Small banks vs. big banks: Where should you put your money?

After the collapse of Silicon Valley Bank, big banks have seen an influx of deposits. But bigger isn't always better.

On the heels of Silicon Valley Bank's collapse, which marked the country's biggest bank failure since the 2008 financial crisis, depositors may have started second-guessing where they bank. In fact, Bloomberg reports that as the banking turmoil has continued to unfold, some of the biggest banks have seen an influx of deposits. JPMorgan Chase & Co. "received billions of dollars in recent days, and Bank of America Corp., Citigroup Inc., and Wells Fargo & Co. are also seeing higher-than-usual volume." Similarly, Fortune reported that Bank of America "brought in more than $15 billion in deposits as SVB sunk," which reportedly "came from fearful customers moving their money."

Why this dash to the big banks? Well, as Michael Imerman, an assistant professor at the University of California Irvine's business school, told Bloomberg, it seems that the "top six banks in the U.S. are and have been too big to fail," which leaves consumers believing that "it's safer to go with a name with higher degree of certainty."

But is banking big really better? As it turns out, there are benefits and drawbacks to both big banks and small banks. As MyBank Tracker contends, "when it comes to big banks vs. small banks the winner isn't always clear."

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Big banks vs. small banks

Perhaps the largest difference between small banks and big banks is the range of financial products and services they can offer. Big banks are generally capable of offering a larger variety compared to smaller, local banks, which may tailor their offerings to the population they serve. This range also extends to ATM networks and branch locations; you'll generally find more sprawling ATM networks and more branch locations with a big bank as compared to a small bank.

However, small banks can win out when it comes to fees and interest rates, as personal finance company SoFi notes that small banks "may charge fewer and/or lower fees and offer more competitive rates on deposit accounts and loans." Service can be more personalized at smaller banks than their behemoth counterparts. But when it comes to technology, it's likely that big banks are out ahead, with a great attention to mobile and online banking experiences.

What about safety?

When it comes to safety, there's no discernible difference between small banks and big banks. "As with bigger institutions, local banks are safe banking options as long as they're federally insured," Insider says.

When a bank is insured by the Federal Deposit Insurance Corporation (FDIC), funds deposited in an account are insured up to $250,000 in individual accounts and $500,000 in joint accounts. If a bank were to collapse, as happened with SVB, your funds would get transferred to another federally insured bank or you would receive a check for the amount.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

To find out if a bank is federally insured, you can look it up online using the BankFind Suite tool, or you can call your bank, the FDIC, or the National Credit Union Administration (NCUA) if it's a credit union. Also look for signage at branch offices and markings in materials, for example in the rate comparison table below, that will identify the institution as an FDIC or NCUA member.

When you apply via links on our site, we may earn an affiliate commission.

What are the benefits and drawbacks of banking locally?

To truly decide whether big banks vs. small banks win out for you, it helps to assess the pros and cons. Here's a look at the advantages and disadvantages that small, local banks can offer:

Pros

Cons

- Often lower fees

- More personalized service

- Convenience of local proximity

- Greater willingness to negotiate and work with customers

- More community-oriented

- Generally fewer products and services than big banks

- Often geographically limited in reach

- Fewer branches and ATMs

- Less robust technology

- More limited customer service

What are the benefits and drawbacks of using a big bank?

Meanwhile, here are the pros and cons of big banks to note:

Pros

Cons

- Wider range of products and services

- Usually more ATMs and branch locations

- Often better, more up-to-date technology

- Greater ease banking abroad

- More around-the-clock customer support

- May charge more and higher fees

- Generally offer lower interest rates

- Usually a more standardized customer approach

- Less community-focused

- Potentially less flexible on requirements, and longer application processing

Are there other banking options to consider?

Big and small banks aren't the only types of institutions where you can deposit your money. Credit unions are another option. These not-for-profit institutions are created and owned by their customers, who are called members.

While credit unions tend to offer fewer products and services, as well as fewer physical branches and ATMs, members see better rates and fewer fees. Credit unions also may offer more flexibility in requirements for loans.

Credit unions are known for their community-focused approach and more personal customer service, though depositors "shouldn't assume that you'll get more personal service at a small bank, or less personal service at a big bank," Investopedia says.

How should you choose where to bank?

Your choice of a bank should ultimately be based on "the compatibility of its services and features with your banking needs," Investopedia says.

Finding a bank that fits the bill can take some shopping around. As you look, you'll want to take into consideration if a bank's services and product offerings meet your needs and what rates and fees a bank charges. Also think about whether you'll want to go to brick-and-mortar branches or if you're comfortable doing everything online, which also raises the question of how technologically-friendly a bank is. Look at questions of accessibility: Are branches and ATMs conveniently located? Is customer support readily available and through what methods?

And last but certainly not least, make sure that any institution you're considering is federally insured — either FDIC-insured if it's a bank, or NCUA-insured if it's a credit union.

Becca Stanek has worked as an editor and writer in the personal finance space since 2017. She has previously served as the managing editor for investing and savings content at LendingTree, an editor at SmartAsset and a staff writer for The Week.

