Hurricane Harvey: How subsidised insurance leads to unsafe homes

In Depth: A US federal programme may be encouraging housebuilding on flood plains

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

As one of the most vulnerable US states, Texas should expect to get hit by a hurricane about once every nine to 16 years, according to climatecentral.org.

Houston, in the southeast corner of the state, is one of the top five US cities most at risk, perched as it is on the edge of the Gulf of Mexico, directly in the path of oncoming storms. But despite the well-documented risk of coastal flooding, about 40,000 people live below the 100-year flood level in Houston.

As a result, when category four Hurricane Harvey blew through Texas this week, it killed at least 39 people, caused an estimated $90bn (£70bn) in damage, triggered chemical fires, shut down oil refineries and left at least 30,000 homeless in its wake.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

"In its devastatingly slow crawl up the industrial Gulf Coast, Hurricane Harvey is proving to be the biggest test yet of the safety and vulnerabilities of the US chemicals industry," Bloomberg writes.

This begs an obvious question: why do Houston and other cities build houses in dangerously flood-prone areas?

An old and expensive problem

For some parts of the US, flooding had been so common and so expensive for such a long period of time that private insurers all but stopped offering flood insurance for homes.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

So, in 1968, the US government passed a bill to instigate a National Flood Insurance Program (NFIP). The Federal Emergency Management Agency says the program "aims to reduce the impact of flooding on private and public structures", and that it does so "by providing affordable insurance to property owners and by encouraging communities to adopt and enforce floodplain management regulations".

While private insurers cover homes, the bills are ultimately paid by the federal government, says the Washington Post.

"People who couldn’t be insured for flood damage before can under the NFIP," the Washington Post says, with the program offering insurance to those who need it because they have a federally backed mortgage and live in highly flood-prone area.

Cheap land

The death and destruction left in the wake of Hurricane Harvey might seem to be a good reason for the US government to renew the flood insurance program before the deadline passes next month. Those in harm's way clearly need all the help they can get from the government.

But critics of the program blame the NFIP for the destruction caused by Harvey, and say that its renewal will lead to further devastation in the future.

"Houston’s horrible situation is the precise argument for why the program needs to be wound down," says MarketWatch. Subsidised insurance for those who live in highly flood-prone regions provides an incentive for companies to build housing in such areas, the site argues.

The Week US agrees. "Where a normal insurance company would jack up the premium price to cover the high risk of floodplain construction, thus discouraging vulnerable building plans among those who cannot afford to cover the cost of disaster, the NFIP will insure this construction at a discount," Bonnie Kristian writes. "This incentivises risky construction and downplays the nature of the risk."

Houston has been on the receiving end of the benefits - and the dangers - of NFIP since the program's inception in 1968, with risky housing developments sprawling out into the city's neighbouring flood plains and swamp-filled drainage basins, which would normally bear the brunt of major flooding.

Vox suggests that building on such cheap land has promoted economic growth and allowed people to turn a blind eye to the enormous risks

Some believe the situation is unsustainable. As climate change intensifies, the frequency but also the severity of hurricanes could increase, meaning supposedly once-in-a-lifetime storms like Hurricane Harvey could batter Houston several times a decade.

With more available housing, more resident have moved into flood-prone areas and, if climate change trends increase the likelihood of flooding, the NFIP will be "overwhelmed" In the space of seven years, NFIP's losses for two hurricanes - Hurricane Katrina in 2005 and Hurricane Sandy in 2012 - equal nearly half of all premiums paid betweeen 1978 to 2016, the Washington Post says.

Trump's dilemma

In August, President Donald Trump repealed an Obama-era directive to improve flood protection standards in the face of climate change, which dictated that those receiving federal funds for building must consider the future effects of flooding in their construction plans.

Trump's decision to roll back the plan was part of an executive order designed to streamline infrastructure construction by "removing federal red tape", writes USA Today.

Yet by repealing the Obama initiative without any indication that the NFIP will face reform, "some conservative groups [say the repeal] would force taxpayers to repeatedly pay to rebuild structures in flood zones."

What next?

Axing the NFIP and returning to private flood insurance, with its accurate risk signaling, is overdue, The Week US says: "It is neither ethical nor practical to maintain the current arrangement of government subsidies for real estate recklessness."

Other's aren't convinced.

"It would be unfair to drop the program at the drop of a hat for the homeowners who already live in such areas," says MarketWatch. "That would make it basically impossible for existing homeowners to resell their properties."

NFIP could instead refuse to guarantee coverage of additional properties, the site suggests. "That would put the risk back into the private sector — where it belongs — and disincentivize building in flood-prone areas."

David Conrad, an independent federal water policy consultant, says something has to change.

"This isn’t the storm of the millennium," he told Politico last week. "It’s going to happen again and again."

-

Tourangelle-style pork with prunes recipe

Tourangelle-style pork with prunes recipeThe Week Recommends This traditional, rustic dish is a French classic

-

The Epstein files: glimpses of a deeply disturbing world

The Epstein files: glimpses of a deeply disturbing worldIn the Spotlight Trove of released documents paint a picture of depravity and privilege in which men hold the cards, and women are powerless or peripheral

-

Jeff Bezos: cutting the legs off The Washington Post

Jeff Bezos: cutting the legs off The Washington PostIn the Spotlight A stalwart of American journalism is a shadow of itself after swingeing cuts by its billionaire owner

-

The plan to wall off the ‘Doomsday’ glacier

The plan to wall off the ‘Doomsday’ glacierUnder the Radar Massive barrier could ‘slow the rate of ice loss’ from Thwaites Glacier, whose total collapse would have devastating consequences

-

Can the UK take any more rain?

