependency "saw it emerge shaken but not beaten".

Now, however, a combination of factors could "easily renew market tensions", the International Energy Agency has warned. Despite price drops and successful efforts to fill gas storage facilities, "major uncertainties remain ahead of the upcoming heating season", according to the watchdog's latest annual gas market report.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

What has happened to energy prices?

Prices in the EU have been falling since June 2022, when energy inflation exceeded 40%. As winter drew to a close last February, Energy inflation stood at 16.6%, "considerably lower" than the 28.7% reported for the same period in the previous year, said Euronews.

Gas-reliant nations including Germany and Italy "pivoted from Russian dependency without major electricity shortages" and price hikes, said Bradshaw on The Conversation, and "there has been more good news" since then.

Energy prices have continued to fall "steadily" in 2023, and Europe’s gas storage levels are on course to reach the 100% capacity target by November.

But while some politicians have have insisted that "the worst of the energy crisis is over", Bradshaw added, "it's a little early to be so confident".

What may change in the coming months?

Simulations by the International Energy Agency (IEA) have indicated that a cold winter combined with a full halt of Russian gas supplies could bring fresh disruptions to the European market. "Full storage sites are no guarantee against market volatility during the winter," the watchdog said.

Analysts told CNBC that the “very volatile” situation could result in a "massive upswing" in prices by the end of the year.

Markets have been "constantly fluctuating" in recent months as a result of a other factors including extreme heat and maintenance at gas plants, the news site reported. Industrial action at major liquefied natural gas facilities in Australia has also had knock-on effects. Although much of the gas sourced from Australia goes to Japan, China and South Korea, the disruption "is likely to result in Asia and Europe competing" for gas from other suppliers.

Lower gas consumption and the filling of storage facilities have "helped to prevent gas prices from skyrocketing to last summer's extraordinary peak of 340 euros" per megawatt hour, CNBC added.

But given the uncertainty in Australia, "Europe should brace itself for more volatility and an increase in prices", said Ana Maria Jaller-Makarewicz, an energy analyst at the Institute for Energy Economics and Financial Analysis, in a research note.

Gas markets are becoming "riskier", she wrote, and the "uncertainty of future events" makes it "extremely difficult to predict" how supply and demand could be balanced and how much prices could rise.

How else is Europe preparing for the winter?

Europe's energy crisis last winter was "severely worsened" when "vital electricity exporter" France was forced to switch off more than a dozen of its nuclear reactors last winter, said BNN Bloomberg. But Electricite de France SA insists it has now "overcome the issues that cut its atomic energy output by almost a quarter in 2022", raising hopes that European households and businesses "won't have to suffer the threats of blackouts or demands to make drastic demand cutbacks that dominated last winter".

In the UK, Ofgem's CEO Jonathan Brearley has called for ministers to implement a "more rigorous framework" to further protect consumers from rising energy prices. Brearley told The Guardian that the energy price cap was a "broad and crude" mechanism that was "no longer fit for purpose", with a record number of consumers already in debt to their energy supplier.

The "harsh reality", said Bradshaw on The Conversation, is that in order to avoid "significant gas pierce spikes", Europe must hope for mild winters for the next two or three years, and no major interruptions to gas supply.

European gas prices remain at around 50% above pre-invasion long-run averages, he pointed out.

But on a more positive note, Bradshaw added, European energy reduction plans should see gas demand get "significantly lower", dropping by 40% by 2030.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Keumars Afifi-Sabet is a freelance writer at The Week Digital, and is the technology editor on Live Science, another Future Publishing brand. He was previously features editor with ITPro, where he commissioned and published in-depth articles around a variety of areas including AI, cloud computing and cybersecurity. As a writer, he specialises in technology and current affairs. In addition to The Week Digital, he contributes to Computeractive and TechRadar, among other publications.

-

Properties of the week: pretty thatched cottages

Properties of the week: pretty thatched cottagesThe Week Recommends Featuring homes in West Sussex, Dorset and Suffolk

-

The week’s best photos

The week’s best photosIn Pictures An explosive meal, a carnival of joy, and more

-

The ‘ravenous’ demand for Cornish minerals

The ‘ravenous’ demand for Cornish mineralsUnder the Radar Growing need for critical minerals to power tech has intensified ‘appetite’ for lithium, which could be a ‘huge boon’ for local economy

-

Zero-bills homes: how you could pay nothing for your energy

Zero-bills homes: how you could pay nothing for your energyThe Explainer The scheme, introduced by Octopus Energy, uses ‘bill-busting’ and ‘cutting-edge’ technology to remove energy bills altogether

-

Pros and cons of geothermal energy

Pros and cons of geothermal energyPros and Cons Renewable source is environmentally friendly but it is location-specific

-

Builders return to the stone age

Builders return to the stone ageUnder the Radar With brick building becoming ‘increasingly unsustainable’, could a reversion to stone be the future?