Becca Stanek has worked as an editor and writer in the personal finance space since 2017. She previously served as a deputy editor and later a managing editor overseeing investing and savings content at LendingTree and as an editor at the financial startup SmartAsset, where she focused on retirement- and financial-adviser-related content. Before that, Becca was a staff writer at The Week, primarily contributing to Speed Reads.

-

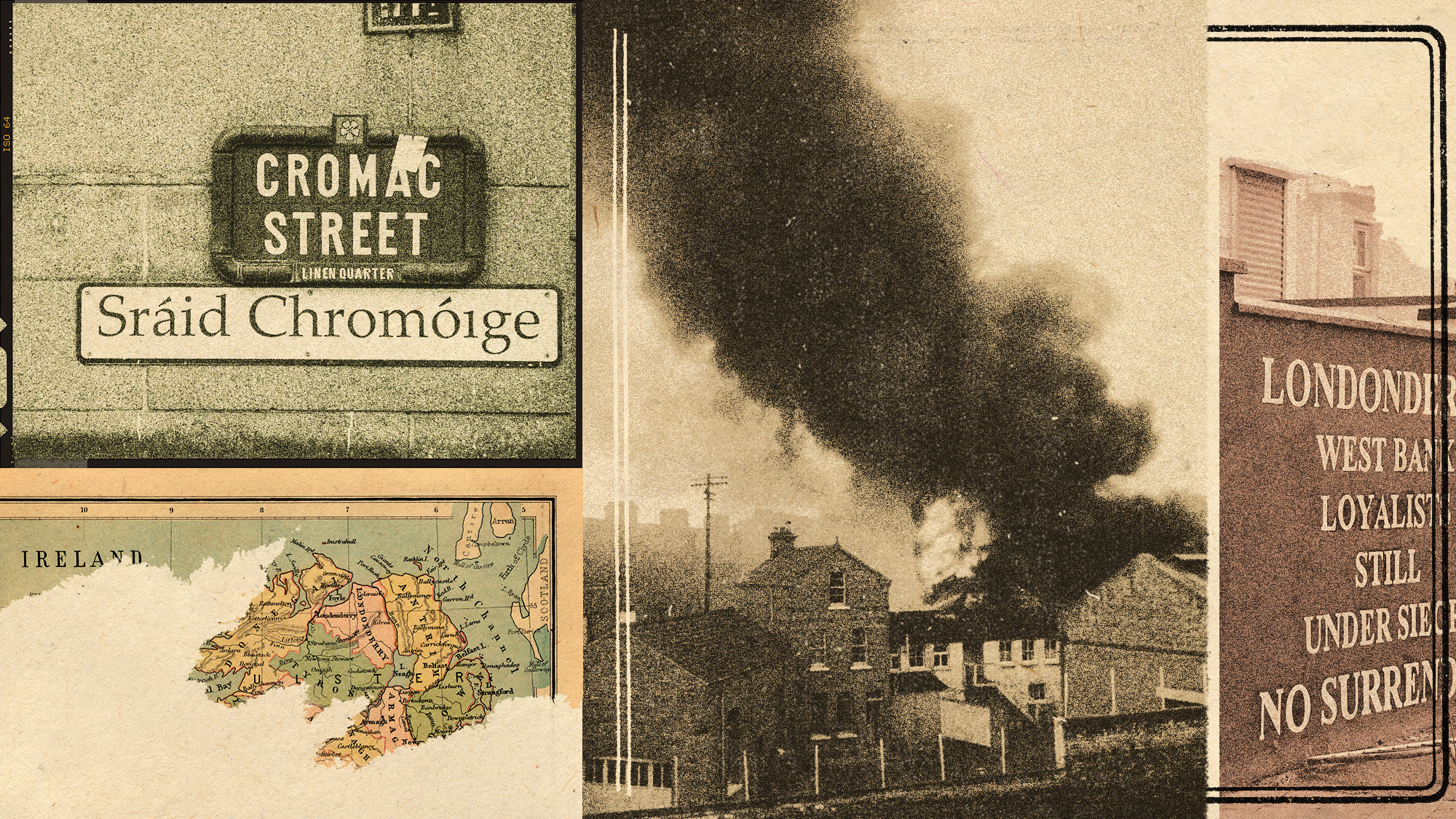

The battle over the Irish language in Northern Ireland

The battle over the Irish language in Northern IrelandUnder the Radar Popularity is soaring across Northern Ireland, but dual-language sign policies agitate division as unionists accuse nationalists of cultural erosion

-

Villa Treville Positano: a glamorous sanctuary on the Amalfi Coast

Villa Treville Positano: a glamorous sanctuary on the Amalfi CoastThe Week Recommends Franco Zeffirelli’s former private estate is now one of Italy’s most exclusive hotels