Can the UK take any more rain?Today’s Big Question An Atlantic jet stream is ‘stuck’ over British skies, leading to ‘biblical’ downpours and more than 40 consecutive days of rain in some areas

-

As temperatures rise, US incomes fall

As temperatures rise, US incomes fallUnder the radar Elevated temperatures are capable of affecting the entire economy

-

The world is entering an ‘era of water bankruptcy’

The world is entering an ‘era of water bankruptcy’The explainer Water might soon be more valuable than gold

-

Climate change could lead to a reptile ‘sexpocalypse’

Climate change could lead to a reptile ‘sexpocalypse’Under the radar The gender gap has hit the animal kingdom

-

The former largest iceberg is turning blue. It’s a bad sign.

The former largest iceberg is turning blue. It’s a bad sign.Under the radar It is quickly melting away

-

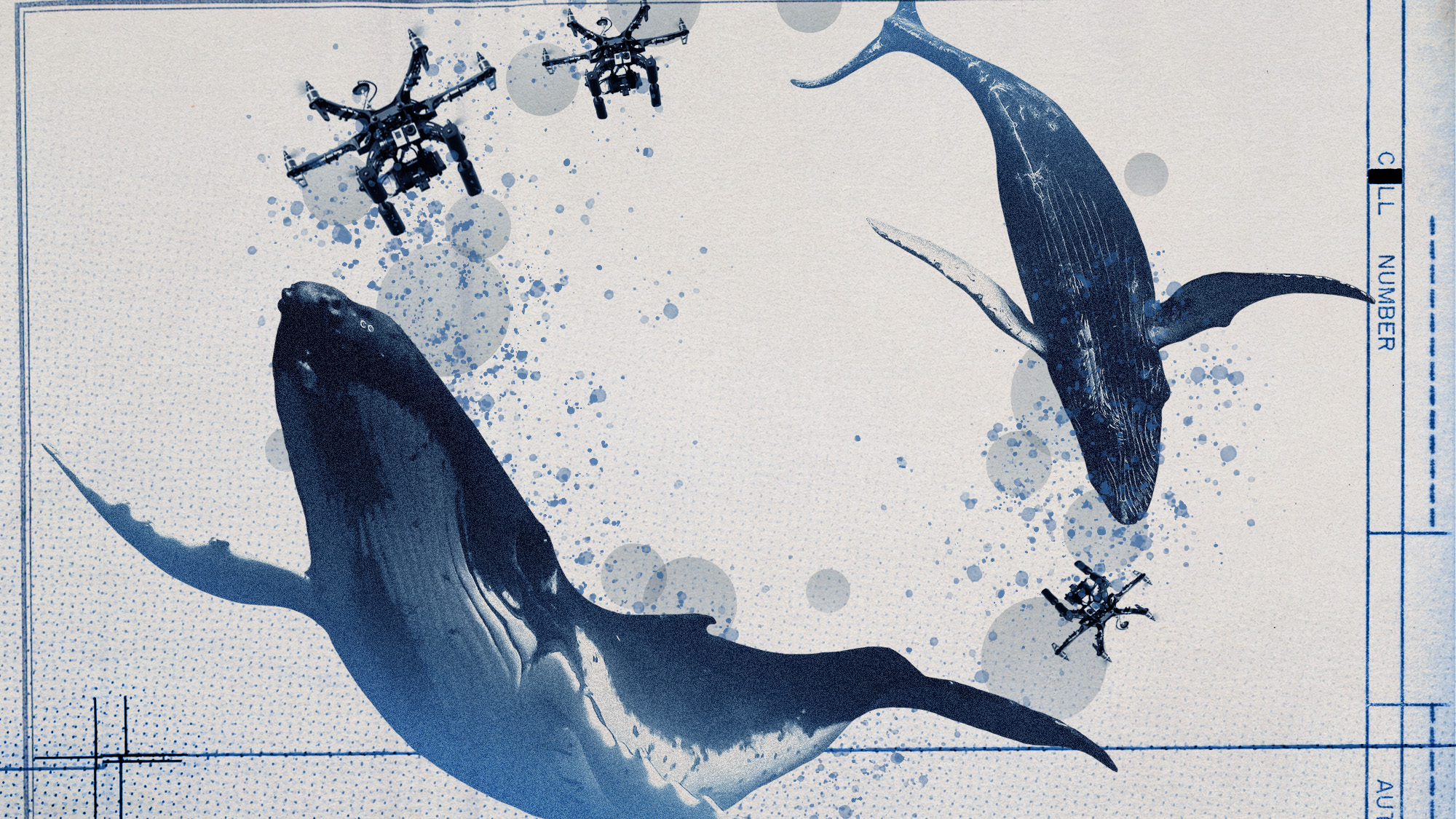

How drones detected a deadly threat to Arctic whales

How drones detected a deadly threat to Arctic whalesUnder the radar Monitoring the sea in the air

-

‘Jumping genes’: how polar bears are rewiring their DNA to survive the warming Arctic

‘Jumping genes’: how polar bears are rewiring their DNA to survive the warming ArcticUnder the radar The species is adapting to warmer temperatures