-

Eel-egal trade: the world’s most lucrative wildlife crime?

Eel-egal trade: the world’s most lucrative wildlife crime?Under the Radar Trafficking of juvenile ‘glass’ eels from Europe to Asia generates up to €3bn a year but the species is on the brink of extinction

-

Megabatteries are powering up clean energy

Megabatteries are powering up clean energyUnder the radar They can store and release excess energy

-

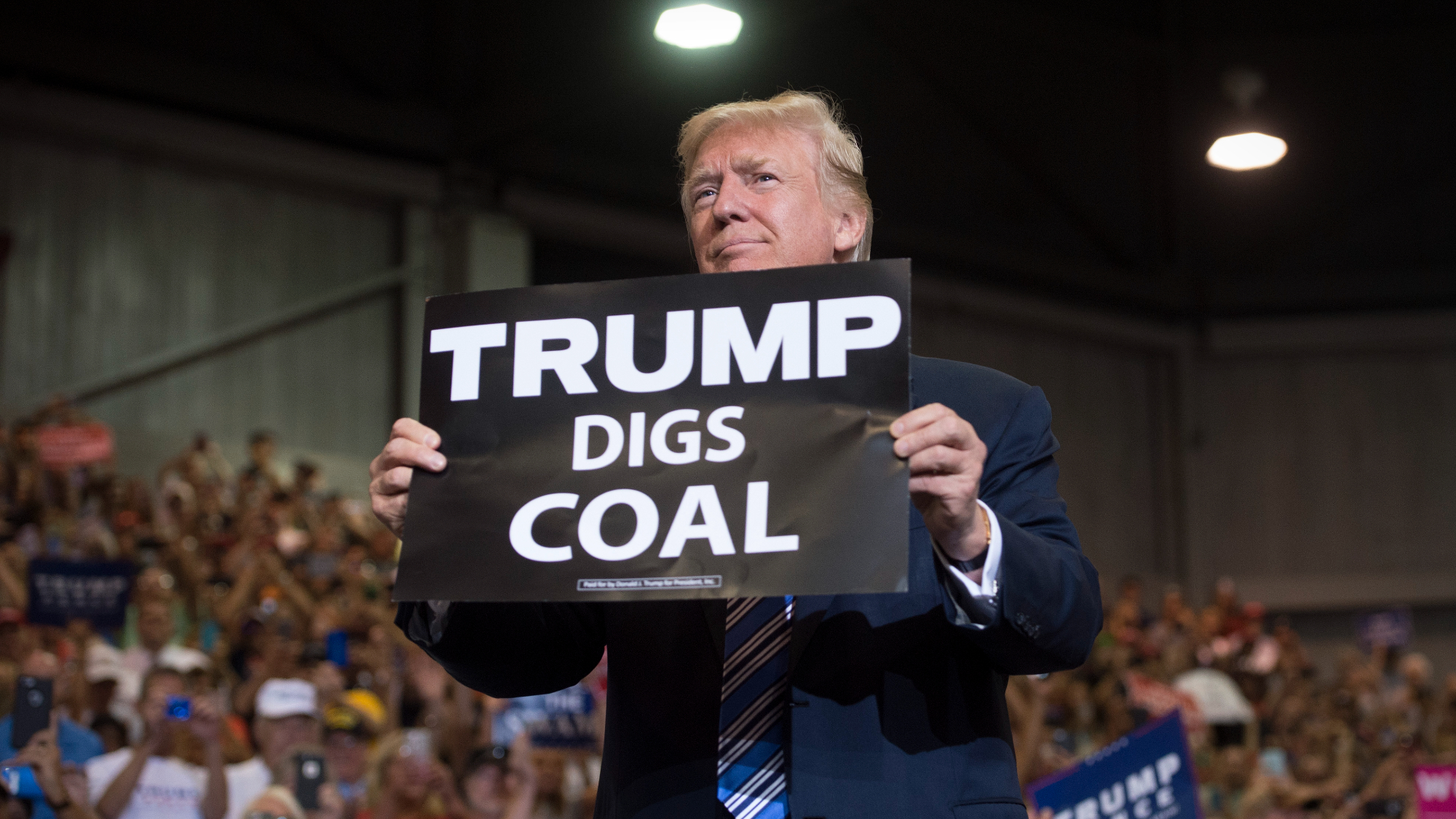

Renewables top coal as Trump seeks reversal

Renewables top coal as Trump seeks reversalSpeed Read For the first time, renewable energy sources generated more power than coal, said a new report

