UK house prices fall at fastest rate for nearly 14 years

First-time buyers may welcome the news but higher than expected inflation means mortgage costs remain an issue

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

House prices in the UK have had their biggest annual fall in nearly 14 years, according to Nationwide, one of the country’s biggest mortgage lenders.

The 3.4% year-on-year drop in May is the biggest since July 2009, “when an annual fall of 6.2% was recorded”, reported Sky News.

A reduction in house prices “would generally be welcomed by first-time buyers, who have watched property values continue to climb in recent years, even during the pandemic”, said the BBC.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

But rising interest rates mean that “mortgage costs are now higher than many people looking to get on the housing ladder might have planned for”, added the broadcaster.

Many lenders, including Nationwide, “have already pulled fixed-rate mortgage offers and replaced them with higher-cost loans in response to the financial market moves following disappointing inflation figures for April”, reported the Financial Times (FT).

Responding to the figures, Chris Druce, senior research analyst at estate agent Knight Frank, indicated that “potential purchasers should expect some volatility around a reasonably stable trend in prices”.

Druce told the FT: “There is still an element of price exploration playing out in the residential property market, as buyers and sellers adapt to the reduction in spending power that has occurred due to the significant increase in borrowing costs over the last 18 months.”

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

The drop in house prices is not a surprise, “given the rise in interest rates over the past year”, said Ross Clark in The Spectator.

“Two months ago Nationwide was expecting the Bank of England base rate to peak at 4.5% this autumn and then to be reduced, reaching 4% by the end of 2024”, he added. But due to recent inflation data, “it now expects rates to peak at 5.5% and to remain over 5% until the end of next year.

“That is not good news for the housing market,” said Clark.

Jamie Timson is the UK news editor, curating The Week UK's daily morning newsletter and setting the agenda for the day's news output. He was first a member of the team from 2015 to 2019, progressing from intern to senior staff writer, and then rejoined in September 2022. As a founding panellist on “The Week Unwrapped” podcast, he has discussed politics, foreign affairs and conspiracy theories, sometimes separately, sometimes all at once. In between working at The Week, Jamie was a senior press officer at the Department for Transport, with a penchant for crisis communications, working on Brexit, the response to Covid-19 and HS2, among others.

-

‘Restaurateurs have become millionaires’

‘Restaurateurs have become millionaires’Instant Opinion Opinion, comment and editorials of the day

-

Earth is rapidly approaching a ‘hothouse’ trajectory of warming

Earth is rapidly approaching a ‘hothouse’ trajectory of warmingThe explainer It may become impossible to fix

-

Health insurance: Premiums soar as ACA subsidies end

Health insurance: Premiums soar as ACA subsidies endFeature 1.4 million people have dropped coverage

-

Can Trump make single-family homes affordable by banning big investors?

Can Trump make single-family homes affordable by banning big investors?Talking Points Wall Street takes the blame

-

AI is creating a luxury housing renaissance in San Francisco

AI is creating a luxury housing renaissance in San FranciscoUnder the Radar Luxury homes in the city can range from $7 million to above $20 million

-

Exurbs: America's biggest housing trend you haven't heard of

Exurbs: America's biggest housing trend you haven't heard ofUnder the Radar Northeastern exurbs were the nation's biggest housing markets in 2024

-

Foreigners in Spain facing a 100% tax on homes as the country battles a housing crisis

Foreigners in Spain facing a 100% tax on homes as the country battles a housing crisisUnder the Radar The goal is to provide 'more housing, better regulation and greater aid,' said Spain's prime minister

-

Why are home insurance prices going up?

Why are home insurance prices going up?Today's Big Question Climate-driven weather events are raising insurers' costs

-

Homebuyers are older than ever

Homebuyers are older than everThe Explainer Rising prices and high mortgages have boxed millennials out of the market

-

Could 'adult dorms' save city downtowns?

