Do student loans affect a credit score?

Repaying loans on time will strengthen your credit — but paying late will hurt it

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Student loans are a major financial commitment and not just because of the long road to repayment. They can also have a bearing on your credit score — and by extension, your overall financial health and borrowing capability.

The good news is that the impact of student loans on credit is not necessarily bad, though it certainly can be. Rather, "student loans affect your credit score in much the same way other loans do: Repaying the loan on time will strengthen your credit; paying late will hurt it," said NerdWallet. There is a little extra buffer when it comes to student loans and your credit too, as they "may give you extra time to pay before you're reported late."

How do student loans impact your credit score?

There are a number of ways student loans can impact your credit score, and the influence can be either positive or negative:

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Hard inquiries: If you apply for student loans with a private lender, that will require a credit check. This helps the lender determine whether to approve your application, but it also "can cause your credit scores to temporarily drop each time they appear on your credit report," said Equifax, one of the three major credit bureaus.

Payment history: How student loans "affect your credit score depends a lot on how you manage your monthly payments," as "payment history is the most important factor in determining your credit score," said CNBC Select. If you are late on payments, that will drag down your score. Meanwhile, "making regular, on-time payments on student loans will help build credit," said NerdWallet.

Credit mix: Having multiple types of debt is viewed positively by lenders, as that juggling "helps show that you're a responsible borrower," said Experian. As such, "taking out a student loan can potentially increase your credit scores by diversifying your credit mix, or the different kinds of credit that appear on your credit report."

Length of credit: "The longer your credit history, the stronger your credit score may be — because it demonstrates your ability to manage credit and debt over time," said NerdWallet. For many, "student loans are their first foray into debt repayment," thus they can help to "establish a long credit history before taking out larger loans, like mortgages."

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Amounts owed: "Credit score calculations consider the amount of debt you owe, which includes the amount you owe on an installment loan like a student loan," said NerdWallet. Having a large debt to your name "can influence your ability to borrow more, such as a mortgage loan," said CNBC Select.

How long do student loans stay on your credit report?

"Loans closed in good standing will remain on your credit report for up to 10 years," said the credit bureau TransUnion. However, negative marks in regards to your student loans will stick on your report as well.

Generally, borrowers with federal student loans "won't see their delinquency, or missed payments, reported until they are 90 days past due," said CNBC Select. Private borrowers, however, "may not have as much time since private lenders can make up their own rules."

Unfortunately, "even one missed payment can lower your credit score, and late payments can stay on your credit report for up to seven years," said TransUnion.

Becca Stanek has worked as an editor and writer in the personal finance space since 2017. She previously served as a deputy editor and later a managing editor overseeing investing and savings content at LendingTree and as an editor at the financial startup SmartAsset, where she focused on retirement- and financial-adviser-related content. Before that, Becca was a staff writer at The Week, primarily contributing to Speed Reads.

