US stock markets fall after Greek vote

Wall Street slide mirrors falls in Asia and Europe as global 'Grexit' jitters take hold

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

American stocks took a tumble today after Greek voters resoundingly rejected the austerity measures required by the country's creditors as a precondition for a new bail-out.

US stock-index futures fell overnight as the result of the referendum became clear, and in early trading in New York, stock markets followed the pattern of falls that had been established by Asian and European markets.

The Standard & Poor's 500 Index extended its steepest weekly slump since March, Bloomberg reports. After an hour of trading, the S&P had fallen by 0.5 per cent and the Dow Jones Industrial Average by 0.6 per cent.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Futures in both indexes fell by a greater margin, indicating that traders believe the markets have further yet to fall.

After 61.3 per cent of Greeks voted No in Sunday's referendum, renewed fears that Athens will leave the euro sent markets into jitters around the globe. In London, the FTSE 100 was down 87 points or 1.3 per cent at 3.15pm.

Leading lenders, including JPMorgan Chase & Co., say a Grexit is now the most likely scenario.

Analysts are divided over what will happen next on Wall Street. Equities vice-chairman at Robert W Baird & Co, Patrick Spencer, says: "The uncertainty around Greece and the outcome are the factors really hurting US futures – markets hate uncertainty. There's too much at risk if the Greeks leave the euro."

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

However, USA Today reports that Paul Hickey, co-founder of Bespoke Investment Group, has told clients not to be alarmed. "There's been no panic of any kind," he said. "Broadly speaking, we think every single market is acting quite rationally."

Meanwhile, news that American employers added fewer jobs than expected last month has dampened expectations that the Federal Reserve will feel confident enough to raise the cost of borrowing in September.

The 223,000 new jobs added to the economy last month fell short of the 230,000 expected by many economists, said The Times this morning. A further dent in confidence came when the job gains for April and May were revised downward by 60,000 jobs, and wage growth was flat for June.

-

‘Restaurateurs have become millionaires’

‘Restaurateurs have become millionaires’Instant Opinion Opinion, comment and editorials of the day

-

Earth is rapidly approaching a ‘hothouse’ trajectory of warming

Earth is rapidly approaching a ‘hothouse’ trajectory of warmingThe explainer It may become impossible to fix

-

Health insurance: Premiums soar as ACA subsidies end

Health insurance: Premiums soar as ACA subsidies endFeature 1.4 million people have dropped coverage

-

Will SpaceX, OpenAI and Anthropic make 2026 the year of mega tech listings?

Will SpaceX, OpenAI and Anthropic make 2026 the year of mega tech listings?In Depth SpaceX float may come as soon as this year, and would be the largest IPO in history

-

Can Trump make single-family homes affordable by banning big investors?

Can Trump make single-family homes affordable by banning big investors?Talking Points Wall Street takes the blame

-

Why is crypto crashing?

Why is crypto crashing?Today's Big Question The sector has lost $1 trillion in value in a few weeks

-

Is a financial market crash around the corner?

Is a financial market crash around the corner?Talking Points Observers see echoes of 1929

-

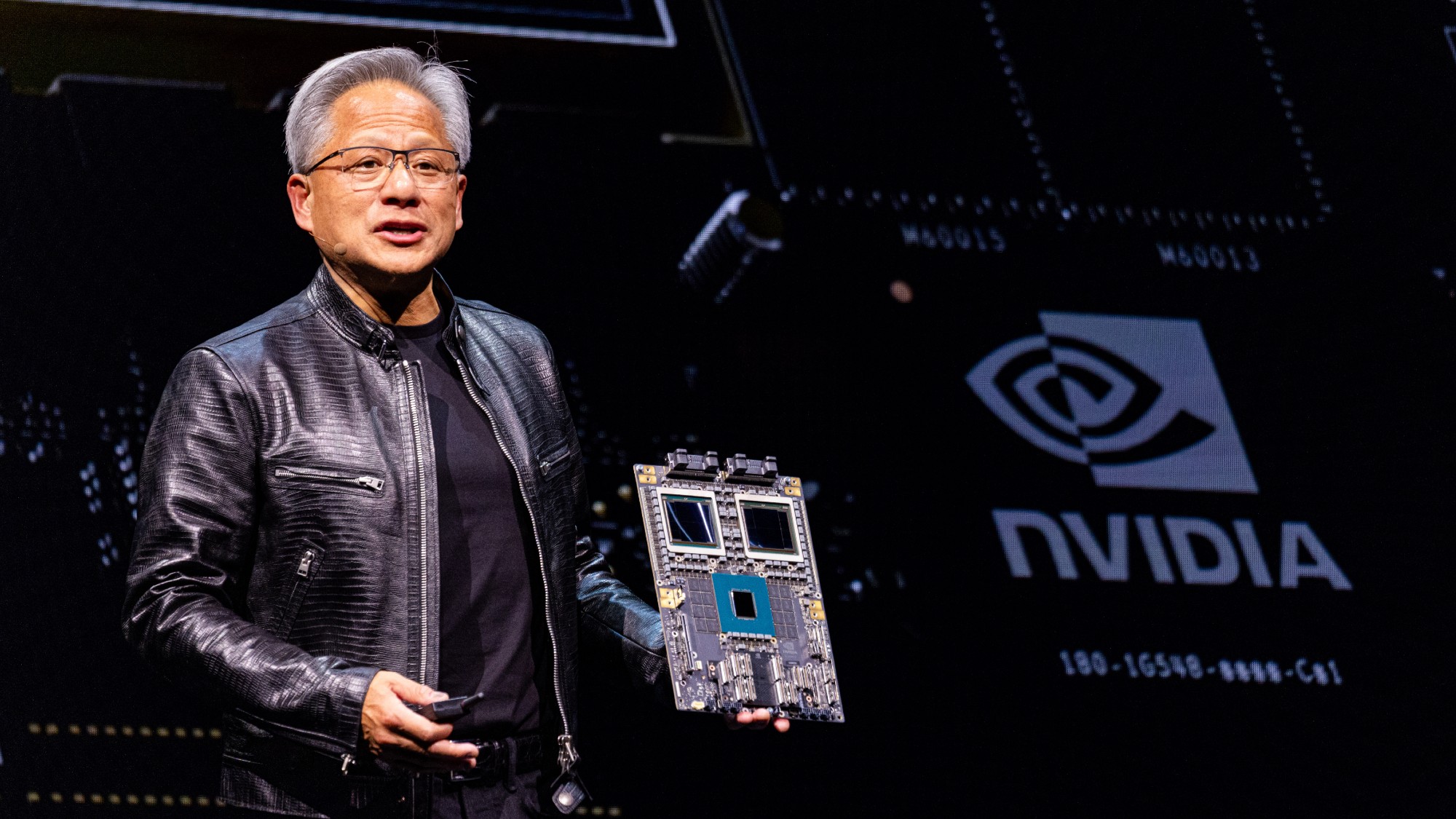

Nvidia: unstoppable force, or powering down?

Nvidia: unstoppable force, or powering down?Talking Point Sales of firm's AI-powering chips have surged above market expectations –but China is the elephant in the room

-

DORKs: The return of 'meme stock' mania

DORKs: The return of 'meme stock' maniaFeature Amateur investors are betting big on struggling brands in hopes of a revival

-

Tesla reports plummeting profits

Tesla reports plummeting profitsSpeed Read The company may soon face more problems with the expiration of federal electric vehicle tax credits

-

Trump's threats to fire Jerome Powell are unsettling the markets

Trump's threats to fire Jerome Powell are unsettling the marketsTalking Points Expect a 'period of volatility' if he follows through