A beginner's guide to passive income

Smart ideas for making money with low-maintenance investments

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Making money without even trying might sound too good to be true — but there are ways to do it. Unlike the "active" income you earn from, say, your 9-to-5 job, "passive" income is a stream of cash that flows without regular work on your part.

But before you jump in and start buying up apartments to rent or dividend stocks, it's important to understand everything that passive income entails. Some sources are more passive than others, and there are tax implications to consider.

What is passive income?

Passive income is money you make "without a large amount of additional work added to your day-to-day routine," said Kiplinger. Examples of passive income include dividends earned from stocks, income from a rental property and royalties from an e-book you published.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

The aim of passive income is to generate an additional source of income alongside the money you're bringing in from your job and other places. Doing so can "help you to grow your savings and increase cash flow," Kiplinger said.

What to know before setting up a passive income stream

You'll want to start by being realistic about how much time, effort and money you want to sink into your passive income project.

Typically, you will need "startup capital" to get your passive income endeavors off the ground, said Investopedia. "To develop a meaningful passive income stream from financial assets like cash-equivalents, stocks and bonds, you'll need a decent account balance." That said, there are some passive income streams that require a type of initial investment that isn't necessarily monetary, such as talent or time.

When determining which passive income stream is a good fit for you, it is also helpful to assess what skillsets you already have. Do you already have experience with investing? Do you know how to create online content or courses? By zeroing in an area in which you already have some knowledge and experience, you can cut down on the time involved.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

But regardless of your familiarity with your chosen income stream, you'll likely need to put in some time at the outset to get the ball rolling. The amount of time involved will vary depending on your chosen method. For instance, opening a high-yield savings account or a certificate of deposit (CD) only takes a bit of research up front, plus some time invested in opening the account. Real estate investing, meanwhile, can be far from passive.

It's also important to realistically assess the risk involved. Some passive income endeavors are riskier than others, and you'll want to ensure you are only taking on as much risk as you're comfortable with. For example, if you create a course that flops, your only loss would be the time it took for you to make it. But if you buy a potential rental property that ends up needing extensive repairs, that presents a much higher level of financial risk.

And last but certainly not least, you will want to factor taxes into the equation. Usually "net income from passive income investments is reported as ordinary income," said Good Financial Cents, with the exception of capital gains income.

4 passive income ideas to consider

Now that you've read up on the basics of passive income, you can start thinking of some ways to earn it. Here are four of the most reliable sources of passive income.

Dividend investments

This can include dividend stocks as well as dividend index funds and exchange-traded funds (ETFs). In either case, you'll get a regular payout of a portion of a company's profits. However, income is not guaranteed; companies may have to decrease dividends or could become unable to pay them.

To get started, you'll need to open a brokerage account. Also note that "you likely will have to tie up thousands, if not tens or hundreds of thousands, of dollars to earn significant income from dividend stocks," said Forbes.

Bonds and bond index funds

Bonds allow investors to lend money to companies, as opposed to taking an ownership stake like they would when investing in stocks. Investors will then earn interest income.

For those who are more risk-averse, such as individuals approaching retirement, bonds can be a safer bet "because of their lower volatility and relative safety compared to stocks," said NerdWallet. However, they will also "generally earn a lower return on your investment."

High-yield savings accounts or CDs

The trick to making investing in a high-yield CD or savings account a solid stream of passive income is to search for the top rates. Often, you'll find those at online banks.

Plus, said Bankrate, "investing in a CD or savings account is about as safe a return as you can find." The downside is that returns might not be as impressive.

REITs

While your initial instinct might be to invest in physical real estate to generate investment income, that can come with a lot of headaches and more time investment than you may want. An alternative way to earn passive income through real estate is by investing in a real estate investment trust (REIT).

REITs "own and manage income-producing properties and distribute the profits to investors," said Good Financial Cents. In some cases, you may need to be an accredited investor, though other platforms make real estate investing more accessible.

Becca Stanek has worked as an editor and writer in the personal finance space since 2017. She previously served as a deputy editor and later a managing editor overseeing investing and savings content at LendingTree and as an editor at the financial startup SmartAsset, where she focused on retirement- and financial-adviser-related content. Before that, Becca was a staff writer at The Week, primarily contributing to Speed Reads.