-

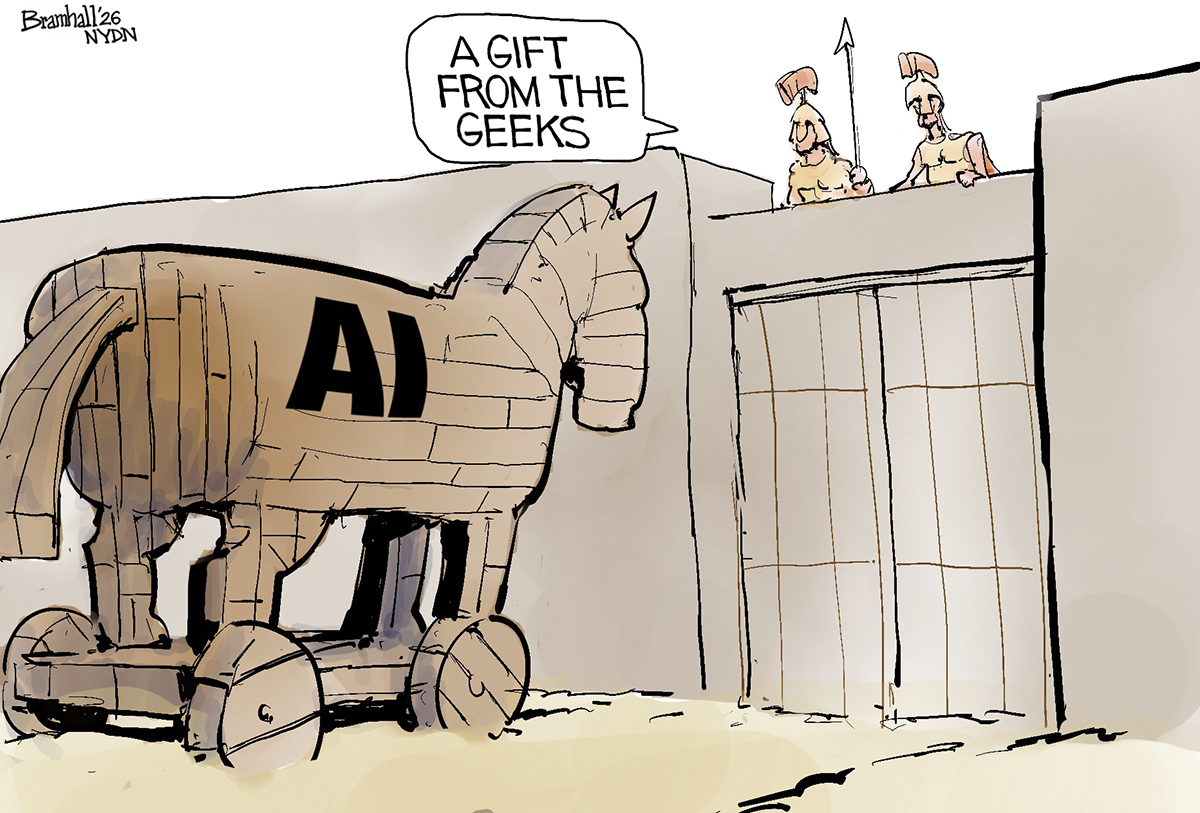

Political cartoons for February 19

Political cartoons for February 19Cartoons Thursday’s political cartoons include a suspicious package, a piece of the cake, and more

-

The Gallivant: style and charm steps from Camber Sands

The Gallivant: style and charm steps from Camber SandsThe Week Recommends Nestled behind the dunes, this luxury hotel is a great place to hunker down and get cosy

-

The President’s Cake: ‘sweet tragedy’ about a little girl on a baking mission in Iraq

The President’s Cake: ‘sweet tragedy’ about a little girl on a baking mission in IraqThe Week Recommends Charming debut from Hasan Hadi is filled with ‘vivid characters’

-

What to expect financially before getting a pet

What to expect financially before getting a petthe explainer Be responsible for both your furry friend and your wallet

-

What to know before filing your own taxes for the first time

What to know before filing your own taxes for the first timethe explainer Tackle this financial milestone with confidence

-

What are the best investments for beginners?

What are the best investments for beginners?The Explainer Stocks and ETFs and bonds, oh my

-

What’s a good credit card APR?

What’s a good credit card APR?The Explainer They have gotten even steeper in recent years

-

How to juggle saving and paying off debt

How to juggle saving and paying off debtthe explainer Putting money aside while also considering what you owe to others can be a tricky balancing act

-

Filing statuses: What they are and how to choose one for your taxes

Filing statuses: What they are and how to choose one for your taxesThe Explainer Your status will determine how much you pay, plus the tax credits and deductions you can claim

-

The pros and cons of tapping your 401(k) for a down payment

The pros and cons of tapping your 401(k) for a down paymentpros and cons Does it make good financial sense to raid your retirement for a home purchase?

-

3 tips to help protect older family members from financial scams

3 tips to help protect older family members from financial scamsthe explainer Prevent your aging relatives from losing their hard-earned money