London housing market 'in reverse', say experts

Demand for houses in London has fallen more sharply than elsewhere in the UK

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

The booming housing market in London has "gone into reverse", with fears over affordability one of the key reasons for the change, the BBC reports.

The latest report from the Royal Institution of Chartered Surveyors (Rics) has revealed that new property enquiries in London are falling more quickly than they have done since 2008. Rics also witnessed a drop in sales and price momentum. "The shift in mood music among potential buyers in the London market has been particularly pronounced but that is in a sense consistent with the move to a more sustainable market in the capital," Simon Rubinsohn, Rics chief economist told Reuters. The report showed that the housing market across the UK remained resilient and experts are predicting that gains will increase more outside of London than in it. But, Rubinsohn warned, "that largely reflects the fact that in some areas, the recovery has only recently taken hold and affordability is rather less stretched".However, some believe it is not yet clear whether the latest figures represent "a pause for breath or a genuine turning point", the Evening Standard reports. Today's report follows a study published earlier this week which suggested that London house price growth would slow from 15.5 per cent this year to 3 per cent in 2015.

Bank of England Governor Mark Carney warned earlier this year that the housing market posed the "biggest risk to financial stability" in the UK.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

London house prices: dramatic slow-down predicted

11 Aug

Double-digit increases in London house prices will come to an abrupt end next year, according to a report from Hamptons International estate agents. The study predicts that uncertainty around the general election and rising interest rates will lead to a dramatic reduction in growth. House price rises in greater London will slow from 15.5 per cent this year to just three per cent next year, according to the forecasts.

Even prime central London locations such as Kensington & Chelsea and Westminster will not be immune from the cooling trend. Hamptons believes growth in such in-demand districts will weaken to three per cent in 2015 from ten per cent this year.

The study coincides with reports of "panic selling", the Daily Telegraph says, as homeowners try to cash in at the top of the market. A rising number of London homeowners are selling up and buying larger homes in commutable neighbourhoods in the suburbs.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

"A recognition that interest rates will begin to rise before too long has led both buyers and sellers to moderate their expectations of future price growth," said Fionnuala Earley, director of residential research at Hamptons International. "This is at a time when the financial position of many households is still stretched as real wages have been falling for five years."

Nationally, the reversal is expected to be less dramatic. Across England and Wales, average prices are expected to rise by 8 per cent this year – a figure which is expected to moderate to 5.5 per cent in 2015.

London house price bubble 'threatens UK economy'

6 June

The International Monetary Fund has warned the British government that rising house prices could lead to a new surge in household debt that would threaten the economic recovery.

This risk is such that "policy action is warranted" to cool the housing market, according to the IMF's annual report on the health of the British economy. It went on to recommend tighter regulation of mortgages that would increase the cost of lending for banks and make it harder for homebuyers to borrow more than they could afford.

Several banks have already introduced limits of four-times earnings on larger mortgages.

Further evidence of Britain's two-speed housing market emerged yesterday with official figures revealing that London house prices are now 25 per cent higher than they were at their pre-credit crunch peak.

The Office for National Statistics put the price increase down to "rising employment, the increasing availability of mortgage finance, a return of consumer confidence and the release of pent-up demand", The Times reports. Foreign demand has also helped to stoke London house prices.

Prices in many areas outside the capital are still below their pre-crisis peak, but London's boom has lifted the national average to its highest ever level.

Earlier this week, Nationwide building society reported a 13th straight month of rising house prices, breaking through the previous peak recorded before the financial crisis hit. The average price of a home in the UK is now £186,512.

Nationwide's chief economist Robert Gardner, said it is "too early" to say that the housing market has taken a turn towards a cooling trend.

He said: "With mortgage rates close to all-time lows and labour market conditions continuing to improve, underlying demand for homes is likely to remain strong."

On Tuesday the European Commission urged the UK to introduce new taxes on high-value homes and modify the Help to Buy scheme introduced last year to make it easier for people to get onto the housing market.

Some critics have argued that the scheme has contributed to the swift climb in house prices and therefore hindered first time buyers, especially in the capital.

In today's report, the IMF praised Help to Buy, but said it may need to be revised or cut short if the flow of lending "increased significantly."

-

The Olympic timekeepers keeping the Games on track

The Olympic timekeepers keeping the Games on trackUnder the Radar Swiss watchmaking giant Omega has been at the finish line of every Olympic Games for nearly 100 years

-

Will increasing tensions with Iran boil over into war?

Will increasing tensions with Iran boil over into war?Today’s Big Question President Donald Trump has recently been threatening the country

-

Corruption: The spy sheikh and the president

Corruption: The spy sheikh and the presidentFeature Trump is at the center of another scandal

-

Can Trump make single-family homes affordable by banning big investors?

Can Trump make single-family homes affordable by banning big investors?Talking Points Wall Street takes the blame

-

Would a 50-year mortgage make home ownership attainable?