-

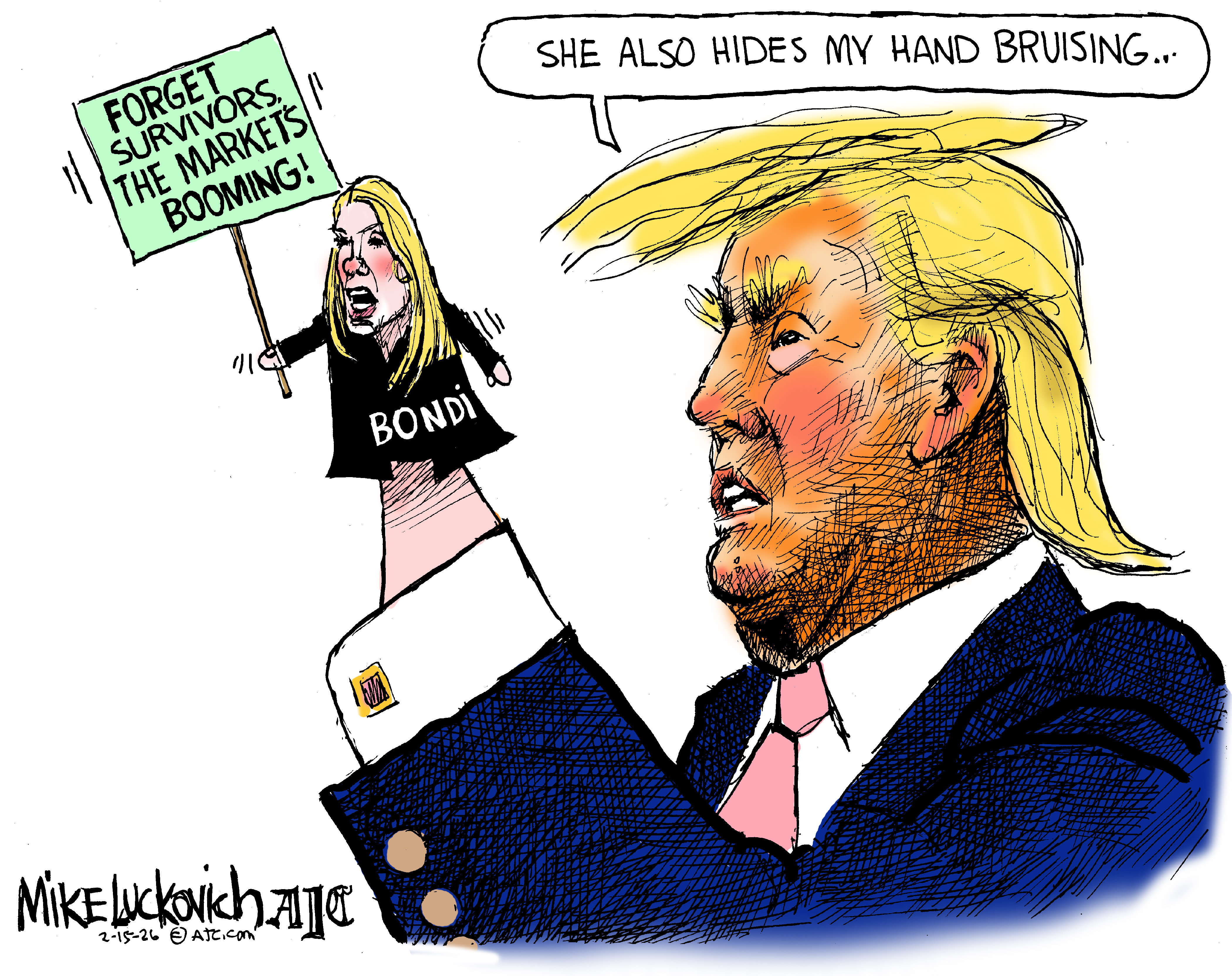

Political cartoons for February 15

Political cartoons for February 15Cartoons Sunday's political cartoons include political ventriloquism, Europe in the middle, and more

-

The broken water companies failing England and Wales

The broken water companies failing England and WalesExplainer With rising bills, deteriorating river health and a lack of investment, regulators face an uphill battle to stabilise the industry

-

A thrilling foodie city in northern Japan

A thrilling foodie city in northern JapanThe Week Recommends The food scene here is ‘unspoilt’ and ‘fun’

-

How to juggle saving and paying off debt

How to juggle saving and paying off debtthe explainer Putting money aside while also considering what you owe to others can be a tricky balancing act

-

Filing statuses: What they are and how to choose one for your taxes

Filing statuses: What they are and how to choose one for your taxesThe Explainer Your status will determine how much you pay, plus the tax credits and deductions you can claim

-

The pros and cons of tapping your 401(k) for a down payment

The pros and cons of tapping your 401(k) for a down paymentpros and cons Does it make good financial sense to raid your retirement for a home purchase?

-

3 tips to help protect older family members from financial scams

3 tips to help protect older family members from financial scamsthe explainer Prevent your aging relatives from losing their hard-earned money

-

Saving for a down payment on a house? Here is how and where to save.

Saving for a down payment on a house? Here is how and where to save.the explainer The first step of the homebuying process can be one of the hardest

-

What would a credit card rate cap mean for you?

What would a credit card rate cap mean for you?the explainer President Donald Trump has floated the possibility of a one-year rate cap

-

Do you have to pay taxes on student loan forgiveness?

Do you have to pay taxes on student loan forgiveness?The Explainer As of 2026, some loan borrowers may face a sizable tax bill

-

Planning a move? Here are the steps to take next.

Planning a move? Here are the steps to take next.the explainer Stay organized and on budget