London housing market 'in reverse', say experts

Demand for houses in London has fallen more sharply than elsewhere in the UK

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

London house prices 'will fall this summer'

28 May

London's house-price bubble will begin to deflate in the next few months, according to the chief executive of the Nationwide building society.

Prices in the capital have been rising sharply in recent months, but a growing number of analysts suggest that values may now have peaked.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

“My view is that in London we will see a natural correction through the summer months," Graham Beale told Reuters. "That intense heat does seem to be dissipating a bit. We could be seeing the early signs of a natural correction.”

Mark Carney, the Governor of the Bank of England said recently that a housing bubble posed the greatest threat to the stability of the UK economy.

New mortgage rules introduced last month were intended to tighten lending criteria and reduce the risk that home-buyers would take on debts they could not afford to pay off. As a result, more applications are likely to be rejected, which in turn will restrict growth in house prices.

According to The Times, figures from the British Bankers’ Association "showed that mortgage approvals by Britain’s high street banks fell for the third month running in April which some economists attributed to tighter mortgage regulations".

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Annual house price inflation for the UK slowed to 8 per cent in March from 9.2 per cent in February. In London, the figure fell more slowly, from 17.8 per cent in February to 17 per cent in March.

-

Antonia Romeo and Whitehall’s women problem

Antonia Romeo and Whitehall’s women problemThe Explainer Before her appointment as cabinet secretary, commentators said hostile briefings and vetting concerns were evidence of ‘sexist, misogynistic culture’ in No. 10

-

Local elections 2026: where are they and who is expected to win?

Local elections 2026: where are they and who is expected to win?The Explainer Labour is braced for heavy losses and U-turn on postponing some council elections hasn’t helped the party’s prospects

-

6 of the world’s most accessible destinations

6 of the world’s most accessible destinationsThe Week Recommends Experience all of Berlin, Singapore and Sydney

-

Can Trump make single-family homes affordable by banning big investors?

Can Trump make single-family homes affordable by banning big investors?Talking Points Wall Street takes the blame

-

Would a 50-year mortgage make home ownership attainable?

Would a 50-year mortgage make home ownership attainable?Today's Big Question Trump critics say the proposal is bad policy

-

Gopichand Hinduja and the rift at the heart of UK’s richest family

Gopichand Hinduja and the rift at the heart of UK’s richest familyIn The Spotlight Following the death of the patriarch, the family’s ‘Succession-like’ feuds are ‘likely to get worse’

-

Mortgages: The future of Fannie and Freddie

Mortgages: The future of Fannie and FreddieFeature Donald Trump wants to privatize two major mortgage companies, which could make mortgages more expensive

-

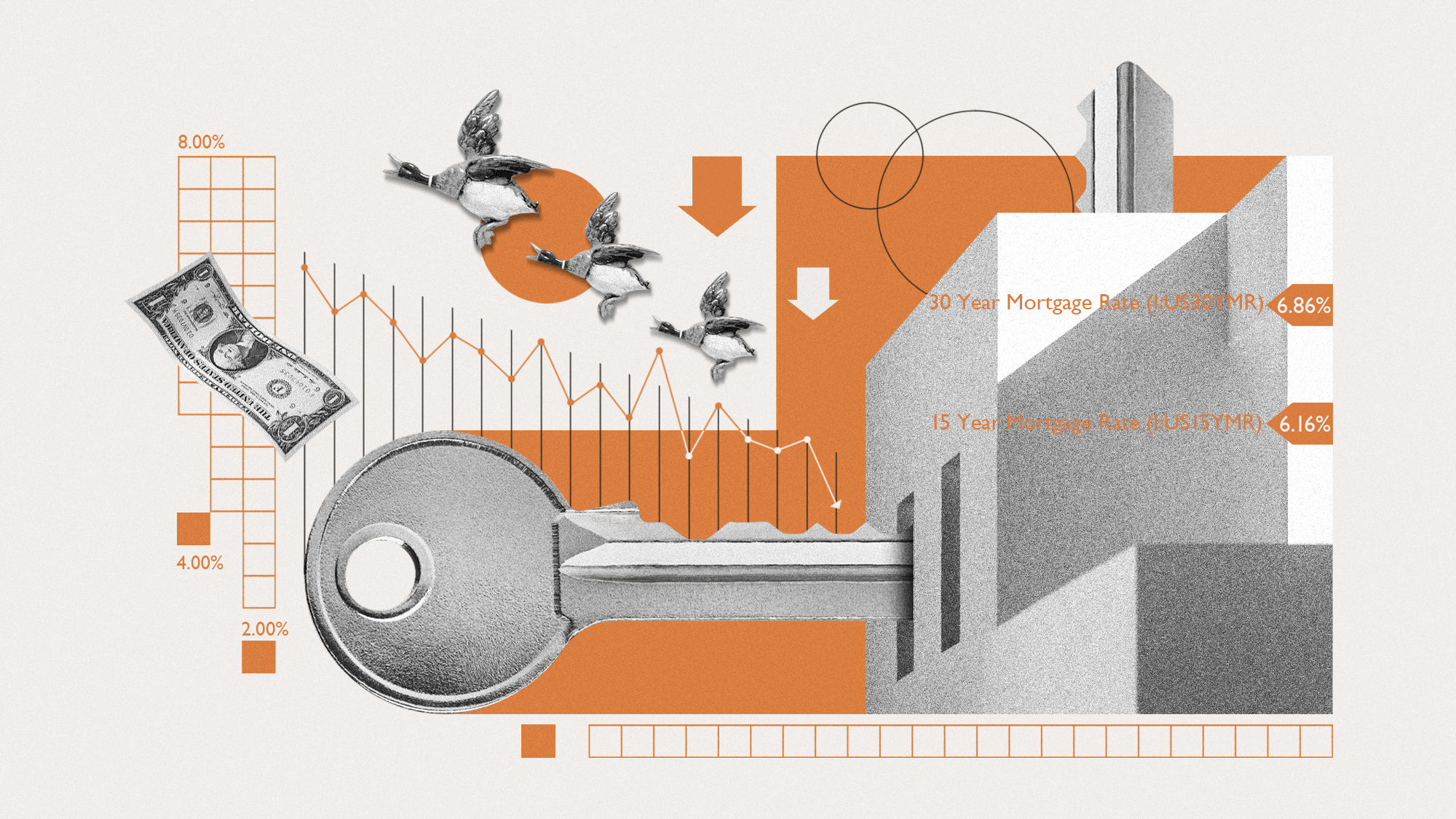

Will the housing slump ever end?

Will the housing slump ever end?Today's Big Question Probably not until mortgage rates come down

-

2023: the year of sticker shock

2023: the year of sticker shockThe Explainer Many Americans were down on the economy this year due to problematic prices

-

Interest rates: more ‘trauma’ for households

Interest rates: more ‘trauma’ for householdsTalking Point Latest hike will cause ‘plenty of pain for borrowers’

-

UK house prices fall at fastest rate for nearly 14 years

UK house prices fall at fastest rate for nearly 14 yearsSpeed Read First-time buyers may welcome the news but higher than expected inflation means mortgage costs remain an issue