Would a 50-year mortgage make home ownership attainable?Today's Big Question Trump critics say the proposal is bad policy

-

Gopichand Hinduja and the rift at the heart of UK’s richest family

Gopichand Hinduja and the rift at the heart of UK’s richest familyIn The Spotlight Following the death of the patriarch, the family’s ‘Succession-like’ feuds are ‘likely to get worse’

-

Mortgages: The future of Fannie and Freddie

Mortgages: The future of Fannie and FreddieFeature Donald Trump wants to privatize two major mortgage companies, which could make mortgages more expensive

-

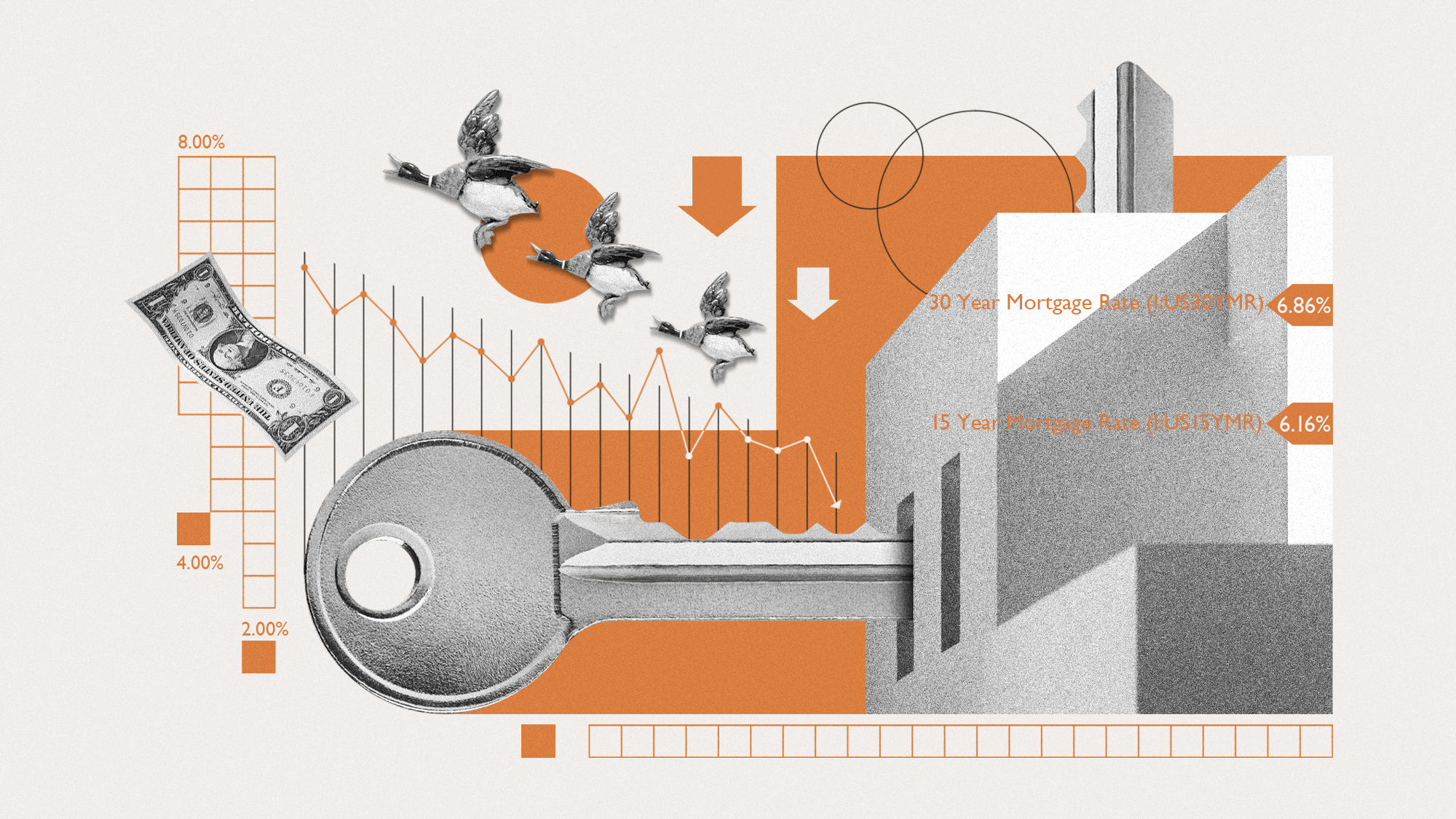

Will the housing slump ever end?

Will the housing slump ever end?Today's Big Question Probably not until mortgage rates come down

-

2023: the year of sticker shock

2023: the year of sticker shockThe Explainer Many Americans were down on the economy this year due to problematic prices

-

Interest rates: more ‘trauma’ for households

Interest rates: more ‘trauma’ for householdsTalking Point Latest hike will cause ‘plenty of pain for borrowers’

-

UK house prices fall at fastest rate for nearly 14 years

UK house prices fall at fastest rate for nearly 14 yearsSpeed Read First-time buyers may welcome the news but higher than expected inflation means mortgage costs remain an issue