-

EPA is reportedly killing Energy Star program

EPA is reportedly killing Energy Star programspeed read The program for energy-efficient home appliances has saved consumers billions in energy costs since its 1992 launch

-

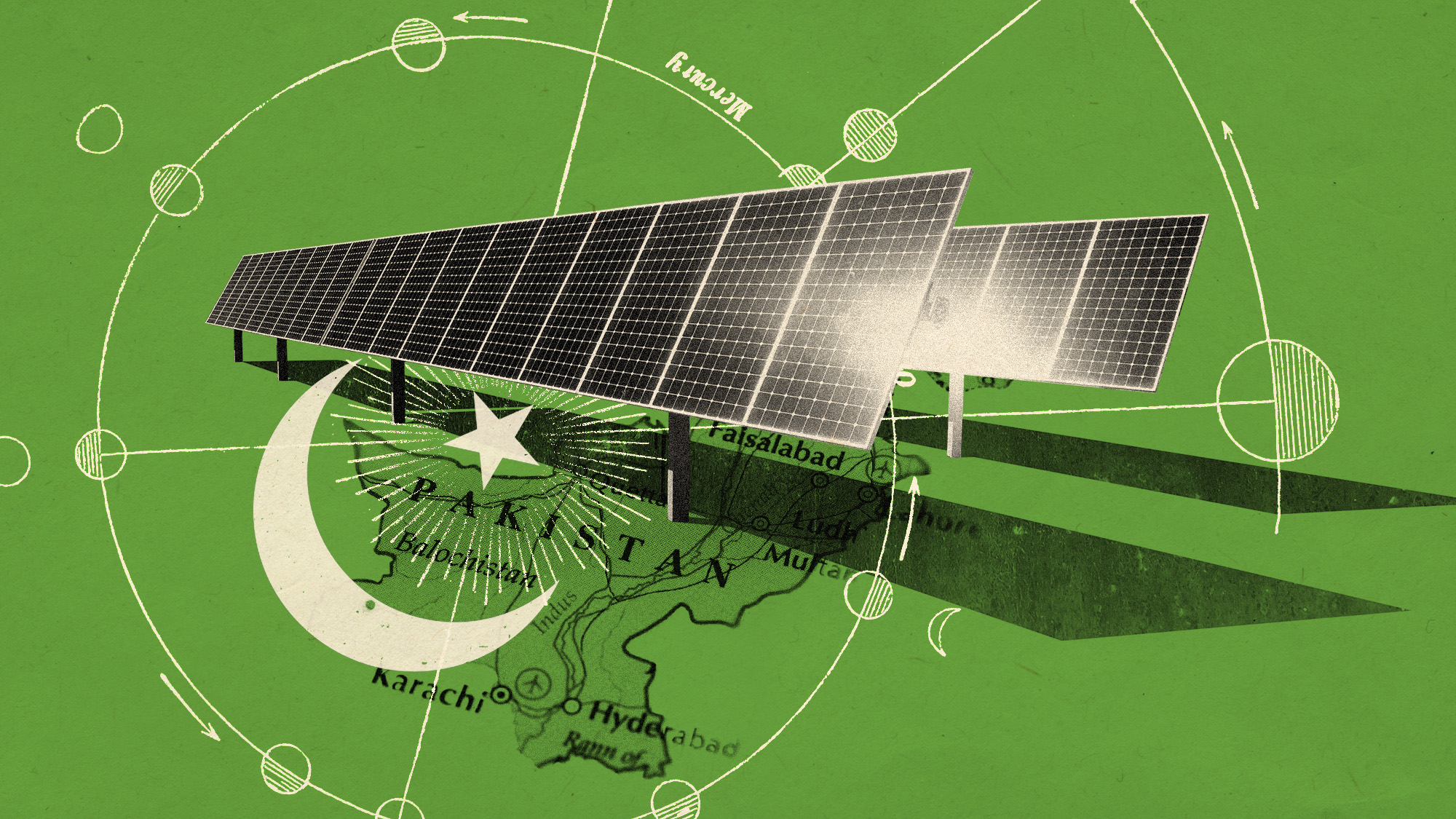

Pakistan's solar panel boom

Pakistan's solar panel boomUnder The Radar A 'perfect storm' has created a solar 'revolution' in the south Asian country