Could 'adult dorms' save city downtowns?Today's Big Question 'Micro-apartments' could relieve office vacancies and the housing crisis

-

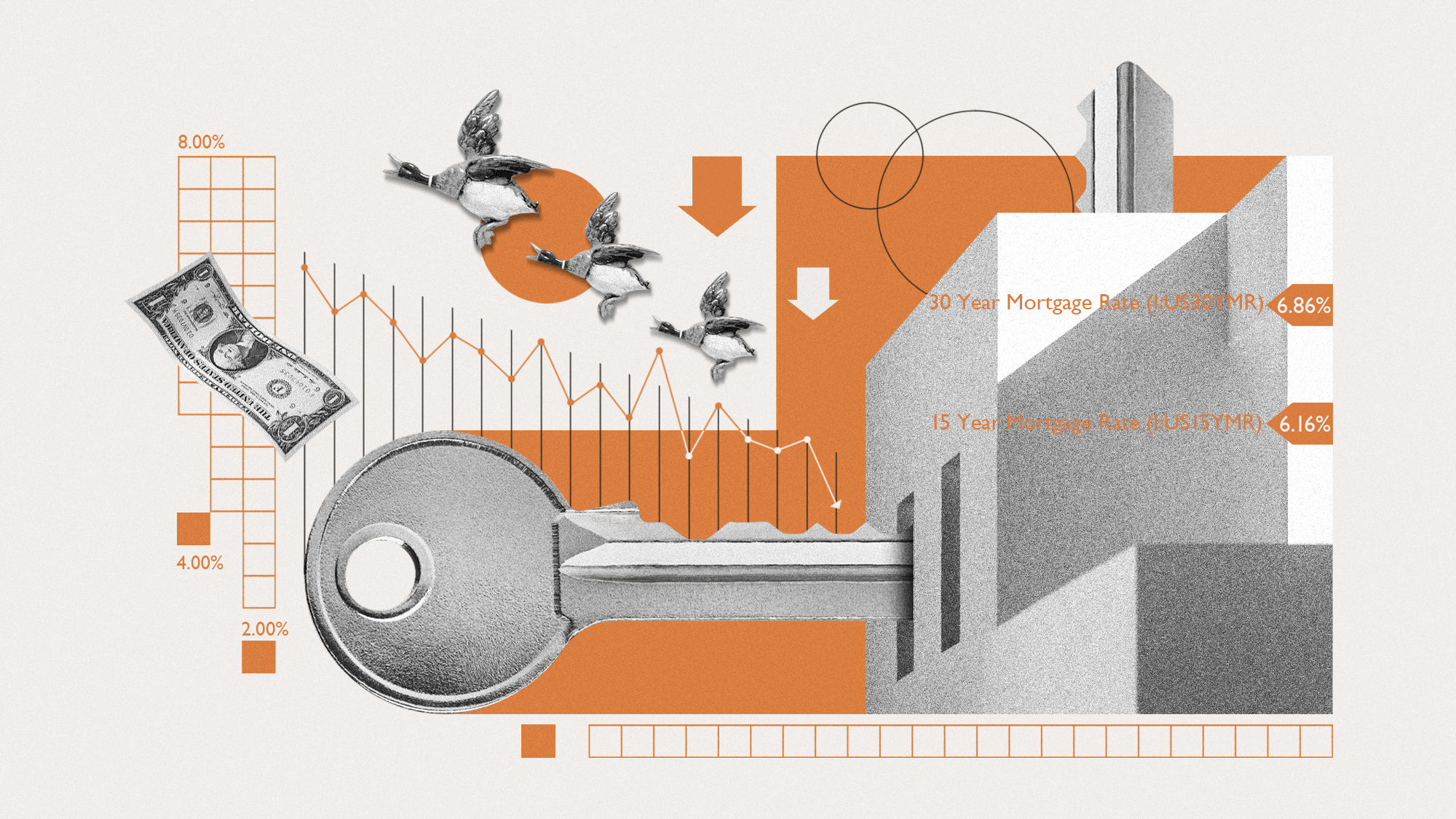

Will the housing slump ever end?

Will the housing slump ever end?Today's Big Question Probably not until mortgage rates come down