-

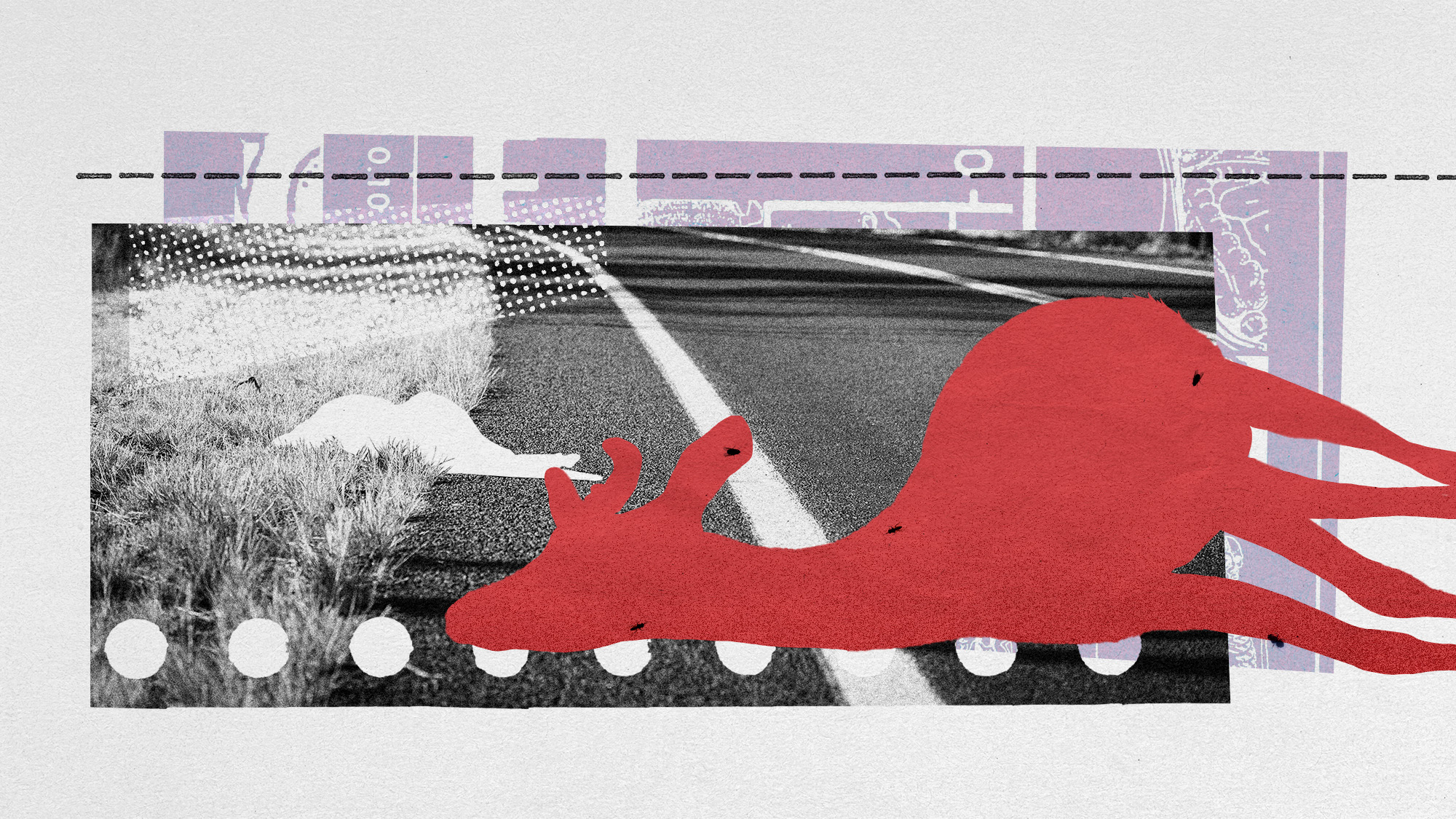

How roadkill is a surprising boon to scientific research

How roadkill is a surprising boon to scientific researchUnder the radar We can learn from animals without trapping and capturing them

-

How your household budget could look in 2026

How your household budget could look in 2026The Explainer The government is trying to balance the nation’s books but energy bills and the cost of food could impact your finances

-

What is a bubble? Understanding the financial term.

What is a bubble? Understanding the financial term.the explainer An AI bubble burst could be looming

-

The FIRE movement catches on as people want to retire early

The FIRE movement catches on as people want to retire earlyIn the spotlight Many are taking steps to leave the workforce sooner than usual

-

Who wants to be a millionaire? The dark side of lottery wins

Who wants to be a millionaire? The dark side of lottery winsIn The Spotlight Is hitting the jackpot a dream come true or actually a nightmare?

-

How can you find a financial adviser you trust?

How can you find a financial adviser you trust?the explainer Four ways to detect professionals who will act in your best interest

-

What should you consider when choosing a financial adviser?

What should you consider when choosing a financial adviser?The Explainer The right person can be a big help with financial planning, investing, taxes and more

-

What Biden's IRA means for EV tax credits: 2024 updates

What Biden's IRA means for EV tax credits: 2024 updatesThe Explainer Which cars are eligible and how much money can owners save?

-

How to ensure you don't outlive your retirement savings

How to ensure you don't outlive your retirement savingsThe Explainer Your golden years should be enjoyed. Don't let finances get in the way.